|

|

| Rating: 4.8 | Downloads: 100,000+ |

| Category: Finance | Offer by: OneTwoApps |

My Budget Book is a comprehensive money management application that helps users track expenses, set financial goals, and analyze spending patterns. It’s designed for anyone looking to take control of their personal finances, whether you’re a student, young professional, or managing a household budget. The app provides tools to create detailed budgets, monitor transactions, and visualize financial data, making money management more accessible and effective.

My Budget Book simplifies complex financial tasks with an intuitive interface that adapts to different user needs. Its key value lies in helping users identify spending habits, set realistic financial targets, and make informed decisions. By offering features like automated categorization and customizable reports, the app empowers individuals to build better financial habits and achieve long-term financial stability.

App Features

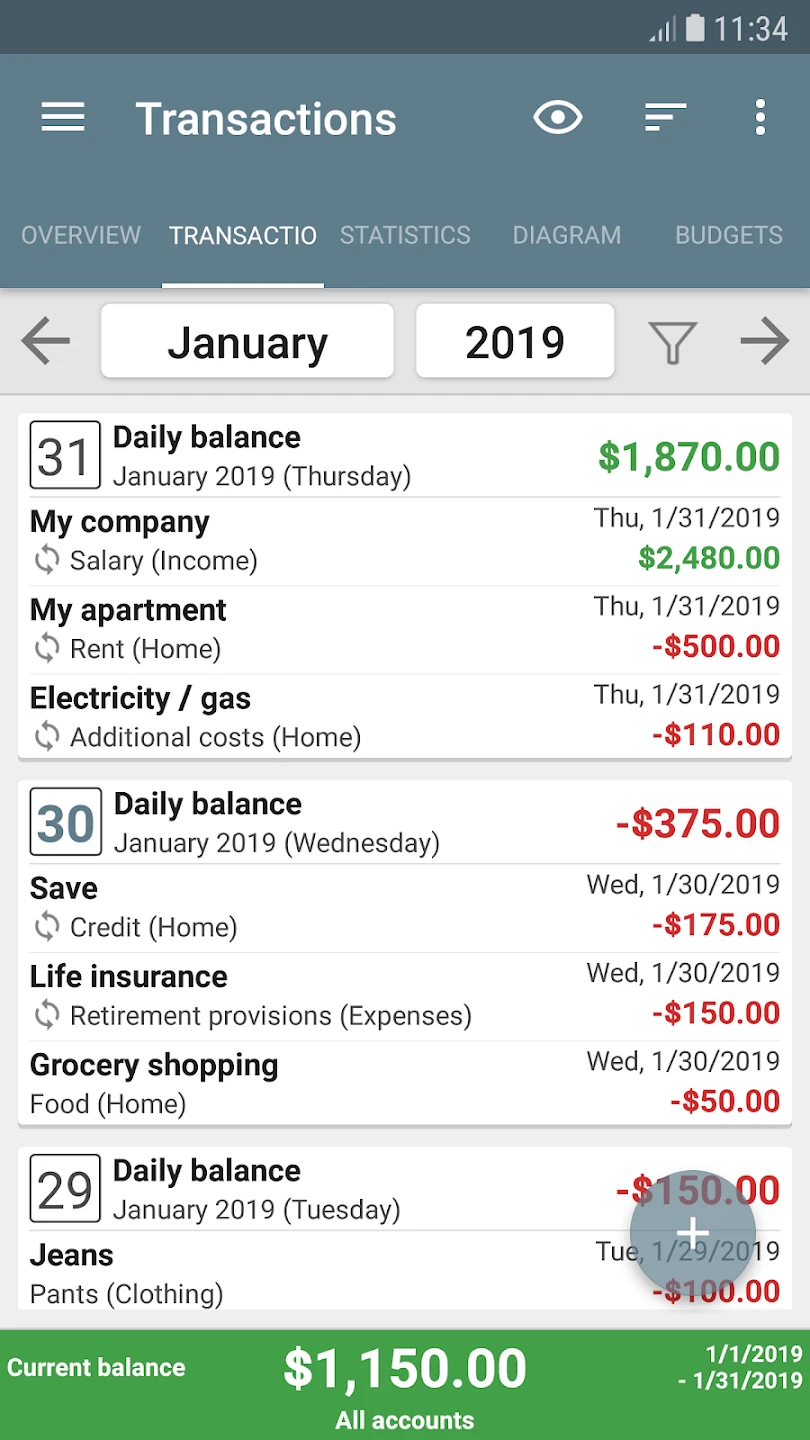

- Expense Tracking: Automatically categorizes transactions and provides real-time updates on spending. Users can quickly see where money is going, preventing impulsive purchases and promoting smarter spending habits.

