|

|

| Rating: 4.6 | Downloads: 50,000,000+ |

| Category: Finance | Offer by: Bank of America |

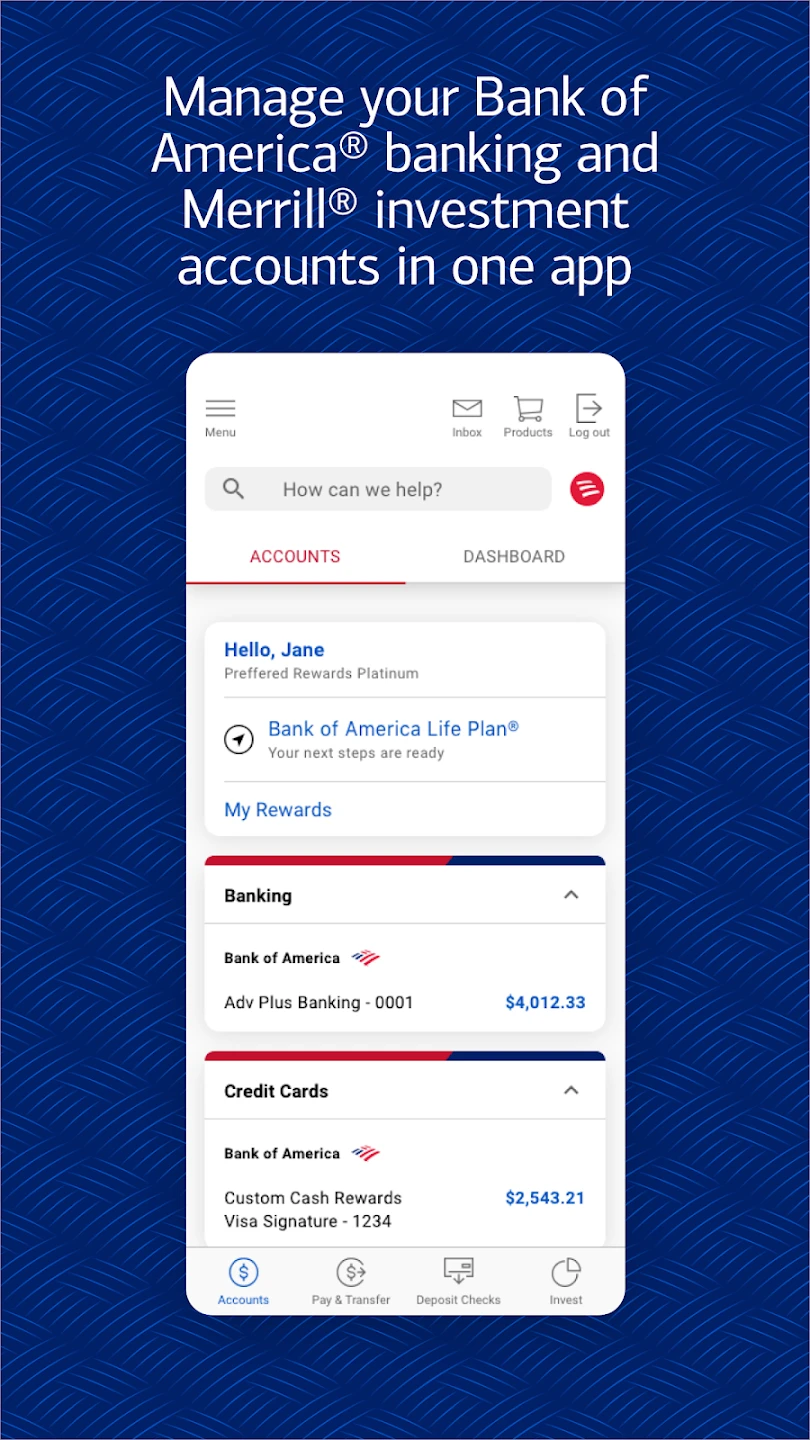

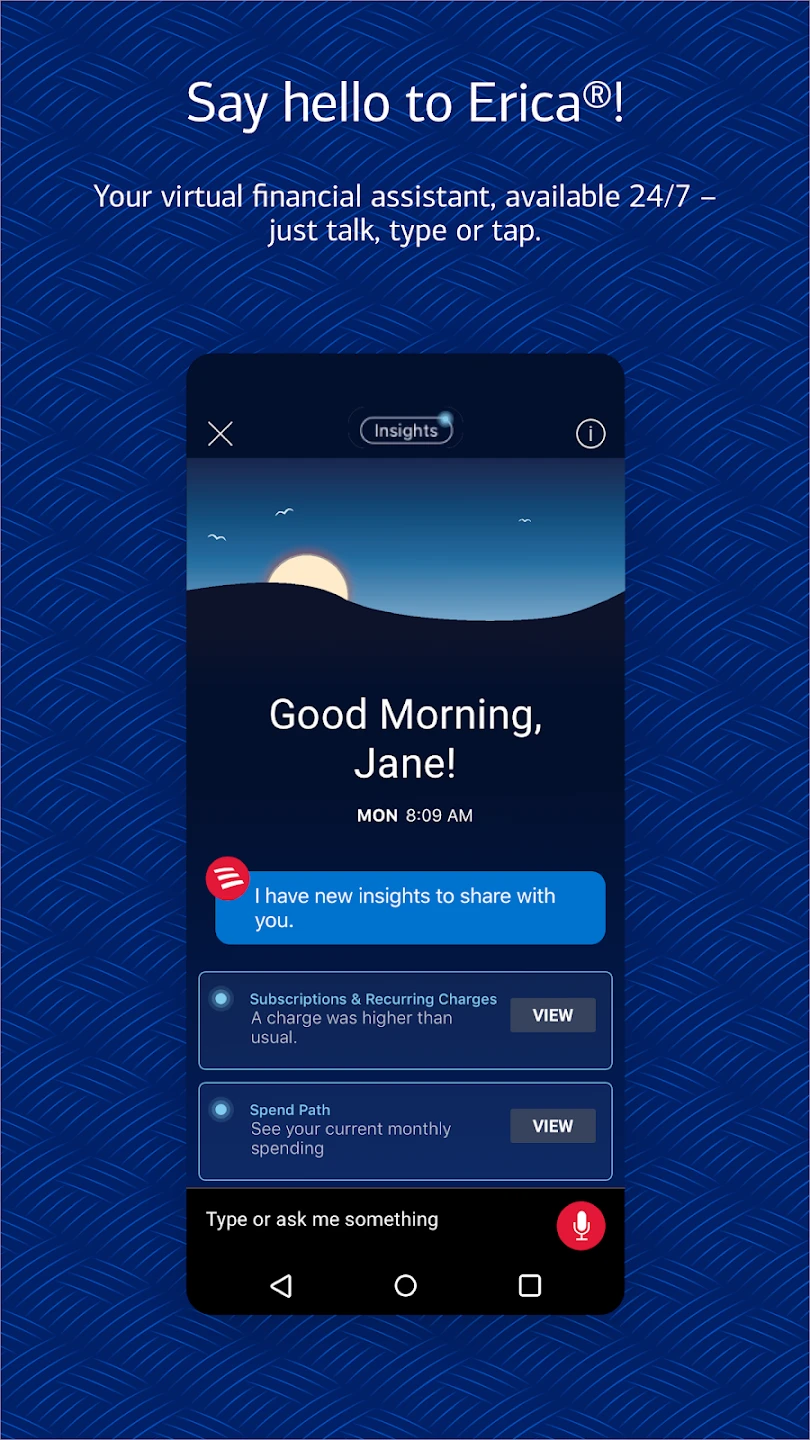

Bank of America Mobile Banking is the official digital platform for managing personal finances on-the-go via your smartphone or tablet. This comprehensive application allows users to check account balances, pay bills, deposit checks, transfer funds securely, and even locate nearby ATMs or branches. It is designed for anyone seeking convenience and greater control over their banking activities from anywhere.

Bank of America Mobile Banking offers significant practical advantages, primarily speed and accessibility. Users can perform crucial banking tasks instantly, such as sending money to friends and family or reviewing transaction history, without visiting a physical branch. This makes everyday financial management more efficient and adaptable to modern lifestyles, saving both time and effort.

