|

|

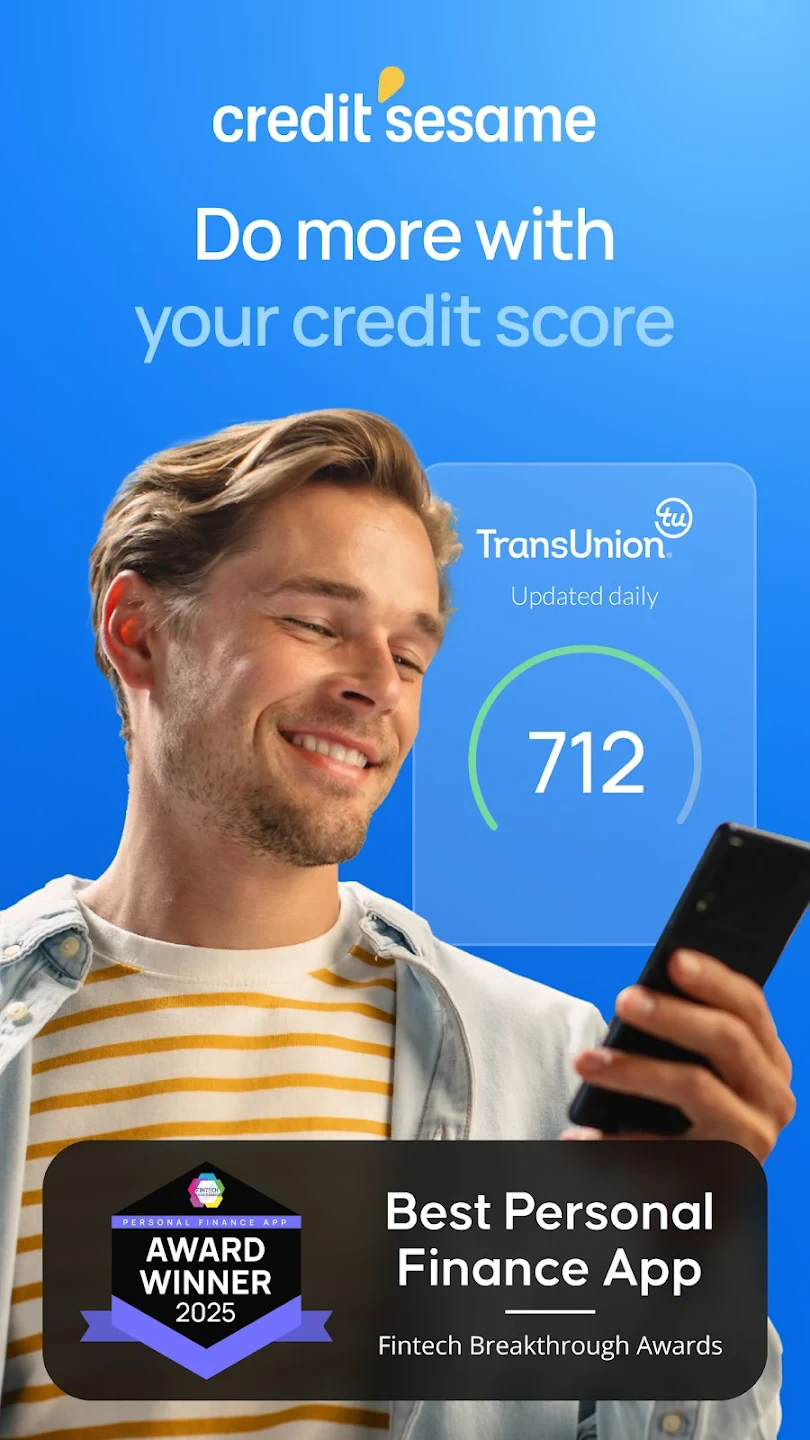

| Rating: 4.7 | Downloads: 5,000,000+ |

| Category: Finance | Offer by: Credit Sesame, Inc. |

Credit Sesame: Grow your score is a comprehensive financial management app designed to help users track and improve their creditworthiness. This mobile application provides detailed credit score monitoring, personalized financial insights, and actionable recommendations for credit enhancement, primarily targeting individuals seeking greater financial control and those building their credit history.

