|

|

| Rating: 4.4 | Downloads: 1,000,000+ |

| Category: Finance | Offer by: Ally Financial |

Ally: Bank, Auto & Invest is a comprehensive financial management application designed to streamline banking, vehicle purchasing, financing, and investment activities. It allows users to handle checking and savings accounts, explore auto loan options, manage existing vehicle financing, and utilize tools for investment tracking or decision-making – catering primarily to individuals actively involved in managing personal finances and potentially seeking vehicle acquisition or optimizing their portfolio.

The key appeal of Ally: Bank, Auto & Invest lies in its unifying platform offering, reducing the need to manage separate services for banking, auto needs, and investing. This potential integration simplifies financial oversight, aids in achieving automotive goals, and provides a convenient avenue for users navigating various aspects of personal wealth, ultimately consolidating financial management capabilities.

App Features

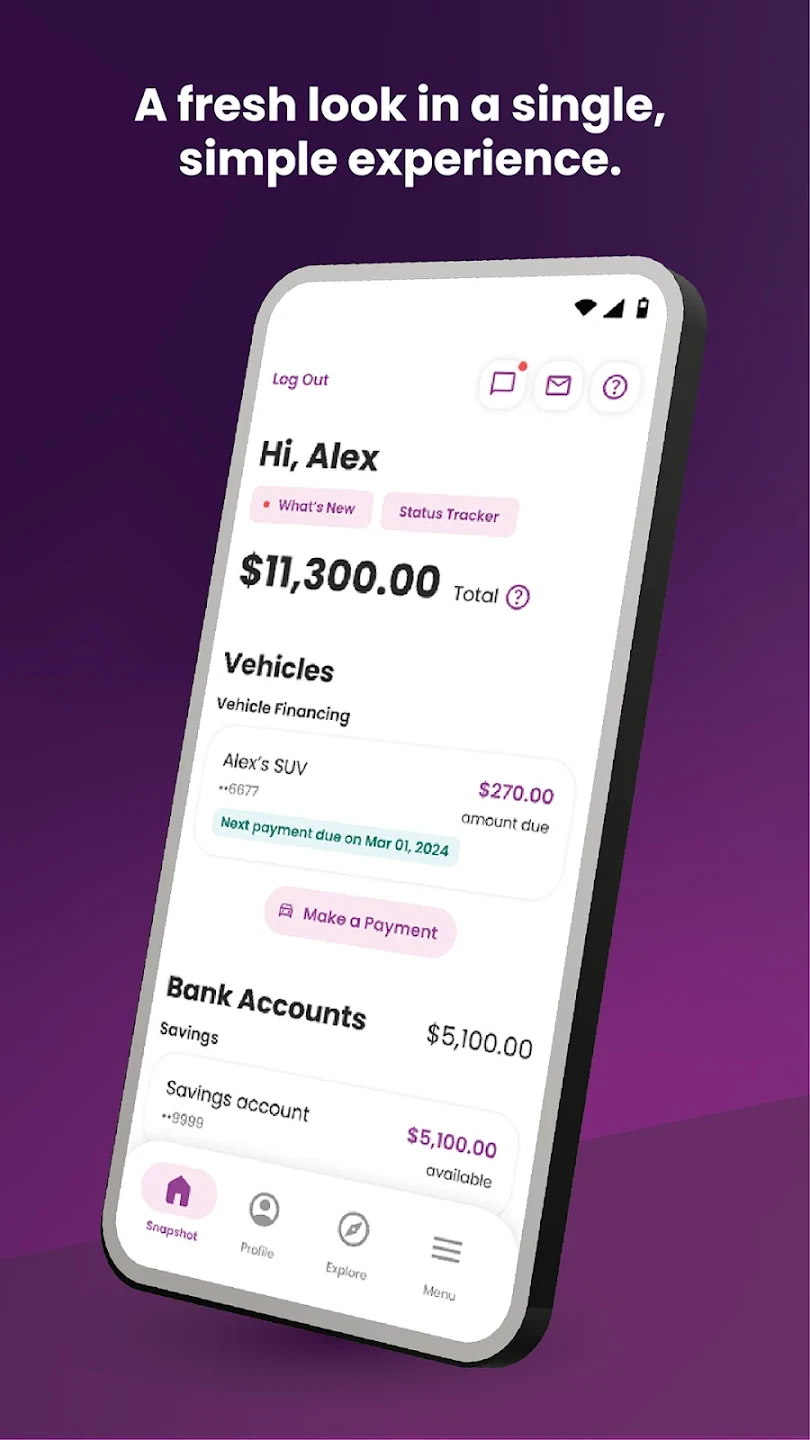

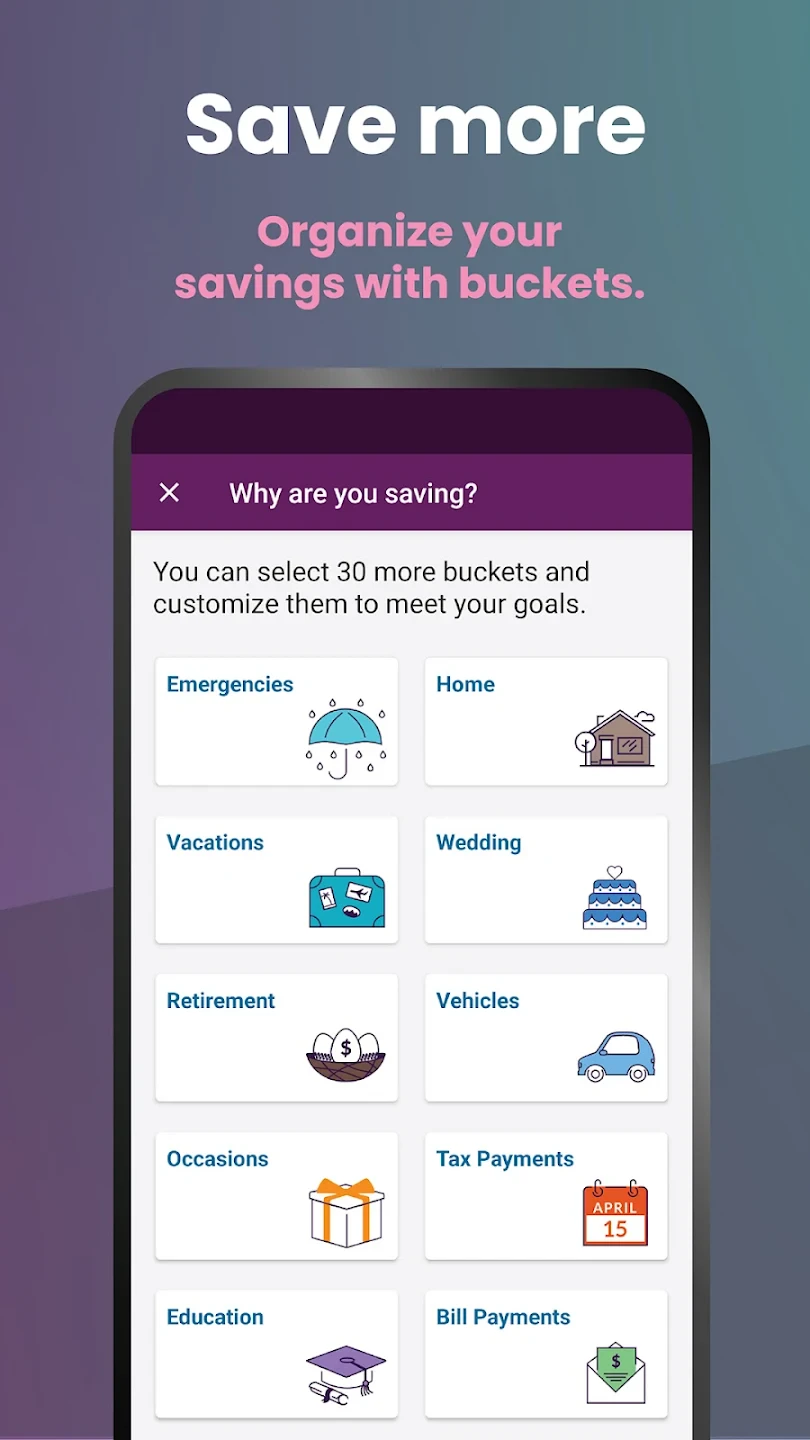

- Integrated Banking Tools: Access and manage your Ally bank accounts, possibly view statements, deposit checks (like CashPass), and perform transfers directly within the app, offering the convenience of day-to-day banking right at your fingertips for your primary Ally accounts. This eliminates the need to navigate separate websites or physical branches for basic account management tasks.

