| Rating: 4.6 | Downloads: 5,000,000+ |

| Category: Finance | Offer by: Capital One Services, LLC |

CreditWise from Capital One is a complimentary personal finance application designed to help users track their credit health, including credit scores and reports, all within a single platform accessible via mobile or web. It empowers consumers to understand their financial standing by offering insights into their credit behavior and providing tools for monitoring financial activities, making it suitable for anyone seeking greater financial awareness and control.

This tool offers significant value for managing personal finances by delivering timely alerts for potential fraud or suspicious activities, simplifying the process of checking credit score updates from the three major bureaus, and providing easy access to personalized financial wellness tips—all free of charge. It helps users stay informed and proactively manage their creditworthiness.

App Features

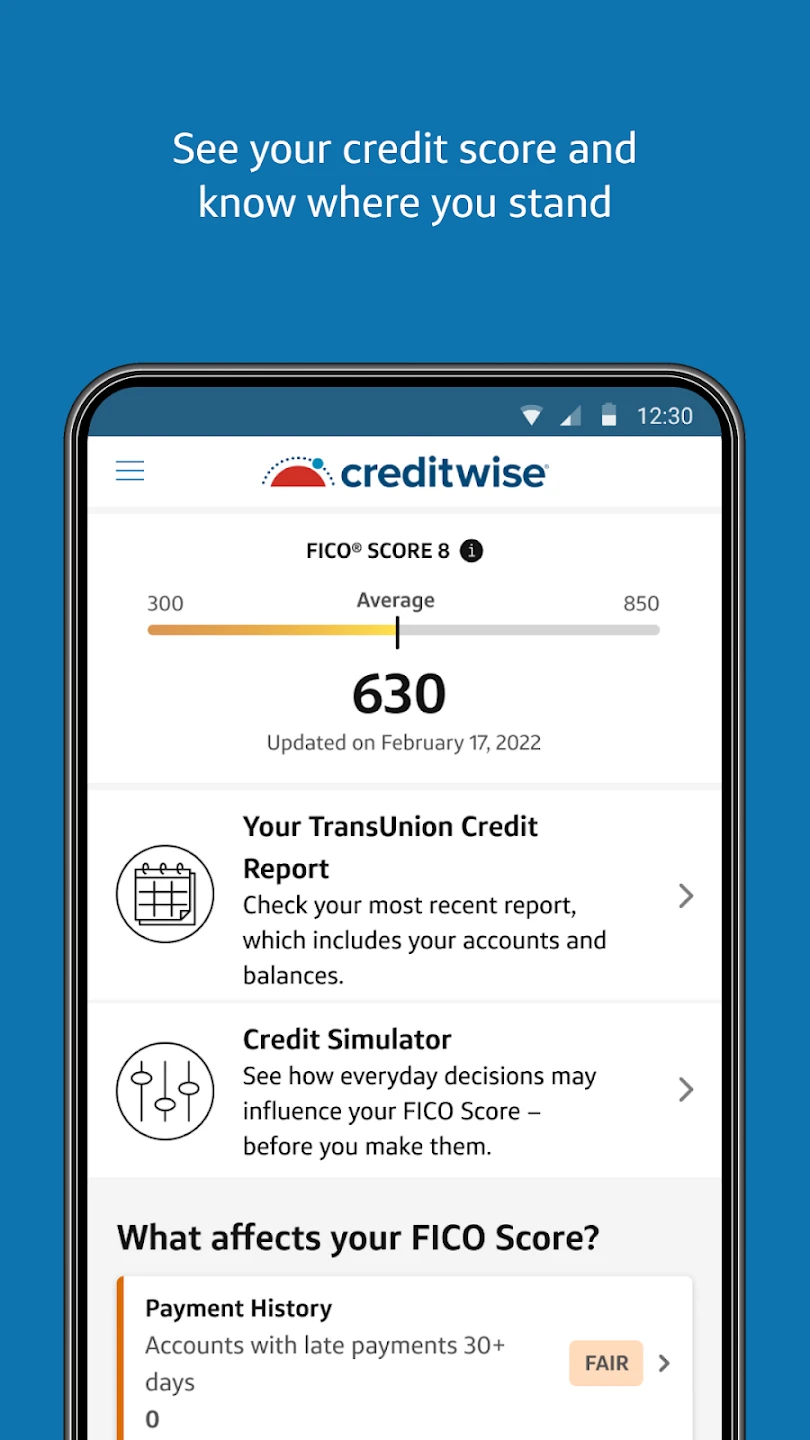

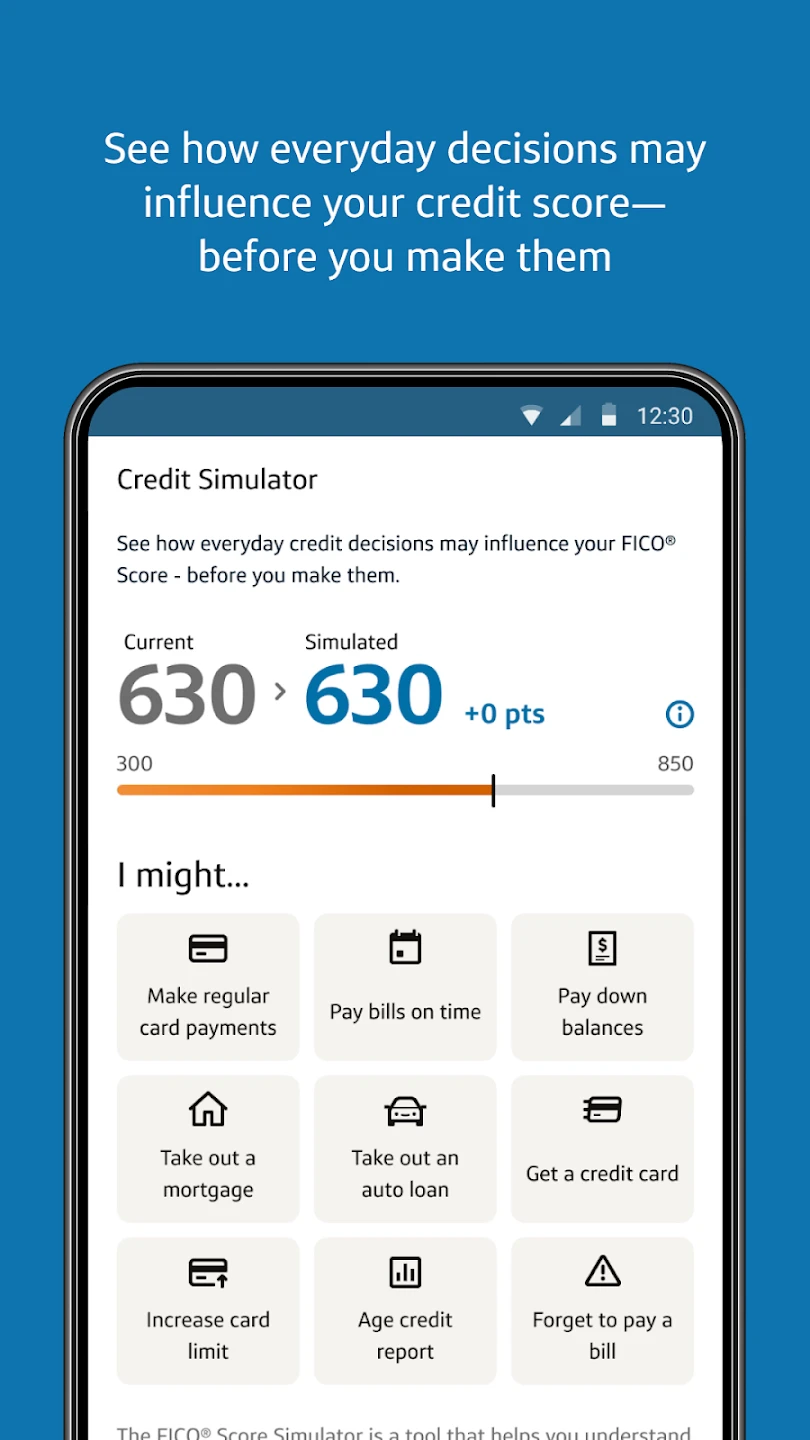

- Free Credit Score Monitoring: Get access to your FICO and VantageScores from all three major credit bureaus, updated regularly, without any cost. This feature empowers users with real-time data to assess their financial standing, helping them understand how factors like payment history impact their score.

