|

|

| Rating: 4.7 | Downloads: 10,000+ |

| Category: Finance | Offer by: Ananta Raha |

The MyMoney Pro – Expense & Budget app is a comprehensive financial tool designed for Android users seeking control over their personal finances. It allows users to track spending, create and monitor budgets, and analyze financial habits through detailed reporting, making it ideal for anyone looking to improve their money management skills, from casual overspenders to meticulous savers.

MyMoney Pro – Expense & Budget offers significant value by providing clear insights into expenditure patterns and simplifying the budgeting process. Its practical usage lies in helping users identify spending anomalies, stay within allocated funds for specific categories, and ultimately achieve better financial control and goal planning, leading to increased confidence in managing personal income and expenses.

App Features

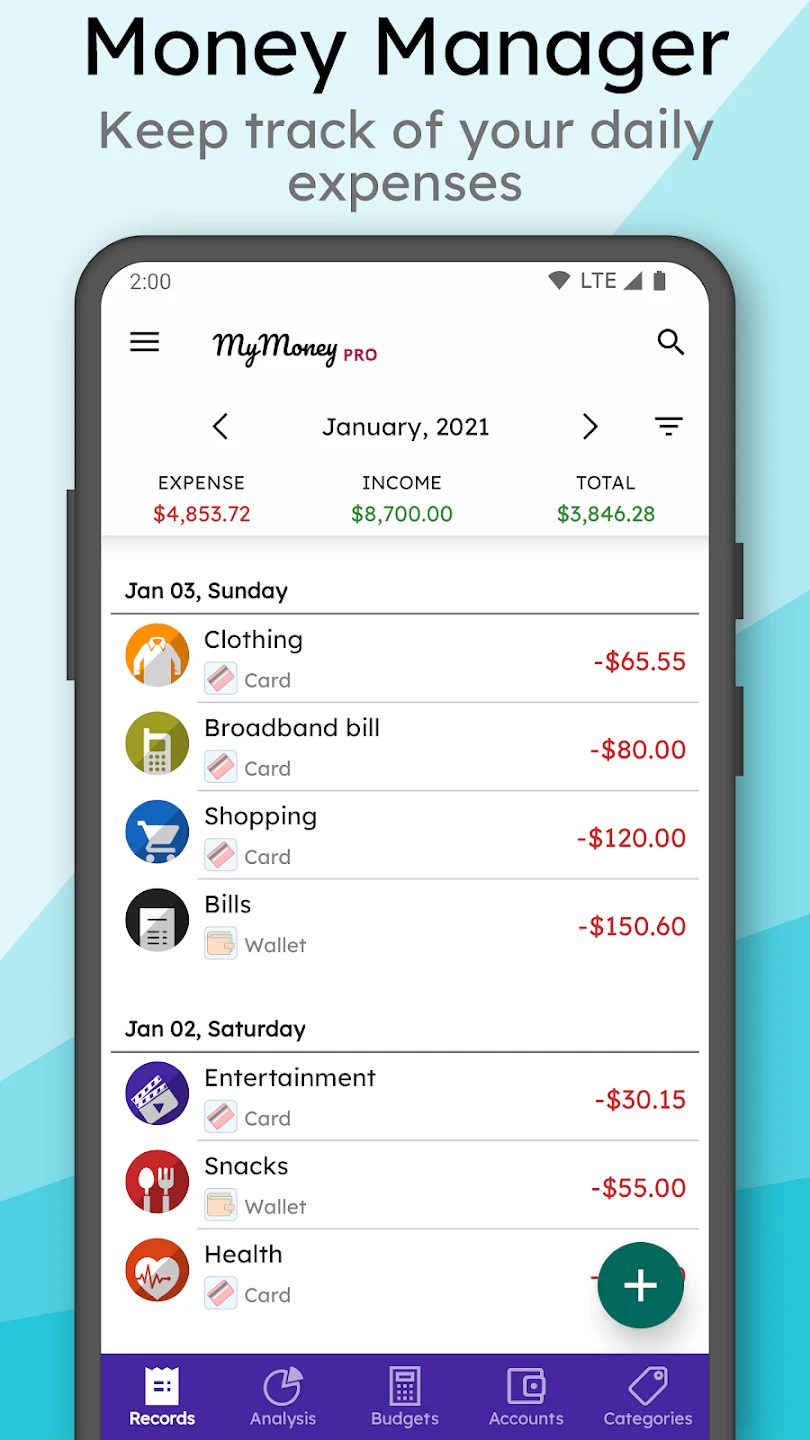

- Expense Tracking: Record every single expense with a simple tap, categorizing transactions to gain a clear view of how money is being spent. This powerful feature eliminates guesswork and provides a solid foundation for informed financial decisions, allowing users to see exactly where their money goes each month.

- Budget Management: Set specific budgets for various expense categories and track progress in real-time. The system uses descriptive budget names and icons, making it easier to understand and adhere to financial goals, ultimately preventing overspending and providing peace of mind.

