|

|

| Rating: 4.6 | Downloads: 1,000,000+ |

| Category: Finance | Offer by: ATM.com, Inc. |

The “ATM: Get Cash, Earn Rewards” app is your convenient digital companion for on-demand cash access paired with a loyalty program. It connects users directly to partners for nearby withdrawals while offering points for each transaction, allowing users to earn rewards without traditional bank account or credit card requirements. Perfectly tailored for those seeking basic liquidity solutions with light incentives, whether for unexpected expenses or travel mishaps.

This application provides significant practical value for everyday users needing funds quickly and potentially incentivizing transaction patterns. The core appeal lies in the seamless combination of immediate cash availability via partnered locations and the accumulation of rewards points, creating a passive income element tied directly to normal cash flow activities.

App Features

- Instant Cash Withdrawals & Rewards Points: Get the cash you need, anywhere, anytime via linked merchants, while watching your reward point balance grow for future benefits like discounts or special offers. This combo offers unparalleled convenience and value back to you every time you use the service.

- Wide Network Collaboration: Easily find and select from a large selection of compatible businesses including banks, credit unions, retailers, and government offices across multiple cities. This extensive network ensures you always have access to cash within easy reach, significantly more flexible than finding standard ATMs.

- Flexible Rewards Program: Every qualifying transaction you perform using the app contributes valuable points towards exclusive rewards, including discounts on future withdrawals, partner store offers, and unique gift card entries drawn weekly. For example, you can use accumulated points for a well-deserved treat from your favorite cafe.

- Transaction History & Balance Tracker: Keep a clear, detailed record of all your cash withdrawals, the source or partner involved, and the points earned from each transaction, all in one easy-to-review interface. This transparency allows for better financial awareness and tracking of your rewards progress.

- Enhanced Security Measures: Your data and transactions are protected by industry-standard encryption protocols and optional biometric verification including fingerprint or facial recognition on the login screen. This multi-layered security ensures peace of mind, making potentially sensitive activities safer than using less secure networks.

- Seamless Point Calculation: Points are calculated based on the transaction volume (lower thresholds start accumulating), the transaction amount, and optimally, the establishment you used. Think of it as tiered loyalty where even small, frequent needs build significant rewards over time.

Pros & Cons

Pros:

- Simple & Immediate Access to Cash

- Generous Reward Points for Every Qualifying Transaction

- Platforms Offer Relatively Low Withdrawal Fees

- Barely Minimum Account Balance Required to Start Using the App

Cons:

- Transaction Currency Conversion Fees May Apply When Crossing Borders

- Minimum Balance Requirements Might Come With Limits on Reward Bonuses

- Processing Times Can Be Slightly Slower Than Standard ATM Transactions, Especially During Peak Hours

- Not All Financial Institutions or Government Offices Are Currently Integrated

Similar Apps

| App Name | Highlights |

|---|---|

| ExpressCash |

Known for its very fast processing speeds at select premium partner locations and no fee cashback bonuses. Great for maximizing cash velocity with fewer waiting times. |

| MoneyNow |

Designed with mobile-first usability in mind, featuring guided steps through the withdrawal and reward claiming process. Ideal for those who prefer intuitive screens over complex interfaces. |

| SpotPay Rewards |

Often praised for its diverse merchant network and AI-powered suggestions for optimal withdrawal times and nearby partners with special point offers. Adds intelligent layering on top of core functionality. |

| QuickRew |

Focuses heavily on team collaboration features |

Frequently Asked Questions

Q: Are there any upfront fees to sign up for or use “ATM: Get Cash, Earn Rewards”?

A: No, the basic registration and access to the core cash withdrawal features are free. Some partner locations might have their own standard ATM fees, but the app itself doesn’t charge activation, monthly, or initial setup costs.

Q: How exactly do I get cash using this app, and do I have to wait in line at the partner locations?

A: The process involves authorizing a withdrawal from your eligible, linked account, then finding a nearby accepting partner business via the app’s map. Your transaction is processed electronically before you even reach the counter, often allowing for significantly faster service than standard ATMs.

Q: What can I actually do with the reward points I earn?

A: Points can be used towards future withdrawals for reduced charges, converting into gift cards for popular stores or retailers, receiving direct discounts on app partner services, or potentially entering periodic draws for special cash prizes or curated experiences.

Q: Are my financial details safe while using the app, especially with features like biometric login?

A: Absolutely. Security is paramount in our design. All sensitive data is encrypted both in transit and at rest. Biometric authentication provides a secure, frictionless way to access your account and manage transactions, adding a layer beyond simple password security.

Q: How often is the list of partner locations and available rewards updated in the app?