- Auto Loan Inquiry & Application Support: The app potentially provides tools to pre-qualify for auto loans, compare potential interest rates, and initiate the loan application process using your Ally banking information, potentially simplifying the entire vehicle purchasing journey and making the process faster using simplified digital documentation. For instance, after bank log-in, submitting necessary financial details for a car loan could be embedded directly.

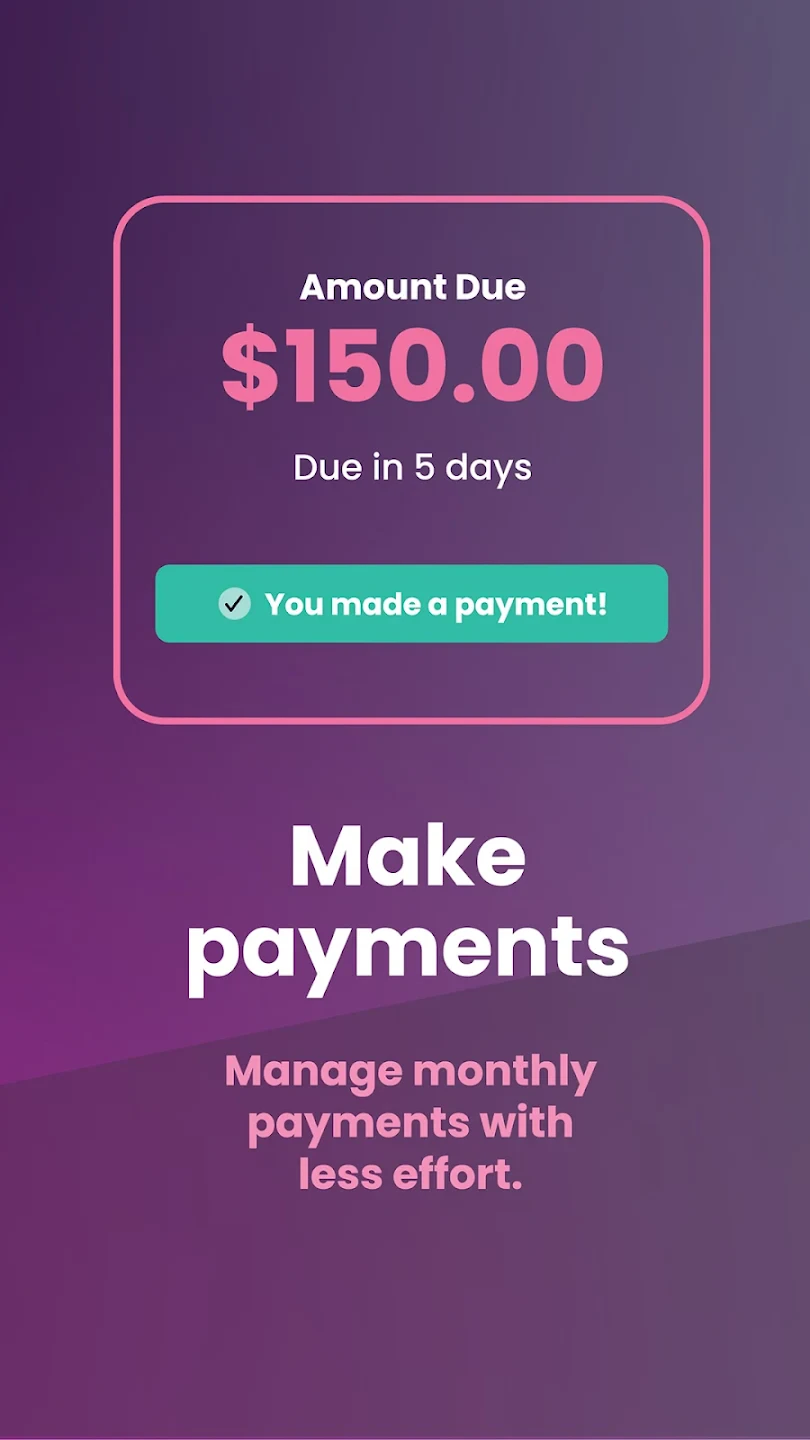

- Vehicle Financing Management Portal: Users might find a dedicated section to monitor and manage existing vehicle loan payments, payment schedules, payoff values, and provide alerts or estimates for upcoming payments or refinance opportunities with Ally, providing clear peace of mind and control over associated auto debt directly connected to their Ally banking relationship.

- Investment Account Access & Tracking: If investing is part of the offering, users could potentially view the performance, holdings, and transaction history of their Ally Invest accounts, alongside market news or alerts curated by the finance platform, facilitating efficient tracking alongside other financial activities. This might mean viewing stock performance while reviewing your auto loan balance without leaving the app.

- Personalized Financial Insights & Alerts: The app features an “Ally Smart” function that offers summary alerts for account activities (like fee thresholds or large transactions) or investment milestones, tailoring notifications to individual usage patterns for different account holders or services within the app suite, ultimately enhancing user awareness and helping protect finances.

- Potential Reward Points System: An advanced feature could allow users to link certain transactions—like fuel purchases or completed auto loan payments—within the Ally ecosystem to accumulate points redeemable for cash back, no-fee handling, or discounts on future Ally financial products and services, providing integrated incentives encouraging loyalty within the Ally network.

Pros & Cons

Pros:

- All-in-One Financial Suite

- Potentially Lower Fees

- Streamlined Loan Applications

- Convenient Alerts & Notifications

Cons:

- Limited Investment Complexity

- Market Dependent Availability

- Basic Mobile Design Potential

- Potentially Lower App Limits

Similar Apps

| App Name | Highlights |

