|

|

| Rating: 4.7 | Downloads: 10,000,000+ |

| Category: Finance | Offer by: Wise Payments Ltd. |

Wise: International Transfers is your go-to application for moving money across borders efficiently and transparently. It simplifies the often-complex process of international payments by offering competitive exchange rates and user-friendly tools, primarily benefiting frequent travellers, freelancers, and families receiving money from abroad.

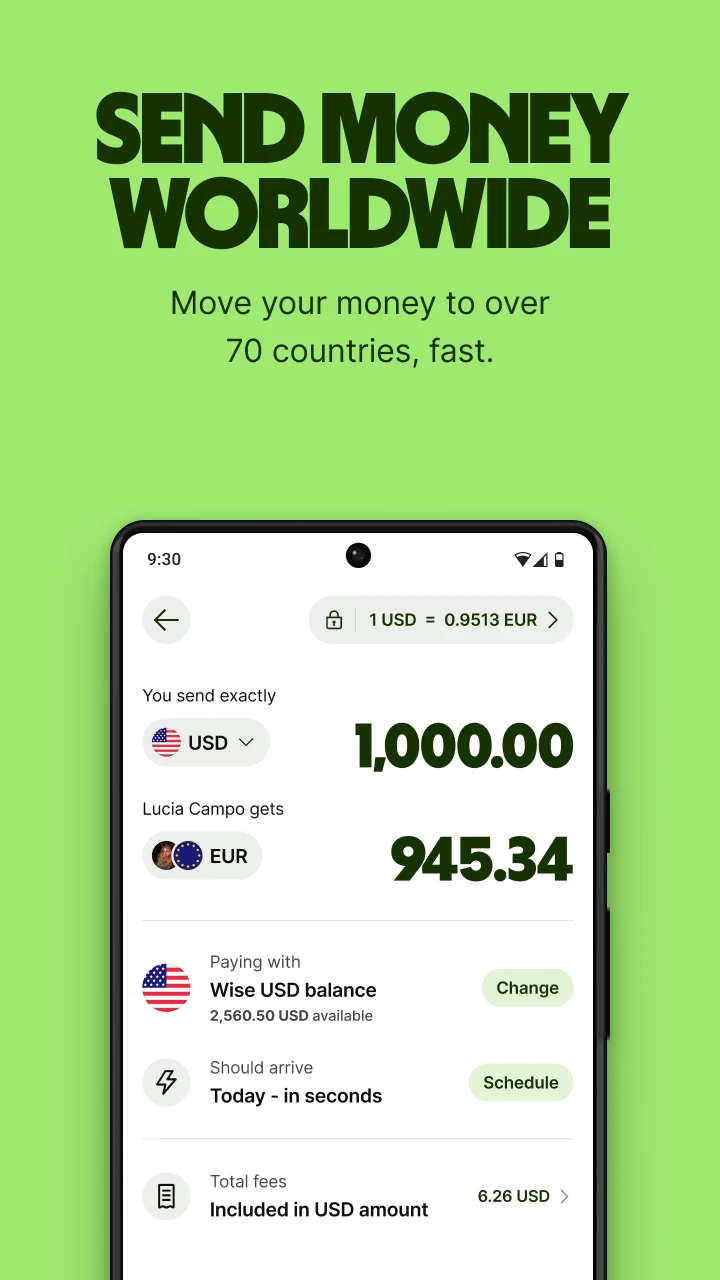

The key appeal lies in its focus on saving you both time and money compared to traditional banks or money transfer companies. Wise: International Transfers provides clarity by displaying the mid-market exchange rate and all fees upfront, making your transactions predictable and trustworthy, especially when sending or receiving funds internationally.

App Features

- Send & Receive Money Globally: This feature allows you to quickly and securely move funds between accounts designated as your ‘Home’ and ‘Away’ addresses. It benefits users by enabling fast, multi-currency transactions with minimal steps, such as a freelancer needing to get paid promptly in EUR or a student needing to send funds to an account in USD.

- Real-time Exchange Rates: The app displays the current mid-market rate, sourced from providers like Wise, and calculates the precise amount that will be sent and received. This transparency significantly improves usability by helping users budget accurately and compare costs instantly before initiating a transfer.

