|

|

| Rating: 4.8 | Downloads: 1,000,000+ |

| Category: Finance | Offer by: Citizens Bank, N.A. |

Citizens Bank Mobile Banking is a comprehensive digital application designed to provide customers with convenient access to their financial accounts anytime, anywhere. This mobile tool allows users to perform essential banking tasks, manage transactions, and stay updated with their financial status through a secure platform. It’s specifically tailored for Citizens Bank account holders seeking modern banking solutions without needing to visit physical branches.

The key value of Citizens Bank Mobile Banking lies in its efficiency and user-friendly interface, enabling customers to handle daily financial needs swiftly and securely. This digital banking solution appeals particularly to busy professionals and families who prioritize time-saving features and the convenience of managing finances remotely, offering practical solutions for everyday banking requirements.

App Features

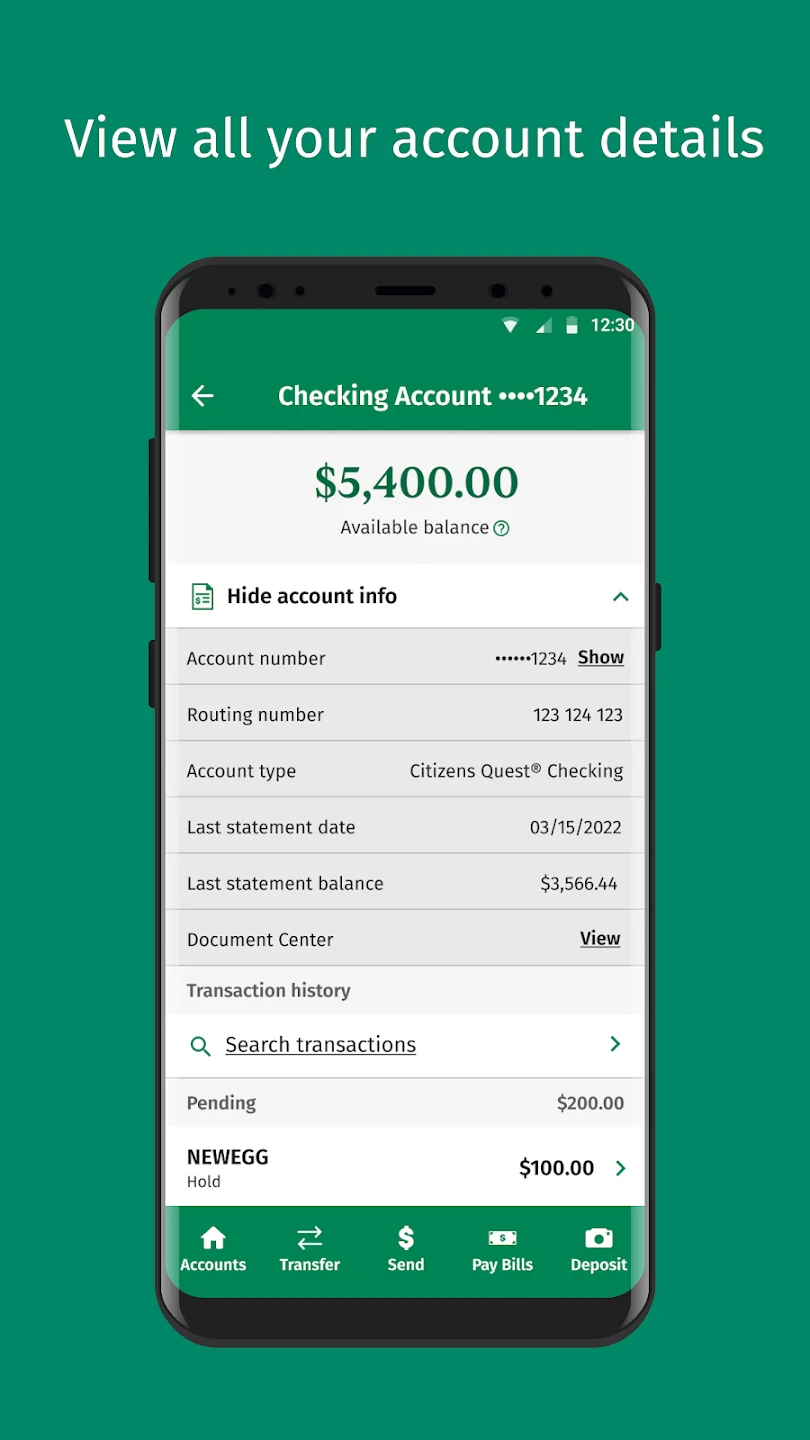

- Account Management Dashboard: Access your checking, savings, and investment accounts in one place with real-time balances. This centralized view helps users track spending patterns and manage finances effectively, allowing informed decisions about money allocation throughout the month.

