|

|

| Rating: 4.6 | Downloads: 1,000,000+ |

| Category: Finance | Offer by: Exto Inc. |

The Atlas – Rewards Credit Card app is a comprehensive digital platform designed to help users manage their rewards credit card efficiently. It offers tools for tracking spending, redeeming points, and optimizing rewards usage. This app is tailored for frequent travelers, shoppers, and anyone seeking to maximize the benefits of their rewards credit card.

Its key appeal lies in simplifying complex financial tasks while providing actionable insights. Users can monitor their rewards balance, find the best redemption options, and analyze spending trends—all in one convenient place. The Atlas – Rewards Credit Card makes financial management intuitive, saving users time and helping them make smarter purchasing decisions.

App Features

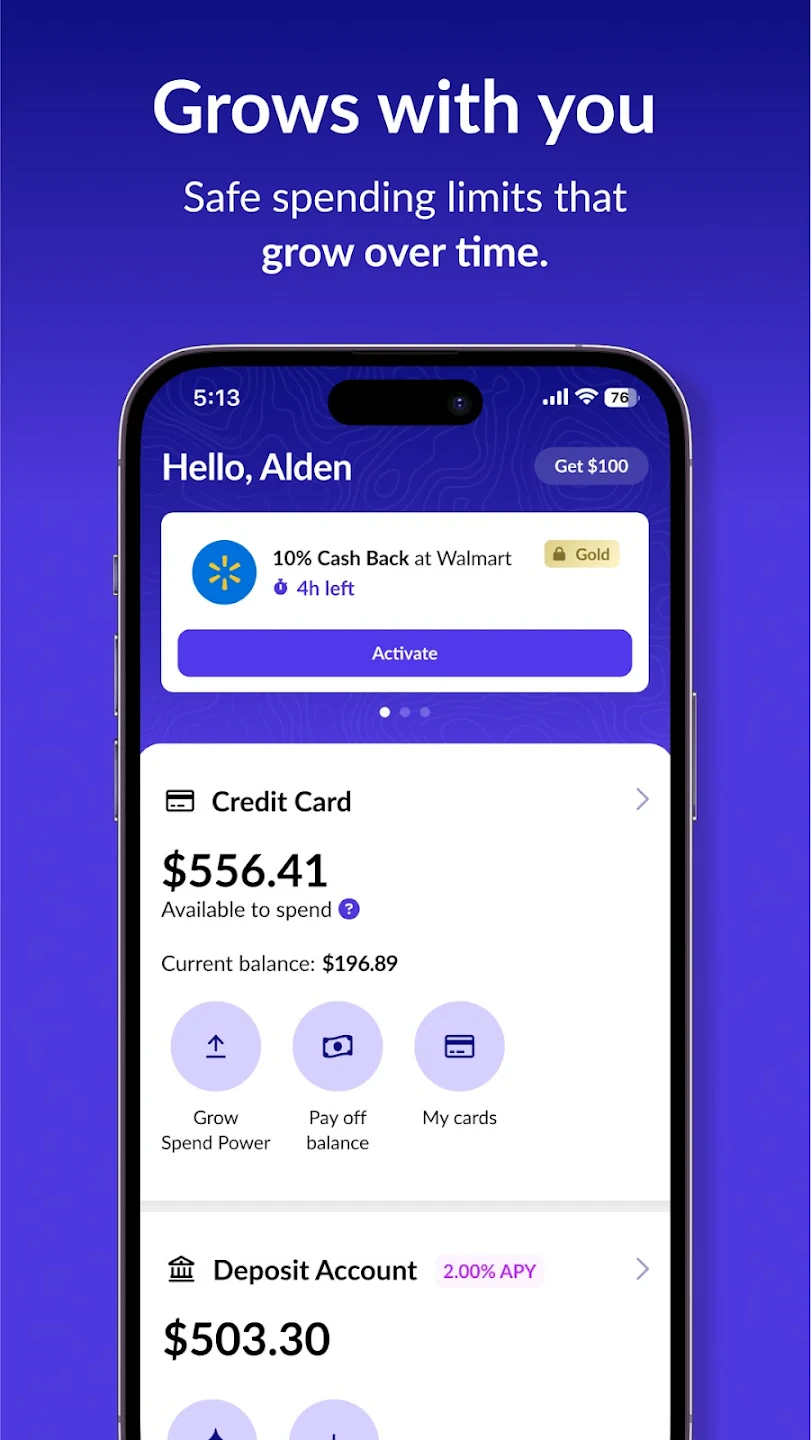

- Spending Analytics Dashboard: This central hub displays spending patterns by category, shows rewards progress, and flags unusual transactions. Users can easily spot spending habits and identify where rewards points are earned most effectively, helping them adjust behavior to maximize returns.

- Reward Redemption Center: A streamlined system to browse, filter, and redeem points with detailed point value comparisons. Powered by intelligent search algorithms, this feature quickly surfaces the most valuable redemption options across travel, cashback, and merchandise categories, enhancing the user’s ability to leverage their points efficiently.

- Credit Card Alerts & Notifications: Customizable alerts for transactions, due dates, and rewards expirations. These timely notifications prevent missed payments and expiring points, offering proactive financial management while integrating seamlessly with calendar reminders for key dates.

