|

|

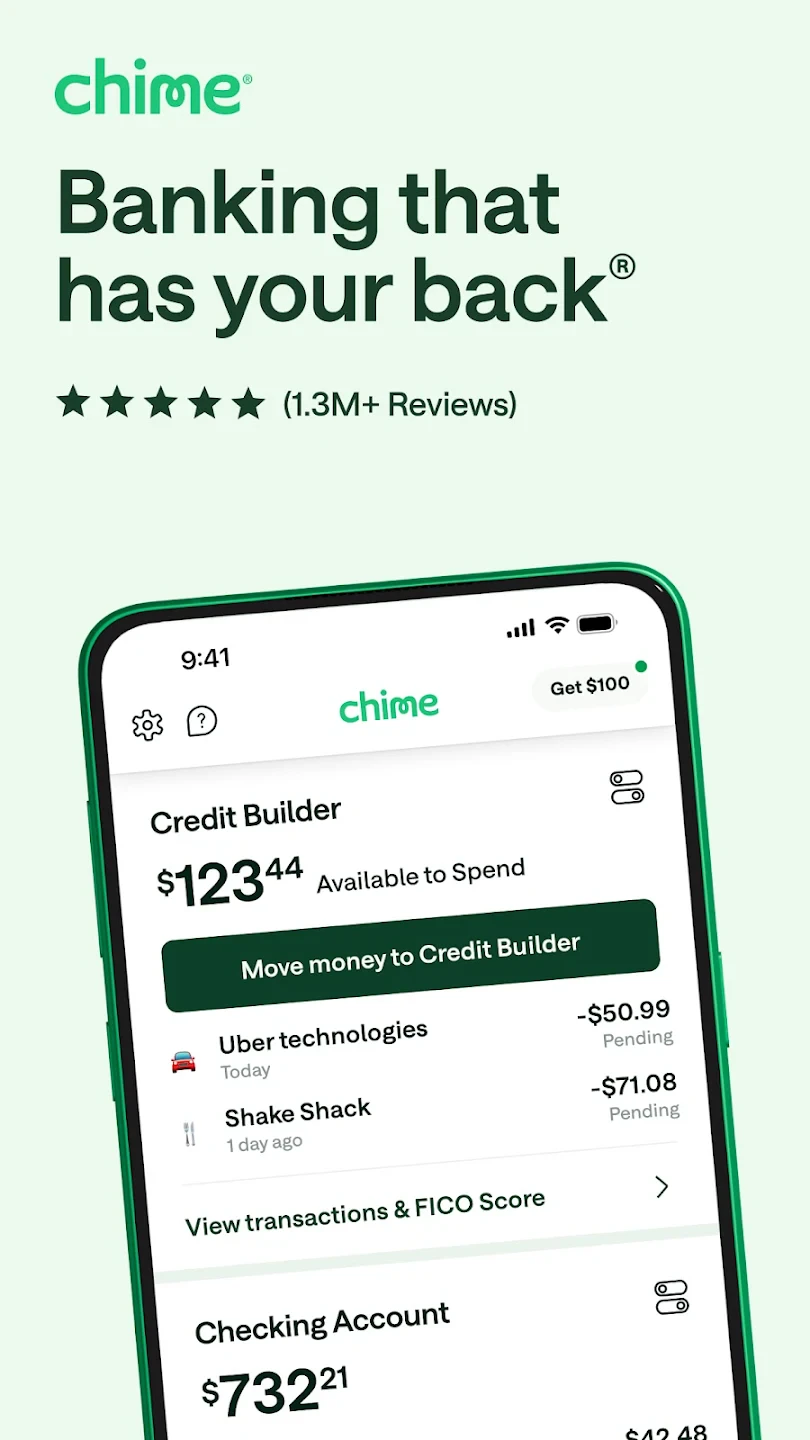

| Rating: 4.7 | Downloads: 10,000,000+ |

| Category: Finance | Offer by: Chime |

App Description

Chime – Mobile Banking is a free digital banking service that helps users manage their finances through an easy-to-use smartphone app. This app allows users to check balances, pay bills, and send money to others—all from their phone—targeting people who want convenient access to their accounts without visiting a physical branch. It offers tools to handle everyday banking tasks efficiently while providing insights for better money management.

Chime’s appeal lies in its simplicity and instant deposit features, which help users access funds faster than traditional banks. Many appreciate how it helps with automatic savings goals, promotes financial awareness, and reduces the stress of banking by offering a seamless mobile experience. This practical approach makes banking accessible for everyday life.

