|

|

| Rating: 4.7 | Downloads: 5,000,000+ |

| Category: Finance | Offer by: Brigit |

Brigit: Cash Advance & Credit is a financial app designed to provide individuals with short-term funding solutions through cash advances and credit products. It caters to people needing quick access to cash for emergencies, expenses like rent or medical bills, or when traditional bank loans are unavailable. The app streamlines the borrowing process, making it accessible to those seeking immediate financial relief.

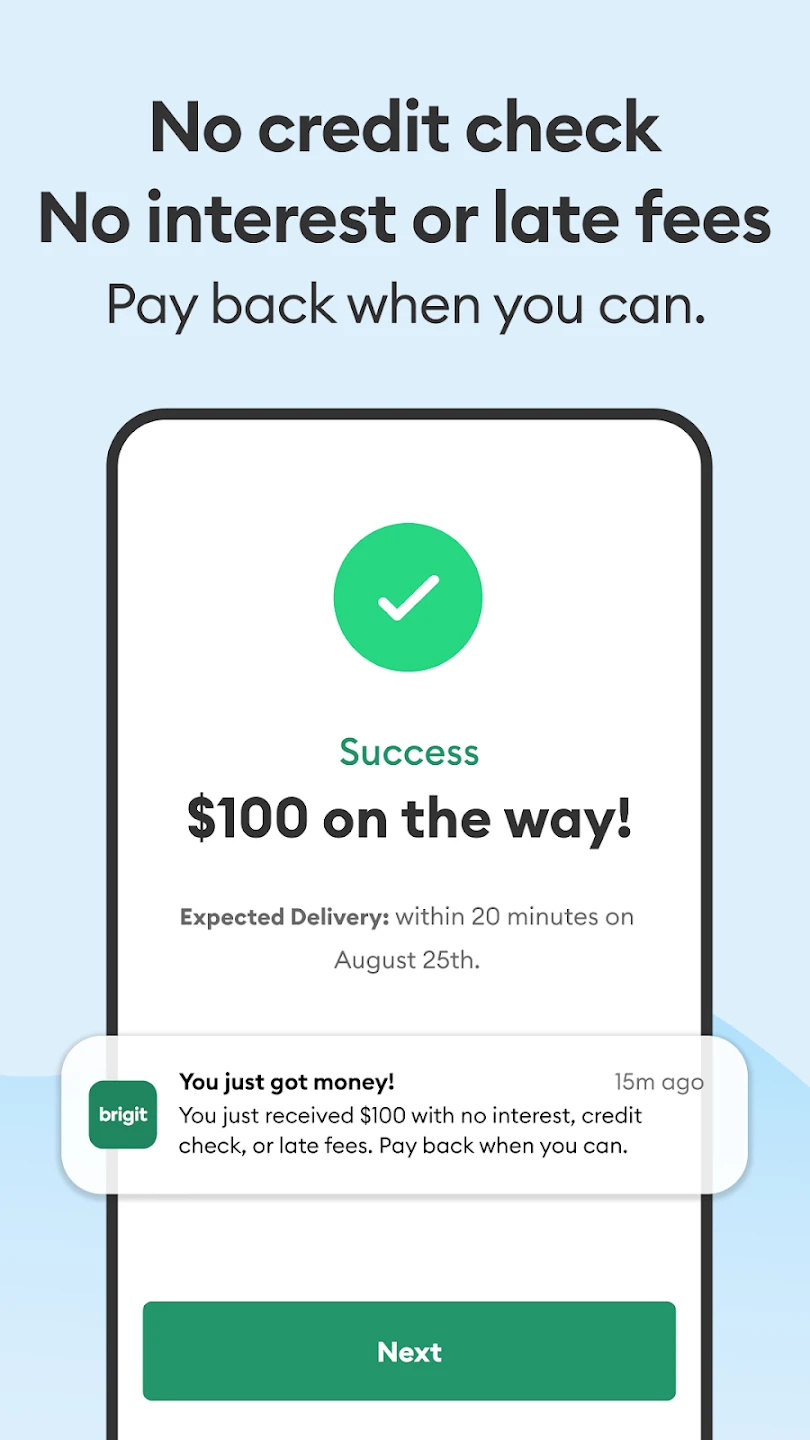

This app offers significant value by providing fast, often same-day, access to funds with minimal documentation. It’s particularly useful for managing unexpected costs or bridging gaps between income receipts and expenses. Using Brigit: Cash Advance & Credit empowers users to maintain stability during financial uncertainties, offering a lifeline without relying on risky alternatives.

