|

|

| Rating: 4 | Downloads: 1,000,000+ |

| Category: Finance | Offer by: Cleo AI |

Cleo AI: Cash advance & Credit is an innovative financial management app designed to assist users with accessing funds quickly through cash advances and managing their credit accounts efficiently. It targets individuals seeking flexible financial solutions, offering a user-friendly interface for handling unexpected expenses or credit needs seamlessly.

This smart financial tool empowers users by simplifying the process of securing short-term cash and monitoring credit health. Cleo AI provides timely insights, personalized recommendations, and convenient access to financial services, making budgeting and managing credit constraints less daunting day-to-day.

App Features

- Cash Advance Requests: Cleo AI allows users to easily apply for cash advances, often linked directly to compatible savings or checking accounts. This feature provides immediate access to funds for unexpected expenses or opportunities, reducing reliance on high-interest traditional loans.

- Credit Score Monitoring & Insights: The app offers real-time tracking of your credit score and detailed reports on your credit history within the Cleo AI platform. Incorporating sophisticated AI analysis, it delivers personalized tips for improving credit health and alerts users to potential issues.

- Integrated Budgeting Tools: Cleo AI helps manage finances by integrating spending data to create budgets aligned with your cash advance plans and credit limits. This functionality enhances financial awareness and helps prevent debt accumulation by showing how cash advances impact overall budgeting.

- Real-time Transaction Alerts: Users receive instant notifications for account activities related to their cash advances and credit usage. Key benefits include enhanced security monitoring and the ability to quickly identify or report discrepancies on transactions.

