|

|

| Rating: 4.7 | Downloads: 1,000,000+ |

| Category: Finance | Offer by: DailyPay Inc |

Here’s the completed app content for DailyPay On-Demand Pay formatted as requested:

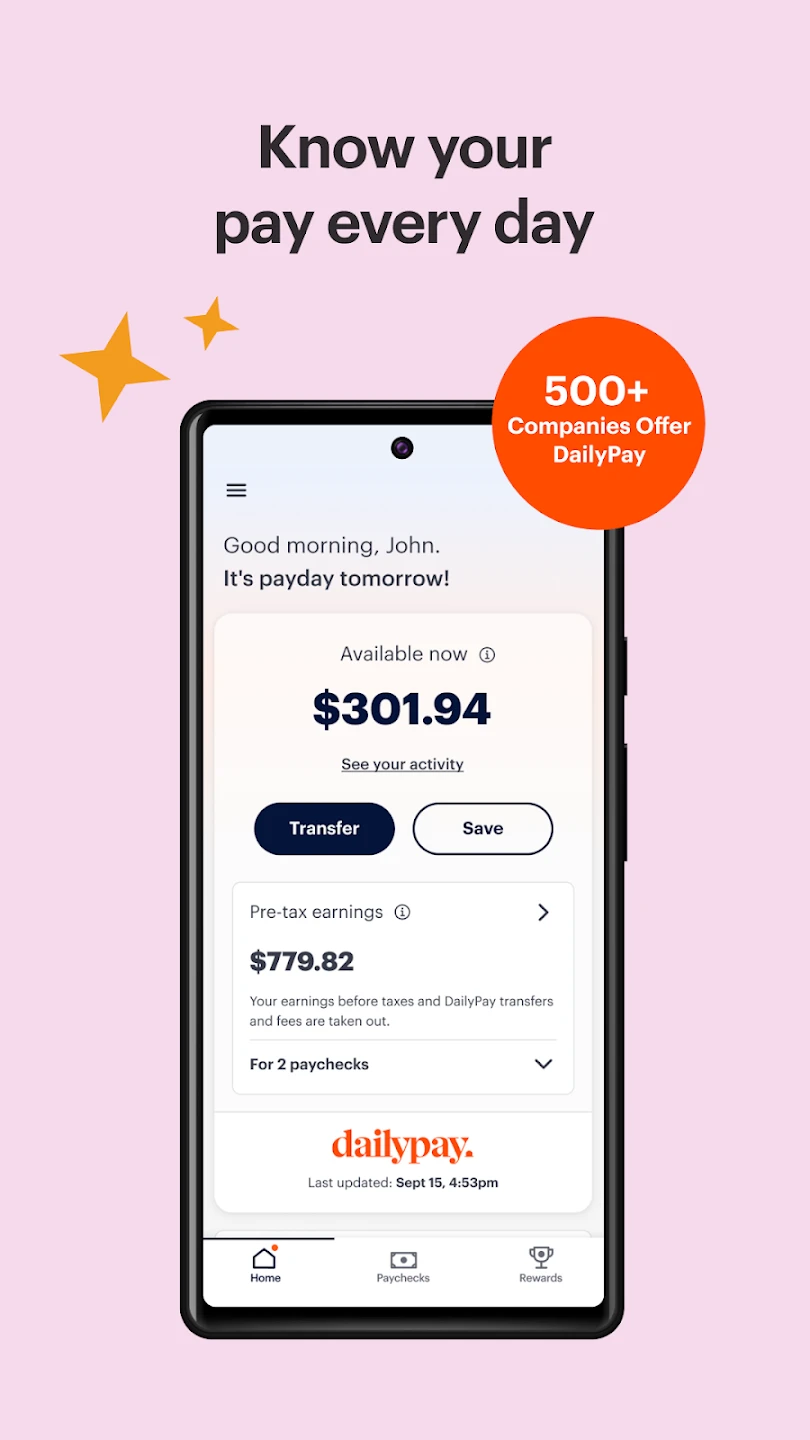

DailyPay On-Demand Pay is a financial app designed to help users access their earned wages immediately, not waiting for traditional pay cycles. It connects directly to payroll systems through secure integration, allowing employees to request partial or full paycheck disbursements at their convenience. This service is ideal for workers in hourly roles, gig economy jobs, or any position needing cash flow flexibility between pay dates.

By eliminating payday delays, DailyPay On-Demand Pay solves immediate financial needs like unexpected expenses or rent payments. Users gain greater budgeting control and can avoid overdraft fees through strategic withdrawals. Its value lies in bridging the gap between earned income and disbursement, giving users peace of mind and financial agility when they need it most.