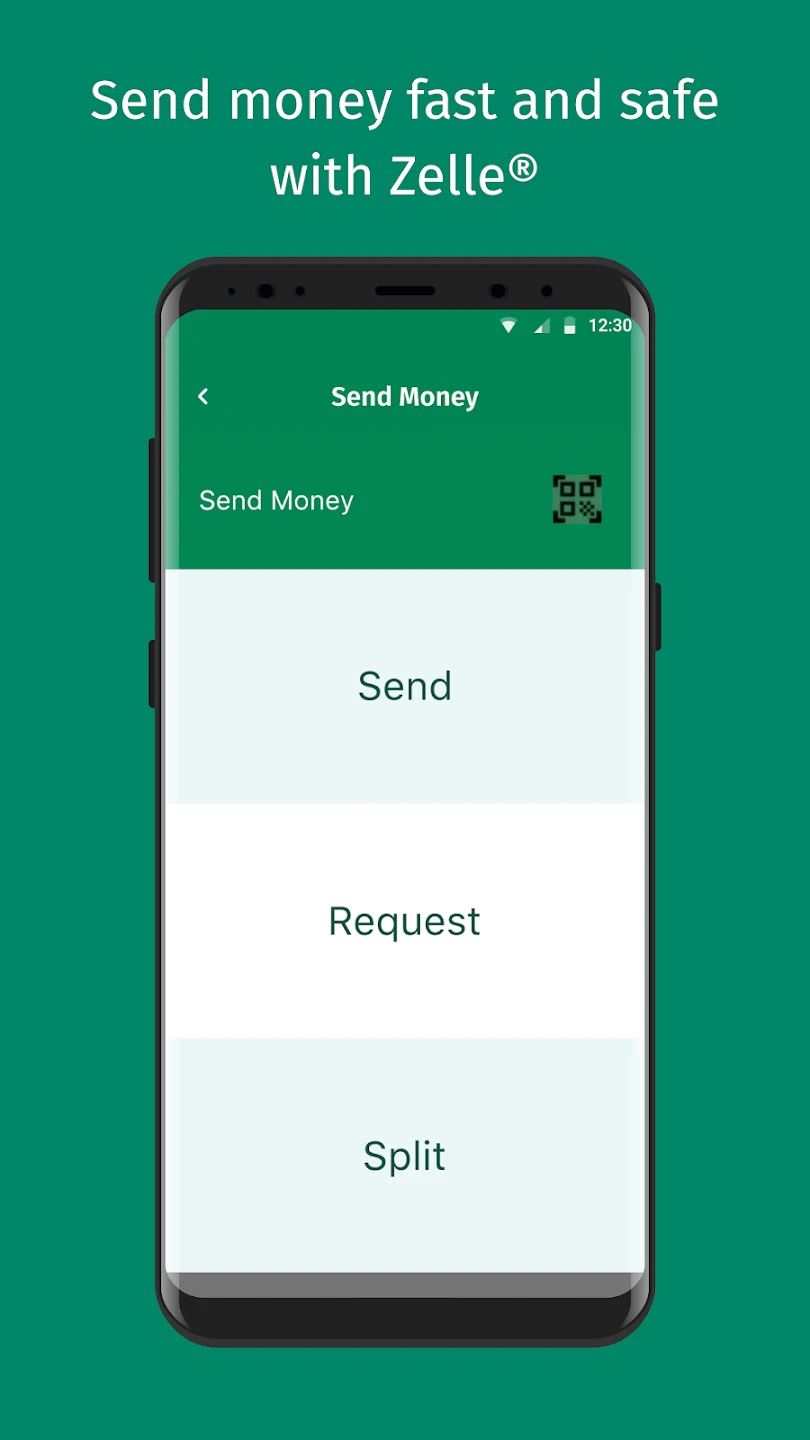

- Person-to-Person (P2P) Transfers: Send and receive money instantly with just a phone number or email address. Using modern, secure protocols like QuickPay, users can resolve gift-giving or expense-sharing scenarios rapidly, eliminating the need for checks or physical cash exchanges for peer transactions.