App Features

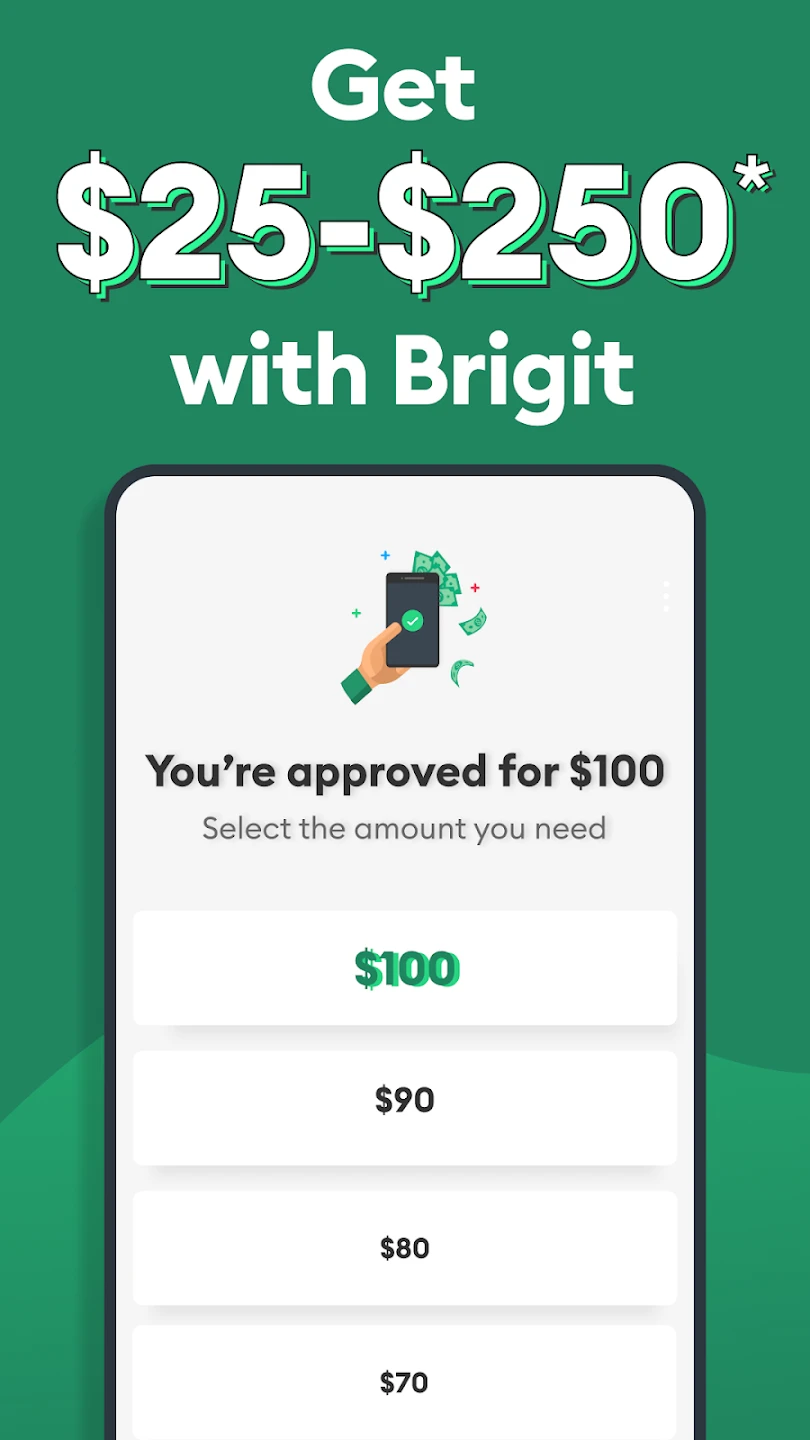

- Instant Cash Advance Approval: This feature allows users to apply for and get approved for cash advances quickly, often within minutes. This saves users time and hassle by eliminating lengthy application processes, providing quick relief during emergencies like car repairs or urgent bills.