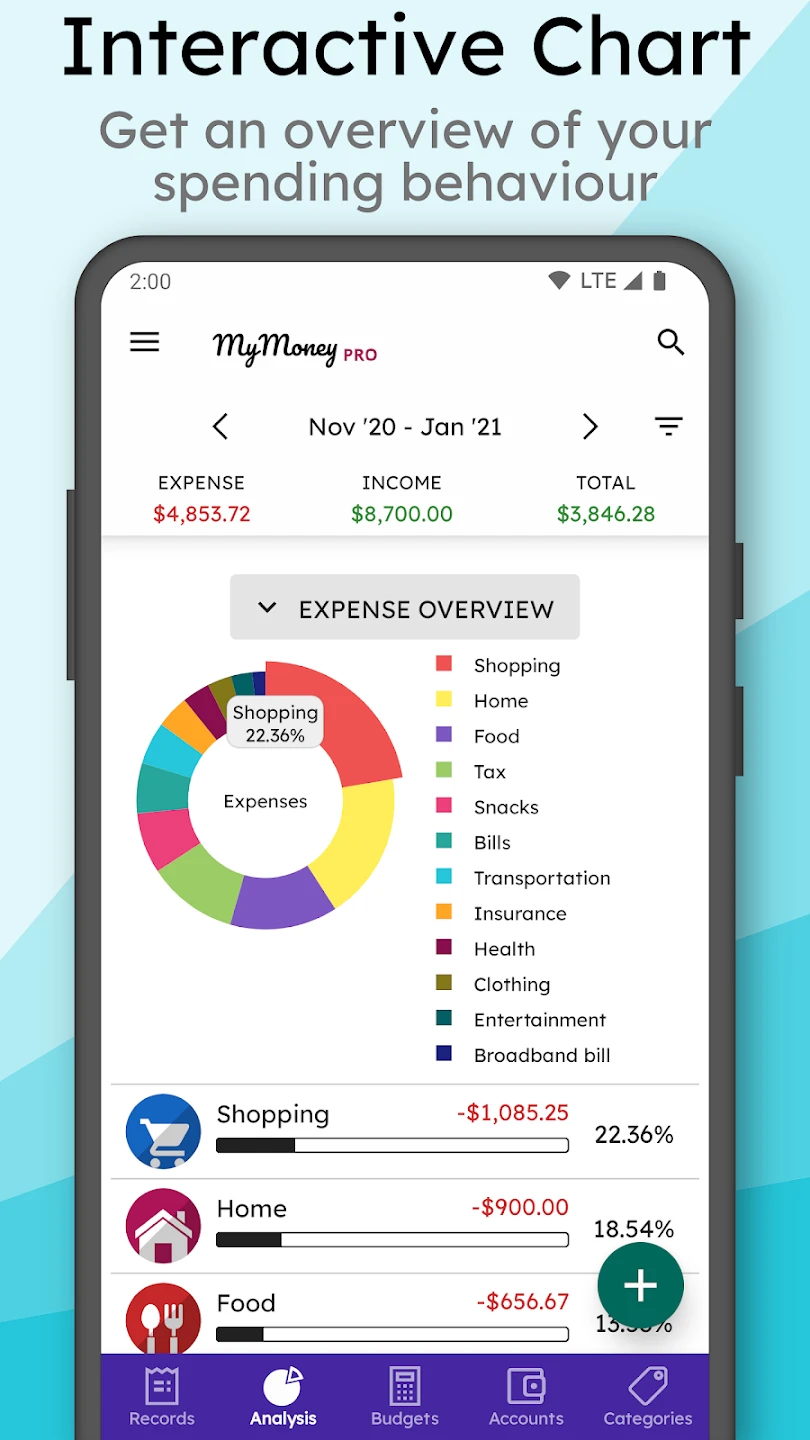

- Detailed Reports & Analytics: Generate insightful visual reports, including graphs and summary statistics, showing spending trends over time. This robust feature transforms raw transaction data into actionable intelligence, revealing saving opportunities and helping identify areas for financial improvement.

- Savings Goals: Create specific targets for saving, like a down payment or emergency fund, and track progress towards achieving them directly within the app. Users typically set goals with specified amounts and deadlines, finding motivation through visual progress indicators and reminders.

- Data Sync & Cloud Storage: Securely sync your financial data across all your devices using cloud services, ensuring your budget and expense information is always up-to-date and accessible. Compatibility with major cloud platforms guarantees that users can manage finances seamlessly on smartphones, tablets, and computers.

- Recurring Transactions: Save time by setting up automatic entries for regular expenses like rent, subscriptions, or loan payments. This intelligent feature reduces manual data entry significantly, automatically categorizing these transactions, and ensuring they are accounted for accurately each period.

Pros & Cons

Pros:

- User-friendly Interface

- Comprehensive Feature Set

- Regular Updates

- Cloud Integration

Cons:

- Potential Subscription Costs

- Learning Curve for Advanced Features

- Platform Limitation (Android Focused)

- Data Sync Delays Occasionally

Similar Apps

| App Name | Highlights |

|---|---|

| EveryDay |

