|

|

| Rating: 4.6 | Downloads: 500,000+ |

| Category: Shopping | Offer by: Play2Pay, Inc. |

Ad It Up—Save on Your Bills is your all-in-one smart app designed to help you manage and cut costs effectively across various household expenses. From utility bills and subscriptions to mobile plans and shopping habits, this platform empowers users to track spending, find savings opportunities, and optimize budgets with personalized insights. It’s crafted for anyone looking to gain control over their finances and make smarter spending decisions.

Whether you’re a budget-conscious student, a family managing monthly expenses, or a professional aiming to save on business costs, Ad It Up—Save on Your Bills transforms how you interact with your finances. Its intuitive tools help you identify wasteful spending patterns, negotiate bills, and discover exclusive discounts, ultimately turning bill-paying from a chore into a proactive path toward financial freedom.

App Features

- Bill Tracking Dashboard: Seamlessly monitor due dates, amounts owed, and payment history all in one place, reducing the risk of late fees. This organized view helps you anticipate expenses and plan your budget more effectively, like knowing exactly when your electricity bill will arrive.

- Savings Engine Analysis: Leverages AI algorithms to scan your spending habits and utility bills, suggesting personalized discounts and comparing prices across providers. This feature dramatically cuts costs by highlighting hidden savings opportunities unavailable through traditional channels, making it faster to find the best deals.

- Negotiation Support Tool: Provides data-driven talking points to help you confidently negotiate lower rates with providers, backed by your usage statistics and comparable pricing data. This empowers users to save significantly on contracts they might have accepted without question, turning negotiations from daunting tasks into confident victories.

- Automated Bill Reminders: Set custom alerts for payments, promotions, and optimal times to lock in discounts before rates increase. The system syncs with calendars and payment methods, making it invaluable for busy professionals who want to maintain financial discipline while saving time.

- Spending Analytics Hub: Offers visually intuitive charts and detailed reports that break down expenses by category, season, or provider, enabling informed decision-making and goal tracking. Users gain clarity on their money, helping small families cut unnecessary subscriptions or large businesses optimize departmental spending.

- Integration with Financial Platforms: Seamlessly connects with bank accounts, credit cards, and popular budgeting tools to provide a comprehensive financial overview. This creates a unified financial ecosystem that enhances overall spending management and supports strategic financial planning.

Pros & Cons

Pros:

- User-friendly interface designed for intuitive bill management

- Comprehensive analytics reveal savings potential users might miss on their own

- Compatibility with major financial institutions and payment systems

- Regular updates add new savings opportunities and features

Cons:

- Free version has limited advanced analytics and savings suggestions

- Setup requires linking sensitive financial accounts and information

- Some features may have subscription costs for premium usage

- Dependence on accurate input means manual errors can skew insights

Similar Apps

| App Name | Highlights |

|---|---|

| MoneyWise Budget |

Focuses on detailed expense categorization and visual budget tracking. Ideal for users prioritizing comprehensive budget planning over direct bill savings negotiation. |

| BillSavvy Pro |

Specializes in utility bill comparison tools and energy-saving tips. Known for its detailed electricity and water consumption analysis, particularly strong for utility-focused savings. |

| FinTrack Essentials |

Offers basic financial tracking with limited bill management and savings features. Good starting point for beginners before moving to more advanced tools like our app. |

Frequently Asked Questions

Q: How secure is my financial data when using Ad It Up—Save on Your Bills?

A: Your privacy and security are top priorities. We employ bank-grade encryption (AES-256) for all financial transactions, comply with GDPR and CCPA regulations, and never share your information with third parties. Data linking is optional, and you control what information is accessed through our strict permission system.

Q: Can the app actually help me find savings beyond typical discounts?

A: Absolutely! Our AI analyzes your spending patterns and market data to identify savings opportunities that most users miss, such as bulk discounts, loyalty rewards, and off-peak pricing. For example, we recently helped users save 15-25% on recurring subscriptions by suggesting alternative payment plans.

Q: Does the free version include all the key features?