App Features

- Account Management: View your checking, savings, and loan balances instantly, and review detailed transaction histories, including filterable categories and dates. This feature empowers users to stay informed about their spending and account growth without waiting for monthly statements, promoting proactive financial awareness and quicker decision-making, such as identifying unexpected expenses.

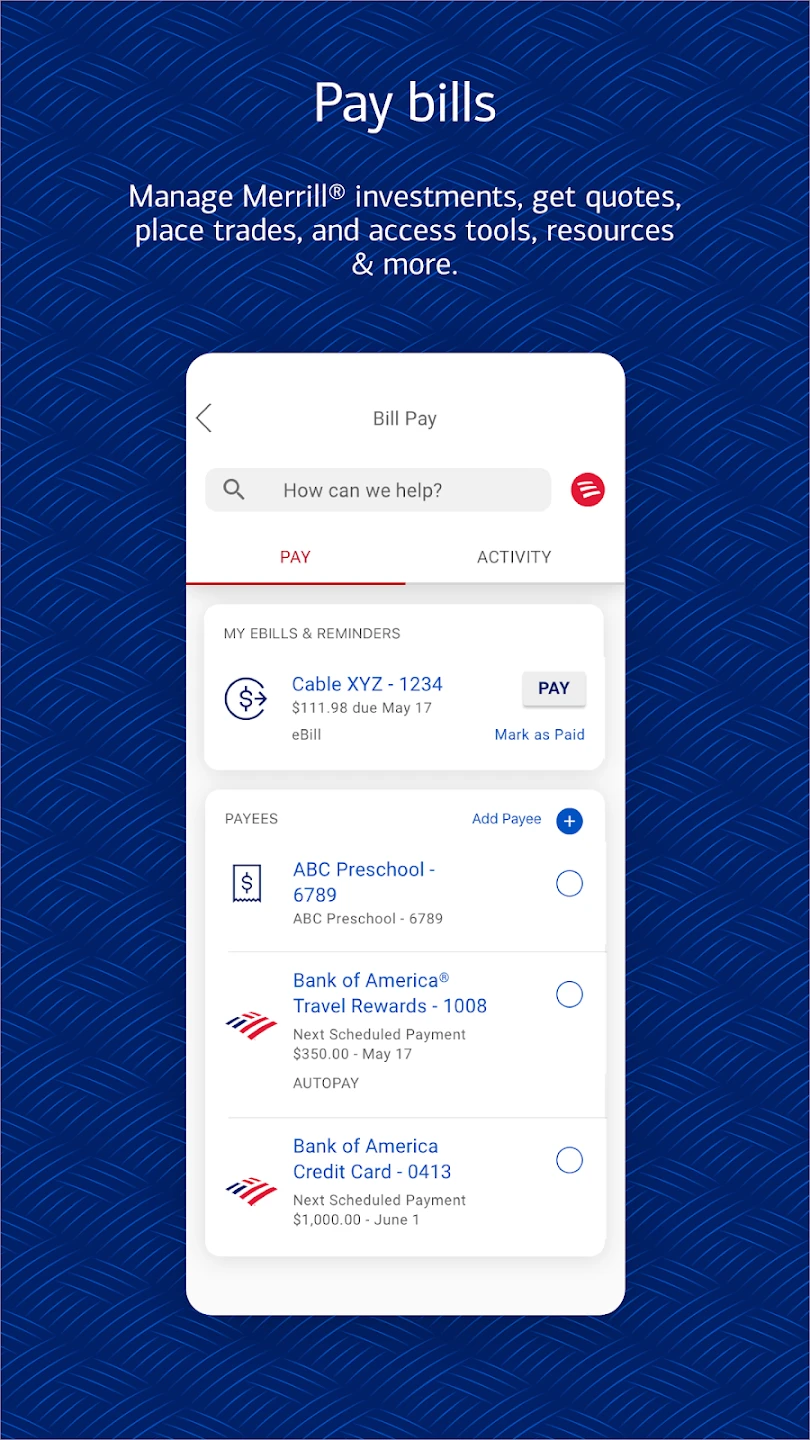

- Billing and Payments: Set up recurring electronic bill payments for utilities, subscriptions, and more, and send one-time payments to individuals with ease. Utilizing secure authentication methods like Touch ID or PIN, the system ensures transactions are protected while offering flexibility, allowing users to pay bills from home or on the road, thereby simplifying personal finance management and preventing late fees.