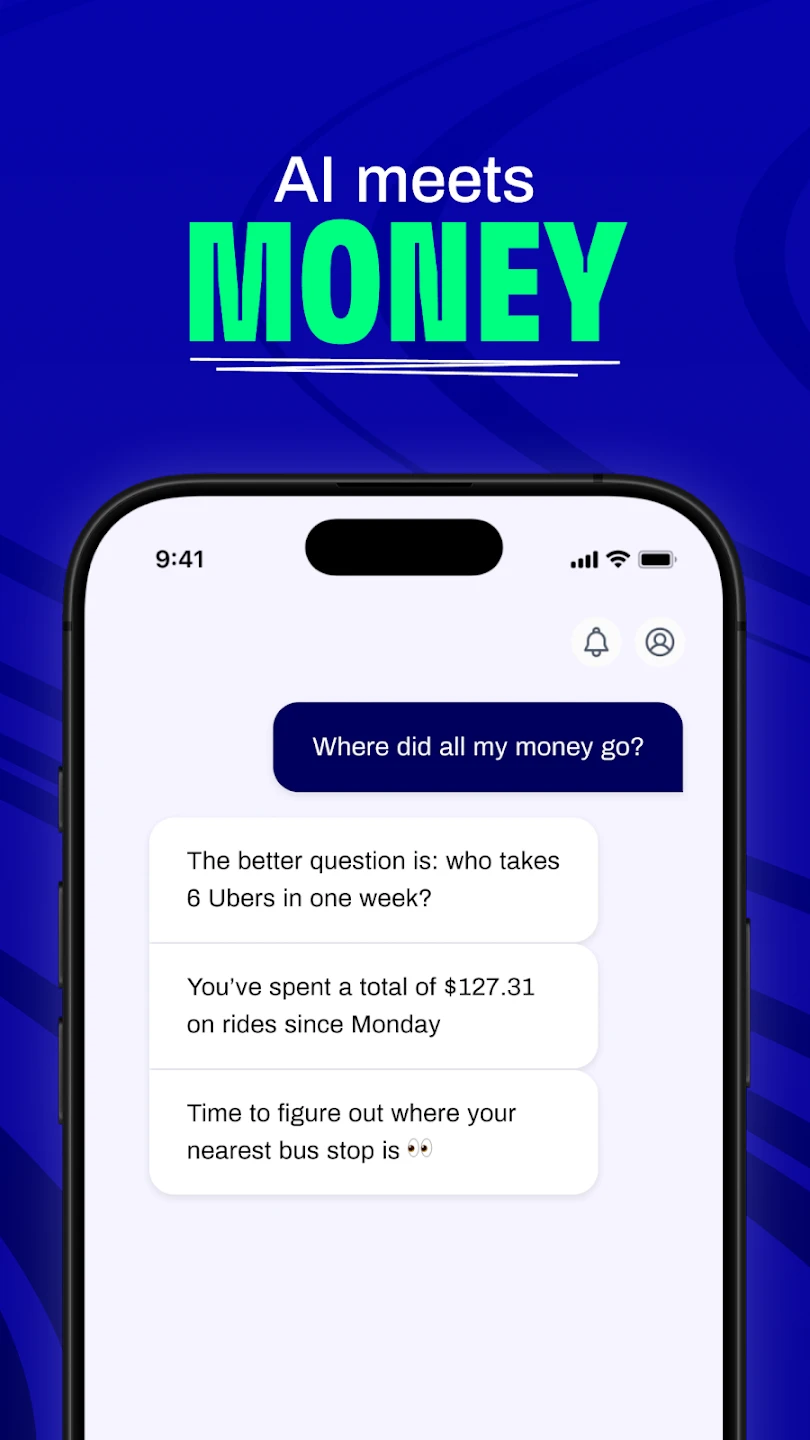

- AI-Powered Financial Guidance: Cleo AI offers tailored financial advice and alerts based on user behavior and financial goals. This feature is valuable for users seeking to understand the long-term implications of cash advances and credit utilization, catering to both cautious savers and those needing flexible financial support.

- Account Management & Settings: Users can manage linked accounts and customize notification preferences directly within the Cleo AI app interface. This flexibility supports different financial habits and security levels, making the app adaptable across various user needs and financial situations.

Pros & Cons

Pros:

- Fast Application Process for Cash Advances

- Convenient Credit Score Tracking & Monitoring

- User-Friendly Interface & Educational Insights

- Potential for Integrated Banking & Financial Planning

Cons:

- Potential Fees Associated With Cash Advances

- Complexity in Managing Multiple Financial Services

- Dependence On User’s Existing Income & Creditworthiness

- Potential Over-Reliance On Short-Term Financing Solutions

Similar Apps

| App Name | Highlights |

|---|---|

| Paytm Money |

This app offers a wide range of financial services, including quick loans and credit score checks. Known for strong regional presence and integration in India, with a vast user base and diverse feature set. |

| LoanMe |

Designed for simplicity in obtaining quick personal loans. Includes streamlined application workflows and focuses on user-friendly interfaces, often with transparent interest rate displays. |

| Credit Karma |

Offers comprehensive Credit score monitoring, reports, and financial education resources. While lacking direct cash advance features, it provides deep insights into credit health and potential lenders. |

Frequently Asked Questions

Q: What is the typical timeframe for a cash advance request processed through Cleo AI: Cash advance & Credit?

A: Processing times for cash advances vary based on factors like requested amount, your financial history, and current banking procedures, but Cleo AI aims to provide relatively quick turnaround, sometimes depositing funds within minutes to a couple of business days.

Q: How does Cleo AI impact my credit score, and is frequent use of cash advances harmful?

A: Cleo AI itself typically doesn’t run frequent credit checks unless initiating a loan. Taking out a cash advance usually involves a hard credit pull, which can temporarily lower your score. Frequent hard inquiries or high debt loads from repeated advances can harm your credit score over time.

Q: What types of income or employment status are typically eligible for cash advances via Cleo AI?

A: Eligibility for cash advances generally depends on the specific lender’s criteria, which Cleo AI partners with. While many services require proof of steady income and a satisfactory banking relationship, strict employment status requirements can vary significantly between providers they collaborate with.

Q: Are there any security measures to protect my financial information when using Cleo AI: Cash advance & Credit?