This app offers fast processing, intuitive design, and wide compatibility. Known for custom workflows and multi-language support. |

| YNAB (You Need A Budget) |

Designed for simplicity and mobile-first usability. Includes guided steps and real-time previews. |

| MoneyLover |

Offers AI-powered automation, advanced export options, and collaboration tools ideal for teams. |

Frequently Asked Questions

Q: How often is transaction data backed up in MyMoney Pro – Expense & Budget?

A: MyMoney Pro – Expense & Budget typically backs up transaction data automatically whenever you sync with the cloud, though manual backup options might also be available for your specific cloud service configuration.

Q: Can I set up alerts or notifications within MyMoney Pro – Expense & Budget?

A: Yes, the app usually includes customizable alerts or notifications for various events, such as when your balance reaches a low point or when you’re nearing your budget limit for a specific category.

Q: Is MyMoney Pro – Expense & Budget suitable for tracking joint finances?

A: The basic expense tracking functions can be used for joint accounts, but MyMoney Pro – Expense & Budget is primarily designed for individual use. More advanced joint budgeting or shared ledger features might require dedicated couple or family finance apps.

Q: Can I link my existing bank accounts directly to MyMoney Pro – Expense & Budget?

A: This feature depends on the specific version of the app and its integration with financial institutions. Some versions support linking via specific banking APIs or partner services for automatic transaction imports.

Q: What happens to my budget data if I stop using MyMoney Pro – Expense & Budget?

