|

|

| Rating: 4.6 | Downloads: 10,000,000+ |

| Category: Finance | Offer by: Credit One Bank, N.A. |

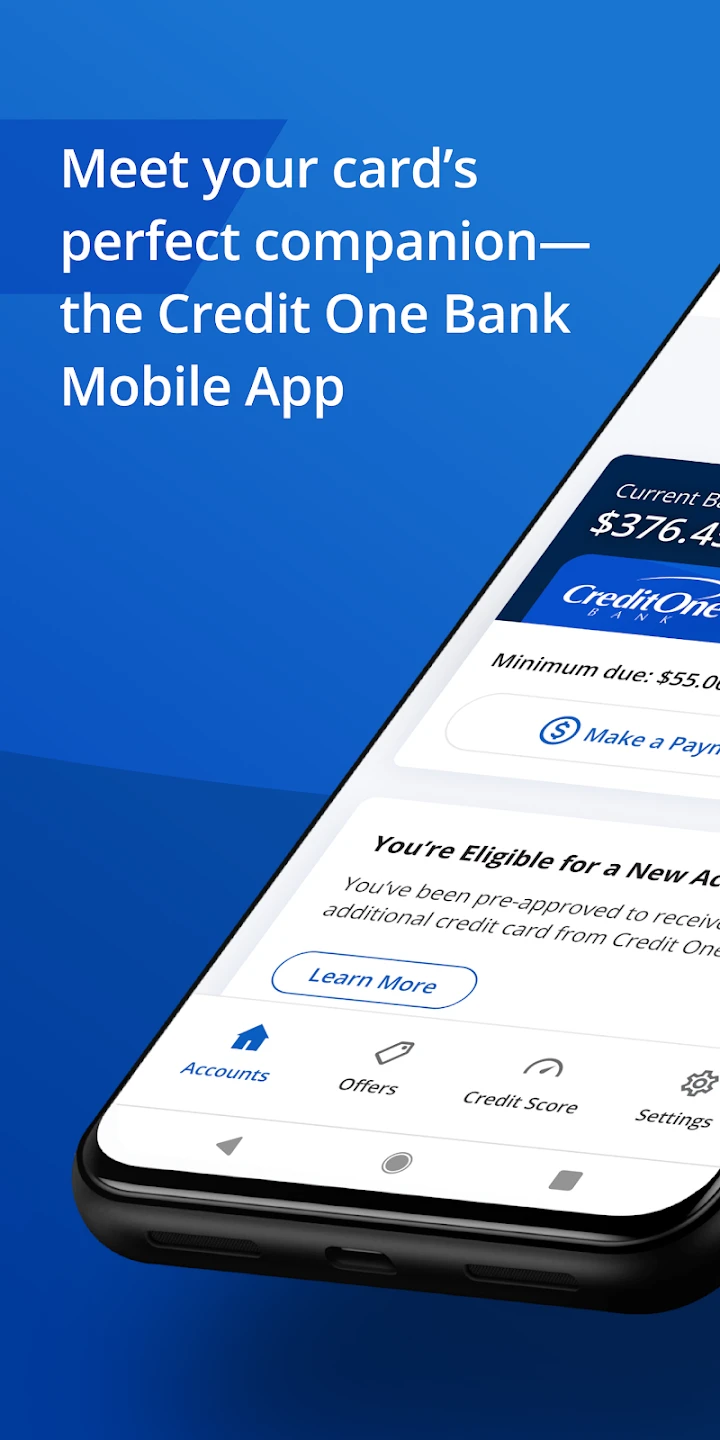

Download Credit One Bank Mobile for convenient management of your finances anytime, anywhere. This essential app allows you to check balances, view transactions, pay bills, and transfer funds securely using your smartphone, designed specifically for Credit One Bank customers to interact with their accounts remotely.