A: Yes, reputable apps like Cleo AI implement security measures such as bank-level encryption, multi-factor authentication options, and compliance with data protection regulations. Always ensure the app uses secure connections (HTTPS) and review its privacy policy for details.

Q: Can I use Cleo AI if I have a poor credit history?

A: While having a less-than-perfect credit history can make securing a cash advance through Cleo AI more challenging or result in less favorable terms (like higher interest rates), many cash advance products target users based on income stability and bank account history rather than solely on credit scores.

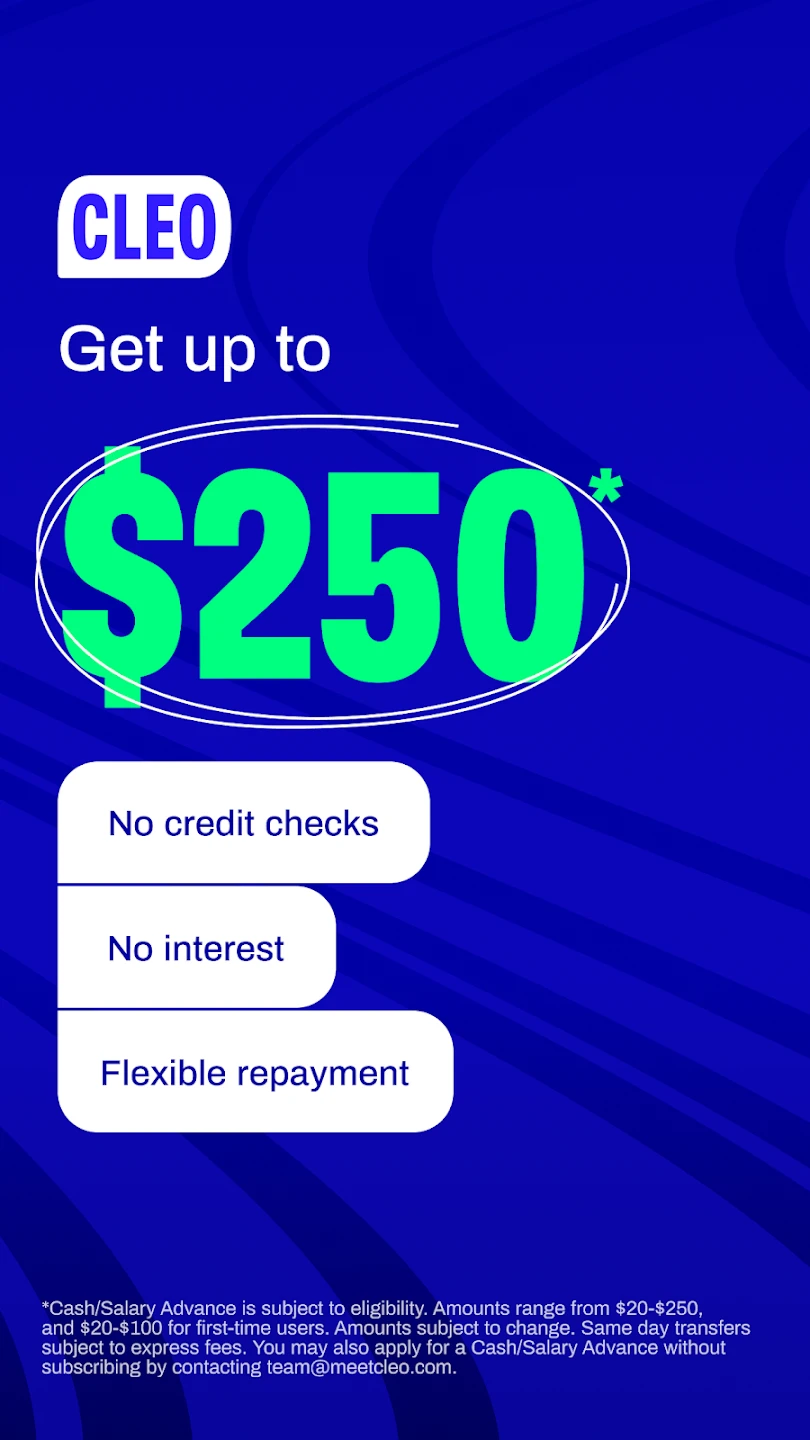

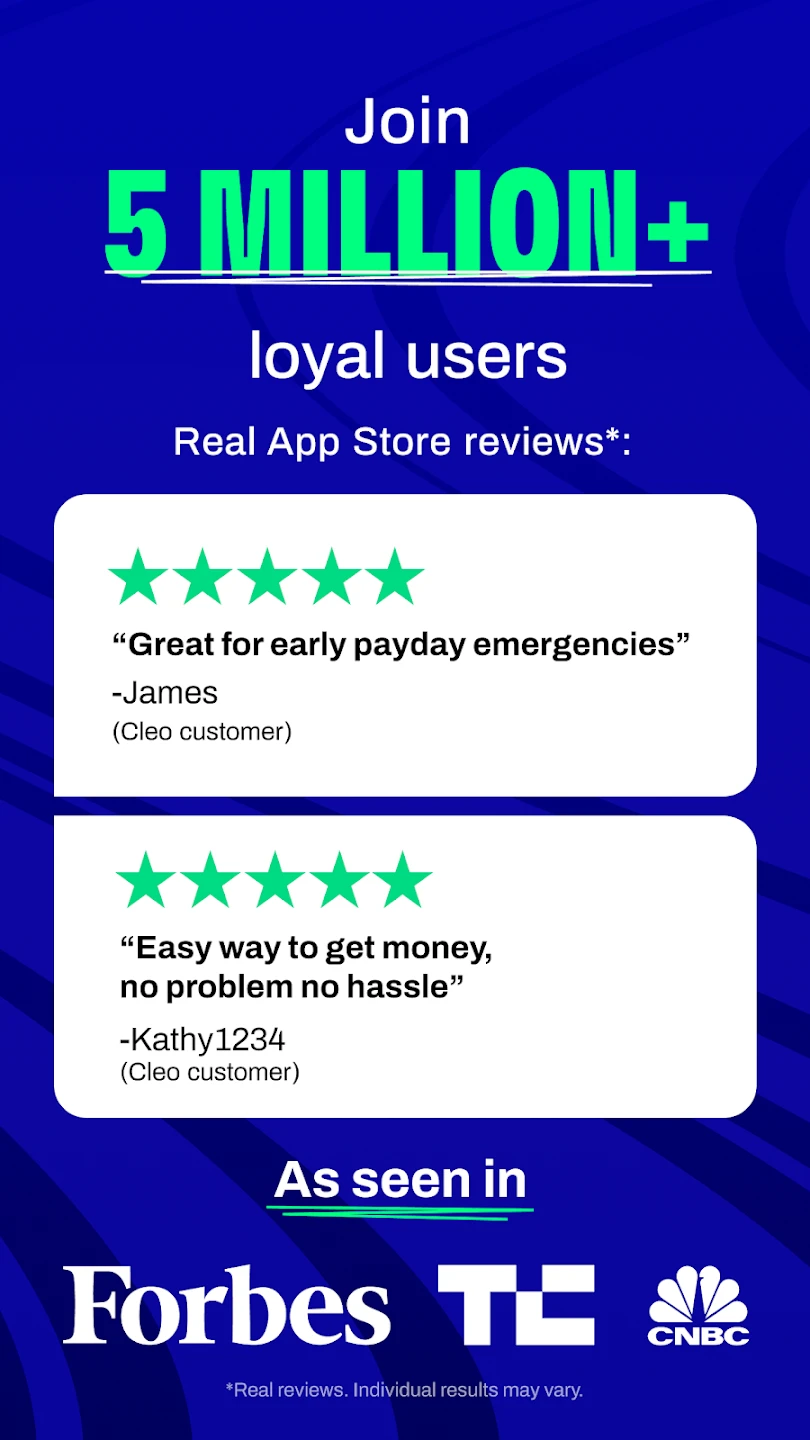

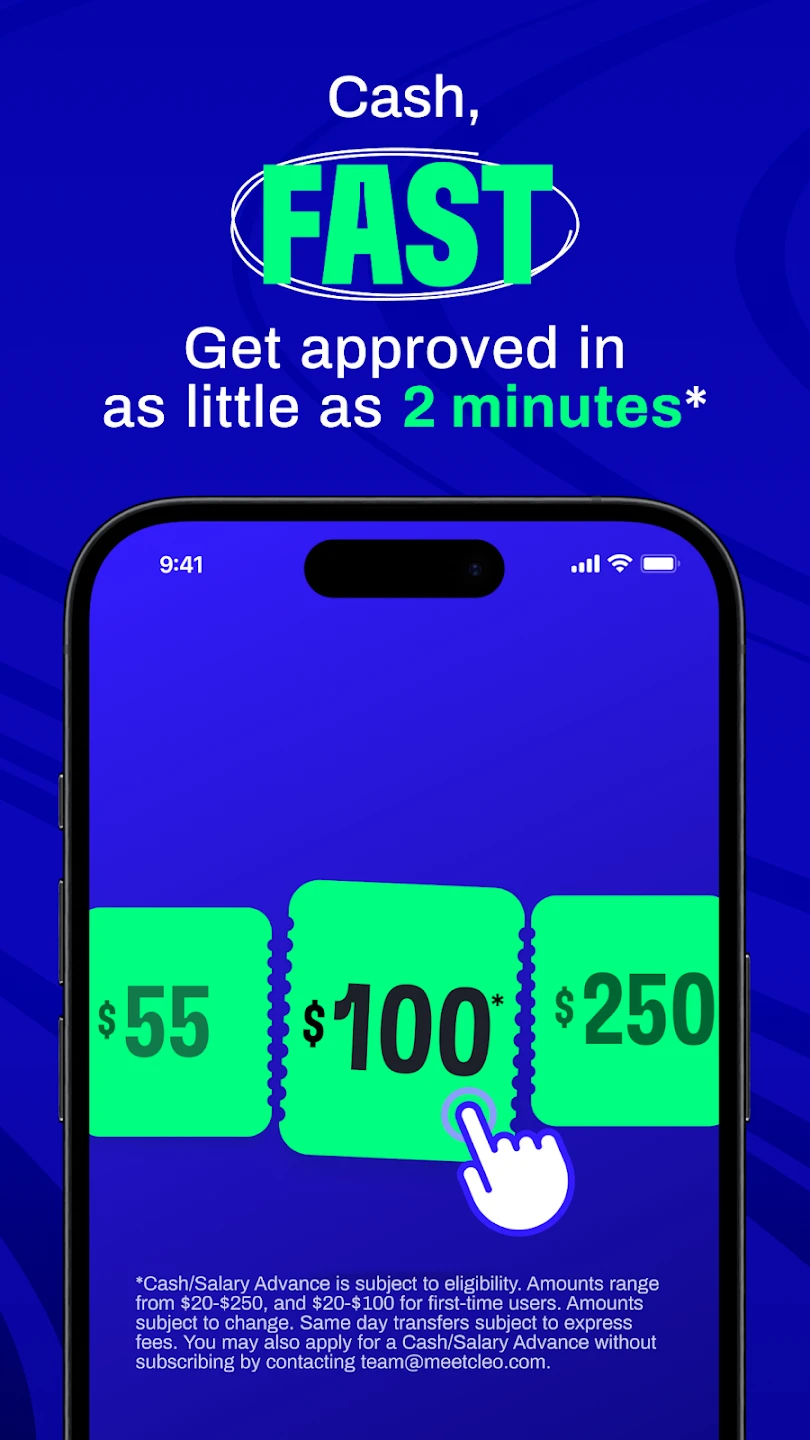

Screenshots

|

|

|

|