|

|

| Rating: 3.7 | Downloads: 500,000+ |

| Category: Finance | Offer by: National General Insurance |

The Direct Auto Insurance app provides a convenient digital platform for managing auto insurance policies. Users can view coverage details, handle billing, file claims on-the-go, and access customer support through a streamlined mobile interface. It’s designed for anyone needing straightforward vehicle protection, from new drivers to experienced motorists seeking reliable coverage.

This app offers practical solutions for everyday auto insurance needs, allowing users to save time and reduce administrative tasks. With features like instant claim reporting and personalized recommendations, Direct Auto Insurance makes handling insurance matters more efficient and less stressful for busy individuals.

App Features

- Instant Quotes: Generate multiple insurance quotes comparing coverage limits, deductibles, and rates in seconds. This helps users quickly find the perfect coverage match for their budget and needs, saving hours of manual comparison.

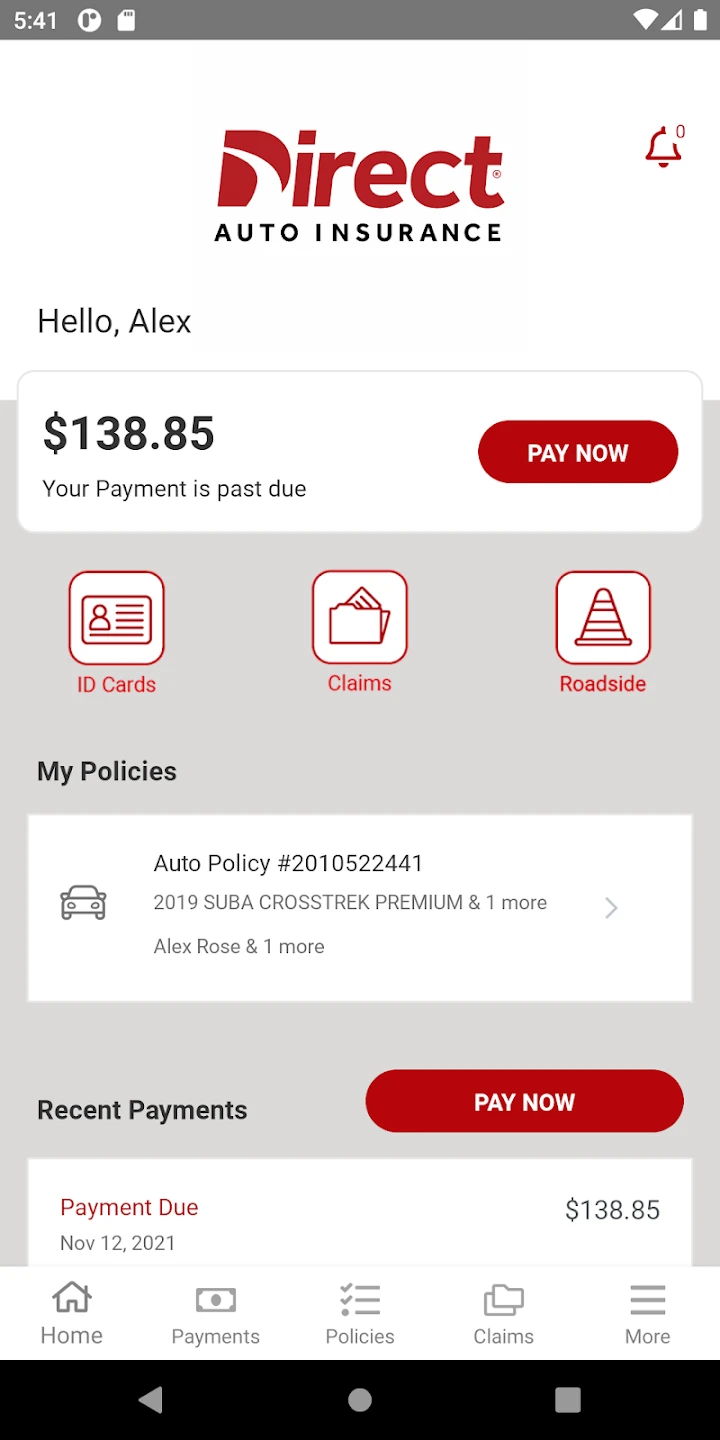

- Policy Management Dashboard: Access and manage all policy details including coverage periods, vehicle information, and renewal dates through an intuitive interface. Real-time updates sync across all devices, ensuring users always have accurate information at their fingertips.