- Budget Planner: Set custom budgets for different expense categories and receive visual alerts when nearing limits. This feature improves financial discipline by helping users prioritize spending and avoid overspending.

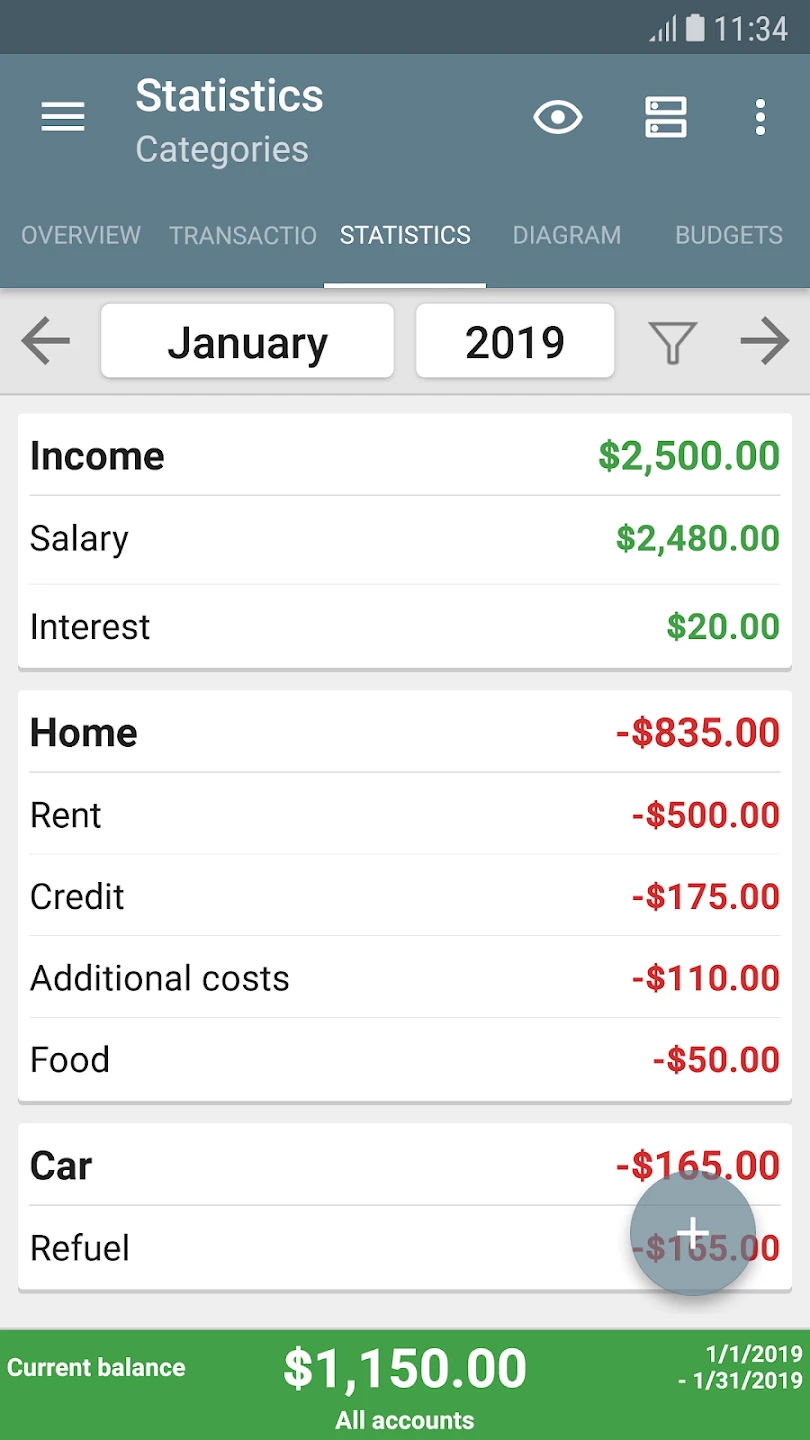

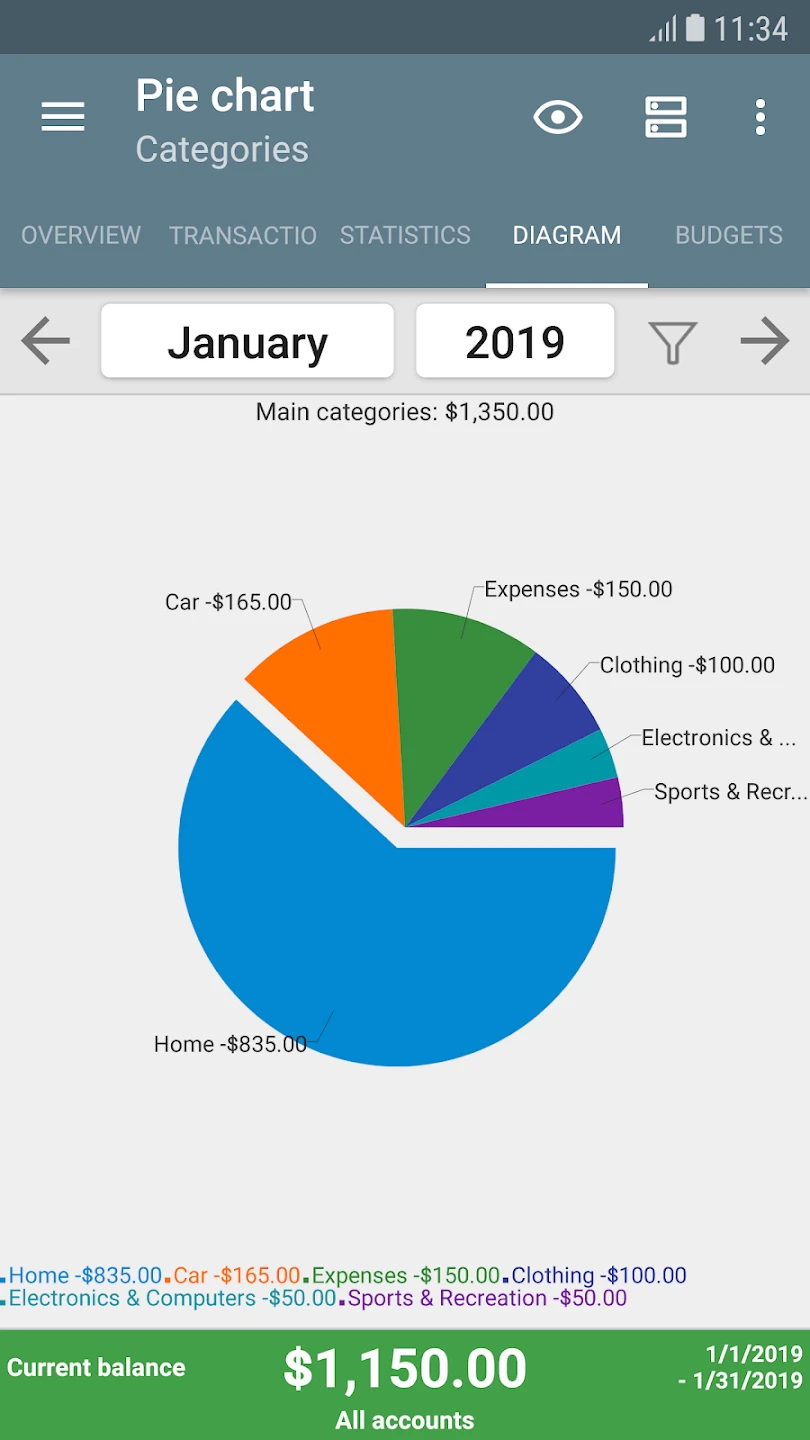

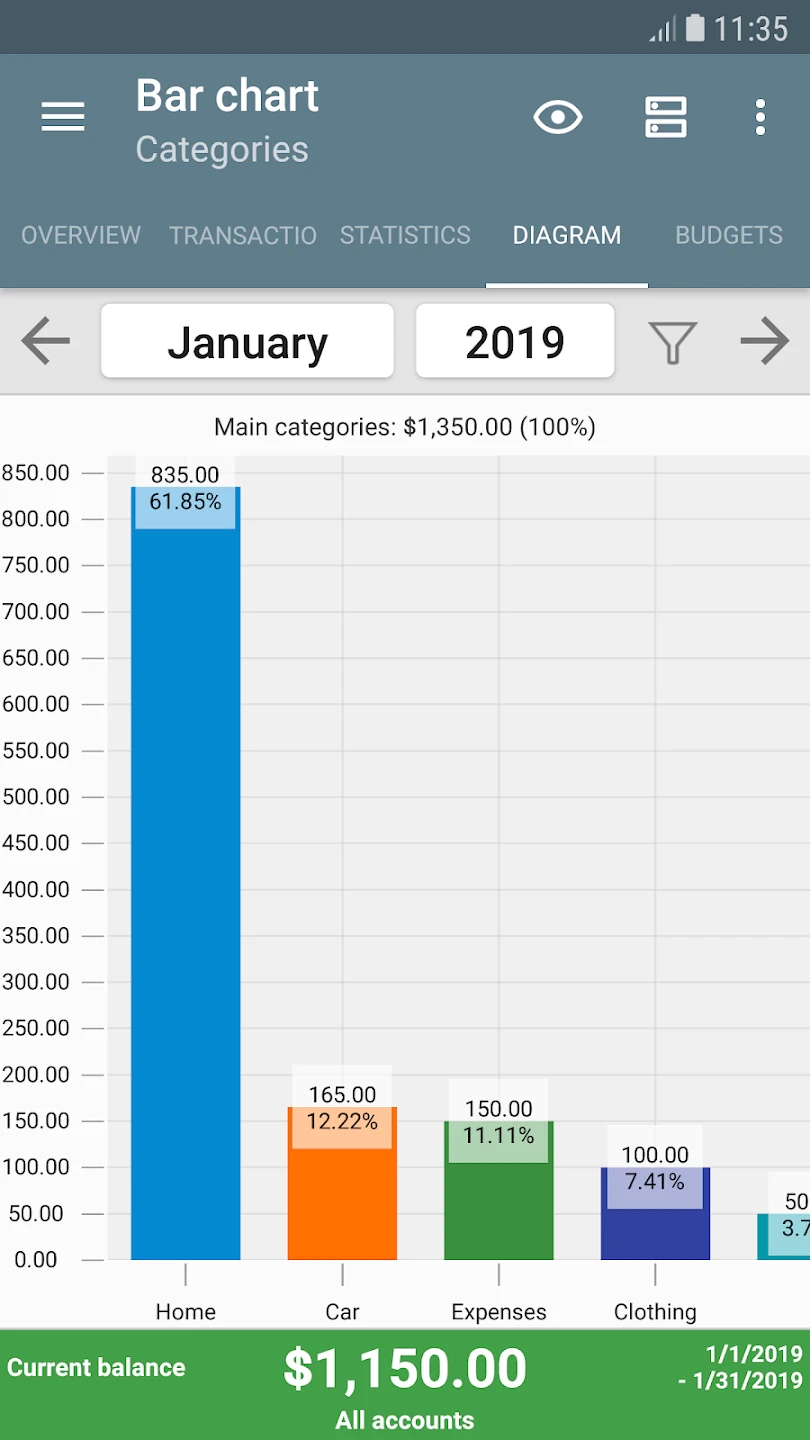

- Financial Analytics: Generates detailed graphs and reports showing income vs. expenses over time. The system highlights saving opportunities based on spending patterns, allowing users to make data-driven decisions.

- Goal Setting: Create specific financial objectives like saving for emergencies or building investments. The app tracks progress with milestone markers and suggests adjustments when targets aren’t being met.

- Multi-Account Support: Seamlessly manage checking, savings, and credit card accounts in one place. This flexibility accommodates diverse financial situations and simplifies complex money management scenarios.