- Mobile Deposits: Take a picture of your endorsed check using the phone’s camera and submit it instantly for deposit; funds may typically be available faster than waiting for an ATM or physical deposit. This feature is incredibly useful for people needing quick access to their money for emergencies, travel, or unexpected expenses, significantly reducing the time required to process physical checks and integrate cash flow faster.

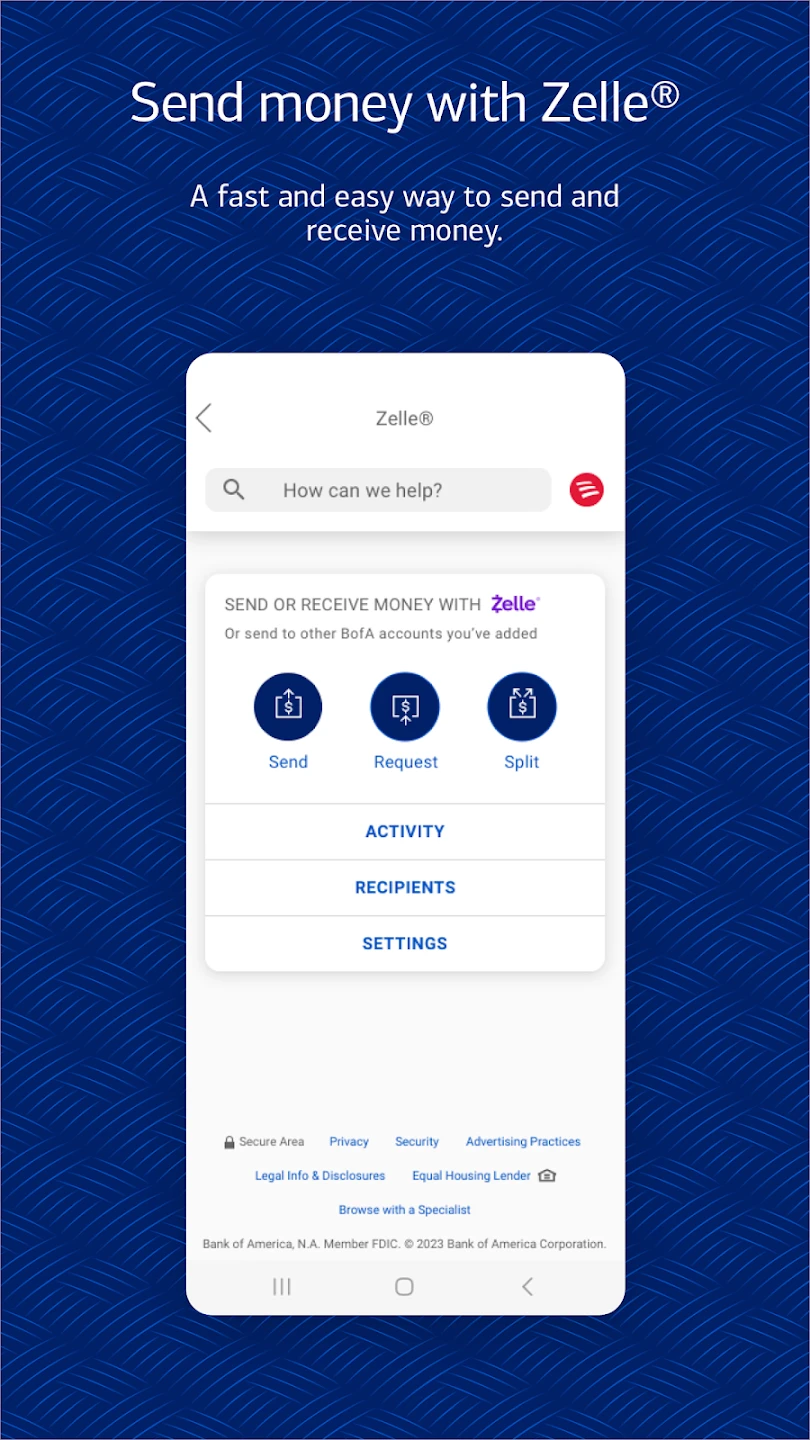

- Funding Transfers: Move money between your Bank of America accounts seamlessly or transfer funds securely with friends and family via the app. For example, splitting weekend costs with roommates or quickly funding an after-dinner coffee, this function saves time by eliminating the need for external apps or physical visits, enhancing convenience and promoting shared financial responsibility easily.