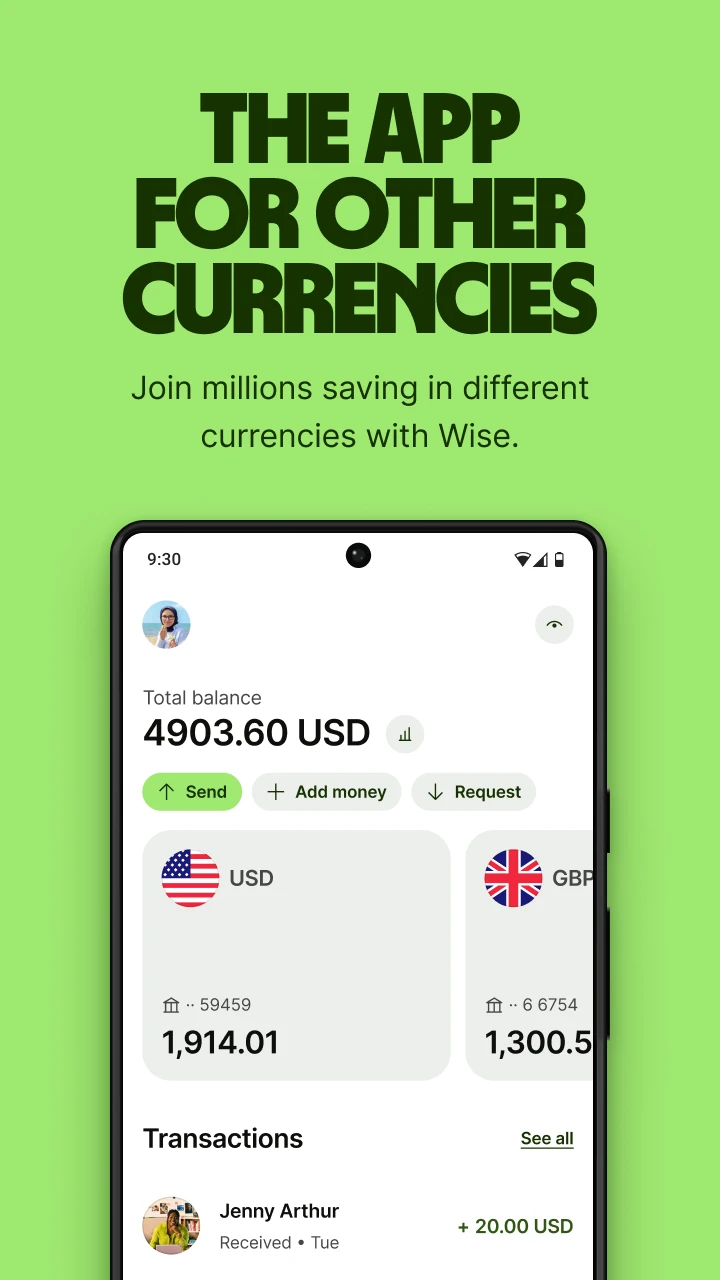

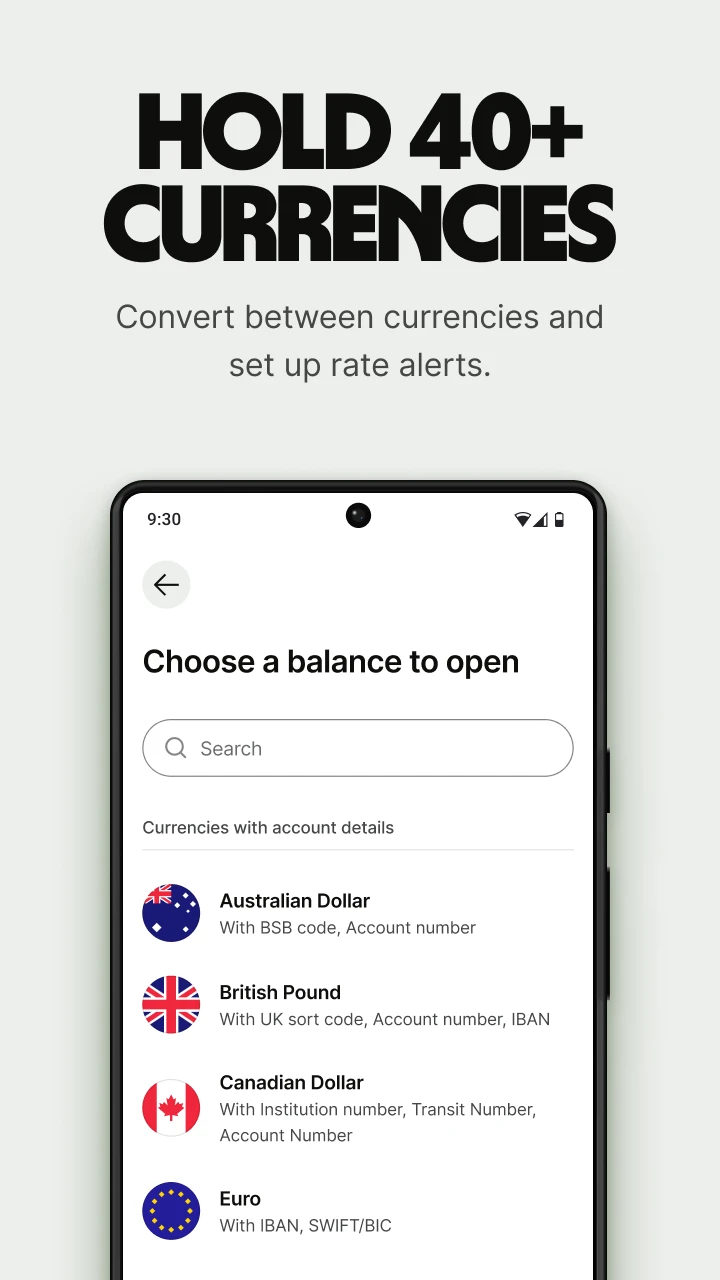

- Manage Multiple Currency Accounts: You can easily view balances in all your currency accounts directly within the app. This is particularly useful for individuals dealing with several currencies regularly, allowing you to track spending, plan expenses while travelling, or monitor income from different sources without constantly switching platforms.

- Secure Transaction Verification: Every transfer involves robust security measures, including two-factor authentication options and encrypted data handling. Users find this valuable as it protects their funds during international moves, providing peace of mind for sensitive financial operations across different countries.

- Bulk Transfer & Split Payments: This functionality allows users to send multiple payments simultaneously, often useful for settling debts with friends or businesses, or distributing funds for collaborative projects. It enhances the experience by streamlining complex financial interactions, saving considerable time over managing separate transactions.

- Transaction History & Alerts: Easily review past transfers with detailed breakdowns of fees and exchange rate impacts. You can set alerts for important activities, like when money is sent or received. This supports overall app usage by keeping users informed and in control of their international finances from any location.

Pros & Cons

Pros:

- Competitive Exchange Rates (Close to Mid-market)

- Transparent Fee Structure & Real-time Rate Visibility

- User-Friendly Mobile Interface

- Fast Transaction Processing

Cons:

- Account Setup May Require Some Initial Verification

- Dependence on Appropriate Bank Accounts for Faster Processing

- Not Always Cheaper Than Cash Withdrawals in Certain Destinations

- Customer Support Availability May Be Limited During Off-Hours

Similar Apps