- Cross-Device Syncing: Sync data across smartphones, tablets, and computers using secure cloud technology. Users can access their financial data anytime, anywhere, ensuring complete control over their finances.

Pros & Cons

Pros:

- User-Friendly Interface: Clean, intuitive dashboard makes budgeting accessible for beginners.

- Comprehensive Tracking: Detailed expense categorization and income management tools provide complete financial visibility.

- Customizable Insights: Users can tailor reports and alerts to match their financial goals and priorities.

- Regular Updates: Frequent new features and improvements enhance functionality over time.

Cons:

- Budget Sync Limitations: Some advanced syncing options require premium subscriptions.

- Setup Complexity: Initial account configuration may take extra time for complex financial scenarios.

- Data Privacy Concerns: Some users remain cautious about entrusting all financial data to third-party services.

- Platform Compatibility: Limited support for niche financial accounts in certain regions.

Similar Apps

| App Name | Highlights |

|---|---|

| Mint by Intuit |

Connects to all financial accounts, offers investment tracking, and syncs across devices. |

| YNAB (You Need A Budget) |

Emphasizes zero-based budgeting with robust expense categorization tools. |

| Personal Capital |

Specializes in retirement planning alongside budget tracking and investment monitoring. |

Frequently Asked Questions

Q: Can I import my existing bank transaction history?

A: Yes, My Budget Book supports direct bank account connections and CSV file imports for seamless setup.

Q: How accurate is the expense categorization?

A: Our advanced algorithm learns from your spending habits over time, but manual adjustments may be needed for unusual transactions.

Q: Is there parental control functionality?

A: The Premium subscription includes family budget features with spending limits and visual progress tracking.

Q: Can I set recurring transactions?

A: Absolutely – create one-time or repeating entries (weekly bills, monthly subscriptions) to save time.

Q: What happens to my data if I cancel the subscription?

A: Your data remains accessible indefinitely with full export options available at any time.

Screenshots

|

|

|

|