App Features

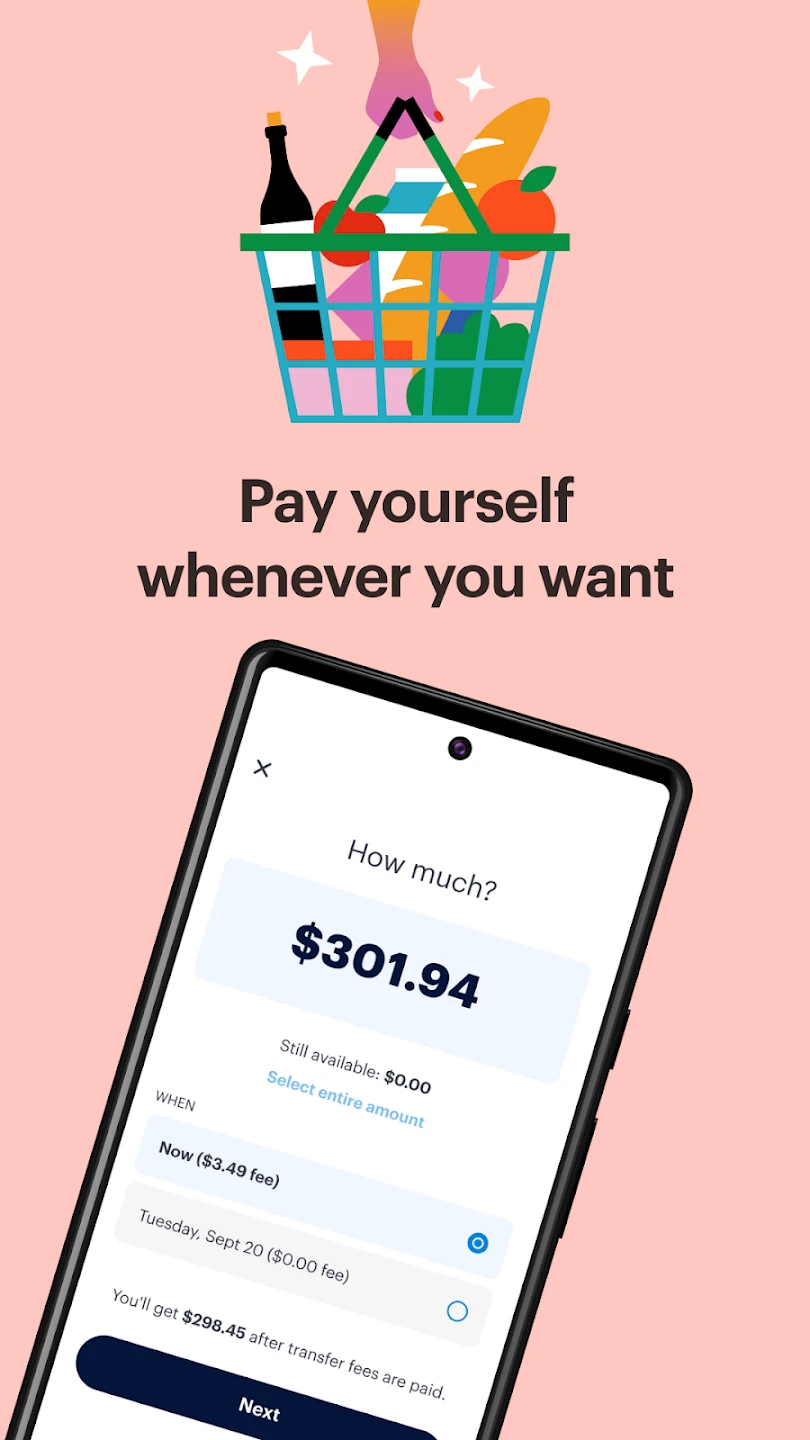

- On-Demand Fund Access: Request partial or full paychecks 24/7 via the intuitive dashboard. This feature benefits users needing immediate funds for groceries or emergencies—no more waiting for scheduled paydays.

- Payroll Integration: Automatically syncs with employer systems using secure APIs like ADP or Gusto. This saves users hours weekly by eliminating manual bank transfers while ensuring accurate disbursements—just one of the app’s time-saving advantages.

- Scheduled Withdrawals: Set automatic withdrawal dates that align with personal financial goals. For example, a user can schedule money release on the first of each month to cover rent without constantly managing cash flow—proactive budgeting becomes effortless.

