|

|

| Rating: 4.7 | Downloads: 10,000,000+ |

| Category: Finance | Offer by: Citibank N.A. |

Citi Mobile® is Bank of America’s official digital banking application, designed specifically for customers to interact with their accounts on the go. The app offers a comprehensive suite of tools covering everything from checking balances and transferring funds to paying bills and managing credit cards. It serves millions of users seeking convenience and control directly from their smartphones or tablets, providing a seamless digital alternative to visiting a physical branch.

The key appeal of Citi Mobile® lies in its ability to offer banking services anytime, anywhere, significantly enhancing financial accessibility. Users appreciate the combination of robust features like person-to-person payments and security alerts within a single, intuitive interface, making daily financial tasks faster and often simpler compared to traditional banking methods.

App Features

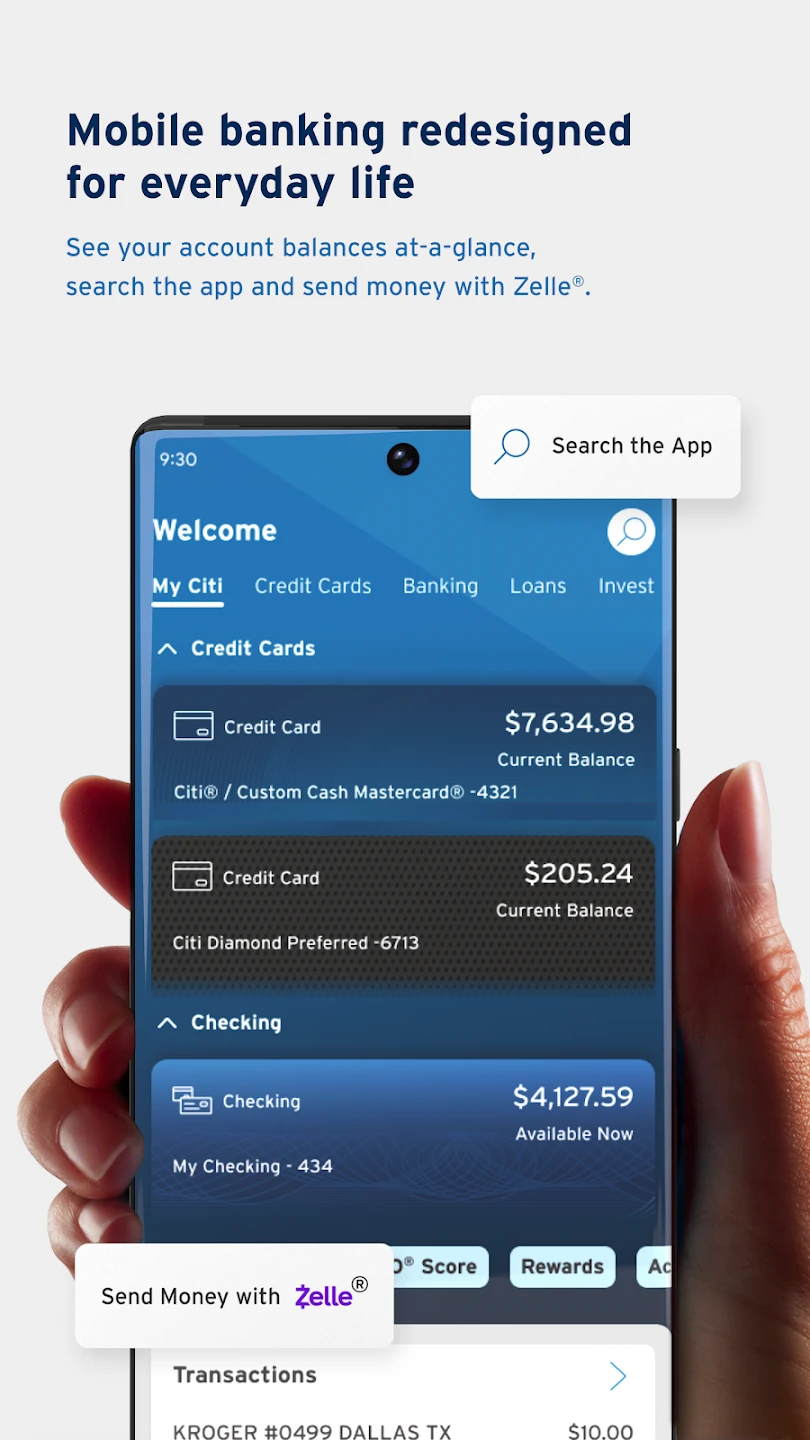

- Account Overview: Get a clear, summarized view of your balances across all linked accounts with a simple tap. This immediate summary helps you track spending and manage your cash flow efficiently, providing peace of mind without needing to navigate multiple menus.