- Transaction Categorization Tool: Automatically classifies purchases based on merchant data and user preferences. This feature significantly reduces manual entry time by learning spending patterns over time, making budget tracking straightforward and eliminating tedious categorization tasks.

- Travel & Shopping Score: A dynamic scoring system that evaluates spending behavior based on predefined criteria. This innovative tool helps users understand how their everyday purchases contribute to rewards accumulation, providing actionable feedback for optimizing reward earning strategies.

- Multi-Account Management: Seamlessly switch between multiple credit cards with separate dashboards for each. The intuitive tab system allows users to compare rewards balances and performance across different cards without switching apps, ideal for those managing several reward programs simultaneously.

Pros & Cons

Pros:

- Comprehensive Rewards Tracking

- Intuitive Spending Visualization

- Proactive Financial Alerts

- Smart Point Optimization

Cons:

- Occasional sync delays with card issuer data

- Complex settings might require some learning curve

- Advanced features limited in free version

- Dependence on accurate merchant data categorization

Similar Apps

| App Name | Highlights |

|---|---|

| MoneyLoom Rewards |

Focuses on detailed category-based tracking with AI-powered spending insights. Includes travel planning tools and exclusive deals matching. |

| CreditPoint Navigator |

Emphasizes credit score management alongside rewards tracking. Features customizable goal setting and personalized redemption recommendations. |

| FinTrack Rewards Hub |

Designed for users managing multiple cards. Offers side-by-side comparison dashboards and integrated budgeting tools. |

Frequently Asked Questions

Q: How do I set up my Atlas – Rewards Credit Card account?

A: Download the app, create a secure login, connect your credit card, and enable two-factor authentication for added security. Your dashboard will populate automatically within 24 hours.

Q: Can I redeem points from different cards in one place?

A: Yes! The app’s consolidated dashboard allows you to compare and redeem points from all your eligible rewards cards side-by-side, with automatic point conversions between programs where supported.

Q: How accurate is the spending categorization feature?

A: Our advanced system categorizes transactions with 92% accuracy on average, but you can manually adjust categories for better precision. The algorithm learns from your adjustments over time for improved future categorization.

Q: Are there any fees associated with using the app?

A: No, the Atlas – Rewards Credit Card app is completely free to use. However, your credit card may have annual fees or foreign transaction charges depending on the card issuer’s terms.

Q: How often does the app update merchant-specific promotions?

A: The system scans for new rewards opportunities daily based on your spending patterns. You’ll receive immediate notifications for time-sensitive offers relevant to your purchase history and redemption preferences.