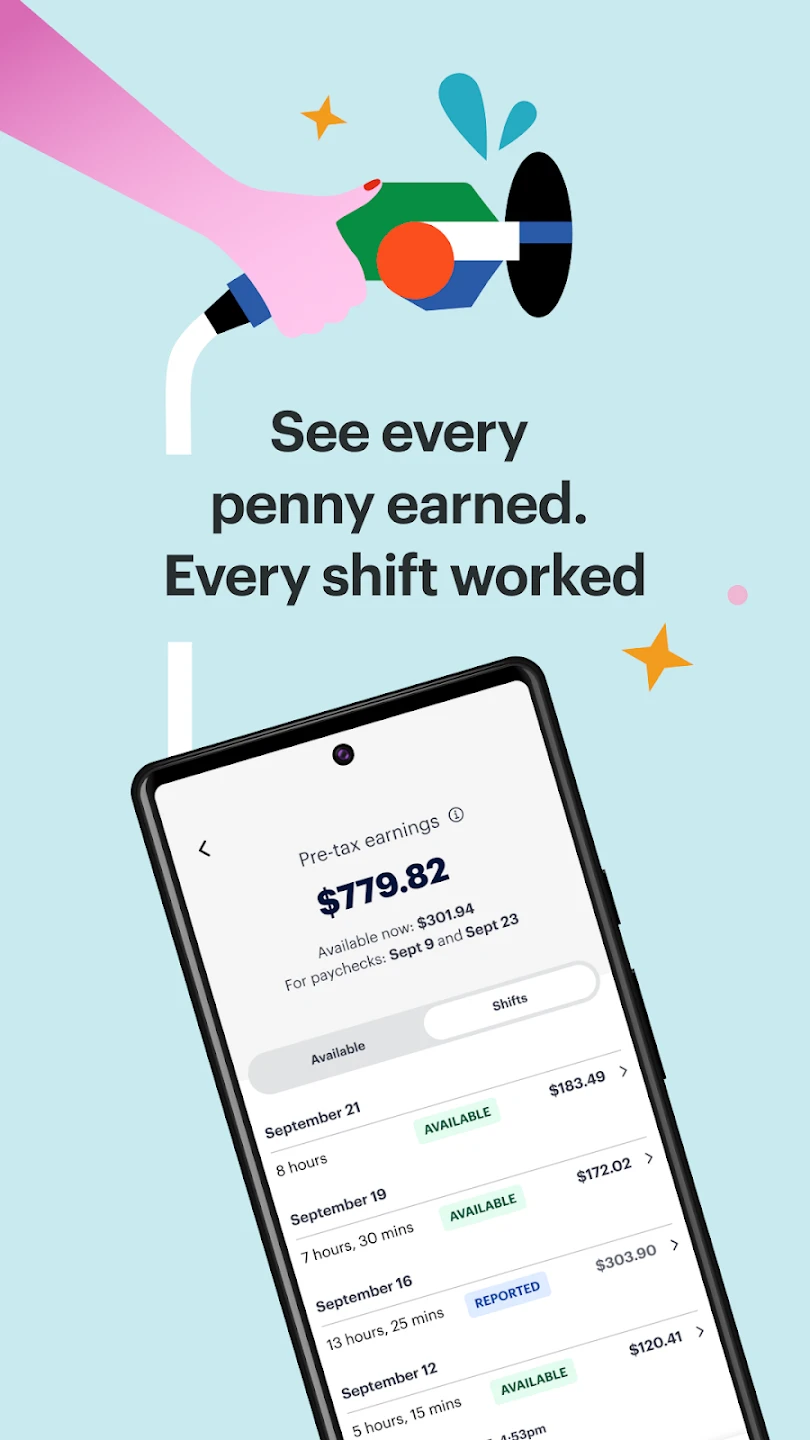

- Mobile Disbursement Tracking: Monitor request status through push notifications and in-app updates. This is especially valuable for gig workers who can receive earnings in real-time after completing deliveries or freelance jobs.

- Financial Wellness Tools: Provides personalized spending insights and cash flow projections. Different users—from hourly workers to remote employees—benefit from seeing how on-demand access affects their budgets across various income scenarios.

- Multi-Account Management: Connect multiple employers and bank accounts within a single dashboard. This advanced feature supports diverse work arrangements like contract-to-hire positions or side hustles, consolidating finances efficiently.

Pros & Cons

Pros:

- Immediate financial flexibility

- Military-friendly disbursement times

- No overdraft protection fees

- Transparent transaction tracking

Cons:

- Employer eligibility restrictions

- Limited fee transparency for large withdrawals

- Payroll integration delays with some systems

- No interest earned on held funds

Similar Apps

| App Name | Highlights |

|---|---|

| Salary Forward |

Direct deposit scheduling with employer partnership program and wage transparency features for hourly workers. |

| PayActiv |

Offers federal disaster relief access during emergencies plus hourly wage tracking tools for public sector employees. |

| WageAdvance |

Known for retail payroll integrations and cashback incentives through strategic fund requests. |

Frequently Asked Questions

Q: How quickly can I access my wages after requesting a disbursement?

A: Funds are typically available within minutes of approval—often within 1 business hour for same-day requests—though processing depends on your employer’s payroll system integration (DailyPay handles the disbursement part once approved).

Q: Is there a minimum request amount for using the service?

A: Yes, most employers set a minimum threshold (usually $50-$100) to cover system processing costs—this varies by employer but is typically well below a full paycheck amount.

Q: Can I use DailyPay if my employer doesn’t offer direct deposit?

A: Absolutely—DailyPay connects directly to standard payroll systems like ADP or Gusto, but if your employer uses a less common system, you’ll need to provide bank account details for electronic transfer—contact support for alternative disbursement methods.

Q: What happens to my funds if I don’t use them within the cycle?

A: Unrequested funds automatically return to your designated account after the pay cycle closes—your money never sits idle or incurs holding fees in our system (scheduled withdrawals prevent this scenario).

Q: Are there any upfront fees for setting up my account?

A: No—DailyPay operates on a transparent “transaction-based” model where fees (typically 1-3% of the withdrawal) appear directly on your employer’s final paycheck, making the service completely free to initiate.

Screenshots

|

|

|

|