|

|

| Rating: 4.4 | Downloads: 10,000+ |

| Category: Auto & Vehicles | Offer by: Planet Coops |

The Taximeter app is a digital tool designed to calculate applicable taxes in real-time as you work, primarily used by rideshare and delivery drivers, freelancers, and small business owners. It automates complex tax computations based on trip details, service type, and user-set parameters, replacing older manual calculations. It’s for anyone needing accurate, on-the-go tax estimation to manage income and ensure compliance efficiently.

This app significantly simplifies the often burdensome task of tax estimation during work. Its key appeal lies in its speed and accuracy, saving considerable time and reducing errors compared to manual methods. Users find the Taximeter invaluable for making informed decisions during shifts and for streamlining their financial management workflow.

App Features

- Real-time Tax Calculation: Instantly compute estimated taxes based on income type (e.g., rideshare, delivery), location-specific rates, service fees, and chosen calculation methods (e.g., progressive tax simulation). This feature provides immediate feedback, allowing drivers or freelancers to adjust service strategies or pricing dynamically and stay compliant on the go.

- Customizable Calculation Rules: Define specific tax parameters within the app, such as deductible expenses, applicable tax brackets, differentials for day vs. night rates, and exemptions tailored to your profession or local regulations. This level of granular control ensures the calculations precisely reflect your unique financial situation and operational costs.

- Activity Logging & Tracking: Log individual trips or transactions, inputting relevant details like service type, income amount, and applicable expenses directly through the app interface. This automatically associates each income source with its tax calculation. Logging simplifies record-keeping and provides a clear audit trail for each transaction, crucial for accurate tax filing later.

- User-friendly & Driver-Focused Interface: Designed with a clean dashboard for quick input (e.g., income amount, trip type) and prominent display of the real-time estimate. Notifications can remind drivers to log earnings after a trip. This ensures usability even during busy shifts and minimizes errors from rushed manual entries.

- Reporting & Summary Generation: Compile logged data into daily, weekly, or monthly summaries, providing totals for gross income, estimated taxes payable, and potentially categorized expenses. Some versions offer exportable reports compatible with basic accounting software. These consolidated reports save significant preparation time during tax season and provide clarity on overall profitability.

- Optional: Integration with Accounting Software: For a more advanced Taximeter app, data can be synced directly with external accounting packages (like QuickBooks or Xero) via secure APIs, automatically importing income and potentially categorized expense data. This feature streamlines bookkeeping and reconciliation processes, ensuring financial records are consistently accurate without manual data entry.

Pros & Cons

Pros:

- High Accuracy & Consistency

- Time-Saving Compared to Manual Calculation

- Reduced Error Potential (especially with complex rates)

- Improved Financial Management & Planning

Cons:

- Potential Cost (Subscription or Per-use Fees)

- Requires Reliable Internet Connection

- Dependence on Correct Input Data from User

- May Have a Learning Curve for Complex Features

Similar Apps

| App Name | Highlights |

|---|---|

| TaxEstimate Pro |

This app offers fast processing, intuitive design, and wide compatibility. Known for custom workflows and multi-language support. |

| DriverTaxCalc |

Designed for simplicity and mobile-first usability. Includes guided steps and real-time previews. |

| BusinessTaxFlow |

Offers AI-powered automation, advanced export options, and collaboration tools ideal for teams. |

| TaxCalc Lite |

Provides offline calculation capabilities and robust history tracking, suitable for various professionals beyond rideshare. |

Frequently Asked Questions

Q: Is the Taximeter app only for rideshare drivers, or can others use it?

A: While designed with rideshare and delivery drivers in mind, the Taximeter app’s core calculation features are also valuable for freelancers, independent contractors, and small business owners across various service industries needing accurate on-the-fly tax estimation.

Q: How accurate is the Taximeter’s calculation, and does it account for all local tax rules?

A: The app’s accuracy depends heavily on the user providing correct and complete income details. It aims to account for specific rules you configure (like tax brackets, fees). Users are advised to understand their specific tax obligations; the app calculates based on your inputs, which should align with relevant regulations, but it’s not a substitute for professional tax advice.

Q: Do I need to be online to use the real-time tax calculation feature?

