|

|

| Rating: 4.4 | Downloads: 50,000,000+ |

| Category: Finance | Offer by: JPMorgan Chase |

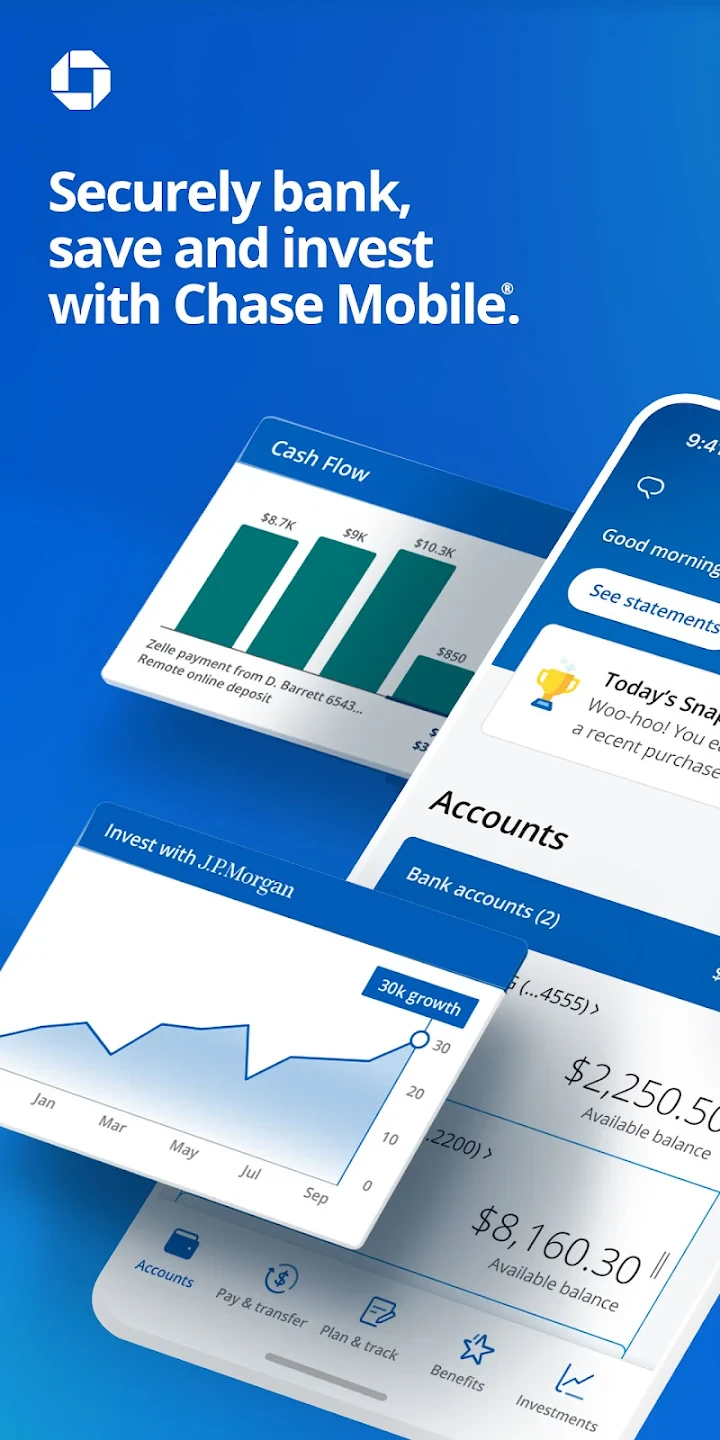

Chase Mobile is a comprehensive banking application designed for J.C. Penney Bank customers who want convenient financial management directly from their smartphones. This powerful tool allows users to monitor accounts, perform transactions, and access various banking services anytime and anywhere. It caters specifically to individuals seeking modern banking solutions that prioritize accessibility and efficiency.

This digital platform streamlines everyday financial tasks, offering features like mobile deposits, bill payments, and instant notifications. Chase Mobile provides a secure and user-friendly interface that saves time compared to traditional bank visits, making banking simple for millions of customers across different income levels and life stages.

App Features

- Account Overview & Quick Actions: Instantly view balances and account history with a single tap, providing a consolidated view of your finances. This dashboard lets you quickly transfer funds or pay bills without navigating multiple menus, saving time during busy mornings or when managing household funds.

- Mobile Check Deposit: Simply capture images of your checks using the built-in camera, and deposits typically process overnight for faster access to your funds. This eliminates lengthy trips to the bank and waiting rooms, proving especially valuable during bad weather or inconvenient hours.