The core value of Credit Sesame: Grow your score lies in its ability to demystify credit management by offering accessible tools to monitor scores across all three bureaus, understand credit impacts, and implement improvement strategies. It empowers users to proactively manage their financial health through personalized education and credit-boosting tips, making credit management less intimidating.

App Features

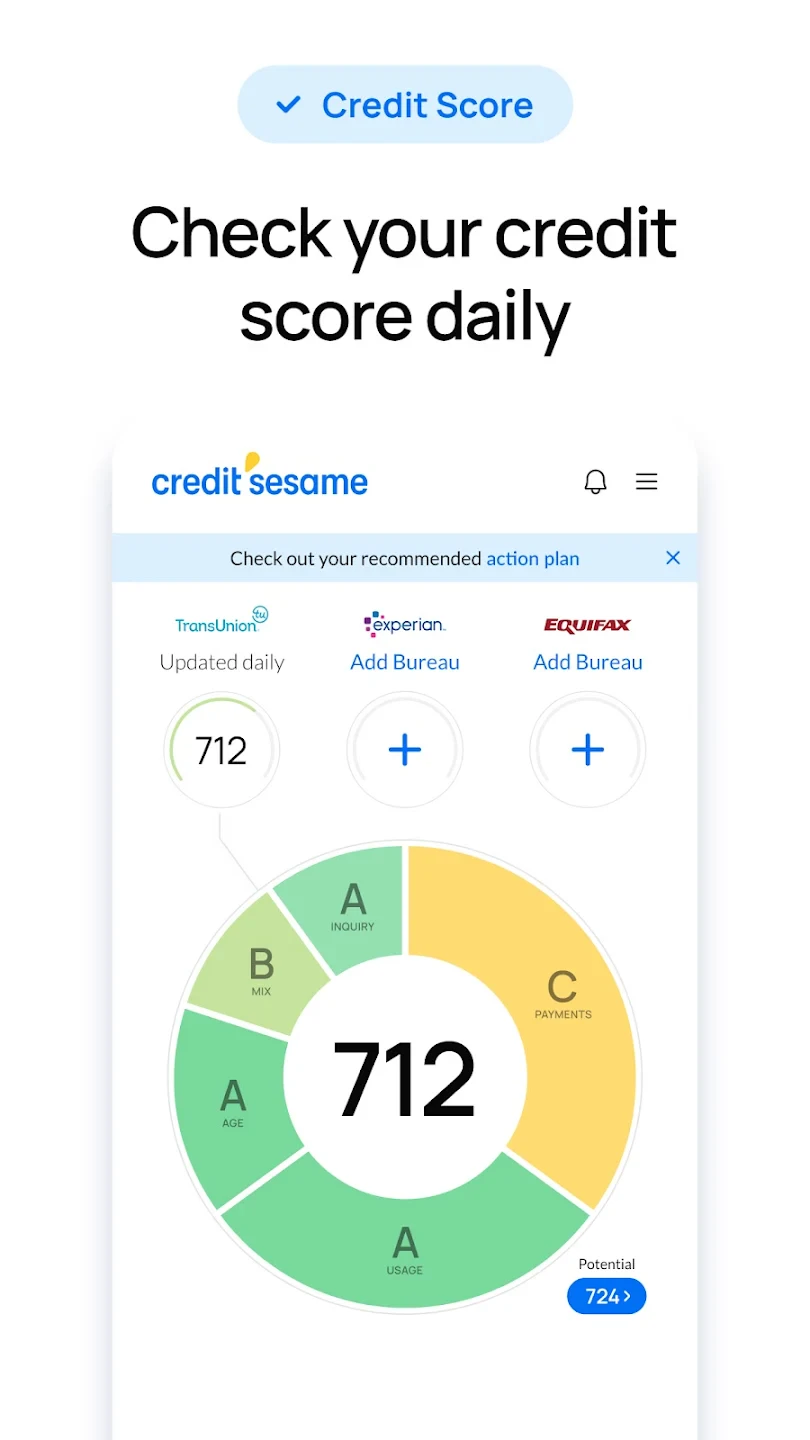

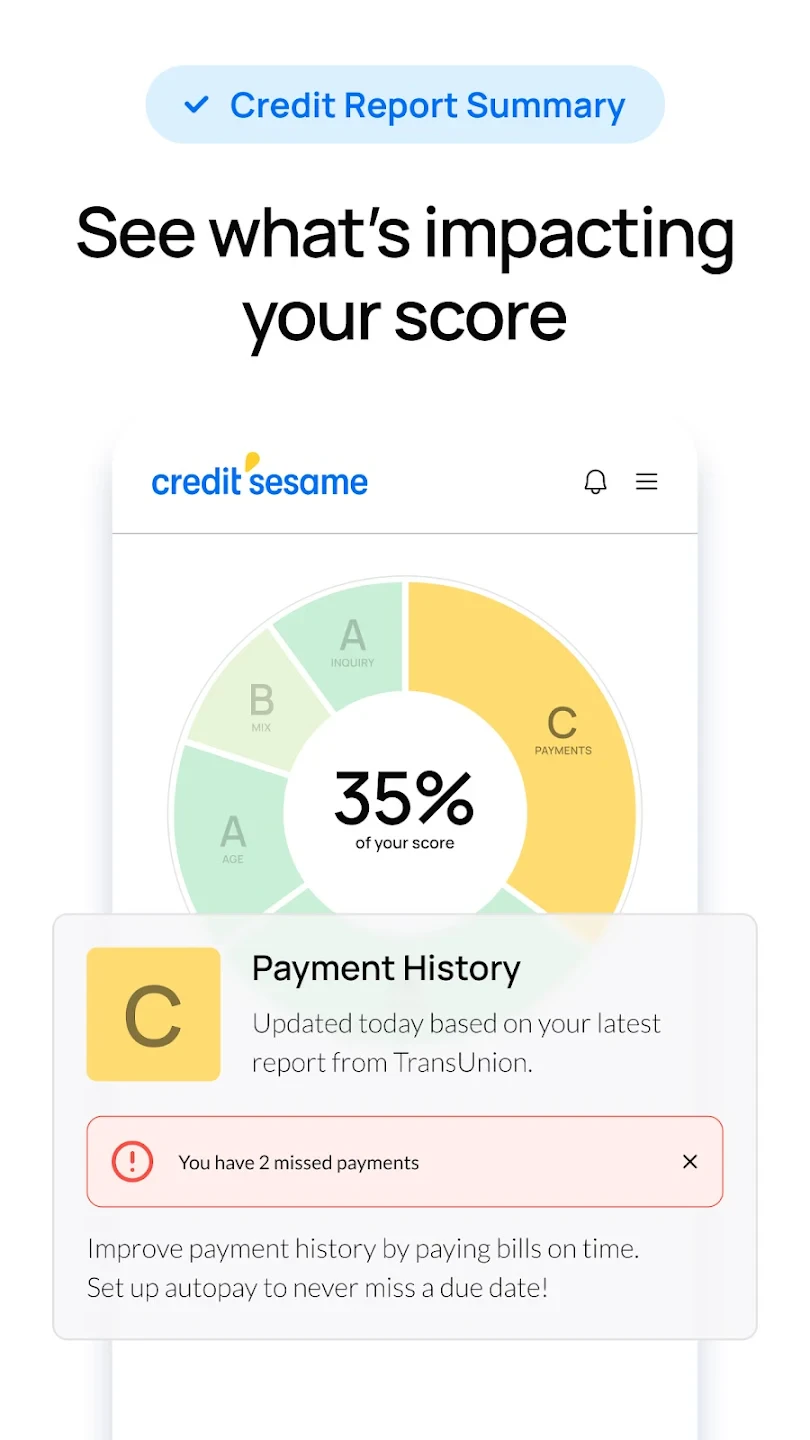

- Real-Time Credit Score Monitoring: Continuously tracks and updates FICO® and VantageScore™ data, allowing users to see fluctuations and maintain awareness of their credit standing without manual effort. This feature provides immediate feedback on how daily financial activities affect credit health.

- Credit Score Simulator: Uses predictive algorithms to estimate the potential impact of credit actions like reducing debt or opening new accounts, presented with clear visual indicators. This tool helps users make informed decisions by showing likely outcomes before implementing changes.

- Personalized Financial Education: Offers tailored learning resources addressing specific gaps identified in a user’s credit profile, explaining technical terms and credit concepts in accessible language. By linking education to individual credit situations, this feature makes learning relevant and actionable.

- Free Monthly FICO® Score: Provides access to one of the three scores reported to mortgage lenders, giving users a realistic view of their creditworthiness for major financial milestones. This transparency is crucial when applying for significant loans or credit lines.