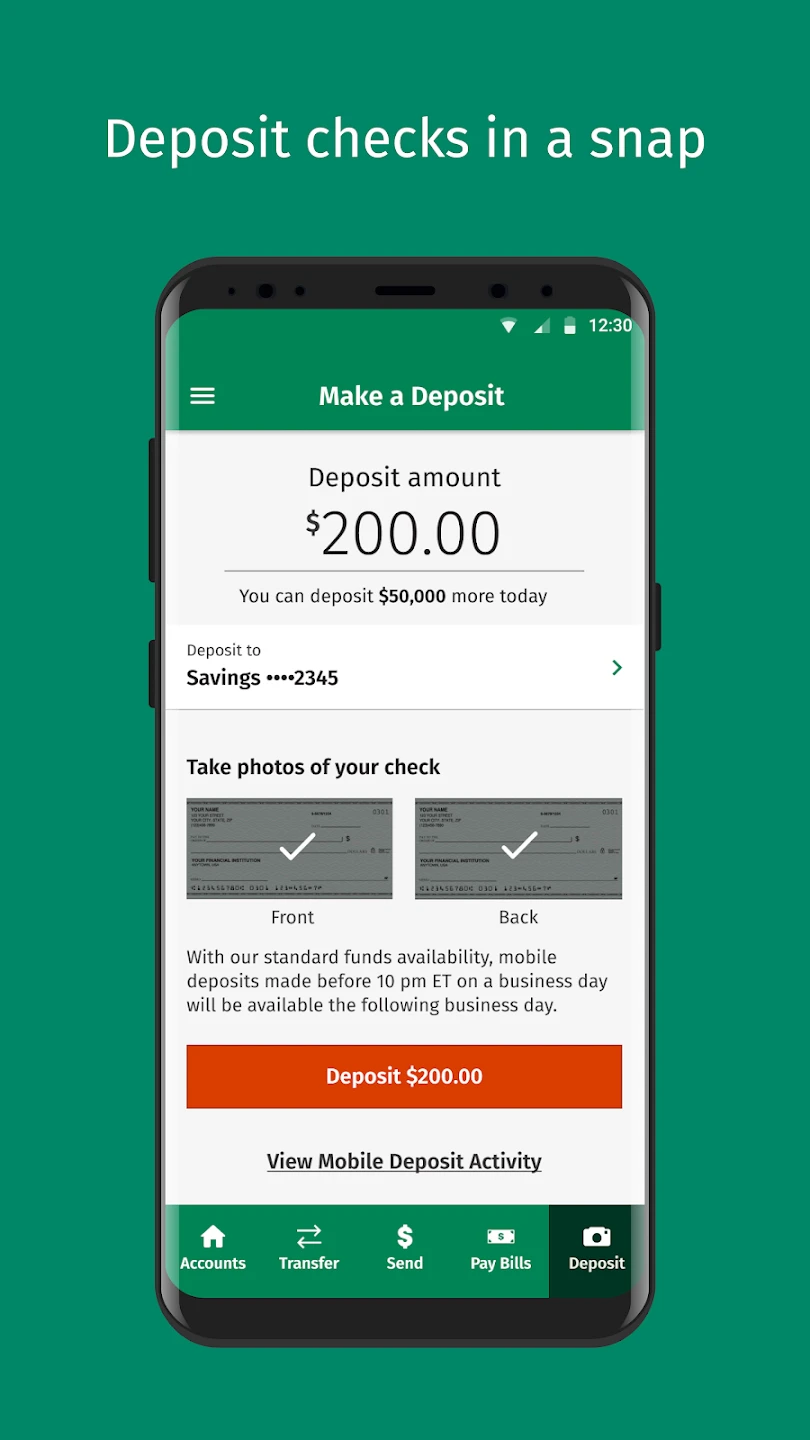

- Mobile Check Deposits: Capture check images via your device’s camera to deposit funds without visiting a branch. This convenient feature saves time during the deposit process and ensures immediate processing for eligible checks, preventing delays often associated with in-branch deposits.

- Bill Pay Management: Schedule payments to utility companies, credit card issuers, and other vendors directly from the app. Users can organize recurring payments, set reminders, and view payment history, streamlining financial responsibilities and avoiding late fee penalties through automated payment tracking.

- Alerts & Notifications Setup: Create custom financial alerts for balance thresholds, transaction activity, or account changes. This proactive notification system keeps users informed about account movements, helping catch suspicious transactions promptly and preventing overdraft fees before they occur.

- Branch & Service Locator: Find nearby branches, locate ATM machines, and view operating hours offline. This utility feature is invaluable during unexpected cash needs or when in-person banking assistance is required, guiding users directly to available resources without internet connectivity.

Pros & Cons

Pros:

- Seamless Mobile Transactions

- Enhanced Security Protocols

- Real-time Account Visibility

- User-friendly Interface Design

Cons:

- Insufficient branch alternatives

- Limited investment product selection

- Occasional sync delays

- Regional feature variations

Similar Apps

| App Name | Highlights |

|---|---|

| FIRSTBANK Anywhere |

This app emphasizes security features with biometric login and fraud detection. Known for its robust transaction history tools and priority customer support during peak hours. |

| BOFA Mobile |

Boasting advanced investment tracking, it includes market data feeds and goal-based planning tools. Designed for active wealth management, with intuitive charting and algorithmic portfolio insights. |

| Chase Mobile |

Known for its comprehensive rewards tracking, this platform integrates spending analytics and travel booking. Offers exceptional mobile deposit processing and priority billing services for preferred members. |

Frequently Asked Questions

Q: How secure is Citizens Bank Mobile Banking?