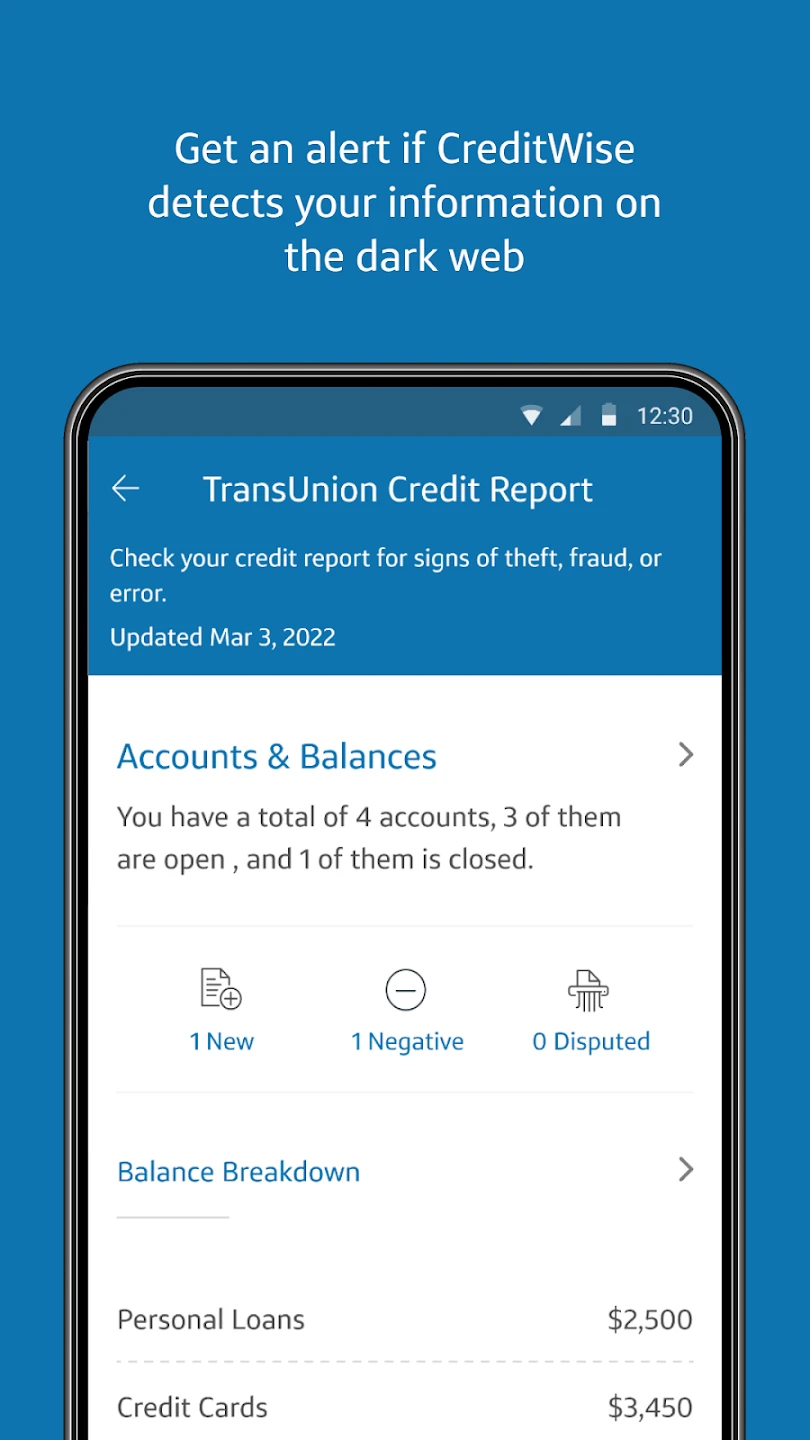

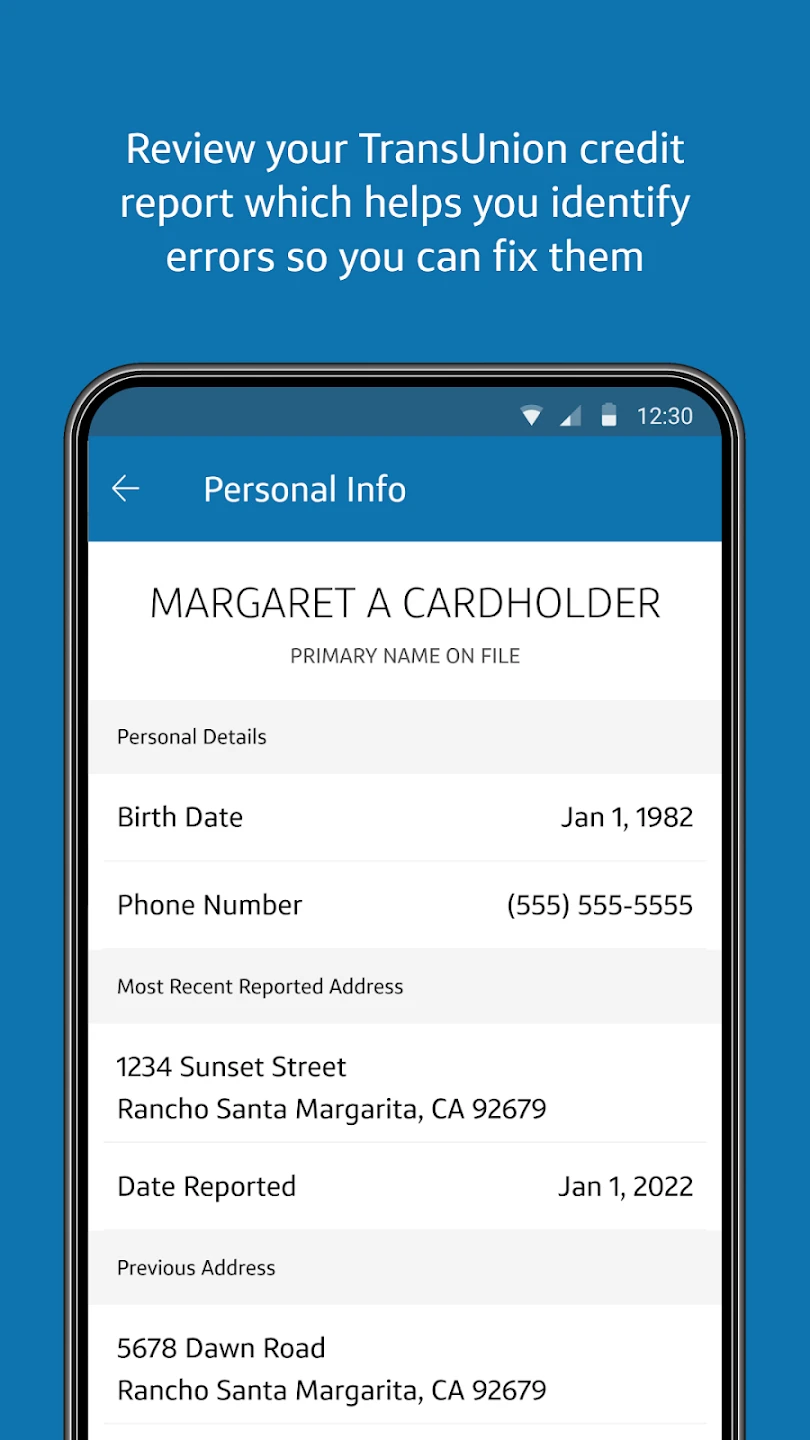

- Credit Report Monitoring: View concise versions of your TransUnion, Experian, and Equifax credit reports. The system flags potential inaccuracies or fraudulent accounts, giving you the tools to address issues swiftly and maintain the integrity of your credit history.

- Financial Alerts and Notifications: Receive immediate notifications for high-risk alerts, suspicious account creation, or significant changes in your score that require attention. This allows for quick action in protecting your identity and finances before problems escalate.

- Budget Tracking and Insights: Create and manage custom budgets aligned with your income and expenses. The system analyzes your spending patterns to suggest improvements and highlight opportunities for cost-cutting, helping you build better financial habits effortlessly.

- Account Linking and Analysis: Connect your Capital One debit and credit cards to the app for comprehensive financial analysis, including transaction categorization and spending trends. This feature provides a complete financial picture by integrating all your accounts for smarter money management.

- Identity Theft Protection: While not replacing traditional services, this feature scans for potential signs of identity theft across your financial data and notifies you of any anomalies. It adds a layer of security by monitoring your digital footprint for suspicious activities.

Pros & Cons

Pros:

