|

|

| Rating: 4.2 | Downloads: 10,000,000+ |

| Category: Shopping | Offer by: Afterpay |

Afterpay: Pay over time is a digital payment app that enables users to shop now and pay in installments later, typically interest-free. It works by partnering with retailers to allow customers to checkout using the Afterpay app, splitting the payment into equal parts due over a short period. This service is ideal for budget-conscious shoppers or anyone looking to delay payment for immediate purchases without needing immediate access to full funds.

The key appeal of Afterpay: Pay over time lies in its simplicity and flexibility—it makes shopping feel immediate while managing finances more smoothly over time. It helps users buy what they need now while spreading the cost across their spending timeline. Many find it useful for everyday purchases, large ticket items, or as a temporary solution during unexpected expenses without incurring credit card interest.

App Features

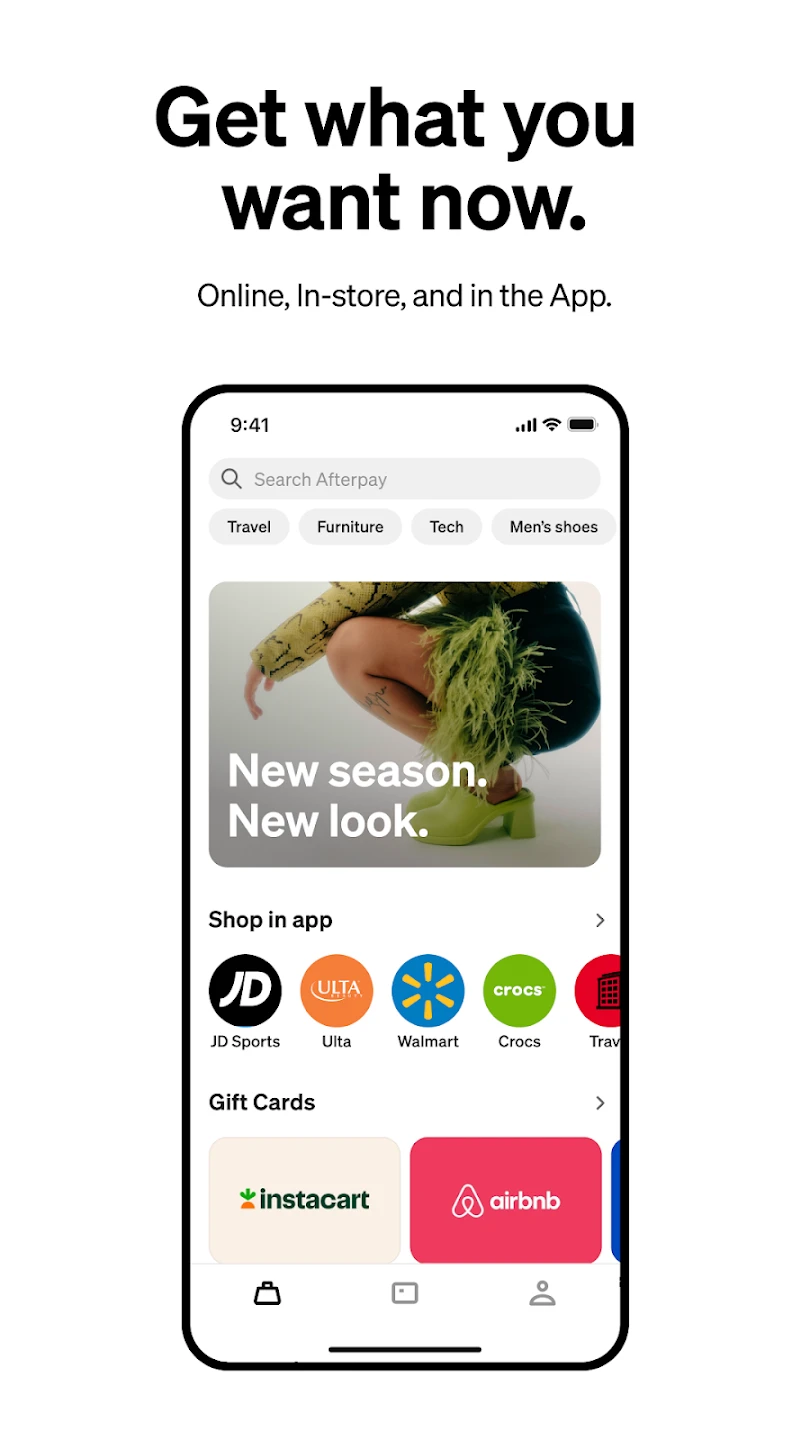

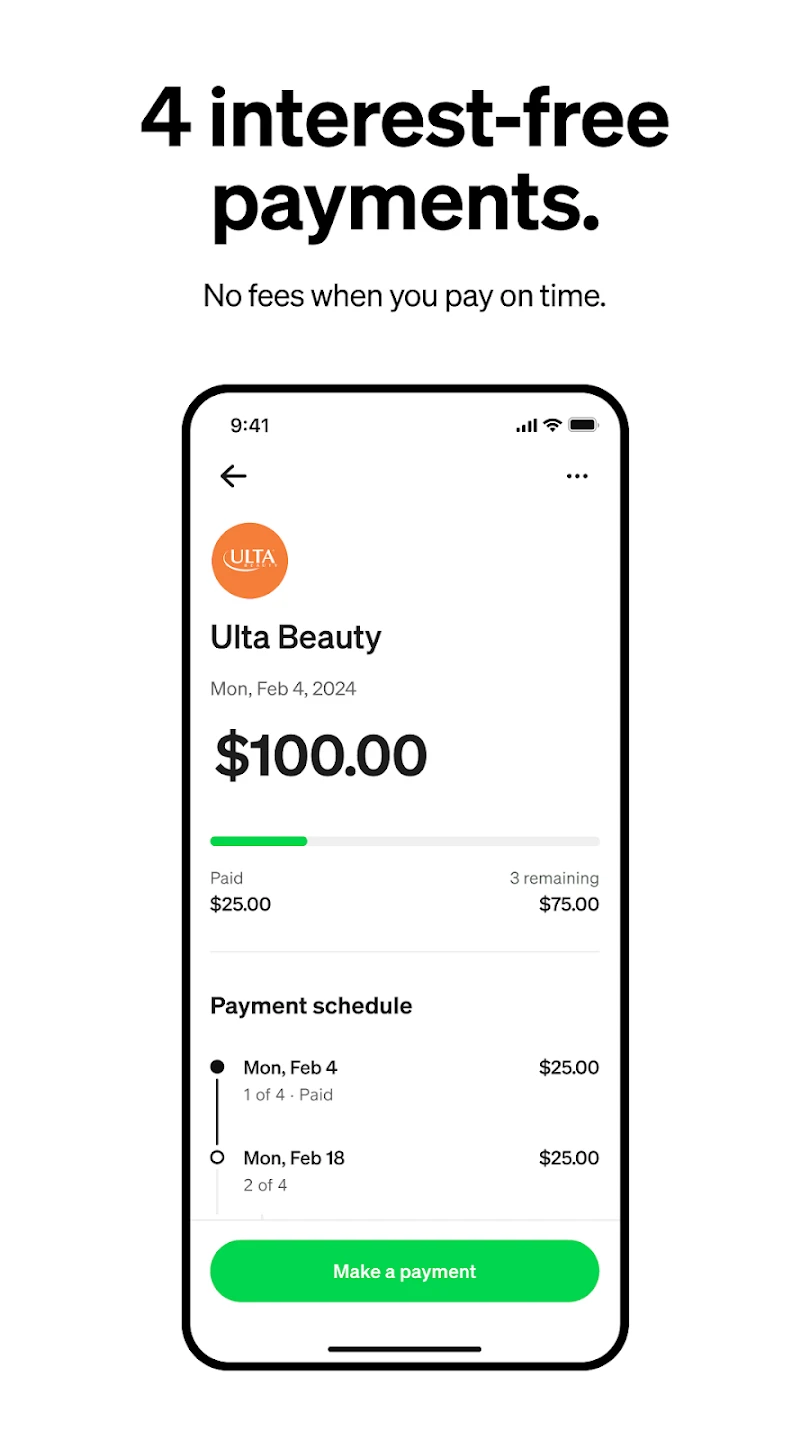

- Shop and Pay in 3 Interest-Free Installments: Afterpay lets you purchase items today and repay them over three equal payments without extra charges. This makes buying more affordable and helps you budget smarter across your monthly expenses.