- Transfers Between Accounts: Move money quickly and securely between your checking, savings, and money market accounts with just a few taps. This feature saves time compared to manual record-keeping and ensures funds are readily available across your accounts when needed for expenses or opportunities.

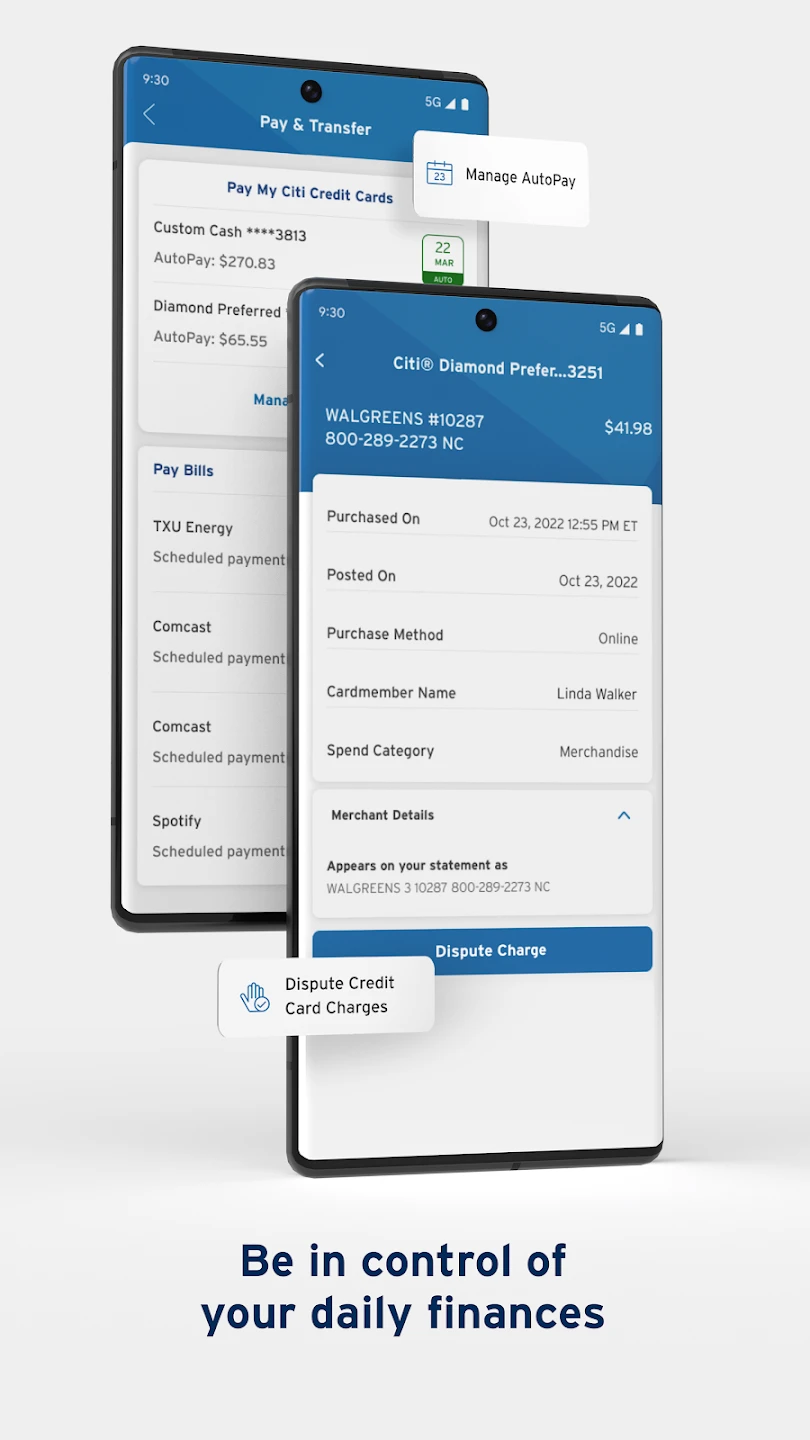

- Bill Pay: Set up and manage recurring or one-time bill payments for vendors directly through the app. It simplifies your payment routine by eliminating checks and envelopes while offering features like payment tracking and potentially early payment options if available.

- Mobile Check Deposit: Use the camera on your phone to deposit checks remotely by taking a clear photo. This eliminates the trip to the bank lobby for depositing checks, making the process incredibly fast and convenient for deposits made within the deposit window.

