|

|

| Rating: 4.6 | Downloads: 1,000,000+ |

| Category: Finance | Offer by: Regions Bank |

The Regions Bank app is a powerful digital banking solution designed to provide comprehensive banking services to customers of Regions Bank. It enables users to manage their finances on the go through secure online transactions, account monitoring, and mobile banking features. This tool is tailored for individuals seeking convenient access to their financial accounts anytime, anywhere.

Its key value lies in offering real-time banking capabilities, allowing users to perform tasks like transfers, bill payments, and check deposits without visiting branches. The app appeals particularly to busy professionals and families who prioritize efficiency in managing daily finances and require immediate access to banking services during critical moments.

App Features

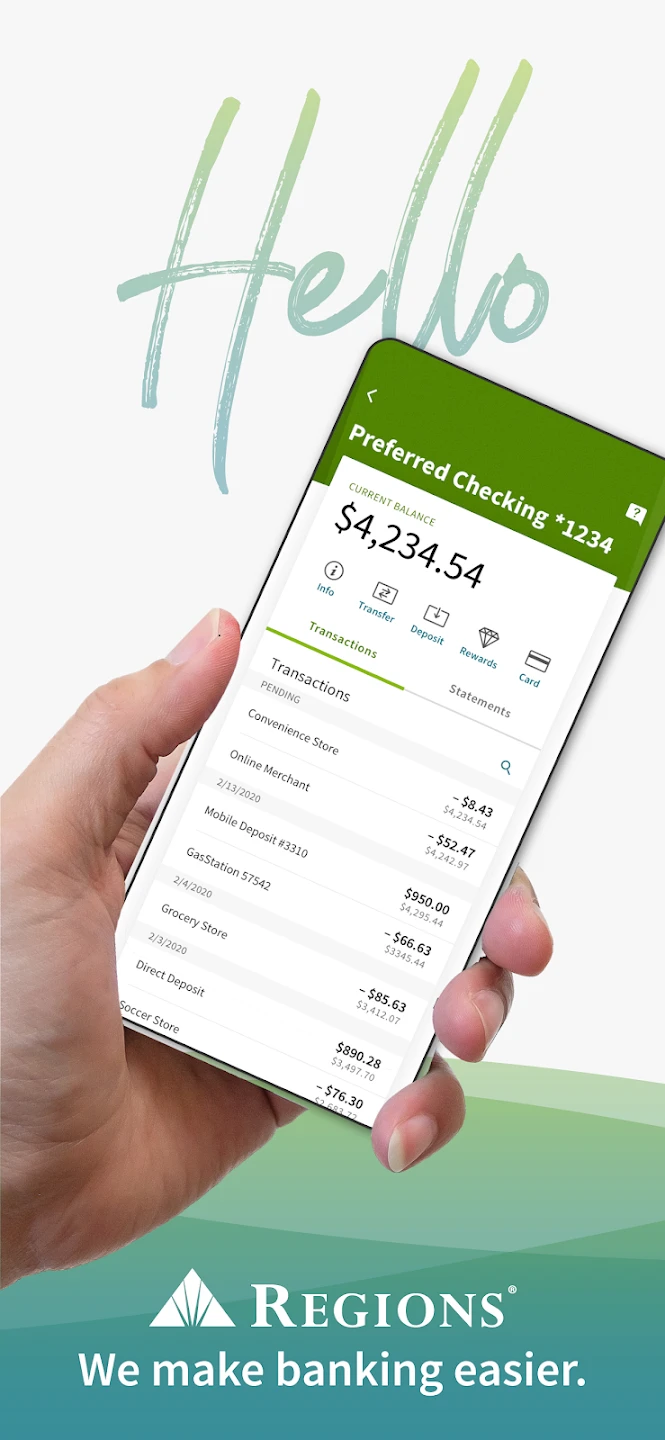

- Account Balances & Transactions: Instantly view your account balances, transaction history, and account details with real-time updates. This feature empowers users to monitor spending patterns and catch potential errors promptly, providing daily financial awareness crucial for effective budgeting.

- Transfers & Payments: Seamlessly move money between your Regions Bank accounts or send funds to external contacts. The intuitive interface simplifies complex financial operations, reducing transfer processing time by faster execution compared to traditional methods while maintaining robust security protocols.

- Mobile Check Deposits: Deposit checks by simply taking a clear photo of them using your device’s camera. This feature saves valuable time and eliminates the need for physical trips to branches, making it ideal for last-minute deposits or rural customers without nearby branch access.

- Bill Pay System: Manage all your bills from one centralized location, allowing scheduling of recurring payments and one-time transactions. This functionality enhances financial planning capabilities by preventing missed due dates and offering custom payment schedules for better cash flow management.

- Alerts & Notifications: Set personalized alerts for account activities, low balances, and transaction milestones. These customizable notifications create a proactive banking experience, immediately informing users of critical account events without needing to constantly check balances.