A: Your budget and expense data is securely stored with your cloud provider. When uninstalling the app, your data remains on the cloud service unless you manually export or delete it through the cloud platform’s settings.

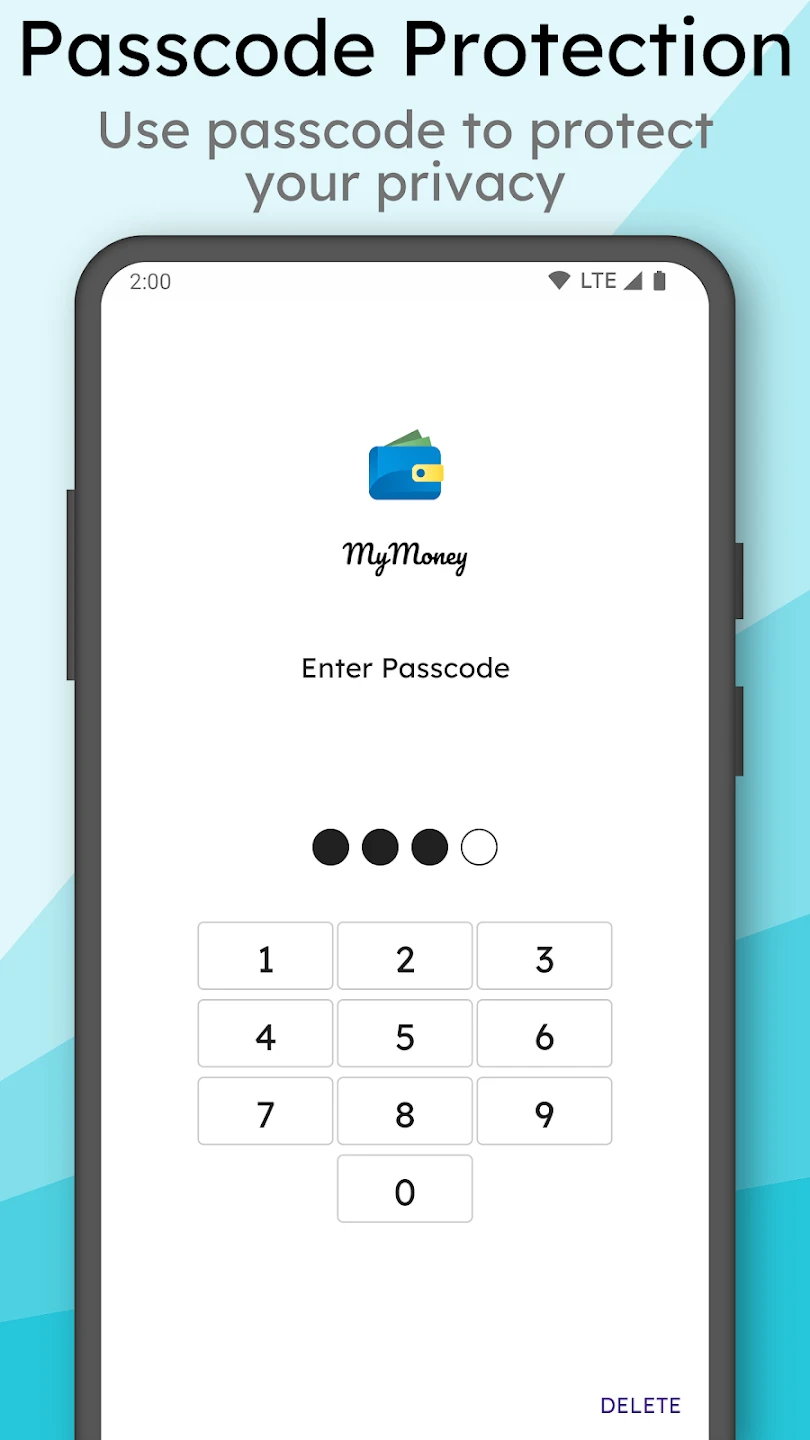

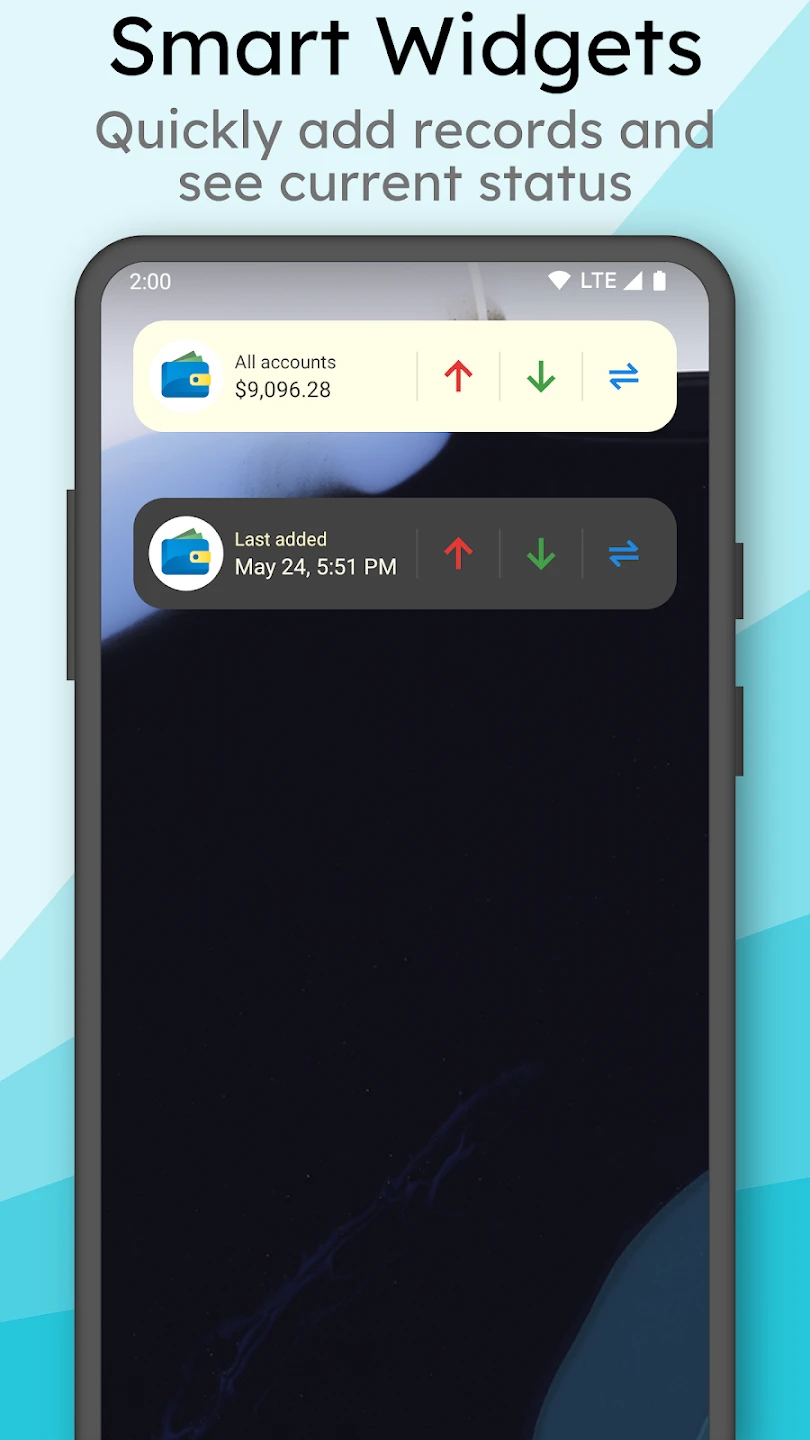

Screenshots

|

|

|

|