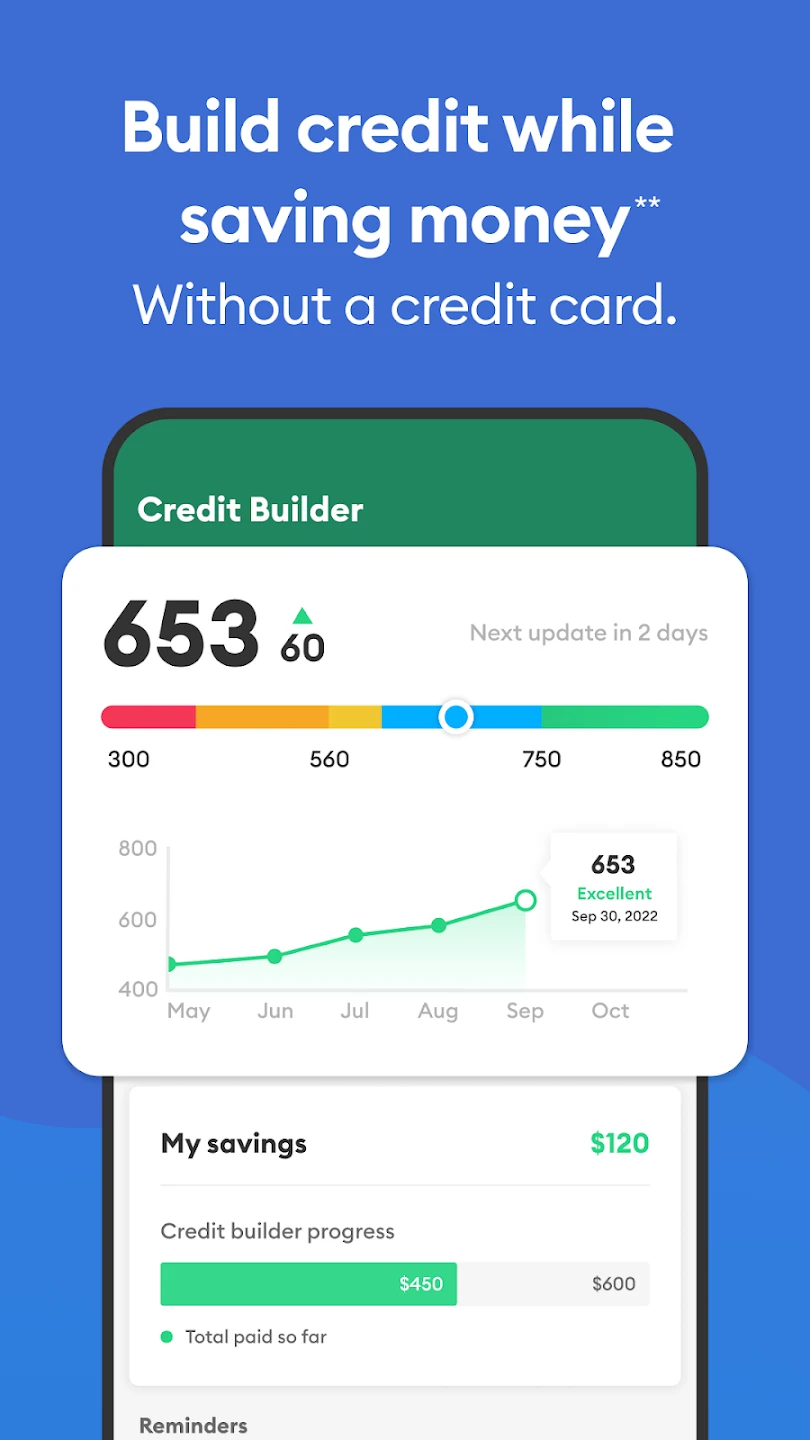

- Streamlined Credit Building: Brigit helps users responsibly build or rebuild their credit history with small, manageable credit products. The platform uses smart algorithms to assess creditworthiness fairly, even for those with limited or damaged credit, improving financial opportunities over time.

- Flexible Repayment Options: The app offers adaptable repayment plans tailored to individual budgets. By allowing customized payment schedules, users can avoid late fees and maintain good standing with the lender, reducing financial stress.

- Integrated Budgeting Tools: Users can track spending and repayment progress directly within the app. These tools help prevent debt accumulation by visually highlighting expenses related to cash advances, encouraging better financial habits.

- Secure Document Upload: Borrowers can submit necessary documents electronically for faster processing. This eliminates the need for physical paperwork, saving users time while maintaining robust security for sensitive financial information.