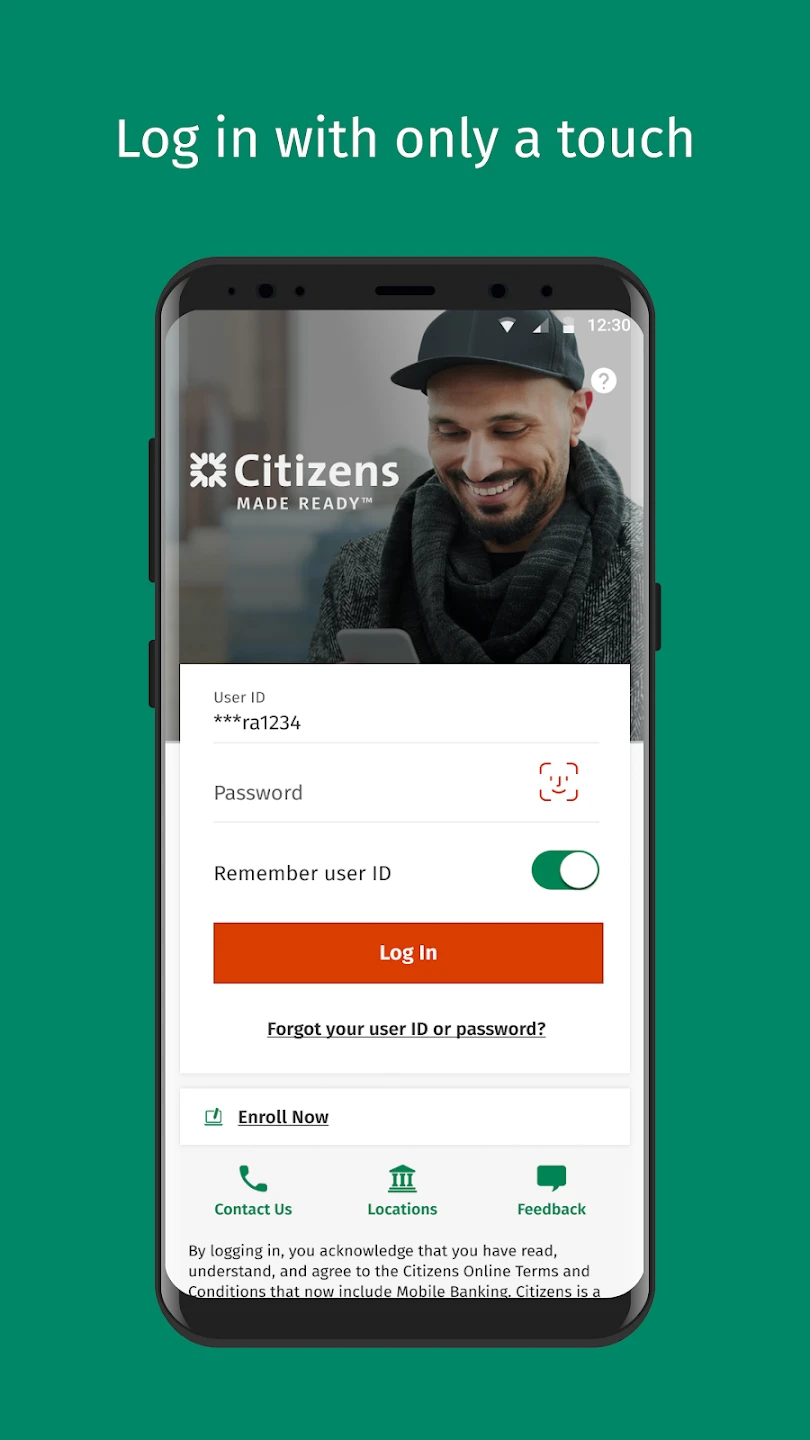

A: Citizens Bank Mobile Banking uses bank-level encryption, multi-factor authentication options like PINs or biometrics, and secure tokenization to protect your financial data. All transactions require your unique credentials.

Q: Can I schedule deposits for weekends?

A: Yes, you can initiate deposits any time through our mobile app. While processing may vary based on deposit type, most funds should be available by the next business day. Weekend deposits are accepted but processed during standard banking hours.

Q: Are there any fees for using Citizens Bank Mobile Banking?

A: The Citizens Bank Mobile Banking service itself is completely free for all account holders. Transaction-related charges (like overdraft fees) depend on standard banking practices, not the mobile platform.

Q: How do I enable mobile check deposit?

A: To start mobile deposits, navigate to the “Deposit” tab, select the account, take clear check images following our capture guidelines, then submit. You’ll receive immediate confirmation once processing begins.

Q: Can I transfer money internationally through the mobile app?

A: While the app supports domestic transfers between your Citizens Bank accounts, international wiring requires visiting a branch or contacting our specialized international services team for assistance due to regulatory considerations.

Screenshots

|

|

|

|