|

|

| Rating: 3.5 | Downloads: 500,000+ |

| Category: Finance | Offer by: Acima |

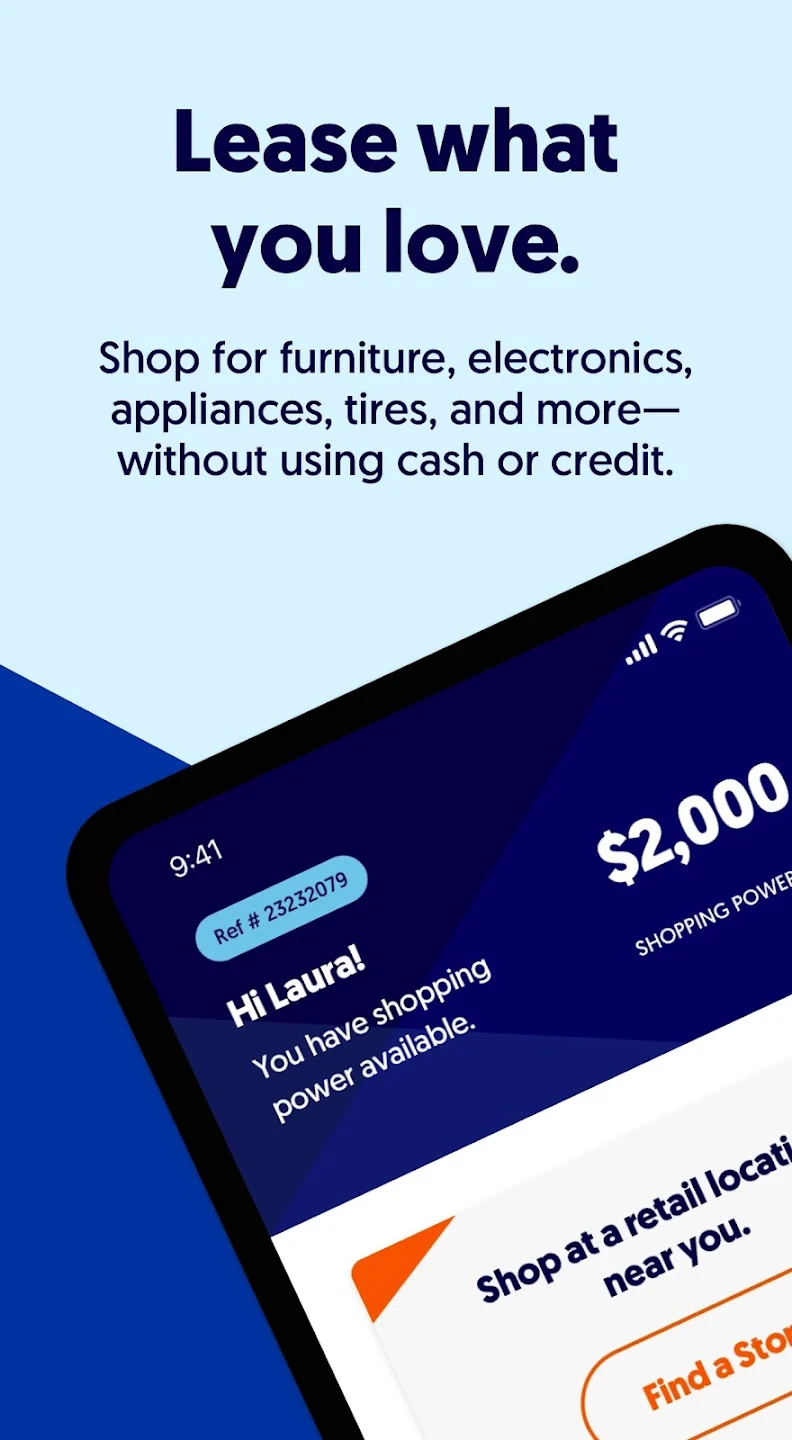

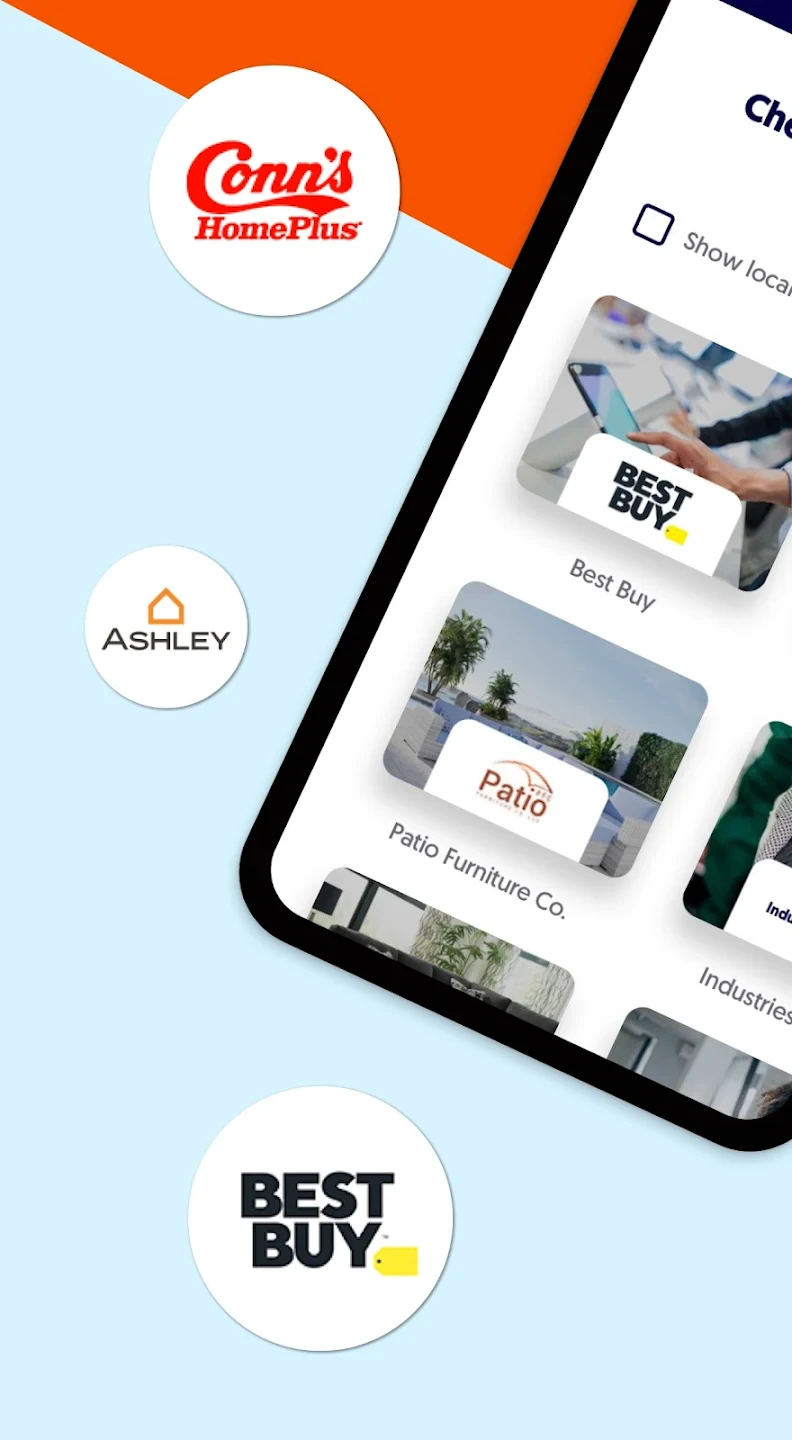

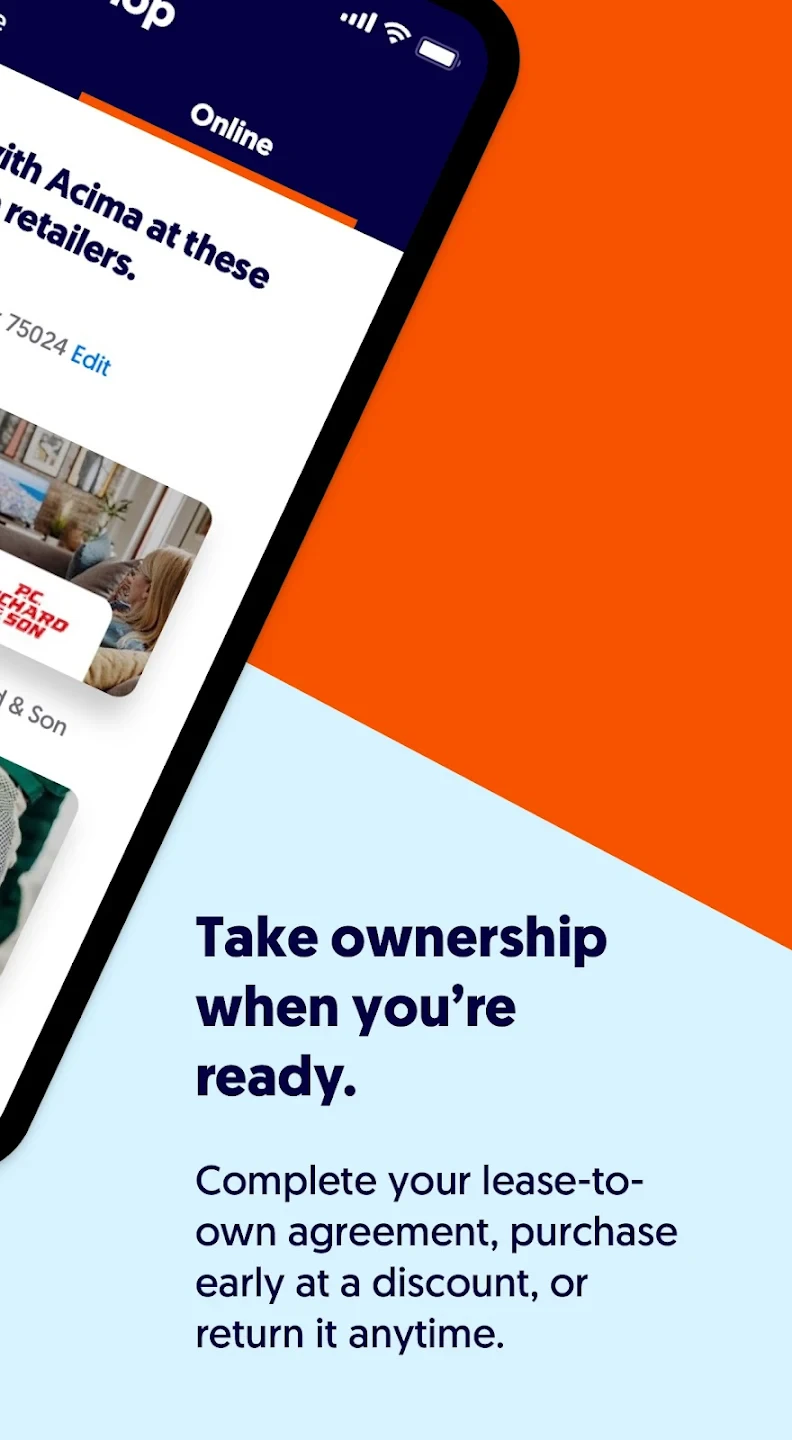

Acima Leasing offers a modern approach to equipment and vehicle financing, enabling users to quickly obtain assets through flexible lease agreements without extensive credit checks. This mobile-first platform streamlines the leasing application process for small businesses, entrepreneurs, and fleet managers who need equipment fast and with minimal upfront capital.

The Acima Leasing app eliminates cumbersome paperwork by digitizing the leasing journey from initial inquiry to final approval. Users gain access to competitive rates, transparent pricing, and 24/7 lease management tools—all accessible through any smartphone or web browser. This empowers business owners to respond rapidly to operational needs without navigating complex traditional finance channels.

App Features

- Instant Quotes & Customization: Generate lease offers in seconds by uploading specifications and receiving tailored rates; for example, a restaurant owner can get a quote for a food truck with specific engine requirements instantly.

- Digital Lease Agreement Generation: The system automatically creates legally binding documents based on your selected terms, reducing errors and saving time previously spent with lawyers.