|---|---|

| Ally Invest |

Expands on the investment side, offering robust stock trading, market research tools, and retirement planning features accessible through the Ally platform. |

| Wells Fargo Mobile |

Mobilizes traditional banking and investment services from Wells Fargo, including loans, banking, and investment options, but with potentially less emphasis currently on automarket functions. |

| CarMax Auto Financing |

Focuses specifically on the car buying and financing experience, with comparison tools and vehicle valuation aids, not necessarily bundling Ally’s primary banking features. |

Frequently Asked Questions

Q: Is Ally: Bank, Auto & Invest replacing my current Ally online banking login?

A: Not necessarily replacing, Ally: Bank, Auto & Invest aims to consolidate services into a single app. You’ll likely use it for banking primarily and manage Auto Loan inquiries/monitoring, currently alongside, though consolidation is probably planned, basic internet banking logins might still exist initially.

Q: What investment options are included with Ally: Bank, Auto & Invest via Ally Invest?

A: Through the Ally Invest component within the app, users can typically access a range of options, including stocks, bonds, mutual funds, ETFs, and CDs, directly from the interface utilizing Ally’s multi-platform approach.

Q: Can I use Ally: Bank, Auto & Invest for refinancing my car?

A: Possibly – the app highlights “Automotive Financial Services” with potential refinancing tools. Users should look for the dedicated loan management or “Finance Center” section to explore pre-qualification or official application options for vehicle refinancing.

Q: Are there any costs associated with using Ally: Bank or Auto features?

A: Ally often promotes competitive rates and specific fee structures, especially for direct deposit ($25/mo) or CashPass checking. However, overdraft avoidance is key to minimize charges, and some premium features might have associated costs – ensure you understand the specific account terms and potential fees before engaging.

Q: How often are my investment data updates in the app?

A: If using the Ally Invest feed within Ally: Bank, Auto & Invest, market data is usually updated regularly, typically based on a standard data feed schedule. Gain potential real-time updates for certain stocks hinged on Ally’s specific platform capabilities.

Screenshots

|

|

|

|