A: Typically, the real-time calculation requires an internet connection to fetch up-to-date rates and ensure accuracy. However, some apps offer limited calculation capabilities offline based on previously saved rules, though updates and full features often need connectivity.

Q: What if the app’s calculations differ from what my accountant expects?

A: It’s common for apps to use simplified estimations or specific user-configured rules that might differ slightly from complex tax code interpretations. While the Taximeter aims for accuracy based on provided inputs, professional consultation is always recommended for complex situations or during actual filing.

Q: Can the Taximeter app handle different tax scenarios within a single workday?

A: Yes, most Taximeter apps are designed to handle different types of income or transactions (e.g., rideshare, delivery, platform fees) during the same period. Users can often toggle between modes or input details specific to each transaction to ensure accurate calculations across their varied activities.

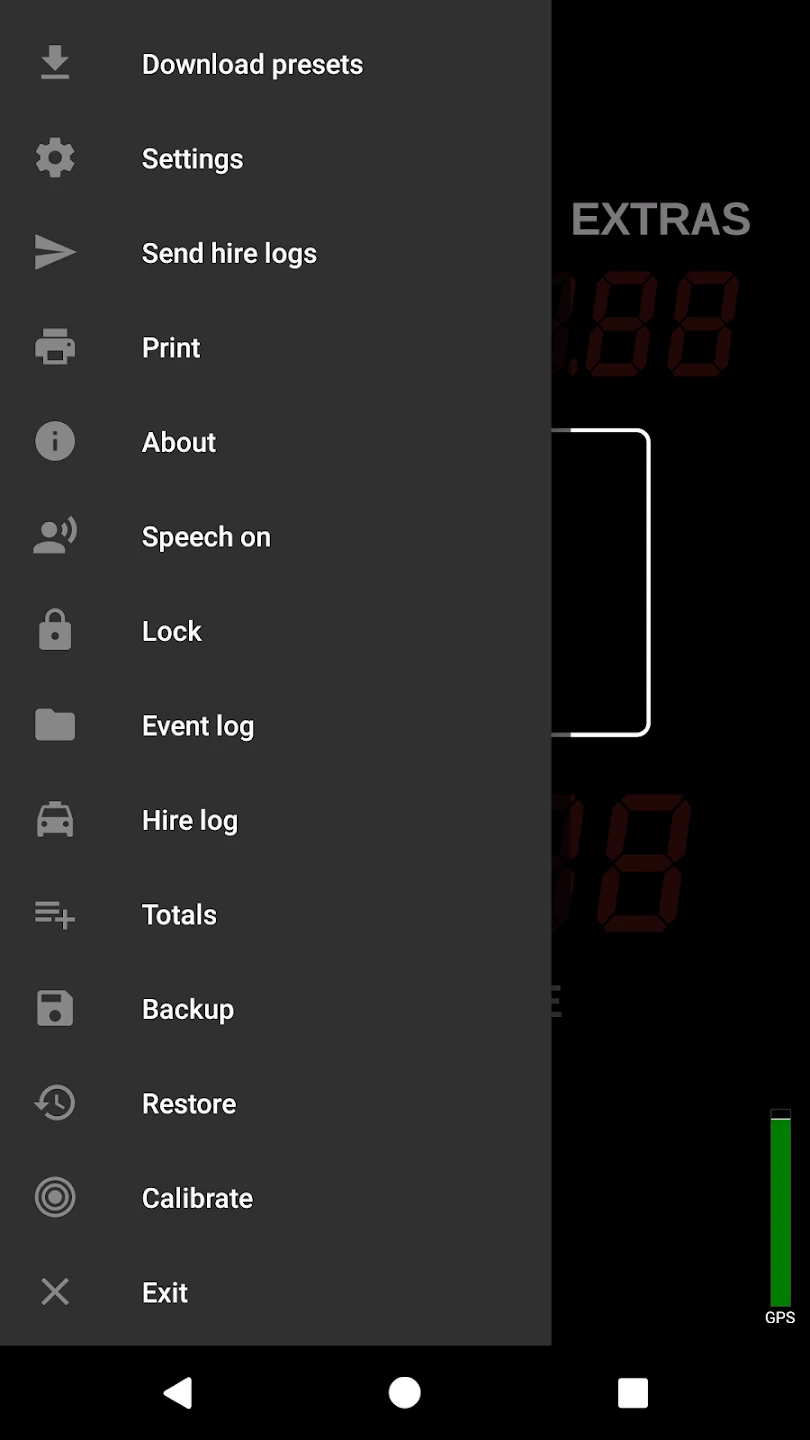

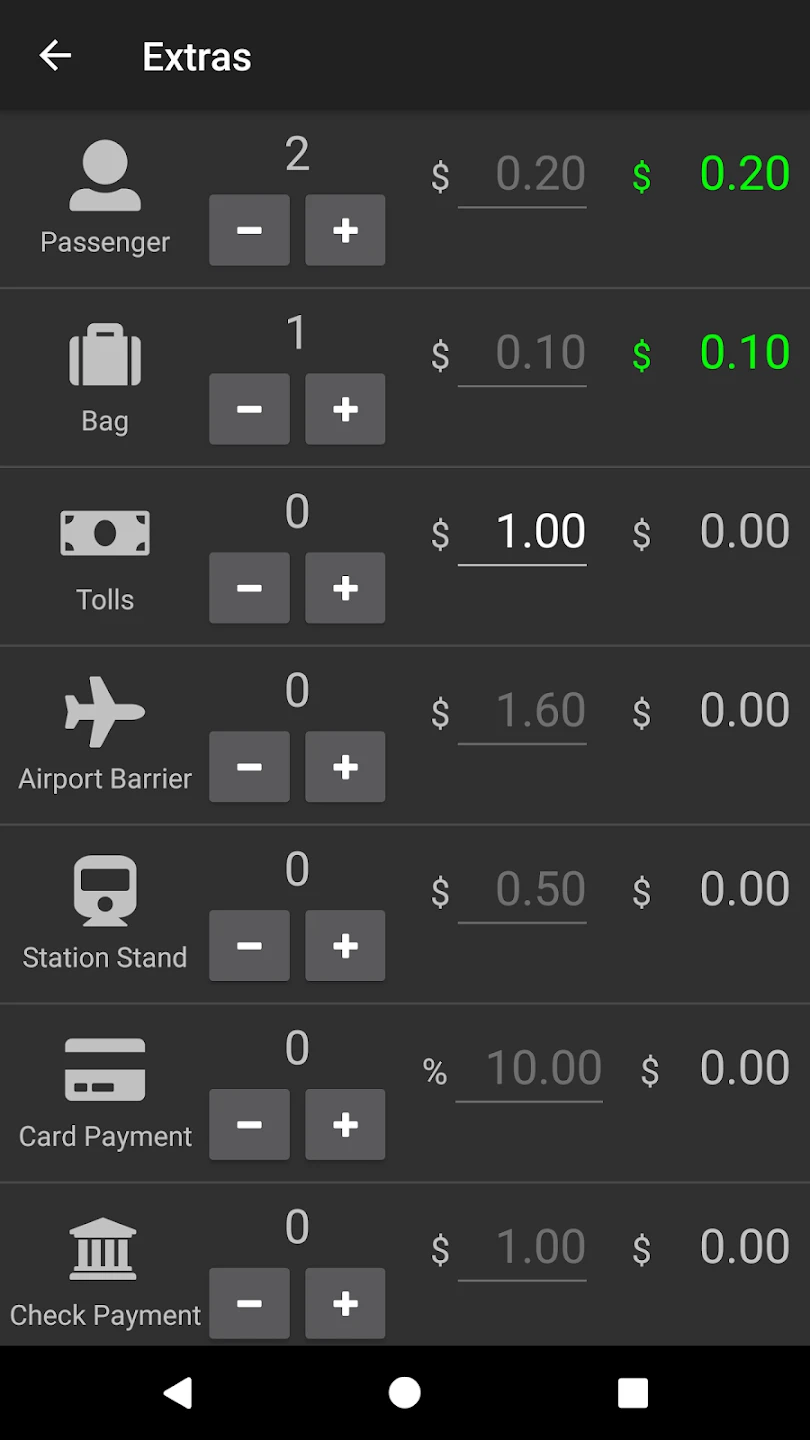

Screenshots

|

|

|

|