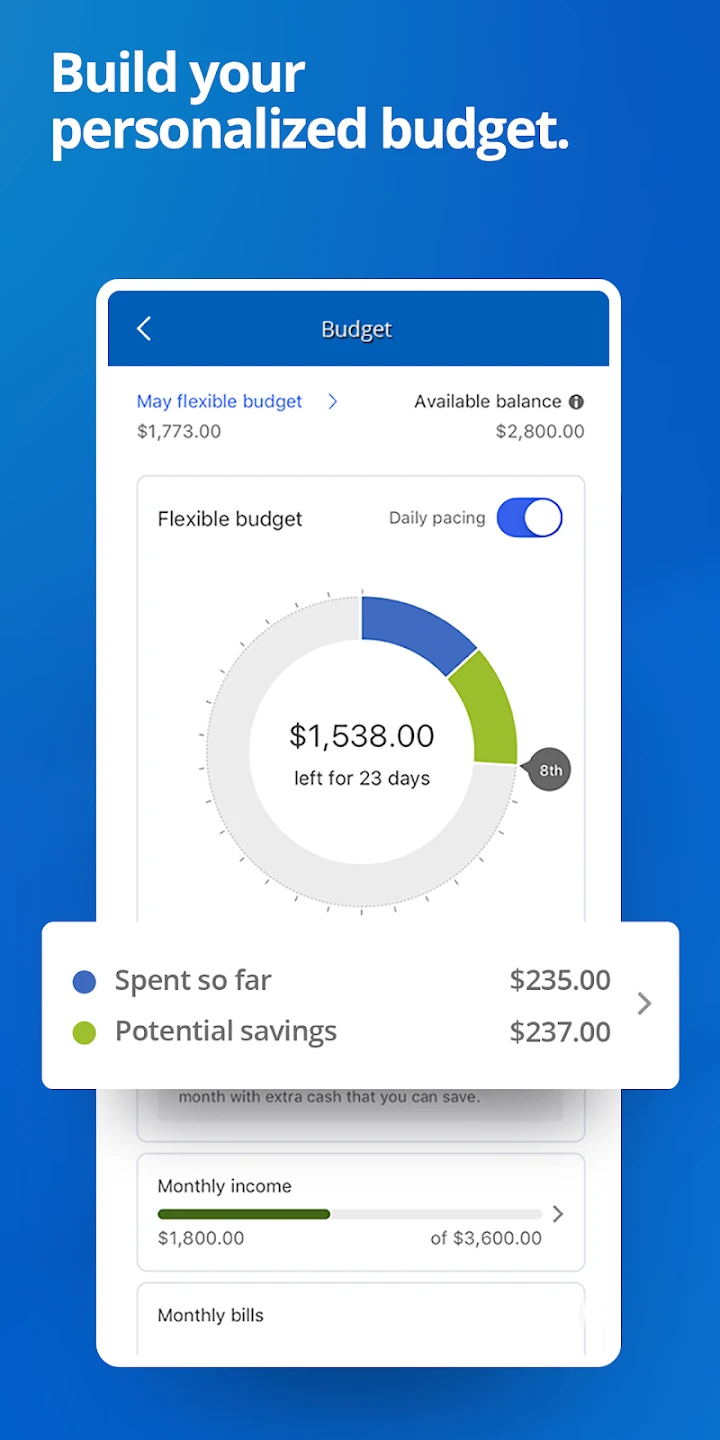

- Bill Pay Management: Set up recurring payments, schedule one-time bills, or view payment history – all within the app. This feature integrates with popular services and reduces paper clutter by consolidating payments into one digital hub.

- Card Services & Fraud Monitoring: View your credit cards, report lost/stolen cards instantly, and receive real-time alerts about suspicious activity. This proactive approach provides peace of mind when traveling or shopping online, offering faster resolution than traditional banking channels.

- Alerts & Notifications: Customize real-time updates on account activity, low balances, or payment due dates. This proactive communication system helps users stay on top of finances without constant manual checking, preventing overdrafts and missed due dates.

- ATM & Branch Locator: Find nearby ATMs with fee information or locate branch offices for in-person services. This navigation tool saves time during travel by providing accurate directions and wait time estimates, optimizing your journey to financial institutions.

Pros & Cons

Pros:

- Extensive Transaction Capabilities

- Robust Security Features

- Real-Time Account Updates

- Convenient Customer Support Options

Cons:

- Complex Interface for Beginners

- Occasional Sync Delays

- Camera-Based Deposits Require Good Lighting

- Some Advanced Features Limited to Web Portal

Similar Apps

| App Name | Highlights |

|---|---|

| Bank of America Mobile Banking |

Offers comprehensive account management, mobile deposit capabilities, and investment tracking. Known for personalized insights and vibrant dashboard design. |

| Wells Fargo App |

Emphasizes security features alongside transaction management. Includes guided steps for common tasks and branch appointment scheduling. |

| Citibank Mobile |

Features advanced transaction categorization and spending analytics. Offers AI-driven financial recommendations ideal for budget-conscious users. |

Frequently Asked Questions

Q: How do I deposit a check using Chase Mobile?

