|

|

| Rating: 3.8 | Downloads: 10,000,000+ |

| Category: Finance | Offer by: American Express |

The Amex App is a powerful financial management platform designed primarily for Amex corporate users to manage employee expenses, company funds, and travel bookings efficiently from a single mobile interface. It simplifies the process of submitting expense reports, tracking spending against budgets, and approving necessary expenditures, making it ideal for finance teams, managers, and HR personnel overseeing company spending.

This key Amex application offers significant value by streamlining often cumbersome administrative tasks, promoting transparency, and accelerating approval cycles for business transactions. Its practical usage lies in providing real-time visibility into spending, reducing manual paperwork, and integrating with accounting systems for accurate financial oversight, saving considerable time and administrative effort across the organization.

App Features

- Expense Reporting & Reimbursement: Easily capture receipts via photo or link, categorize expenses according to predefined company rules, and submit reports for instant review by finance teams, significantly reducing processing times compared to manual methods. This feature simplifies the often tedious reimbursement process, allowing employees to get approved faster.

- Company Card Management: Provides full visibility and control over corporate Amex cards, including setting spending limits per card or user group, viewing recent transactions, and generating detailed reports on all card usage for better financial oversight. Utilizing dynamic controls, managers can mitigate risks and ensure adherence to corporate spending policies in real-time.

- Travel Booking & Itinerary Tracking: Integrate travel bookings directly from the app – from flights and hotels to car rentals – automatically linking reservations to employee profiles and expense accounts. This solves the problem of coordinating travel details and simplifies expense claims by attaching booking confirmation directly within the report. Selective emphasis: The seamless booking process saves time and ensures employees have all necessary details in one place.

- Real-time Transaction Tracking: Offers immediate visibility into all corporate spending, allowing managers and finance teams to monitor budget allocations, identify cost centers, and detect potential issues or deviations quickly. Key benefit: Enables proactive financial management rather than reactive accounting by highlighting spending trends or anomalies as they occur.

- Policy Compliance & Controls: Set and enforce company-specific policies within Amex, such as mandatory approval workflows for certain expense categories, spending limits for specific cards during certain periods, or preferred vendor lists for travel accommodations. This flexibility ensures tailored solutions meet diverse departmental or company-wide requirements. Important terms: Customizable approval workflows and dynamic spending controls are fundamental to maintaining fiscal responsibility.

- Integration Capabilities: Optional – Amex integrates seamlessly with popular accounting software platforms, general ledger systems, and expense analytics tools, ensuring that all financial data captured within the app is accurately reflected in the broader financial ecosystem, supporting robust financial reporting and analysis. Technical insight: This integration relies on secure API connections, minimizing manual data entry and synchronization errors.

Pros & Cons

Pros:

- Enhanced Security & Control

- Significant Time Savings

- Improved Transparency & Visibility

Cons:

- Potential Subscription Costs

- Learning Curve for New Users

Similar Apps

| App Name | Highlights |

|---|---|

| Concur Expense |

Focuses heavily on travel and expense management with advanced reporting features. Known for its robust compliance controls and extensive global support. |

| Oracle Procurement |

Part of a larger suite, it manages procurement to expense tracking within enterprise systems. Includes workflow automation for approvals and integrates deeply with financial ledgers. |

| Expensify |

A widely used platform known for its intuitive receipt scanning and simple expense categorization. Offers flexible integrations and strong mobile capabilities for freelancers and small businesses. |

Frequently Asked Questions

Q: Can I use my personal Amex card within the Amex corporate app?

A: Typically, the Amex corporate app is dedicated to managing company cards and expenses; personal cards are generally managed through the standard Amex mobile app experience.

Q: What are the primary benefits of using the Amex App for corporate travel?

A: The Amex App simplifies travel by enabling direct booking, providing real-time itinerary access for trip participants, streamlining expense capture with digital receipts, and integrating bookings seamlessly into company expense reports for easier reimbursement and accounting.

Q: Are there any limits to how much I can spend using company funds via Amex?