- Complimentary credit monitoring tools that include score tracking and report summaries

- Regular fraud alerts that keep users protected from financial threats

- User-friendly interface with intuitive navigation across all major devices

- Budgeting guidance integrated directly into everyday financial habits

- Secure data handling with bank-level encryption and privacy protocols

- Easy account integration with Capital One financial products

Cons:

- Limited report depth compared to full bureau reports available elsewhere

- Occasional system delays in updating score changes or transaction data

- Restricted customization options for budgeting features and alert settings

- Mobile-only limitations affecting web functionality in certain browsers

- Regional service availability varying based on user location data

- No direct investment tracking outside of credit portfolio monitoring

Similar Apps

| App Name | Highlights |

|---|---|

| Experian CreditWorks |

This free service offers similar credit monitoring features with detailed identity theft reports and educational content. Known for comprehensive fraud detection tools and seamless integration with credit card issuances. |

| FreeCredReport |

Designed for simplicity and mobile-first usability. Includes guided steps for checking credit reports and real-time score updates with custom alert triggers for unusual activity. |

| Credit Karma |

Offers free credit score monitoring from two major bureaus and personalized financial advice, with user-friendly visuals. Ideal for quick insights but less robust in fraud monitoring compared to premium options. |

Frequently Asked Questions

Q: Is CreditWise from Capital One completely free to use?

A: Yes, the core credit monitoring, score tracking, and alert features are complimentary. Capital One offers this as a value-add to its banking products, though premium identity theft recovery services may require separate subscription.

Q: How often are my credit scores updated in the app?

A: You receive updates at least once per week from participating bureaus for the standard view, and more frequent updates for Premium users, ensuring timely awareness of any credit behavior changes.

Q: Can I link accounts from other financial institutions using this app?

A: Yes, you can connect external bank accounts and credit cards from various issuers. However, the most detailed analytics are optimized for Capital One-branded products for maximum functionality.

Q: How quickly do I get alerts for potential fraud on my credit report?

A: Alerts are designed to reach you within minutes of detecting high-risk anomalies in your report or unusual account creation attempts, enabling rapid response before significant damage occurs.

Q: Does this app help with budgeting besides tracking spending?

A: Absolutely. The built-in tools not only categorize transactions but also generate custom budget recommendations based on your income, expenses, and savings goals, helping you create and adhere to personalized financial plans.

Screenshots

|

|

|

|