- Branch and ATM Locator: Access a map showing nearby Bank of America branches, ATMs, and specific service locations like Centers. This is invaluable for users who need in-person assistance, want to find a nearby machine for a withdrawal, or are exploring new areas, integrating offline services smoothly with digital capabilities and ensuring users can complete transactions efficiently whenever digital isn’t sufficient.

- Security Controls: Customize security settings, including the option to set a daily spending limit for person-to-person transfers, and enable biometric login like face recognition. This robust security layer provides customizable peace of mind, allowing users like parents sending money to their children to limit transaction amounts, thereby safeguarding against excessive or unintended spending while supporting ease of use for everyday transfers.

Pros & Cons

Pros:

- Comprehensive Feature Set

- High Convenience & Speed

- Robust Security Measures

- Seamless Fund Transfers

Cons:

- Requires a Stable Internet Connection

- Mobile Deposits Have Processing Time

- Some Advanced Features May Be Web-Based

- Interface Can Feel Slightly Cluttered to Some Users

Similar Apps

| App Name | Highlights |

|---|---|

| JPMorgan Chase App |

This app offers a vast suite of services, including robust investment tracking and sophisticated spending insights with category tagging. Noted for its award-winning user interface and extensive customization options. |

| Wells Fargo Mobile |

Focused on simplicity and security for everyday banking tasks like deposits and loan payments. Includes helpful features like saving goals and branch appointment scheduling directly within the app. |

| TD Bank Mobile |

Known for its accessibility features and smooth user experience for managing accounts and conducting mobile deposits. Often praised for its intuitive navigation and seamless integration with credit services. |

Frequently Asked Questions

Q: How do I enable Mobile Deposit for the first time in the Bank of America Mobile Banking app?

A: First, ensure your device and the Bank of America app are running the latest versions for security and compatibility. Go to the Banking tab, select ‘Deposit’ or ‘Manage Accounts,’ find the option to ‘Add or Manage Mobile Deposit,’ and follow the secure prompts. You’ll typically need to upload photos of endorsed checks taken with your smartphone’s camera, and the system will guide you through the submission process.

Q: Can I send money internationally directly through Bank of America Mobile Banking?

A: Yes, the app supports sending money abroad using services like Bank of America’s Global Express Wire for faster international transfers, or standard person-to-person electronic transfers, depending on the recipient’s location and account type. International wires often require specific details and may have associated fees, while domestic and some international P2P payments might be free based on your eligibility, providing versatile funding options for various needs.

Q: Is the Bank of America Mobile Banking app available on older iPhone models or Android phones with less processing power?

A: While the app aims for broad compatibility, performance depends on your device’s operating system and hardware capabilities. Bank of America generally supports devices running recent versions of iOS or Android, typically requiring at least 128MB of RAM and specific OS minimum versions, which most modern smartphones meet. For the optimal experience, checking the official system requirements on the Bank of America website or app store listing before downloading is recommended, but many users with older but capable devices still report good function.

Q: Are there any hidden fees for using features like Mobile Deposits or sending money through the Mobile Banking app?

A: Fees are transparent and typically only apply to specific, higher-cost services. Most Mobile Deposit options are free, and sending money via person-to-person electronic transfers within the Bank of America app is currently free for personal accounts, provided both parties are Bank of America customers. International wire transfers, however, usually involve fees. Always check the details or transaction summary screen before confirming to see if a fee applies to the specific action you’re about to take.

Q: What should I do if I temporarily lose internet access while using the Bank of America Mobile Banking app?

A: If you lose your connection, simply try reconnecting to Wi-Fi or cellular data. While some core features like viewing cached balances might still work briefly without an internet link, functions requiring secure server interaction—like logging in, checking detailed transaction history, making transfers, or performing Mobile Deposits—will be unavailable until the connection is restored. The app prioritizes security, preventing actions that would require a connection and exposing your account.

Screenshots

|

|

|

|