App Features

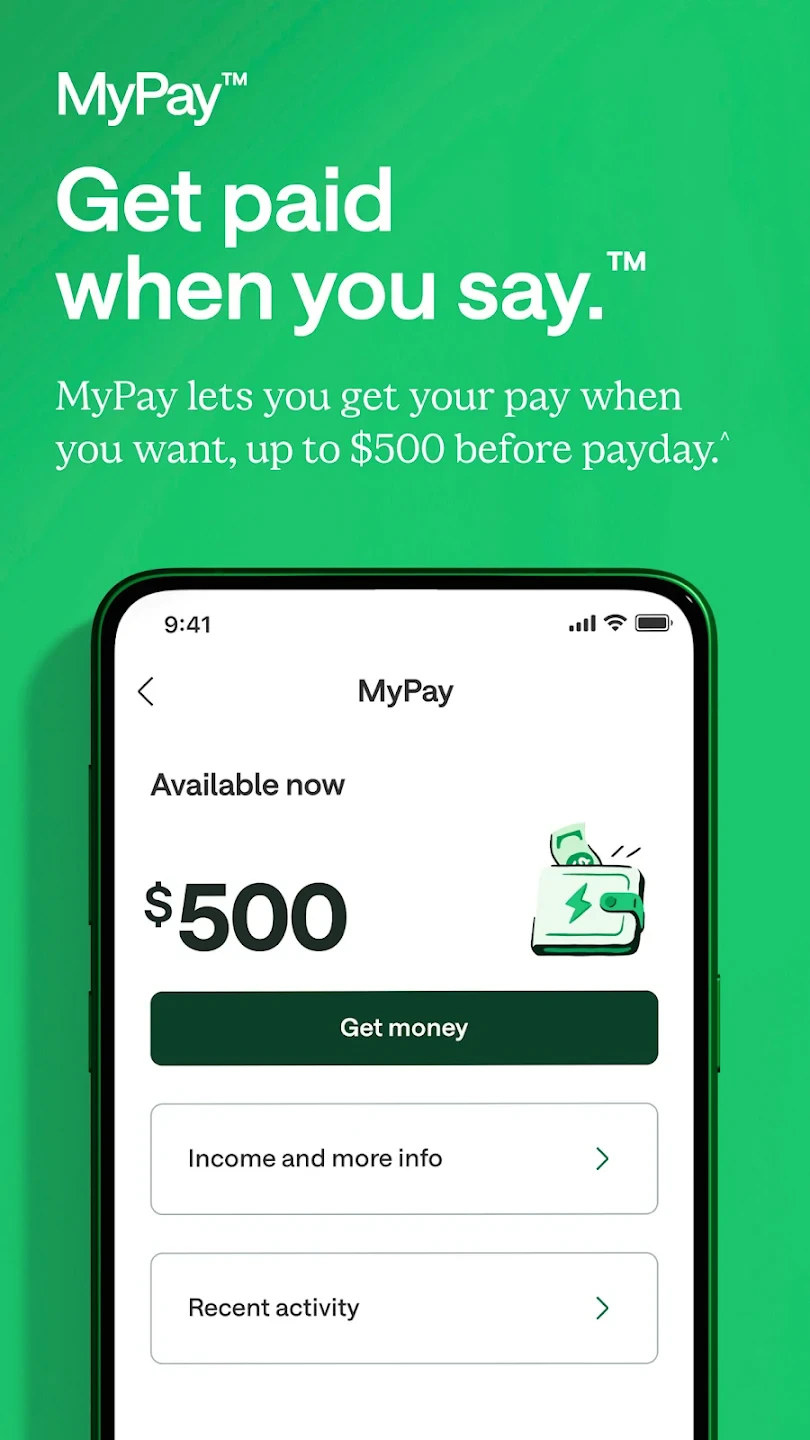

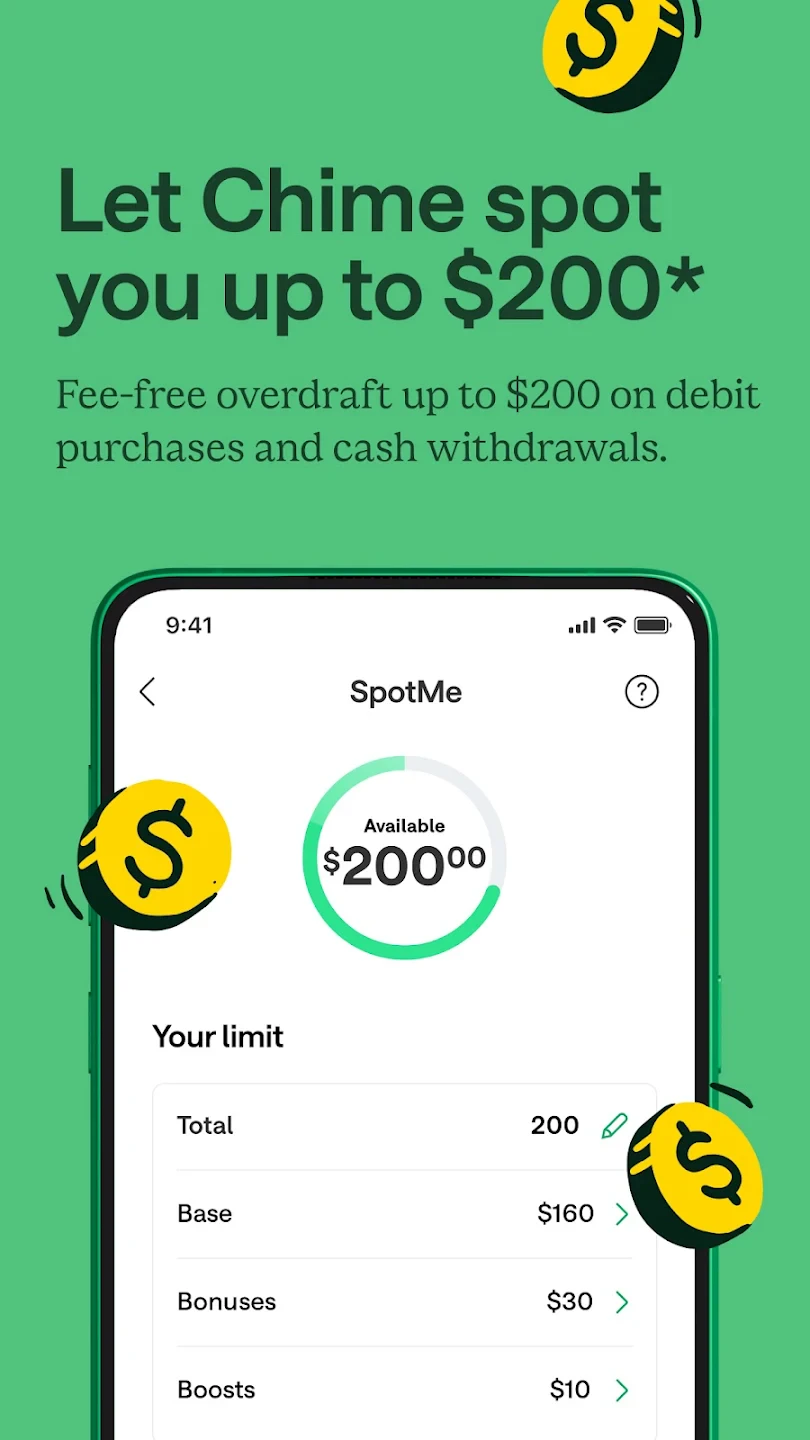

- Instant Deposits: Get your deposited checks or direct deposits available up to two days faster, which helps avoid overdraft fees. Imagine needing the money for an unexpected expense—this feature saves you from bouncing checks or late fees.

- Daily Deals: Discover discounts from top retailers and redeem them with just one tap. For instance, you might save 20% at Target or get a free smoothie at Smoothie King when shopping through this integrated feature.