A: Simply open the app, navigate to the ‘Deposit’ section, use your phone’s camera to capture a clear image of both sides of the check, review the details, and submit. Funds are typically available within 24 hours, though exact timing may vary based on check amount and source, and you can track its status within the app.

Q: Can I use Chase Mobile to send money internationally?

A: Yes, the app supports person-to-person transfers domestically and to selected international locations via the ‘Send Money’ feature. While international transactions incur currency conversion fees, it still offers faster alternatives to physical wire transfers for many common use cases.

Q: What security measures protect my account when using Chase Mobile?

A: The application employs bank-level security including encryption, biometric authentication (face ID/fingerprint), and unique app-based security codes. Additionally, you’ll receive alerts for suspicious logins, unusual transaction patterns, and when your device is accessed remotely, creating multiple layers of protection.

Q: Are there any transaction limits when using the mobile check deposit feature?

A: Yes, there are daily and monthly dollar amount limits for mobile deposits, currently set at $2,500 per day and $7,500 per month by default, though specific parameters may vary slightly based on account type. These limits help mitigate risk while providing substantial flexibility for most everyday deposit needs.

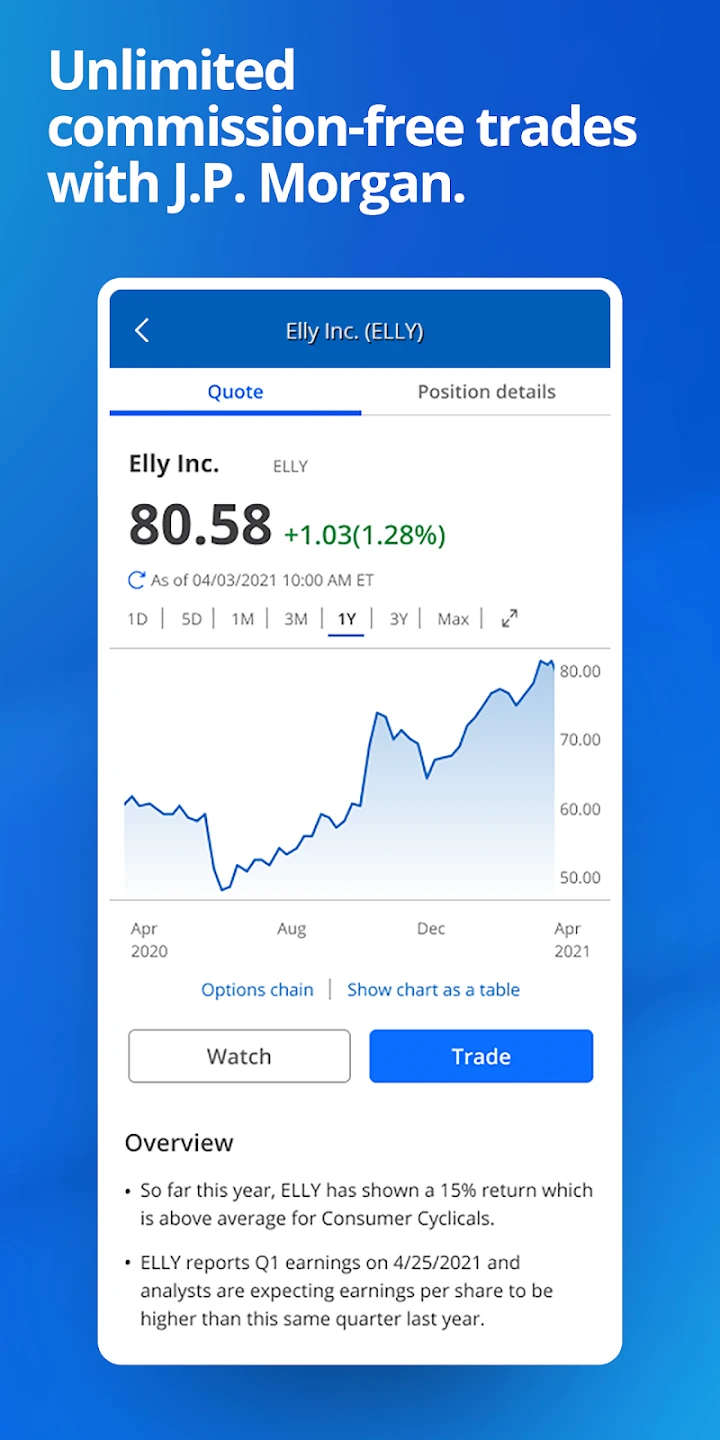

Q: Can I manage my investment accounts through Chase Mobile?

A: Yes, for clients with investment accounts, the mobile application provides portfolio tracking, account statements, transaction history, and performance charts. While it offers robust market data and analysis updates, complex investment management tasks may still require using the full online portal or speaking directly with a financial advisor.

Screenshots

|

|

|

|