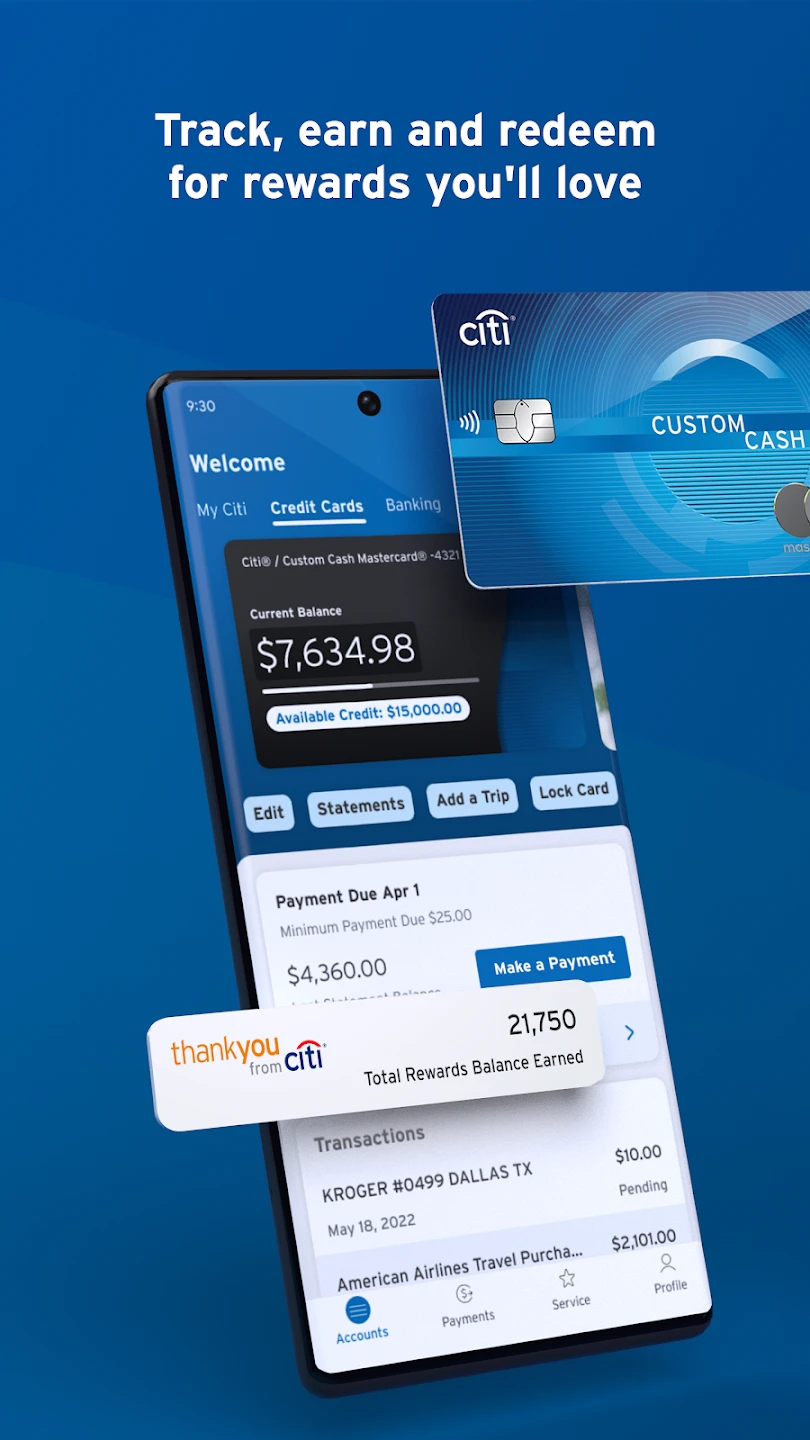

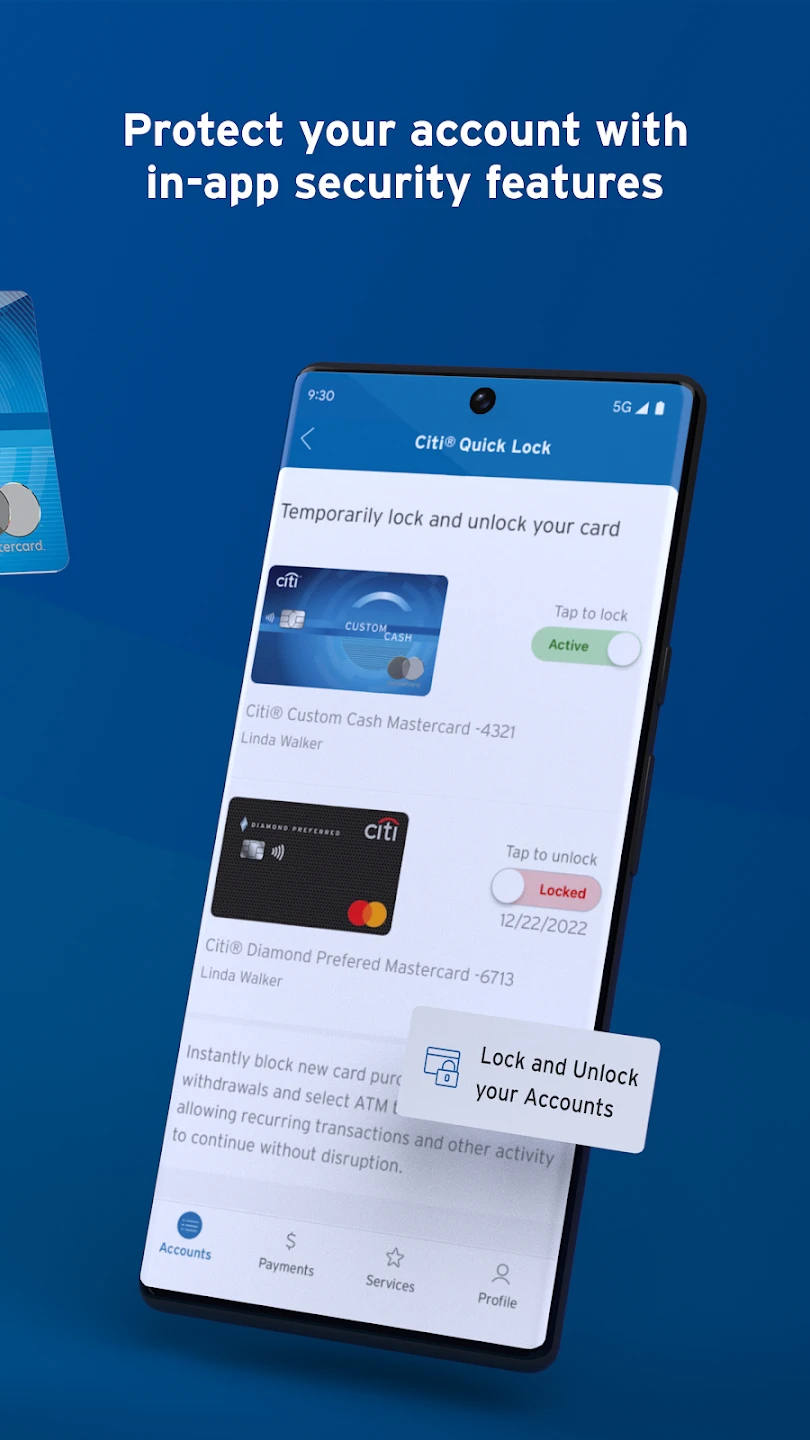

- Card Management & Alerts: Manage card activation, blocking, and spending alerts all in one place. This empowers users to quickly respond to unusual account activity or manage their cards according to their lifestyle needs on the fly, enhancing overall security and convenience.

- Mobile App Payments (P2P): Easily send and request money with friends, family, or businesses through integrated services like Zelle® or Boost™. This feature simplifies splitting costs or receiving money instantly, often faster than other electronic transfer methods and directly from your account.

Pros & Cons

Pros:

- Wide Feature Range

- User-Friendly Interface

- Enhanced Security Features

- 24/7/365 Accessibility

Cons:

- Occasional Sync Delays

- Feature Availability Varies by Account Type

- Technical Glitches During Updates

- Sometimes Overwhelming Options for New Users

Similar Apps

| App Name | Highlights |

|---|---|

| Chase Mobile |

Known for a clean design and excellent mobile check deposit. Offers card controls and a robust investment tracking section if you have those accounts. |

| Wells Fargo Mobile |

Frequently praised for its intuitive navigation and quick transaction approvals. Features mobile deposit and comprehensive loan management tools. |

| Bank of Ireland Mobile |

Offers a strong focus on investment management alongside core banking. Includes advanced reporting features and foreign currency management. |

Frequently Asked Questions

Q: How do I deposit a check using Citi Mobile®?

A: You can use the mobile deposit feature by taking a clear front and back image of the check. Ensure you are within your deposit window timeframe (typically two banking days). The app processes the deposit, and funds usually post within one business day.

Q: Is my banking information secure on Citi Mobile®?

A: Absolutely. Citi Mobile® employs multiple security layers including encryption, biometric authentication (like Touch ID or Face ID), and fraud alerts to protect your information and accounts. Transactions require secure connections.

Q: Can I pay my Citi credit card through the Citi Mobile® app?

A: Yes, absolutely. The app includes a dedicated section for managing credit and debit cards. You can easily view balances, make payments, set up billing alerts, and even lock/unlock your cards directly from your phone.

Q: What happens if I lose my phone?

A: This is a primary reason for having quick card controls. You can immediately use the app to block your cards and put a freeze on account access, preventing unauthorized transactions. Report it securely through the app’s security options.

Q: Does Citi Mobile® work with older smartphones?

A: While we constantly strive for broad compatibility, the app requires a minimum operating system version and device memory. Check the app’s listing on your device’s app store for the current minimum iOS or Android requirements to ensure full functionality.

Screenshots

|

|

|

|