- Seamless Payment Tracking: Monitor all lease obligations in real-time with color-coded notifications for upcoming renewals or penalties, preventing late fees automatically while providing financial clarity.

- Multi-Vendor Comparison: Compare rates and terms simultaneously across different asset providers, enabling smarter purchasing decisions that could save thousands in unnecessary markup.

- 24/7 Customer Support Portal: Get immediate access to leasing advisors via secure messaging, bypassing lengthy phone waits to resolve urgent operational disruptions.

- Asset Tracking Dashboard: Visualize all leased equipment across locations with built-in maintenance scheduling capabilities, preventing costly downtime by aligning service with lease cycles.

Pros & Cons

Pros:

- Rapid Equipment Acquisition

- No Exorbitant Origination Fees

- Streamlined Paperwork Management

- Transparent Pricing Display

Cons:

- Some Equipment May Have Residual Value Penalties

- Credit Score Requirements May Differ

- Complexity With Specialized Assets

- Regional Provider Availability Limits Options

Similar Apps

| App Name | Highlights |

|---|---|

| Equipment Financing Plus |

Known for its robust asset valuation tools and industry-specific financing solutions for manufacturing. |

| FleetLease Pro |

Designed for multi-unit operators with guided workflows and integrated maintenance tracking. |

| QuickCap Leasing |

Offers dynamic interest rate comparison and specialized solutions for high-value equipment. |

Frequently Asked Questions

Q: How quickly can we get equipment using Acima Leasing?

A: In many cases, we’ve processed lease-to-purchase equipment within 48 hours, though complex requirements might need additional review.

Q: Are credit checks really waived for all applicants?

A: The Acima Leasing process evaluates each case holistically—while traditional finance relies heavily on FICO scores—we consider operational history and business viability.

Q: How do we compare equipment finance options against traditional banks?

A: We provide clear ROI calculations showing our average savings are 15-20% lower total financing costs due to simplified processes and direct vendor relationships.

Q: Can we modify our lease terms during the contract period?

A: Absolutely—if your equipment needs change, our system enables mid-cycle amendments with just a few clicks after verification.

Q: What happens if our business relocates during the lease term?

A: Our app includes relocation assistance features and can often reassign leases—contact support for specific location requirements before moving.

Screenshots

|

|

|

|