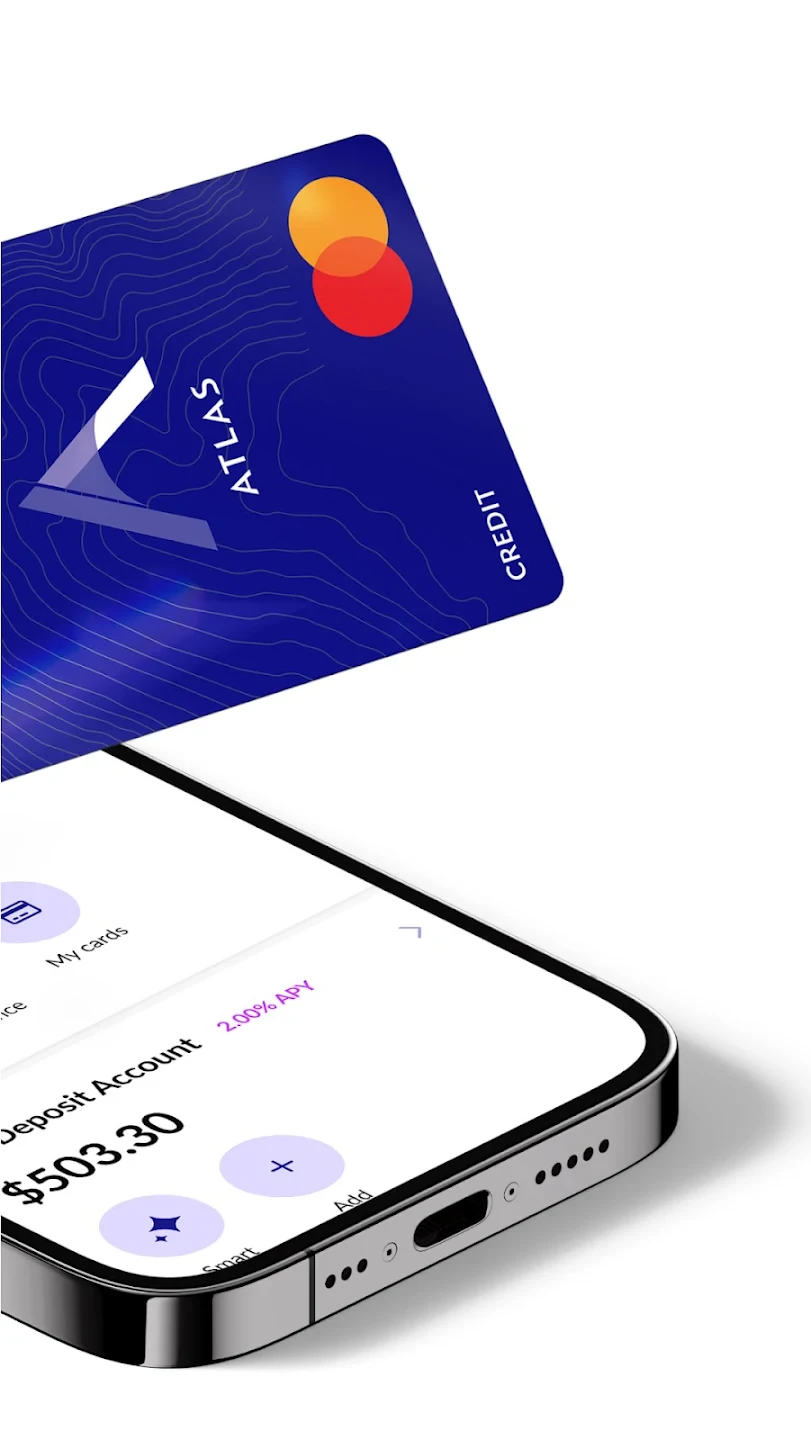

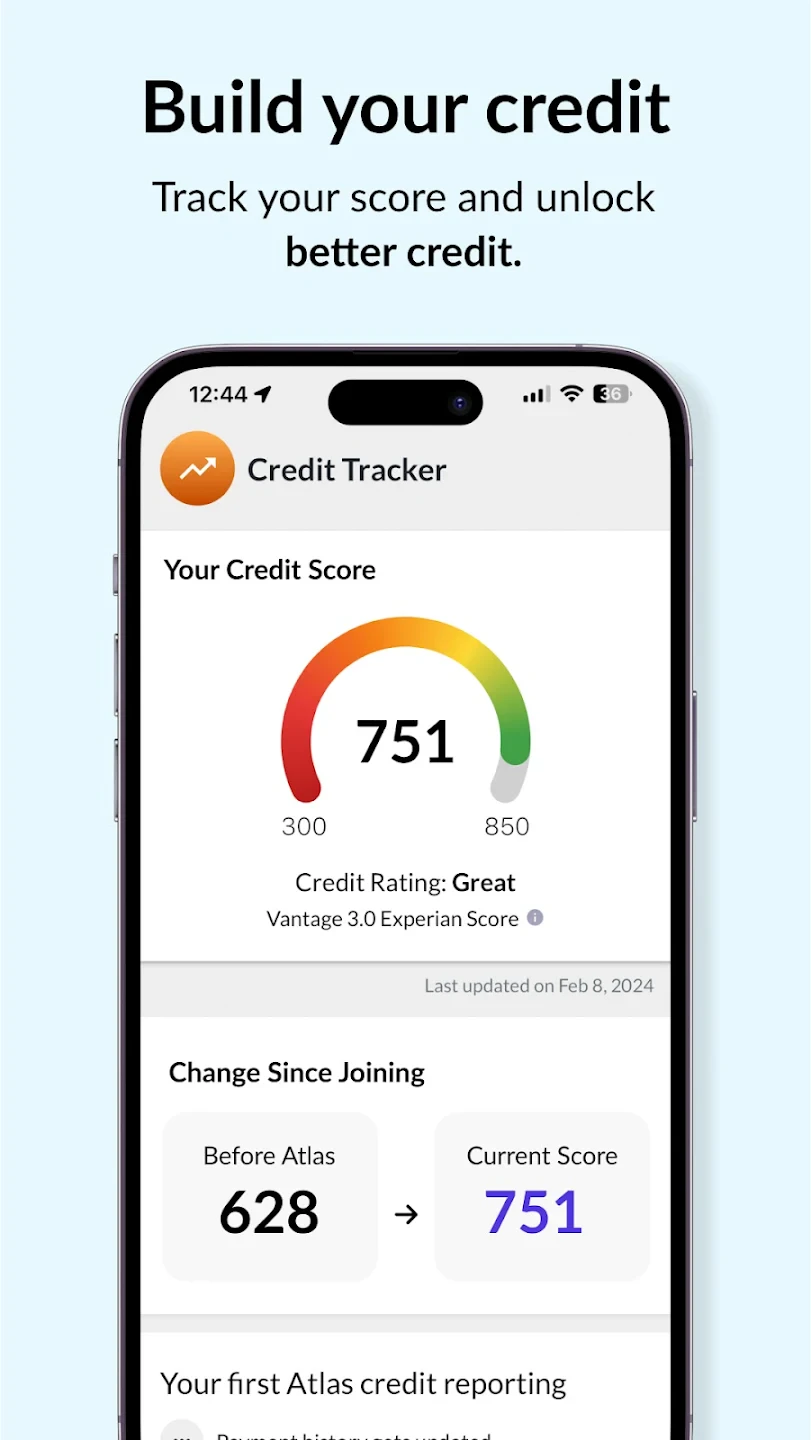

Screenshots

|

|

|

|