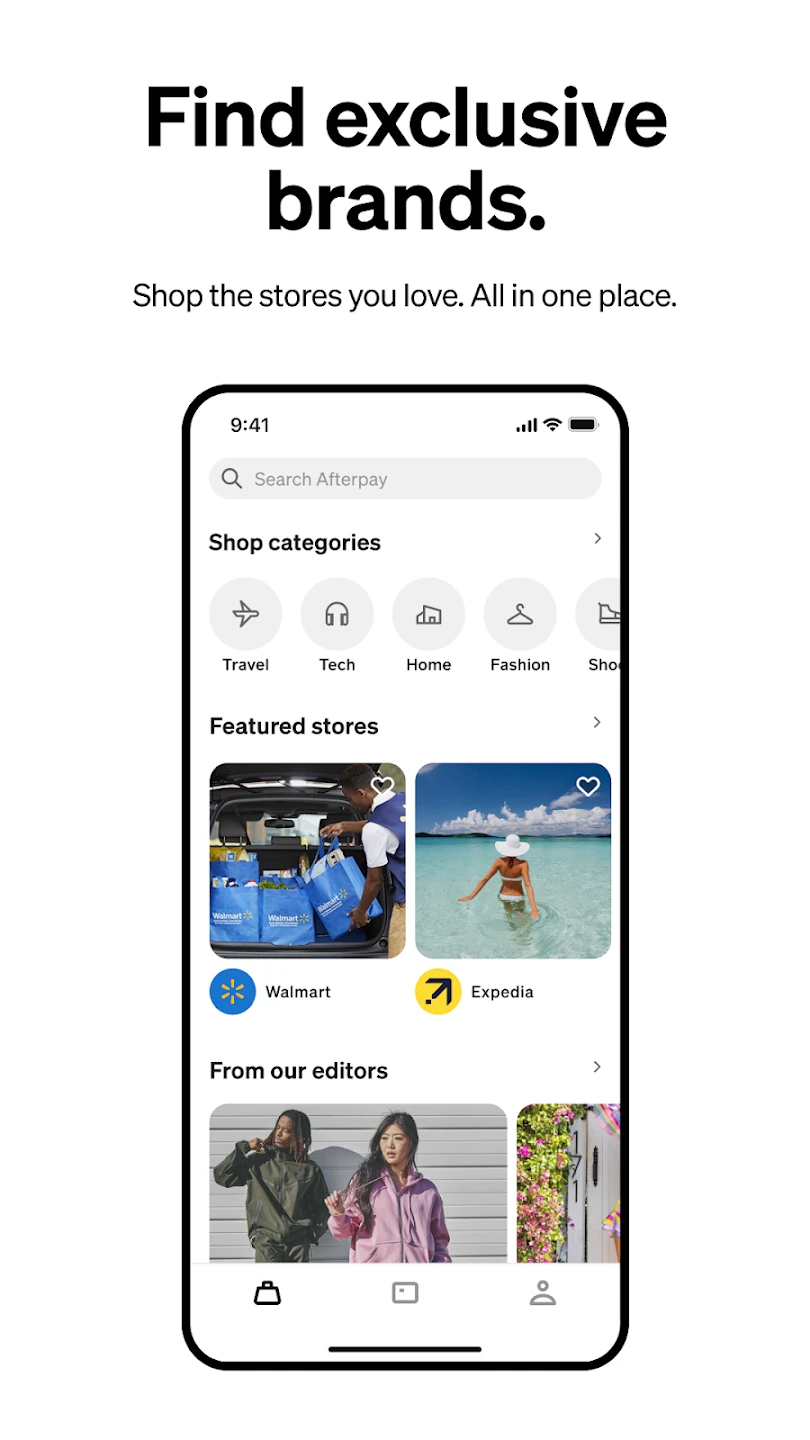

- Eligibility Checker: The app instantly tells you which Afterpay retailers and items are available for purchase. Using this feature helps avoid disappointment at checkout, especially during busy sales periods or for specific products.

- Automatic Payment Reminders: Afterpay sends gentle notifications as payment dates approach. These alerts help users stay on track with repayments without missing deadlines, reducing late fee risks.

- Spend Tracking: View upcoming payments across all your purchases. This feature provides complete transparency on your payment schedule, preventing accidental overspending and helping manage cash flow effectively.

- Spending Limits: Afterpay assesses your ability to repay based on your transaction history. This responsible design protects your account from overextension, ensuring only affordable purchases are approved to maintain financial health.

- Account Management: Access purchase details, payment history, and modify preferences. This centralized approach streamlines management across different retail platforms and simplifies customer support interactions.

Pros & Cons

Pros:

- Seamless, Interest-Free Shopping

- Simple Three-Step Process

- Spendsafe Purchase Protection for eligible items

- Wide Retailer Availability across major online stores

Cons:

- Potential for overspending without immediate awareness

- Eligibility restrictions based on purchase amount or frequency

- Automatic payments might not suit everyone’s cash flow

- Credit checks may impact some applicants’ approval chances

Similar Apps

| App Name | Highlights |

|---|---|

| Klarna |

This app offers interest-free installments, virtual checkout, and purchase protection. Known for multi-retailer integrations and advanced payment tracking tools. |

| Afterbuy |

Provides similar interest-free payment options with flexible repayment terms. Includes guided checkout and spend management insights for users. |

| Afterpay UK |

Offers comparable services including delayed payment options and seamless integration with UK online stores. Features priority customer support for urgent issues. |

Frequently Asked Questions

Q: How quickly are payments processed with Afterpay?

A: Your first payment is due 14 days from purchase, with the second due 28 days later, and final payment within 42 days. This standardized timing helps you plan your finances around a consistent schedule.

Q: Can I change my payment plan if my financial situation changes?

A: Yes, you can contact Afterpay support directly to discuss modifications. This flexibility is designed to help users maintain payment stability during life changes.

Q: Are there any fees or interest charges on Afterpay purchases?

A: No, eligible purchases through Afterpay are interest-free with no hidden fees. This transparency is part of the core Afterpay promise.

Q: What if I can’t make a payment on time?

A: Late fees apply if you miss a payment, but you can catch up with one larger payment. Recurring payment failures may lead to temporary account restrictions.

Q: How can I check my eligibility for Afterpay services?

A: The app evaluates your recent transaction history automatically. If declined, you’ll receive an on-screen notice with reasons. This instant feedback helps improve your chances for better results over time.

Screenshots

|

|

|

|