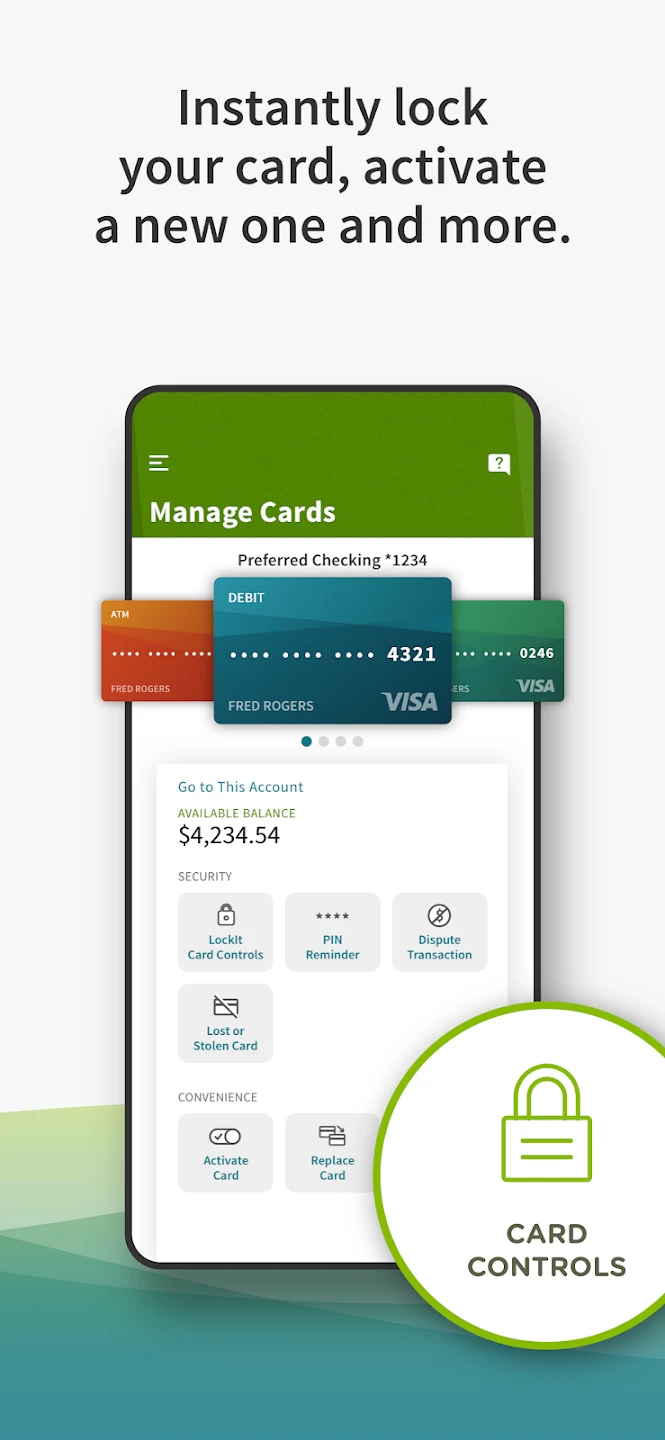

- Security Features: Includes multi-factor authentication, biometric login options, and transaction encryption for secure access. The advanced security layers provide peace of mind for users conducting sensitive financial operations while on mobile devices.

Pros & Cons

Pros:

- Comprehensive Banking Features

- User-Friendly Interface

- Enhanced Security Protocols

- Multi-Device Compatibility

Cons:

- Occasional Technical Glitches

- Branch Limitations for Certain Transactions

- Account Verification Requirements

- Regional Feature Variations

Similar Apps

| App Name | Highlights |

|---|---|

| First Citizens Bank Mobile |

Known for its advanced budgeting tools and AI-powered financial insights. Offers premium security features including facial recognition and behavioral analytics. |

| Wells Fargo Digital Banking |

Focuses on comprehensive investment management alongside core banking. Includes market trend analysis and goal-based financial planning assistance. |

| Capital One App |

Emphasizes credit management and rewards optimization. Features exceptional fraud detection and specialized tools for rewards point maximization. |

Frequently Asked Questions

Q: How quickly can I transfer funds within Regions Bank?

A: Instant transfers are available between your own Regions Bank accounts with no processing time. For transfers to external accounts, the standard processing time is 1-2 business days depending on the receiving institution.

Q: Can I access all Regions Bank services without an internet connection?

A: Basic account information like balances is accessible offline through your device’s cached data. However, transaction initiation, transfers, and mobile deposits require an active internet connection for secure processing and compliance verification.

Q: What security measures are in place for mobile transactions?

A: Regions Bank employs multiple layers of security including end-to-end encryption, two-factor authentication, biometric verification (fingerprint/face recognition) options, and transaction monitoring systems designed to detect suspicious activities.

Q: How do I deposit a check remotely?

A: Simply open the Mobile Check Deposit feature within the app, take a clear photo of both sides of the check against a light-colored background, and follow the guided process to submit it for processing.

Q: Are there any transaction limits for mobile banking?

A: The daily transaction limit is $5,000 for most standard activities, with higher limits ($25,000) available upon request for specific services like wire transfers. These limits can be adjusted based on your account history and banking relationship level.

Screenshots

|

|

|

|