The key appeal lies in its portability and efficiency; whether you’re quickly checking your balance before a meeting or managing bill payments on the go, Credit One Bank Mobile streamlines everyday banking tasks, saving you time and effort without needing to visit a physical branch.

App Features

- Account Management: Easily view your checking, savings, credit line, or loan balances and transaction history in one place. This immediate access helps you stay on top of your spending habits and account status effortlessly.

- Bill Payment: Use the app to securely pay bills from merchants and service providers you already use, or even schedule recurring payments to ensure timely payments. This feature integrates seamlessly with online billers, reducing paperwork and payment errors.

- Mobile Check Deposit: Capture images of your checks using your phone’s camera and deposit them instantly without visiting a branch. This function saves significant time for deposits that would otherwise require physical trips to the bank.

- Funds Transfer: Send money securely between your own Credit One Bank accounts or even to friends and family with just a few taps. Quick and easy transfers mean you can allocate funds where you need them faster.

- Alerts & Notifications: Customize your financial alerts for activities like low balance notifications or transaction confirmations to stay informed about your accounts, even when offline. Receiving timely notifications helps prevent overdrafts and keeps you aware of your spending.

- Card Controls: Potentially lock or unlock your credit card directly from your device, depending on account features, offering a crucial security measure if your phone is lost or stolen.

Pros & Cons

Pros:

- Enhanced Convenience and Accessibility: Access your accounts, pay bills, and deposit checks from the palm of your hand.

- Improved Efficiency in Banking Tasks: Faster transfers and payments compared to traditional methods.

- Increased Security Features: Biometric authentication options like Touch ID or Face ID, along with secure data transmission.

- Cost-Effectiveness: Avoids travel costs and time associated with branch visits, and often utilizes existing features without additional fees.

Cons:

- Technical Glitches and App Performance: Users may encounter occasional issues or bugs that temporarily affect functionality.

- Security Concerns Despite Measures: Any mobile banking app carries inherent digital security risks that users should remain vigilant against.

- Feature Limitations Compared to Physical Branches: May lack the comprehensive services and advice available during face-to-face banking interactions.

- Potential Compatibility Issues: Depending on the device or operating system, some features might face usability restrictions.

Similar Apps

| App Name | Highlights |

|---|---|

| Bank of America Mobile App |

Offers comprehensive account management, investing tools, and robust mobile payment features for Bank of America customers. |

| Chase Mobile |

Famous for its mobile check deposit, integrated credit card management, and mobile payment capabilities, popular among Chase users. |

| Wells Fargo App |

Known for providing a wide array of services including loan management, investment tracking, and extensive security options. |

Frequently Asked Questions

Q: What is the most straightforward way to deposit a check using the Credit One Bank Mobile app?

A: The simplest method is using the Mobile Check Deposit feature directly within the app. Just open the relevant section (often found under ‘More’ or ‘Deposit’), capture clear images of both sides of the check, review them, and submit. Your deposit is then typically processed quickly, often within one business day, depending on the amount and your relationship with the bank.

Q: Does Credit One Bank charge any fees for using the Mobile app for transactions like deposits or transfers?

A: Generally, the basic functions included in the Credit One Bank Mobile app, such as account viewing, bill payment setup, and Mobile Check Deposit, are included with your primary checking account and do not incur extra transaction fees. However, standard transfer limits might be in place, and specific deposit processing times could depend on the type of deposit or amount. Always check the app’s fee section for any specific charges.

Q: How do I ensure the security of my information when using the Credit One Bank Mobile app?

A: Security is paramount. The app employs encryption technology to protect your data during transmission. You must use a secure connection (like Wi-Fi or cellular data, though cellular is often more secure than public Wi-Fi). Utilizing biometric security like fingerprint or facial recognition adds another layer. Be cautious with the information you share and report any suspicious activity immediately through the app’s support features.

Q: Can I use the Credit One Bank Mobile app to send money to someone who is not a Credit One Bank customer?