A: Our team actively works to expand the network daily, and reward program specifics are updated at least monthly. Automatic notifications within the app alert you to new partners near your location and any changes or enhancements to the earning and redemption structure.

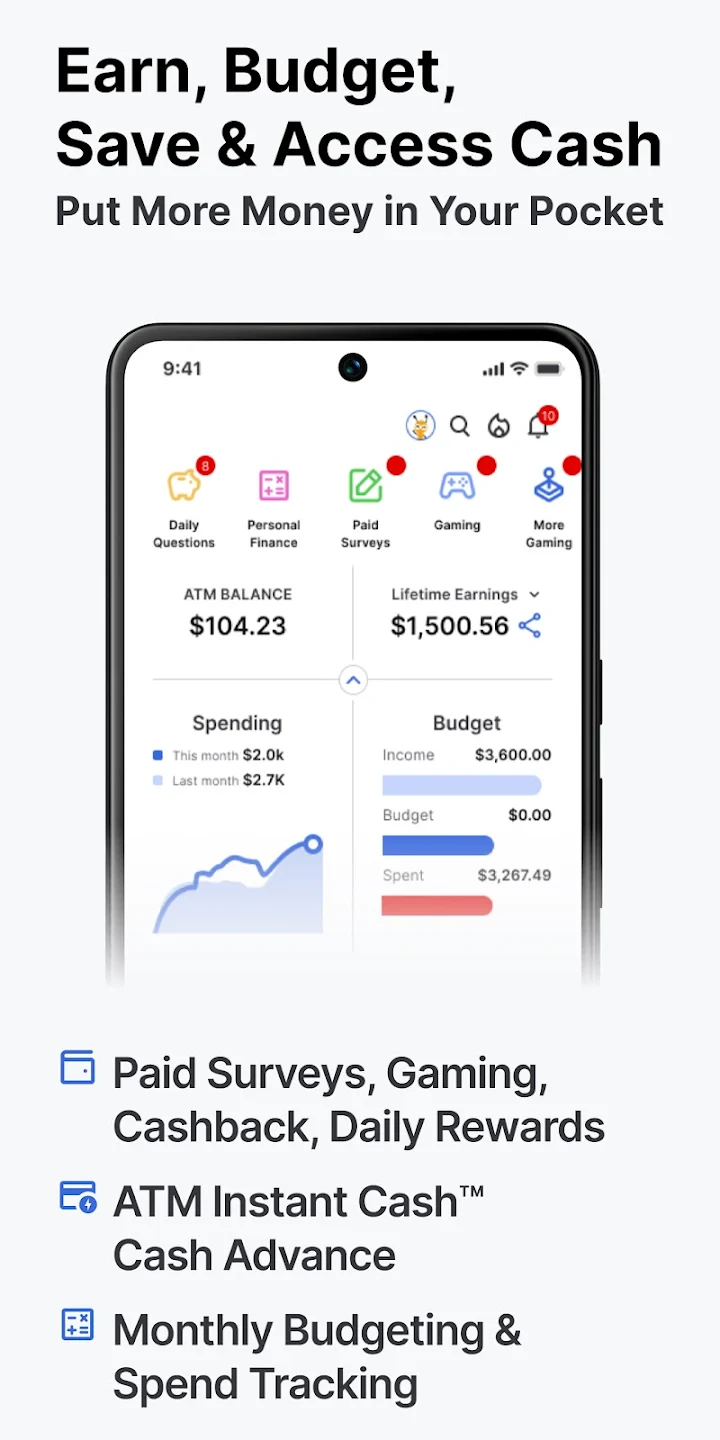