- Vahe Financial Assistant: An AI-powered chatbot that answers credit-related questions, offers score interpretation, and suggests improvement strategies based on user input and credit history. This 24/7 support makes financial advisors accessible directly within the app.

- Credit Building Challenges: Gamified tasks like paying bills on time or checking balances regularly earn points and unlock rewards, encouraging consistent positive financial habits. This feature transforms abstract credit goals into tangible achievements.

Pros & Cons

Pros:

- Comprehensive Credit Tracking

- Transparent Pricing Structure

- Personalized Improvement Plans

- Free Educational Resources

Cons:

- Limited Advanced Analytics Features

- Score Variations Explained Simply

- Data Refresh Rate Canlag

Similar Apps

| App Name | Highlights |

|---|---|

| Experian CreditWorks |

Connects directly with Experian data while offering identity protection features. Known for detailed dispute management tools and myExperian dashboard customization. |

| Credit Karma |

Offers extensive TransUnion and Experian score access with simple, beginner-friendly explanations. Includes robust credit monitoring alerts and a large repository of educational articles. |

| Mint by Intuit |

Integrates credit tracking within its comprehensive budgeting platform. Features seamless banking sync, automated bill pay, and wealth-building tools alongside credit management. |

Frequently Asked Questions

Q: How often is my FICO score updated in Credit Sesame: Grow your score?

A: Your FICO score refreshes daily, typically within minutes of the bureau’s data update, giving you current information to manage your financial health.

Q: What’s the difference between the free and paid subscription tiers?

A: The free tier provides essential monitoring with your TransUnion Score, while paid subscriptions unlock premium features like FICO Score access, personalized coaching, and advanced analytics for deeper credit insights.

Q: Can I improve my credit score faster with Credit Sesame: Grow your score?

A: Yes! Through our score simulator and personalized action plans, Credit Sesame: Grow your score identifies high-impact strategies tailored to your situation, helping you potentially see faster improvements by focusing on actions with the greatest credit impact.

Q: Is my financial data secure with Credit Sesame: Grow your score?

A: Absolutely. We employ bank-level encryption, secure socket layer technology, and adhere strictly to data protection standards like GDPR and CCPA, ensuring your sensitive financial information remains private and protected.

Q: Does the app offer guidance specifically for first-time credit builders?

A: Definitely! Our Vahe assistant and educational resources are tailored to beginners, starting with credit basics before introducing complex topics, making Credit Sesame: Grow your score ideal for those establishing their financial foundation.

Screenshots

|

|

|

|