A: Yes, typically, the Funds Transfer feature allows you to send money to friends and family, even if they don’t have an account with Credit One Bank. You usually just need their email address or phone number to initiate the transfer.

Q: Is the Credit One Bank Mobile app available for both iOS and Android devices?

A: Yes, Credit One Bank provides its Mobile app for both iOS (Apple devices) and Android (Google devices), ensuring a wide range of smartphone users can access their accounts conveniently. You can download the appropriate version from the App Store or Google Play Store.

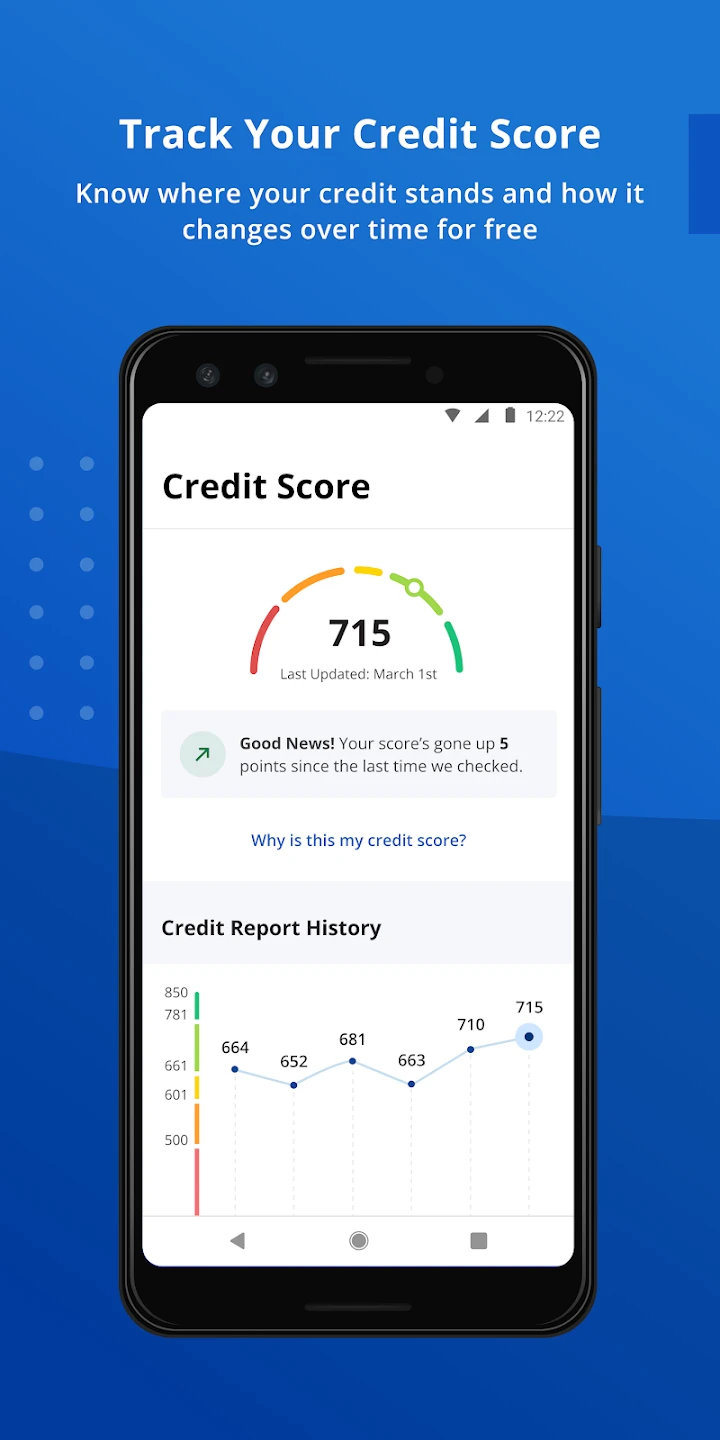

Screenshots

|

|

|

|