- Claims Filing Simplification: Document vehicle damage by taking photos, filling out claim details through guided prompts, and uploading supporting evidence with just a few taps. This feature expedites the claims process and provides peace of mind during unfortunate incidents.

- Smart Recommendations Engine: Receive personalized coverage adjustments based on driving patterns, location data, and historical claims. The system automatically suggests relevant discounts and coverage upgrades during renewal periods, maximizing savings potential.

- Multi-Device Synchronization: Seamlessly access policy information, transaction history, and claim status updates across smartphones, tablets, and computers. Cloud-based storage ensures all critical documents are securely available whenever needed.

- Customer Support Portal: Connect with insurance agents and claims adjusters via in-app messaging with real-time response guarantees. The system tracks interaction history for personalized assistance, making complex issues easier to resolve.

Pros & Cons

Pros:

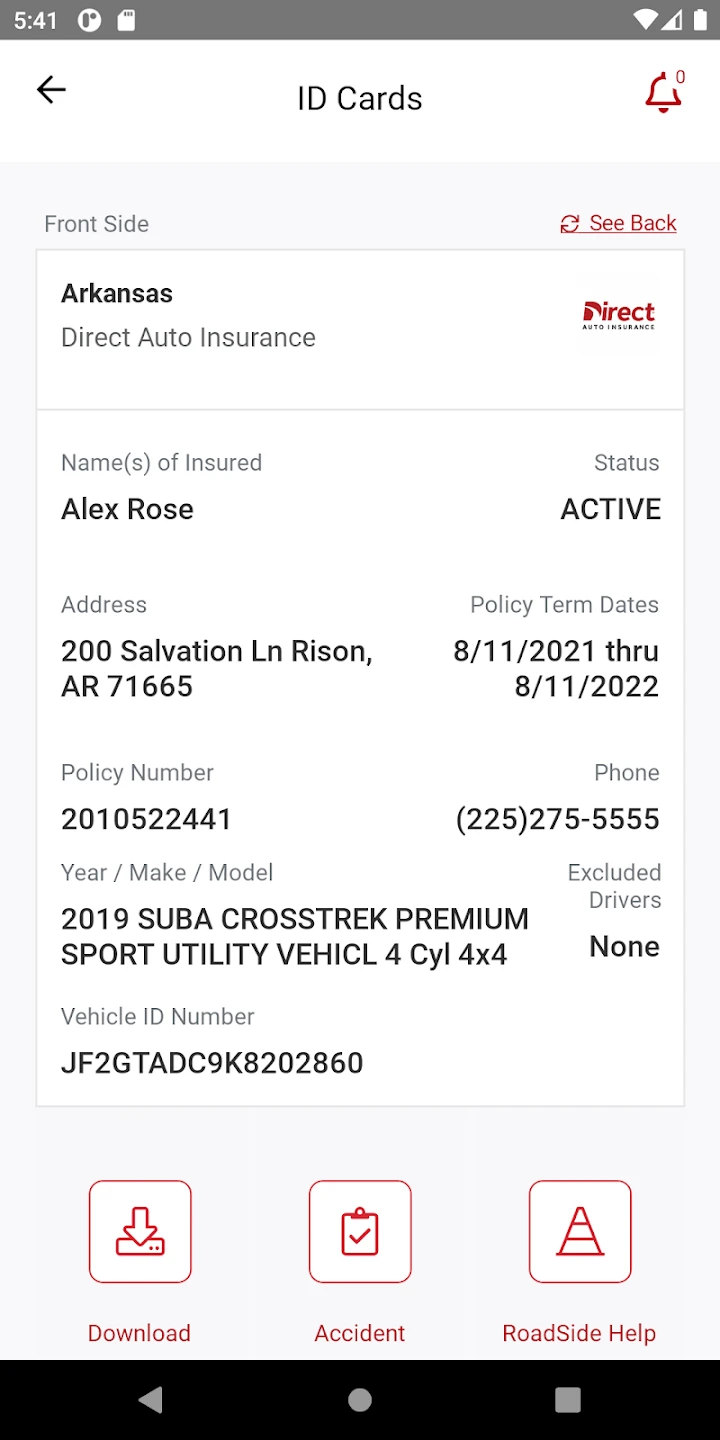

- Comprehensive digital policy management eliminates need for paper documents

- 24/7 access to claim history accelerates resolution processes

- Intelligent savings recommendations maximize policy value

- Seamless mobile experience for everyday insurance tasks

Cons:

- Initial setup requires extensive documentation submission

- Limited in-person agent interaction options

- Some features require subscription fees for premium services

- Potentially complex interface for novice users

Similar Apps

| App Name | Highlights |

|---|---|

| RapidQuote Auto |

Known for extreme speed ratings and detailed comparison tools. Features a unique visual rating system showing insurer performance metrics. |

| AutoCover Connect |

Specializes in telematics integration and usage-based insurance. Includes a driving score dashboard tracking mileage and safe driving habits. |

| ShieldDrive Mobile |

Offers robust roadside assistance integration and emergency protocols. Includes step-by-step guidance for common roadside issues. |

Frequently Asked Questions

Q: How quickly can I receive insurance quotes through Direct Auto Insurance?

A: You’ll typically see initial quote estimates in seconds, with detailed analysis available within 15 minutes of completing the information form. Most standard policies are quoted within an hour during business hours.

Q: What types of vehicles are eligible for coverage through this app?

A: The Direct Auto Insurance platform supports coverage for most passenger vehicles manufactured in the last 30 years, including cars, trucks, motorcycles, RVs, and classic vehicles. Specialty coverage is available through the app for collector cars and commercial vehicles.

Q: Can I file a claim remotely if my car is stolen?

A: Absolutely! The app features a dedicated theft claim module with step-by-step guidance. You can submit evidence remotely while law enforcement handles the recovery process. Direct Auto Insurance has a 24/7 emergency contact system for stolen vehicle claims.

Q: What happens if I accidentally drop my deductible amount?