Screenshots

|

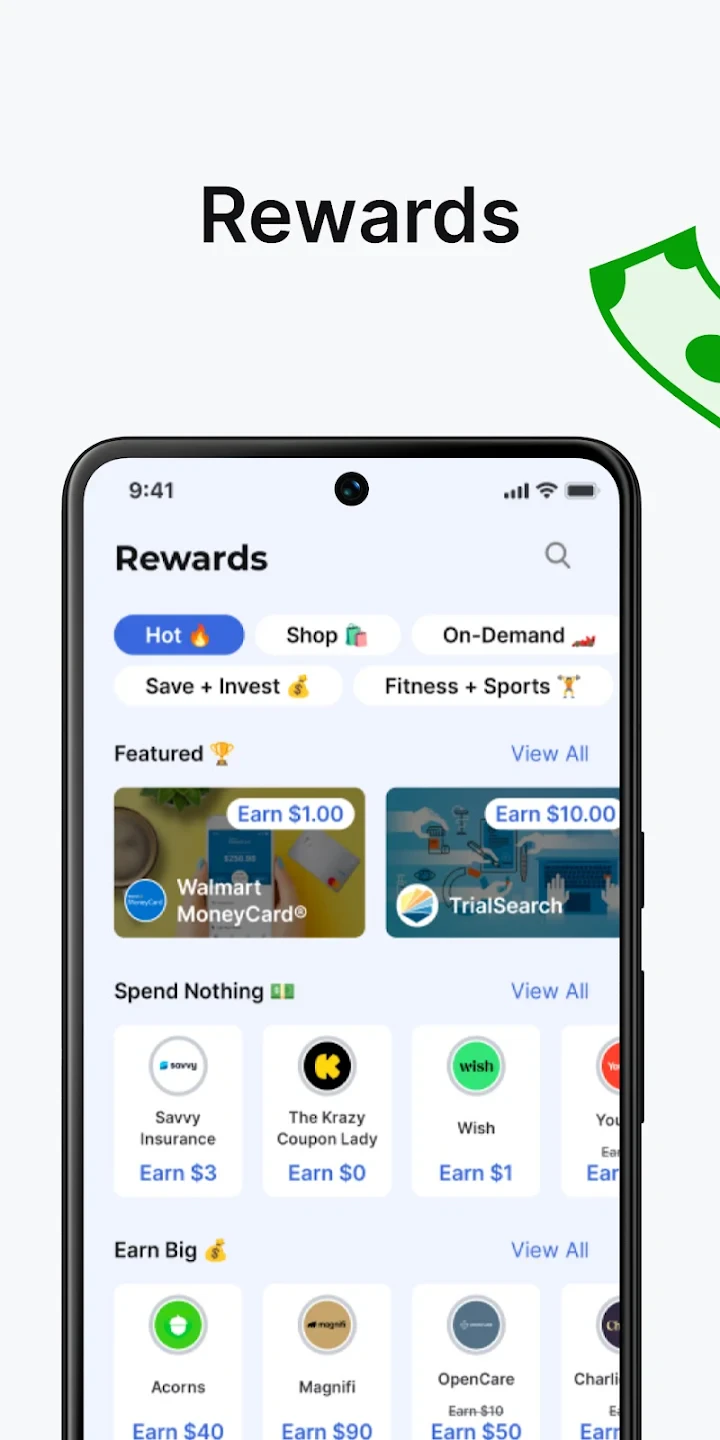

|

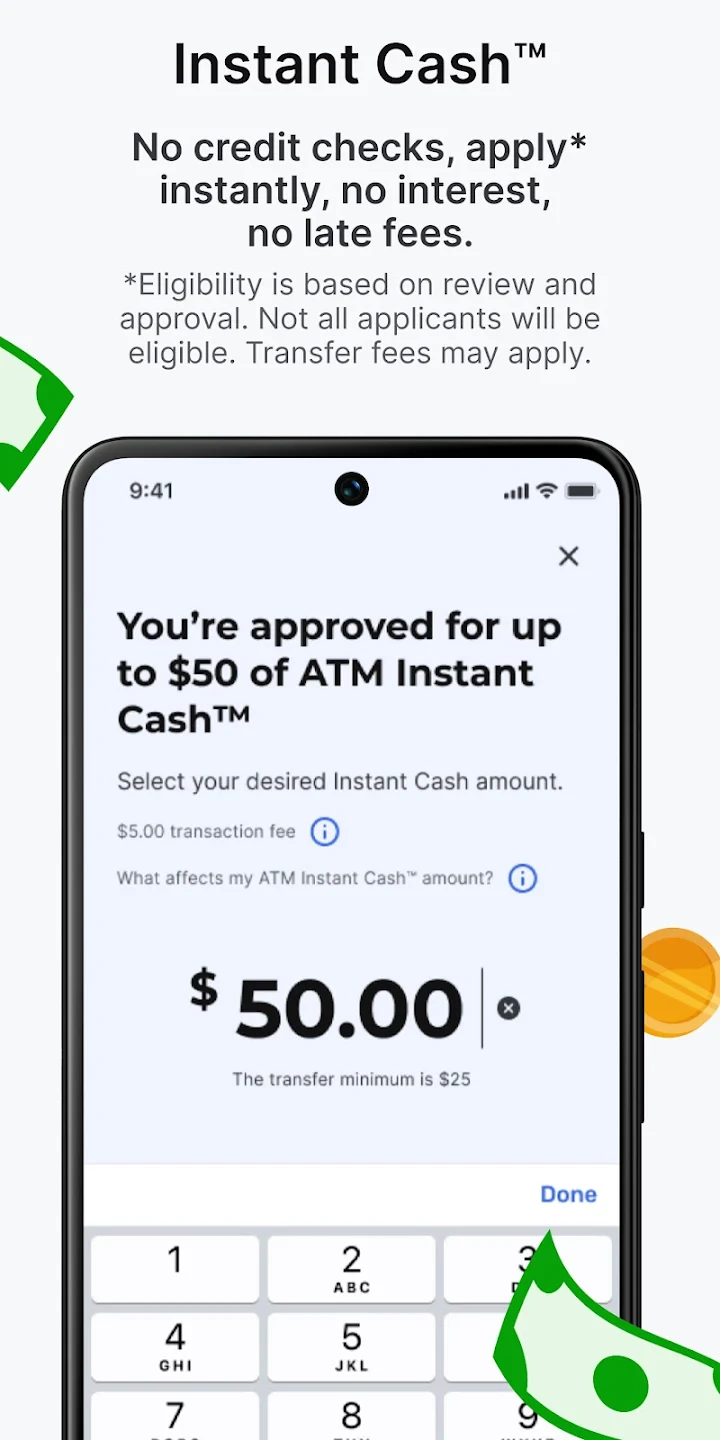

|

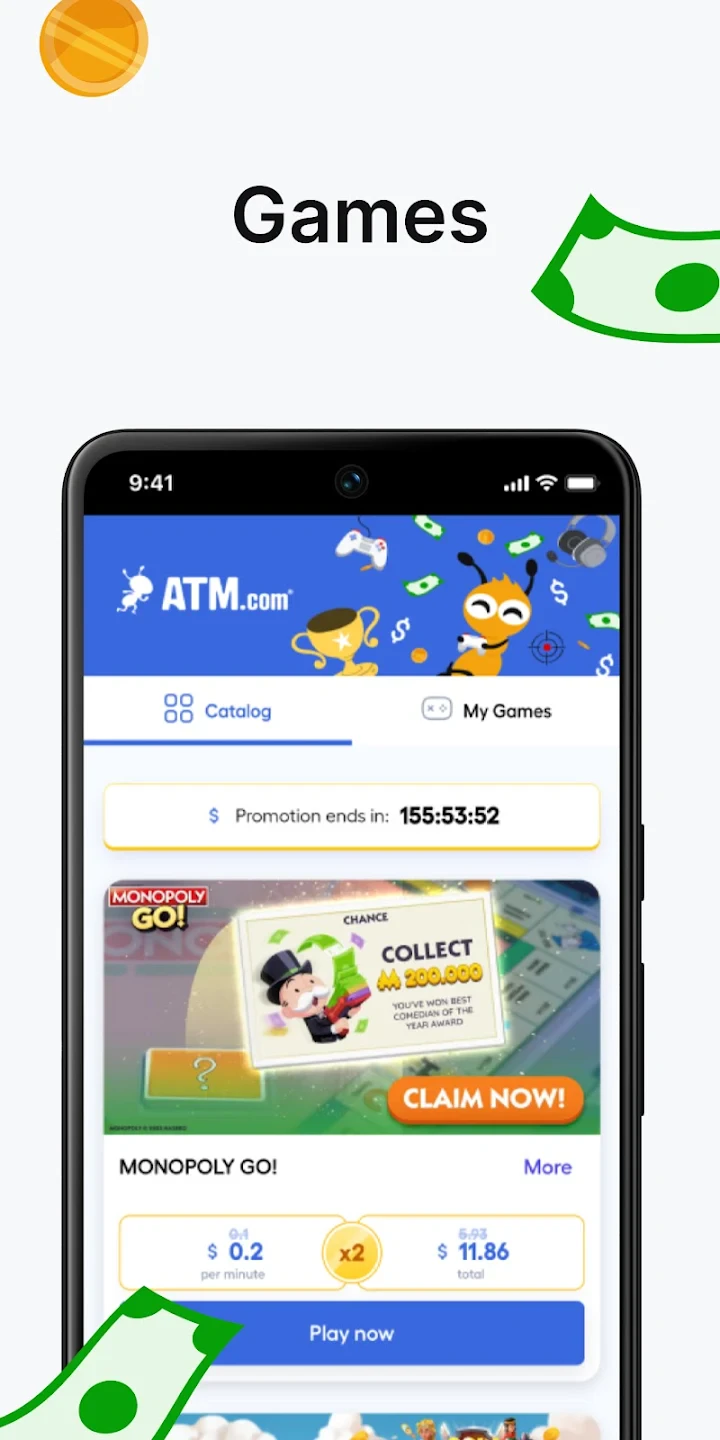

|