A: Yes, companies can configure spending limits within the Amex platform, restricting card usage per employee, specific card numbers, transaction categories, or geographic regions. These limits are crucial for risk management.

Q: How do I report an unauthorized transaction on a company Amex card through the app?

A: If you suspect fraud or an unauthorized charge, immediately contact your company’s finance department or the Amex Card Service Center. They will guide you on the process to report it, which often involves flagging the transaction in your Amex account online or via the app.

Q: Does Amex offer support specifically for users of its corporate apps?

A: Yes, corporate card members usually have access to specialized support channels, often via dedicated account managers for larger accounts, or specific contact points within the Amex website or app designed to handle business inquiries promptly.

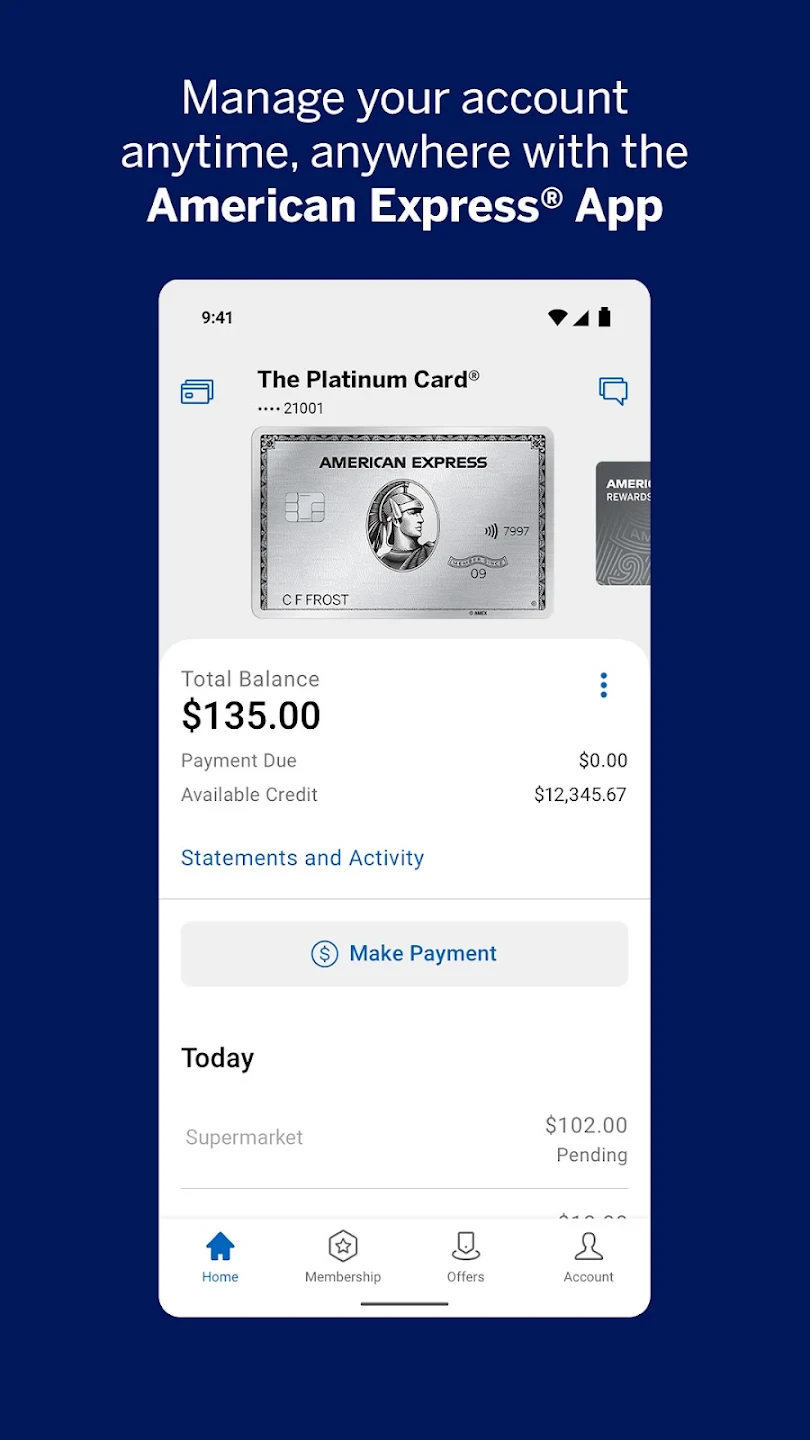

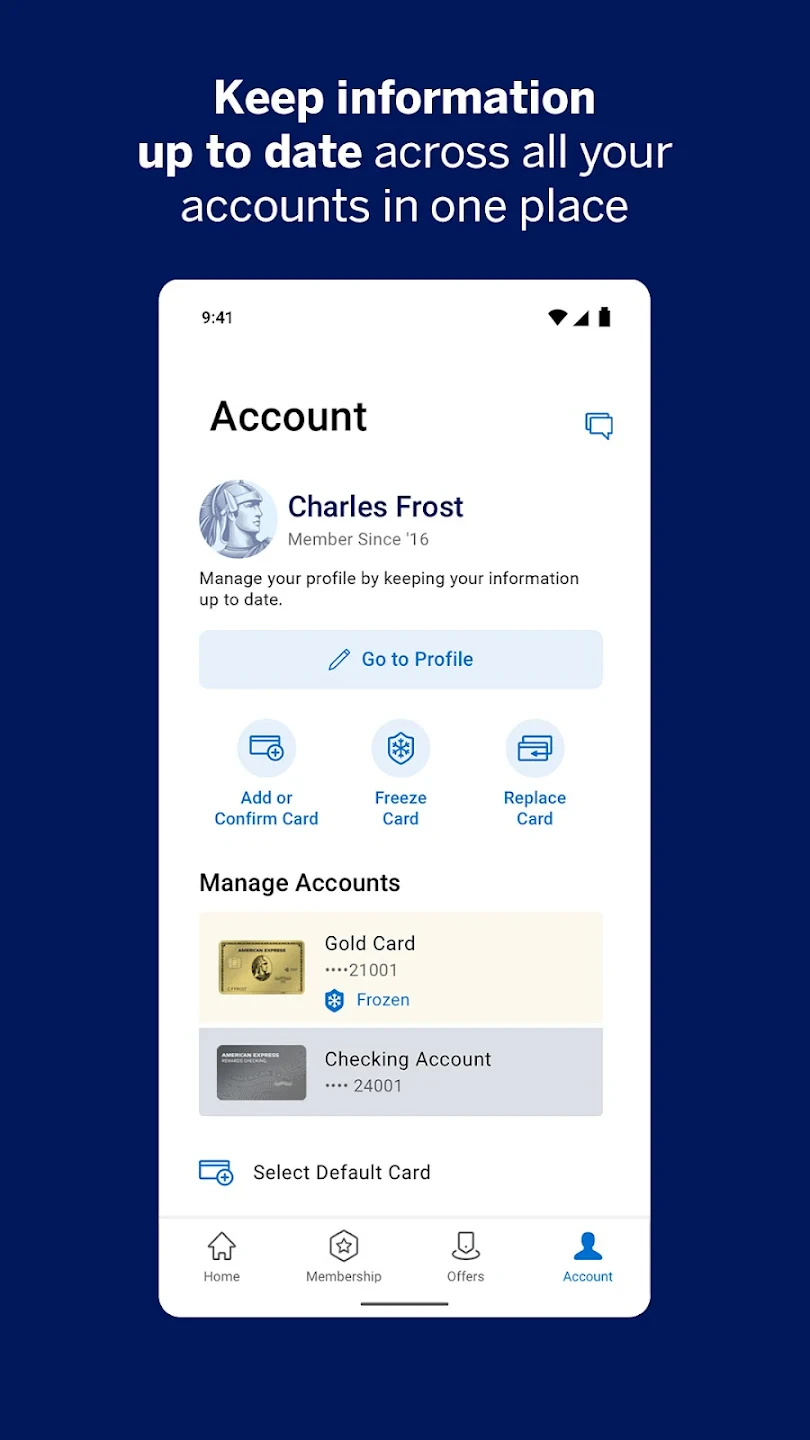

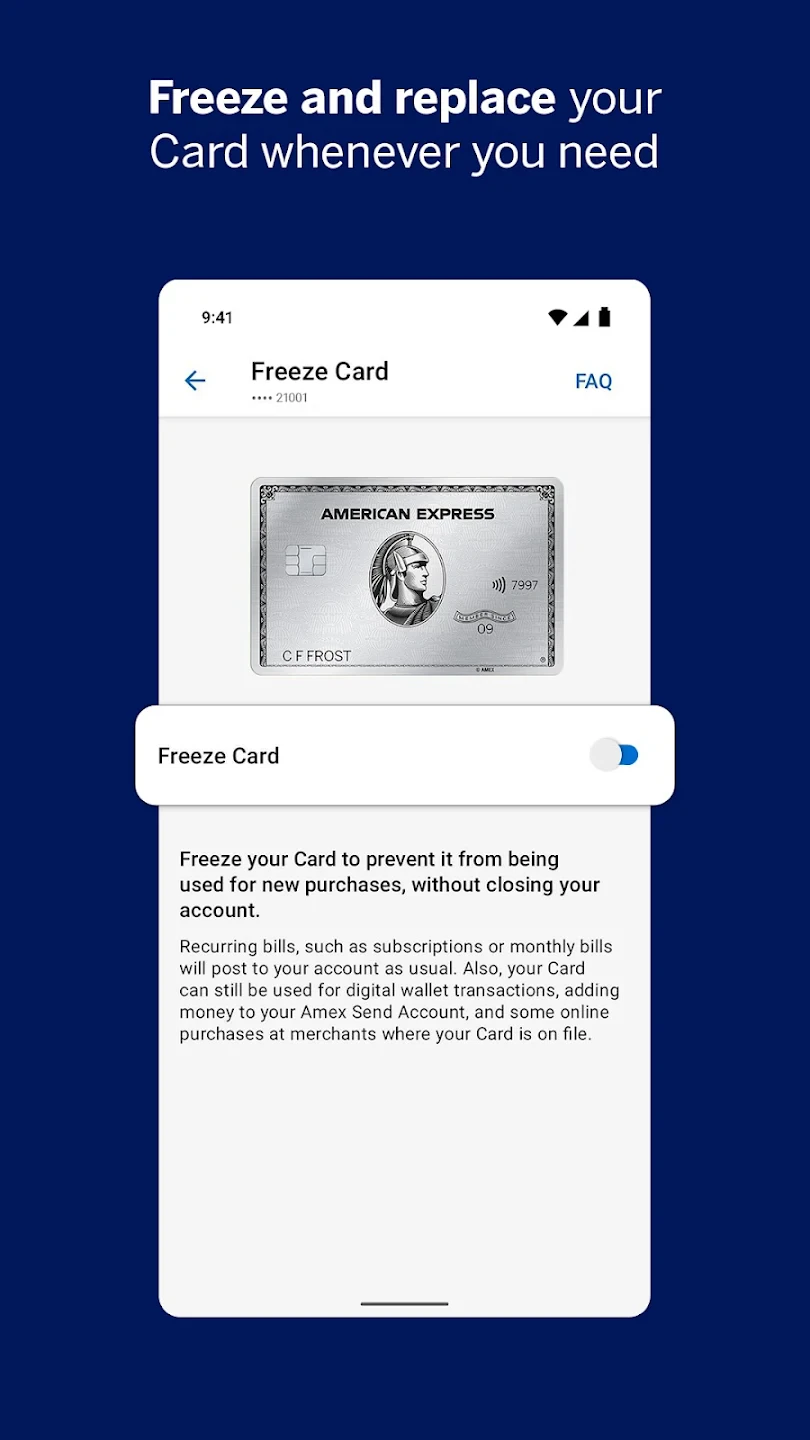

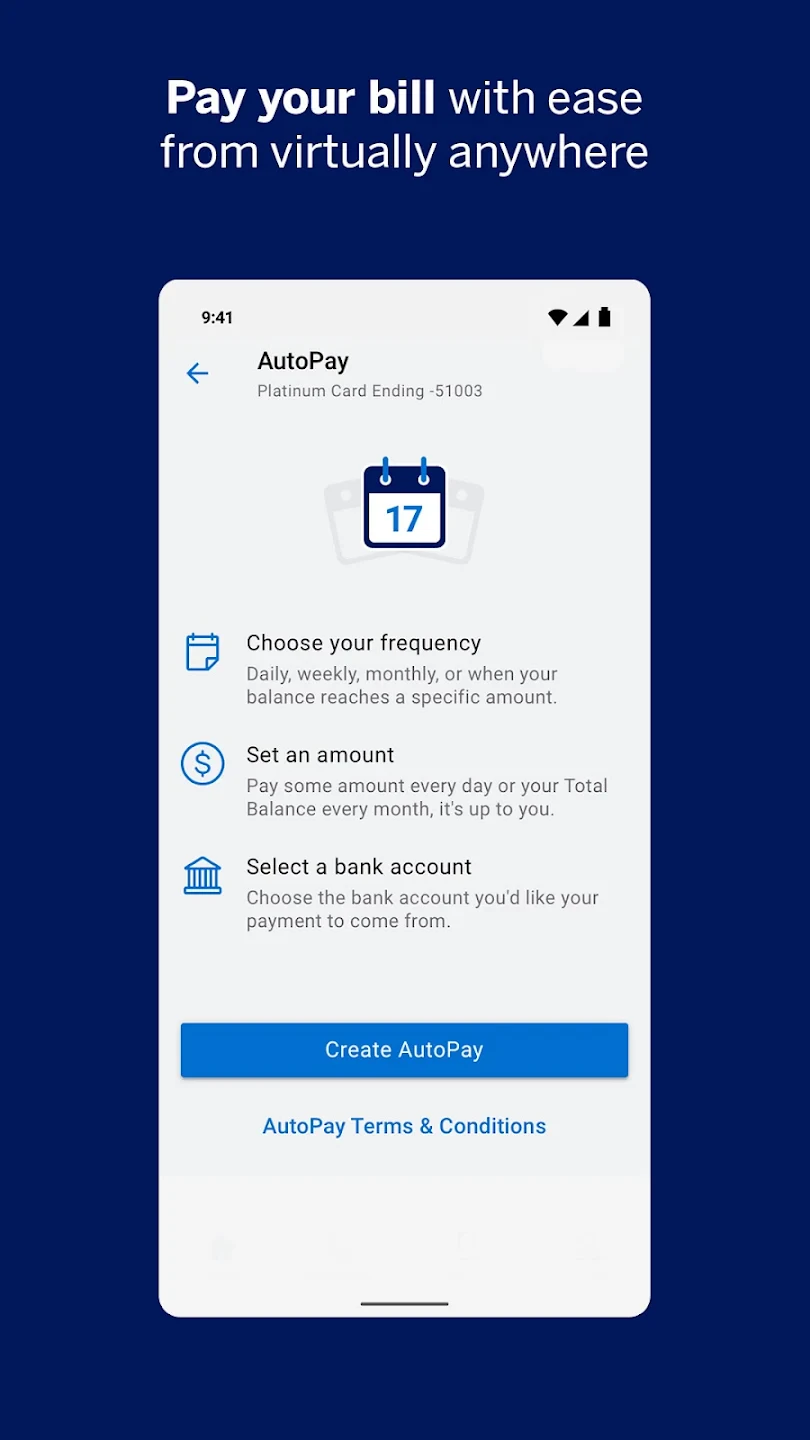

Screenshots

|

|

|

|