A: The free version provides core bill tracking and basic savings analysis. Premium features like advanced negotiation tools, detailed spending analytics reports, and expanded savings potential require the Ad It Up—Save on Your Bills Pro subscription, which costs $4.99/month or $49/year with an automatic 20% discount for annual billing.

Q: Can I track multiple household accounts in one place?

A: Yes! The app supports multi-account tracking for families or roommates. You can set up individual user profiles with separate budgets and notifications, or designate one primary account holder to oversee household finances. All users can access shared savings insights while maintaining privacy controls.

Q: What happens if I can’t find savings for my bills?

A: Our system doesn’t guarantee savings but provides data-backed alternatives. If no immediate savings are identified, we suggest budget optimization strategies, payment plan adjustments, or upcoming promotional periods. Many users find they save an average of 8-12% within the first month by following our personalized guidance.

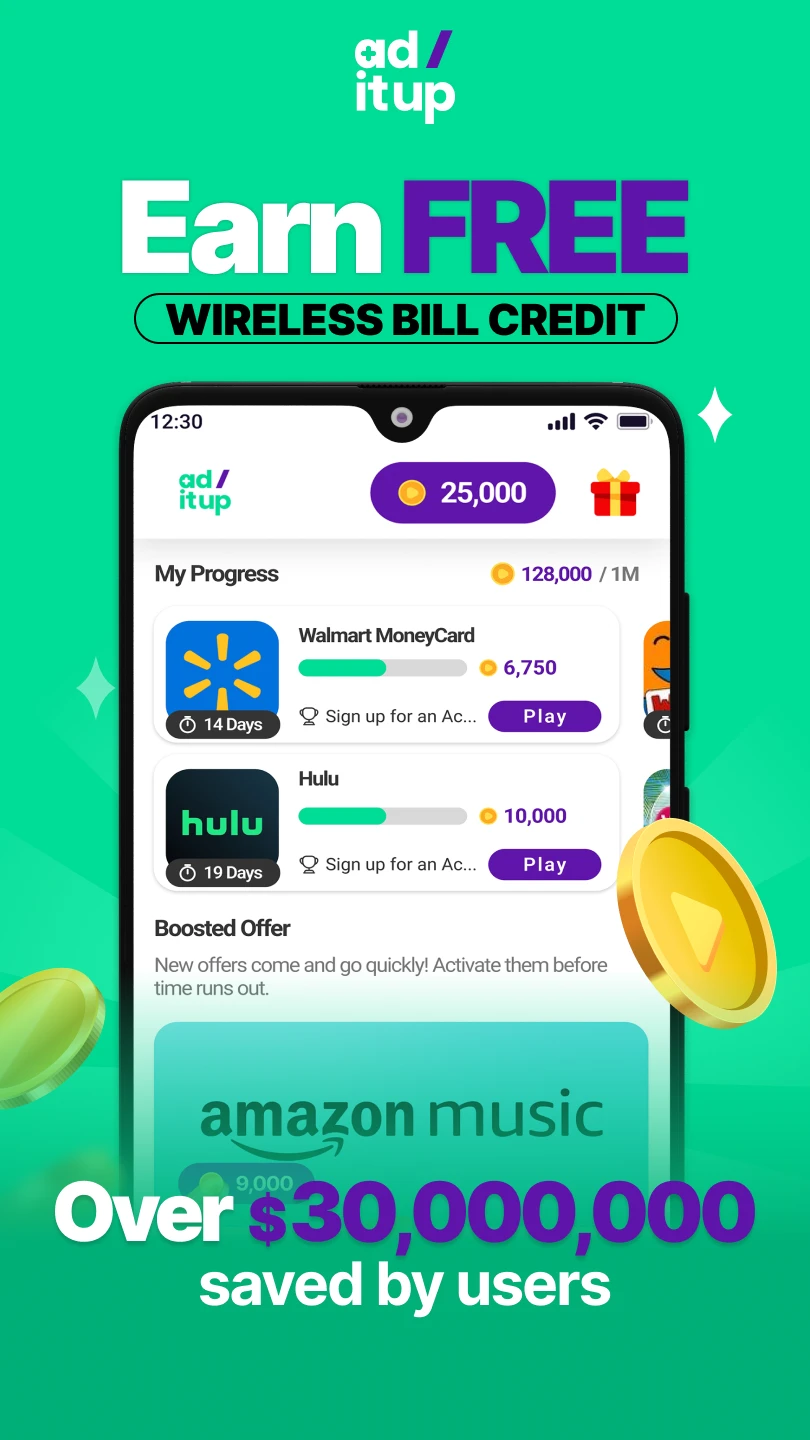

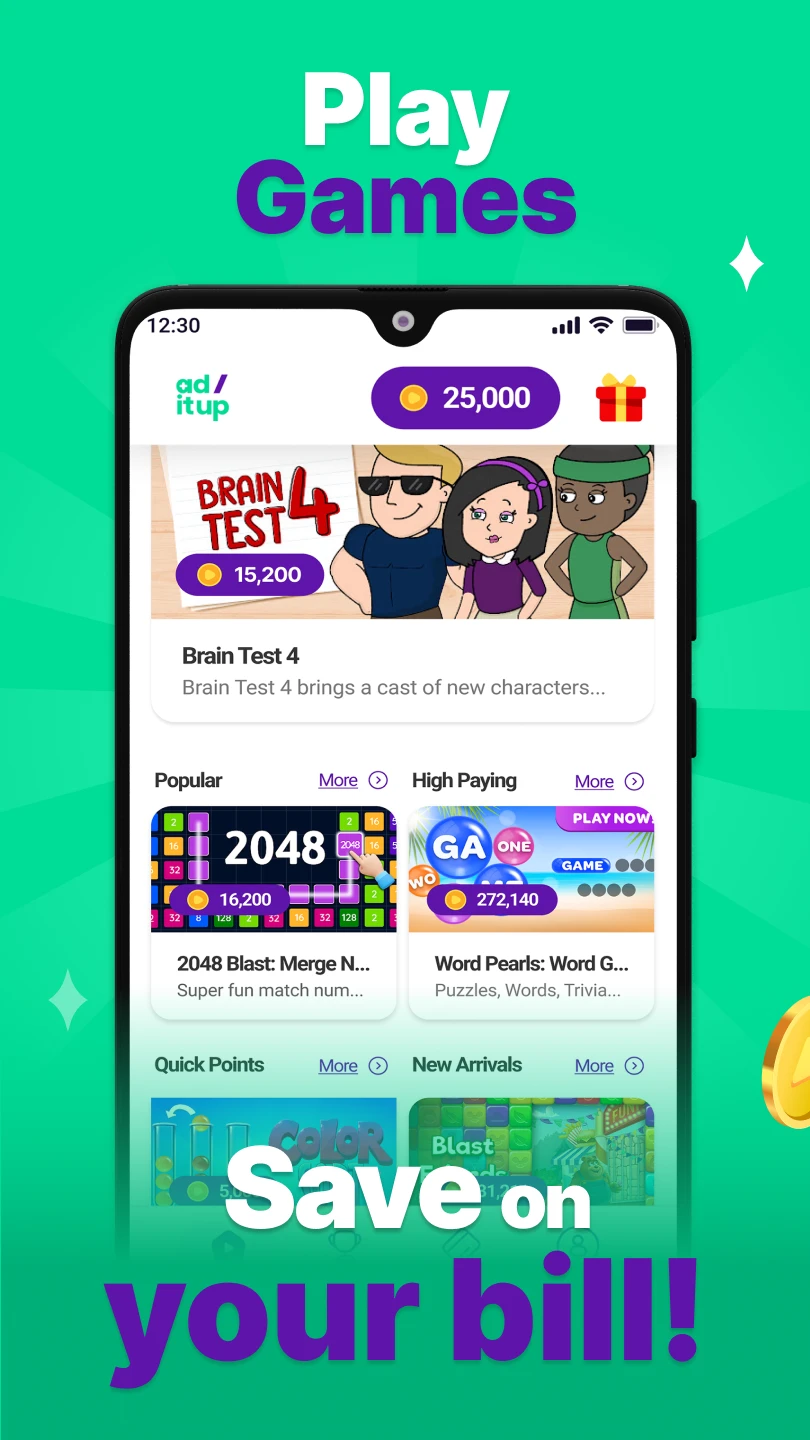

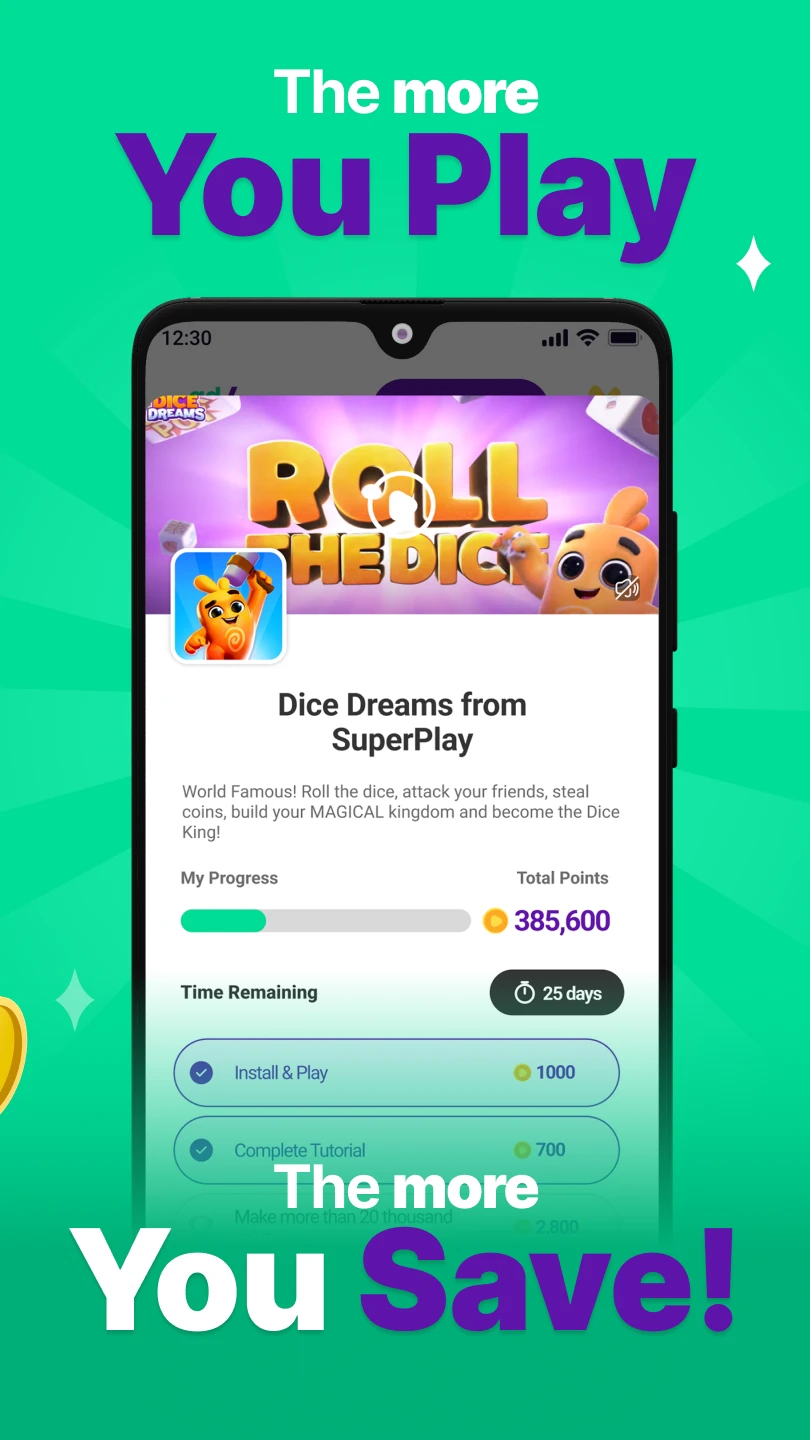

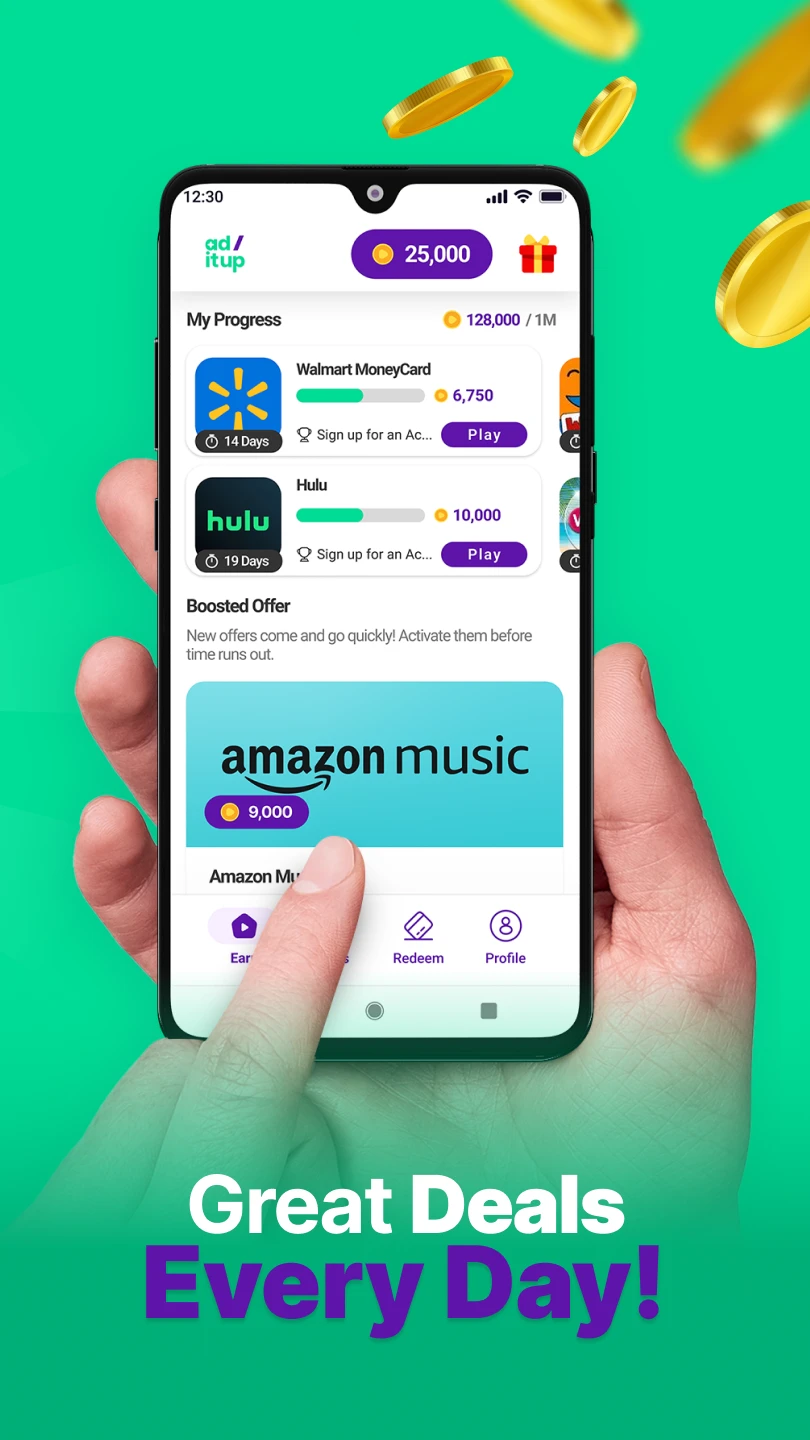

Screenshots

|

|

|

|