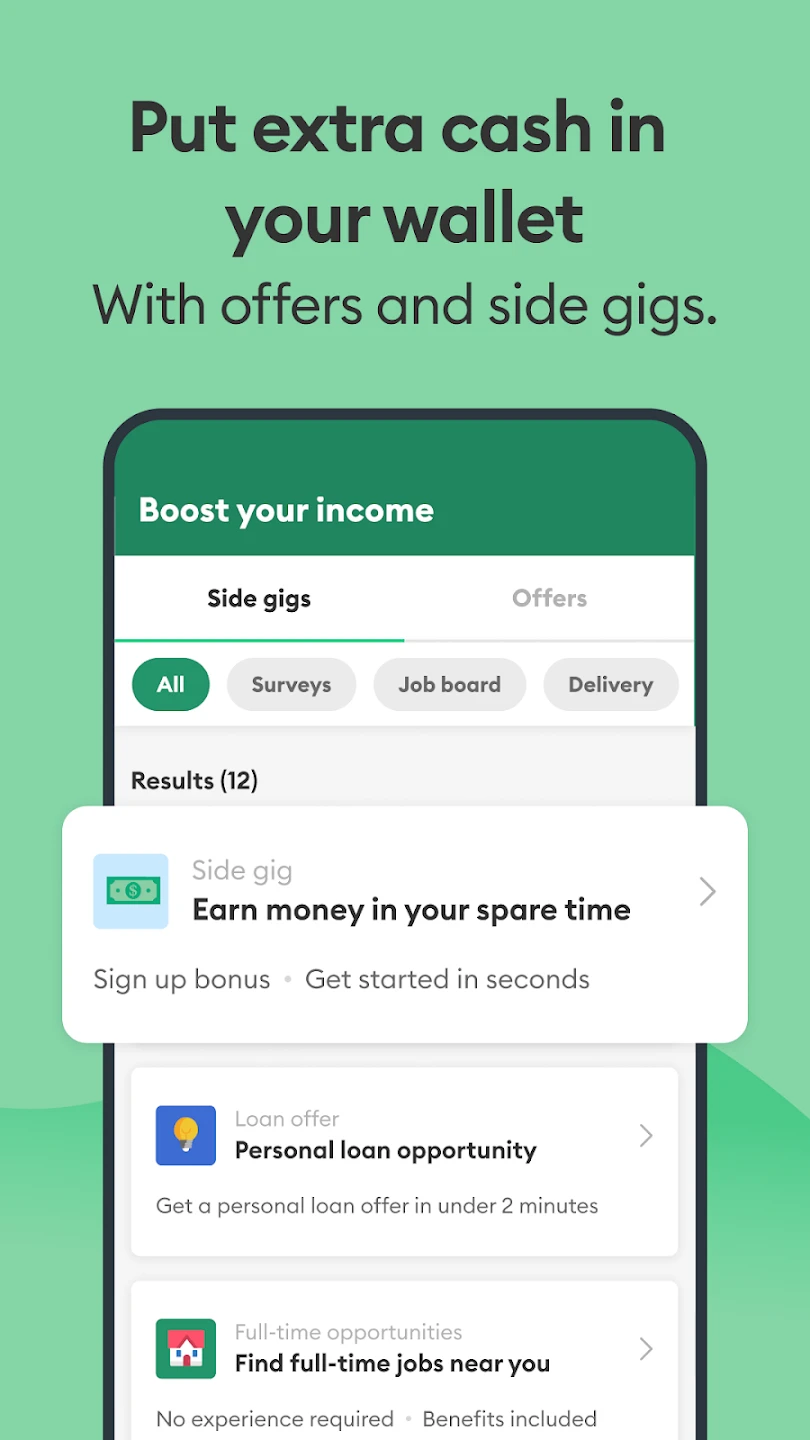

- Financial Wellness Resources: The app provides educational content and guidance on money management. These resources help users understand the implications of borrowing and make informed financial decisions, promoting long-term financial health.

Pros & Cons

Pros:

- Accessibility for Bad Credit Users

- Fast Disbursement

- Minimal Documentation Needed

- Integrated Budgeting Features

Cons:

- Potential for High-Interest Costs

- Limited Borrowing Amounts

- No Customizable Terms for All Users

- Dependence on Mobile Internet Access

Similar Apps

| App Name | Highlights |

|---|---|

| Dave |

This app provides immediate access to earned but unpaid wages, known for its no-cashback policy and funds transfer speed. |

| PayPal Loans |

Offers small personal loans with competitive interest rates and direct integration with existing PayPal accounts. |

| Square Card |

Designed as a credit-building tool |

Frequently Asked Questions

Q: How quickly can I receive funds from Brigit: Cash Advance & Credit?

A: Depending on your situation and time of application, you may receive your cash advance approval as soon as the same day, with actual disbursement happening within 24-48 hours, making it an excellent option for urgent needs.

Q: Is Brigit: Cash Advance & Credit suitable for someone with poor credit?

A: Yes, many users with limited or damaged credit have found ways to access funds through Brigit. The platform evaluates applications based on multiple factors beyond just credit score, providing access to financial solutions for over 90% of applicants who qualify.

Q: What are the minimum requirements to qualify for a cash advance?

A: Generally, you need to be at least 18 years old, have a valid bank account, provide government ID, and show a steady income source. While specific eligibility may vary by location and circumstances, these basic requirements apply across most Brigit services.

Q: Can I use Brigit: Cash Advance & Credit to rebuild my credit history?

A: Yes, through their credit products, you can begin rebuilding credit. Responsible usage, including timely repayments and maintaining available credit limits, helps improve your score. The platform also provides educational resources to guide your credit journey.

Q: Are there any hidden fees or charges with Brigit services?

A: No, all applicable fees are clearly listed upfront. Transparency is emphasized in pricing, showing you exactly what charges you’ll face before finalizing any agreement, avoiding surprises and ensuring accountability in financial services.

Screenshots

|

|

|

|