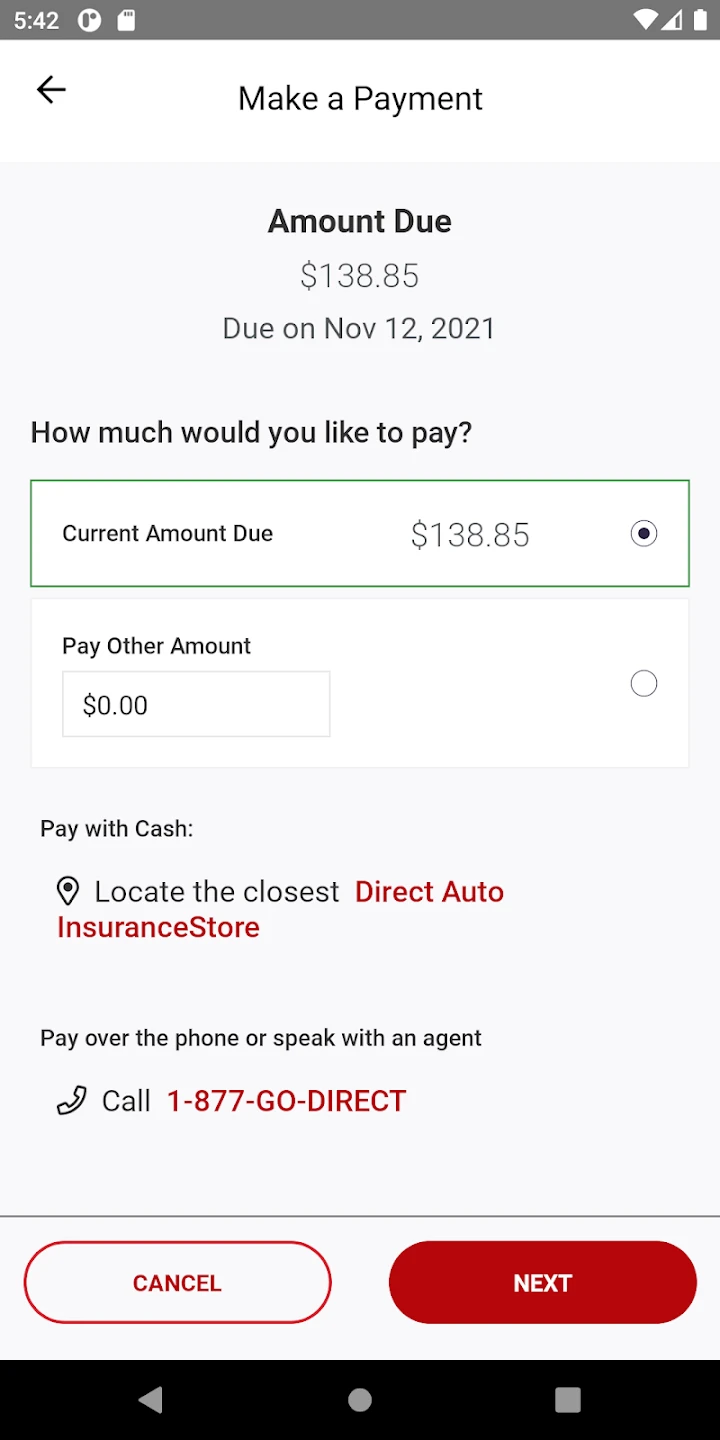

A: Dropping your deductible will typically increase your monthly premium by 10-20%, depending on your location and driving history. Remember that lower deductibles mean higher premiums, and vice versa. You’ll always see the exact cost changes before finalizing any adjustments.

Q: How secure is my personal information in the app?

A: Direct Auto Insurance utilizes bank-level 256-bit encryption for all data transmissions. The app employs multi-factor authentication and continuous monitoring for potential threats. All user information is stored in secure, offsite data centers with regular penetration testing.

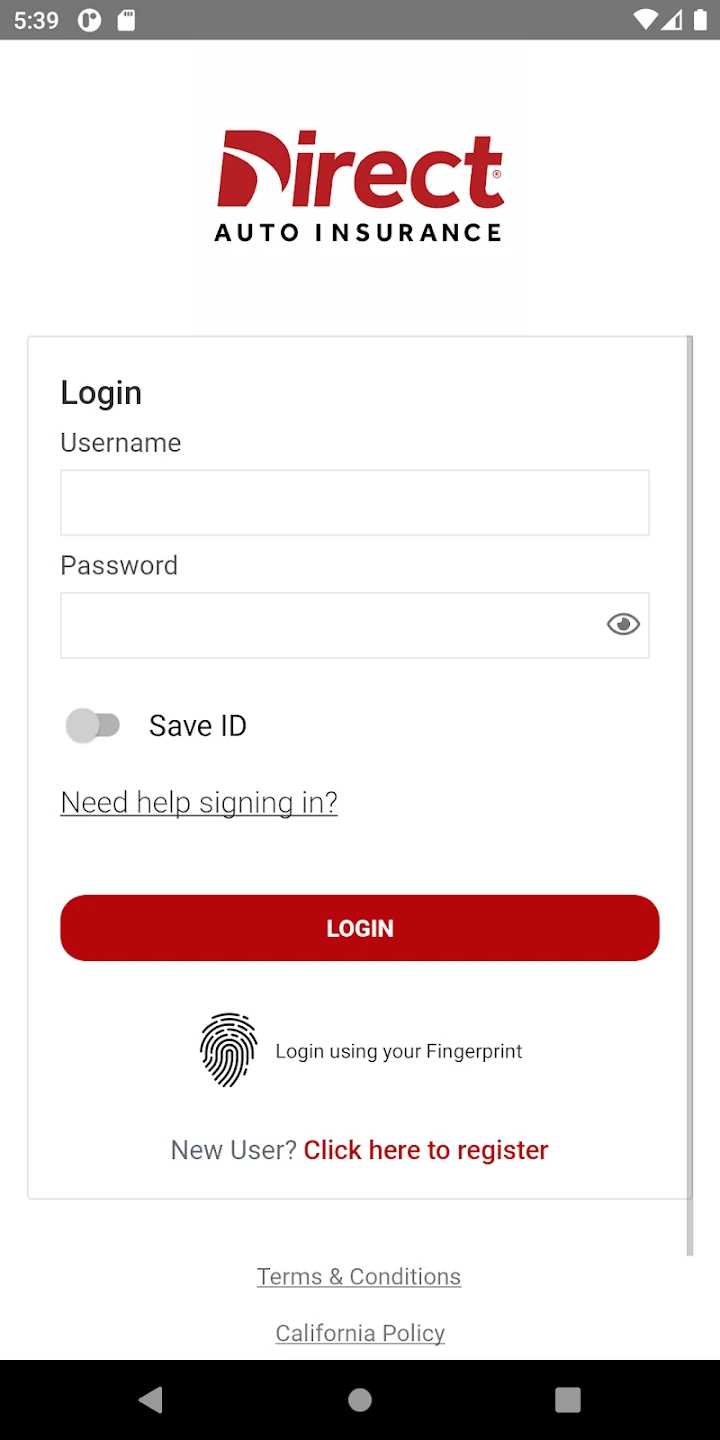

Screenshots

|

|

|

|