| App Name | Highlights |

|---|---|

| Revolut |

This app offers fast processing, intuitive design, and wide compatibility. Known for custom workflows and multi-language support. |

| PayPal |

Designed for simplicity and mobile-first usability. Includes guided steps and real-time previews. |

| Zappy |

Offers AI-powered automation, advanced export options, and collaboration tools ideal for teams. |

Frequently Asked Questions

Q: How does Wise: International Transfers ensure I get a good exchange rate?

A: We display the real-time mid-market rate and use our competitive exchange rate, which is typically very close to this benchmark, ensuring you get a fair deal on international transfers.

Q: Can I send international transfers using my mobile data or Wi-Fi?

A: Yes, you can send and receive Wise transfers using both mobile data and Wi-Fi connections. Just make sure you have an active internet connection to initiate or manage transfers.

Q: What happens if my international transfer is rejected?

A: If a transfer is rejected, typically due to issues like incorrect details, insufficient funds, or verification requirements, you’ll receive an in-app notification explaining the reason. You can then correct the information provided and resubmit the request.

Q: Are there any hidden fees for sending money internationally?

A: No, Wise is committed to transparency. The cost is displayed clearly before sending – you’ll see the mid-market rate and the fee, allowing you to calculate the total cost easily. There are no unexpected hidden charges on international transfers.

Q: What security measures does Wise have in place for my money?

A: We employ bank-level security, including encryption for data, multi-factor authentication for logins, and robust fraud detection. Your funds are held securely, often via partner banks, ensuring safety during your international transfers.

Screenshots

|

|

|

|