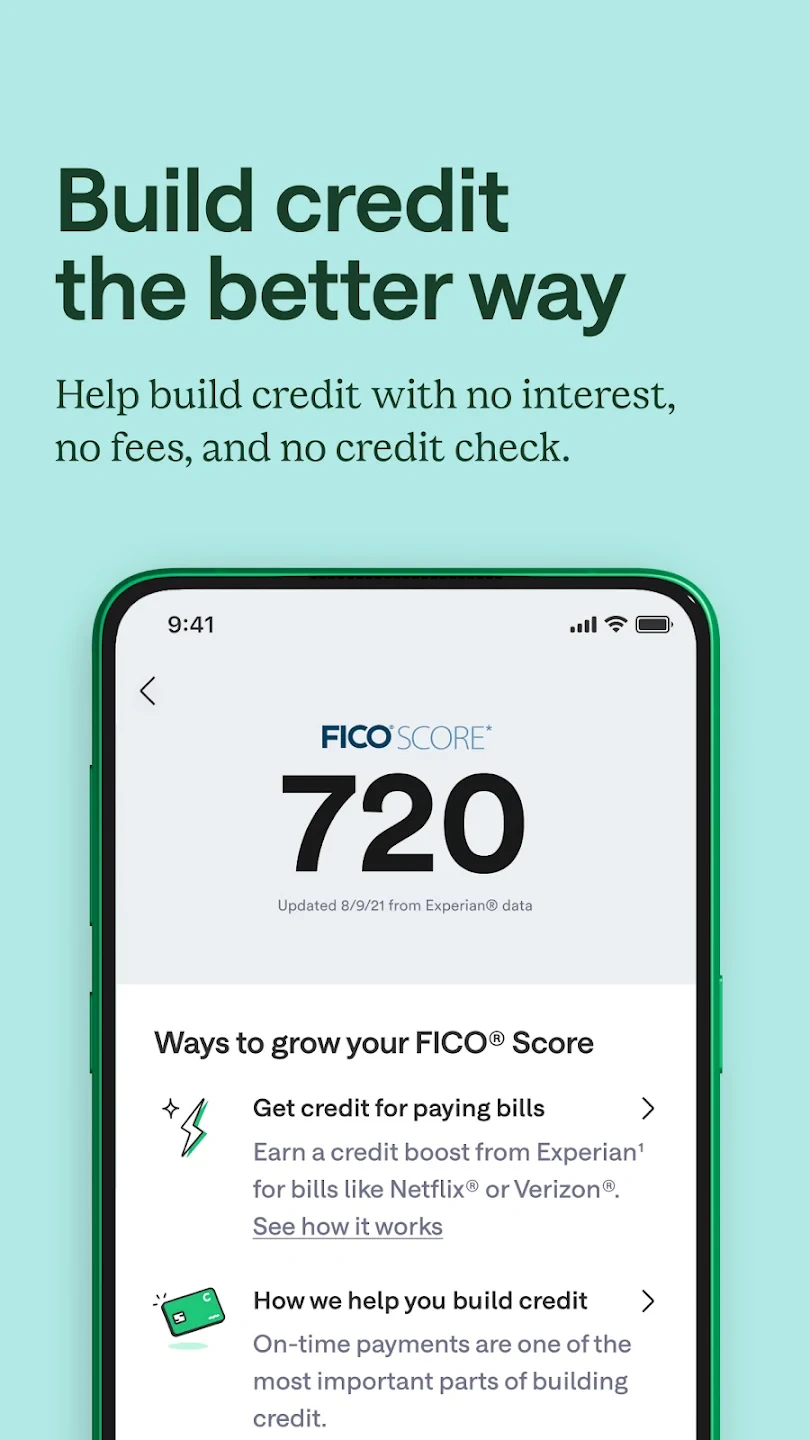

- Budgeting Tools: Track your spending with visual charts and categorize transactions to better understand your finances. This helps you identify areas where you could cut back, like eating out too much, and set savings goals for larger purchases.

- Mobile Check Deposit: Snap a photo of your check directly in the app to complete the deposit process without visiting a branch. You can easily handle paying bills or saving money for a vacation, all while staying in your comfort zone.

- Savings Goals: Automate savings by rounding up purchases to spare change and saving towards specific targets like a vacation fund. Users love seeing progress with visual milestones that keep them motivated over time.

- Bill Pay with Scheduling: Set automatic payments and due dates for bills to ensure timely payments. This avoids late fees and simplifies managing rent payments or subscriptions with just one glance at your dashboard.

Pros & Cons

Pros:

- No monthly fees for the checking account

- Quick deposits that are typically available on deposit day

- Simple budgeting tools that don’t require complicated setups

- Free ways to save with round-up features

Cons:

- Savings account interest rates are generally low

- ATM fees apply at non-network locations

- Some premium services require a paid membership

- Customer support is primarily text-based with limited call options

Similar Apps

| App Name | Highlights |

|---|---|

| PayPal |

This app offers instant person-to-person money transfers and integrated bill payments. Known for global accessibility and secure transaction encryption. |

| YNAB (You Need A Budget) |

Focused on zero-based budgeting principles with detailed transaction categorization. Features guided planning tools and robust goal tracking capabilities. |

| Monzo |

Popular for its real-time transaction notifications and intuitive spending graphs. Offers joint accounts for collaborative financial planning with family members. |

Frequently Asked Questions

Q: How quickly are deposits reflected in my account?

A: Chime – Mobile Banking typically shows deposits available on deposit day, with direct deposits often credited immediately after the batch closes. The app uses instant deposit technology to minimize waiting periods.

Q: Can I open a Chime account if I’m under 18?

A: Yes, minors aged 13+ can open a Chime account with a parent or guardian’s involvement, using secure identity verification through the app.

Q: Are there any monthly maintenance fees for the checking account?

A: No, Chime offers its core checking account without any monthly service fees, but some premium features may require an additional subscription.

Q: What happens to my data when using the budgeting tools?

A: Your transaction data is securely stored and used only for personalized insights and recommendations, with options to lock sensitive information for privacy.

Q: How does the mobile deposit feature work for checks?

A: Simply open the Chime app, tap Deposit, and use your phone’s camera to capture both sides of the check. Funds typically become available the next business day using optical character recognition technology.

Screenshots

|

|

|

|