|

|

| Rating: 4.7 | Downloads: 5,000,000+ |

| Category: Finance | Offer by: Activehours Inc. |

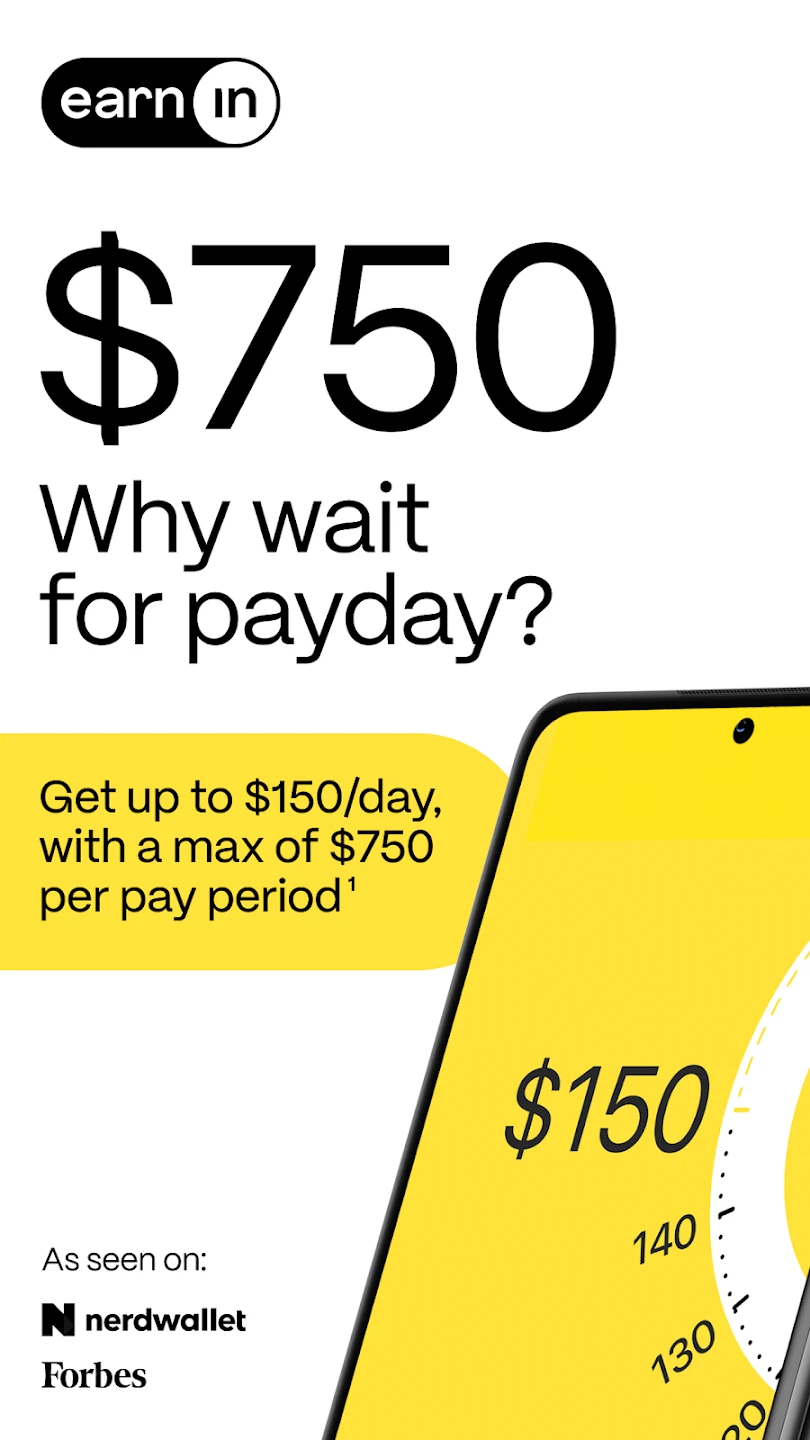

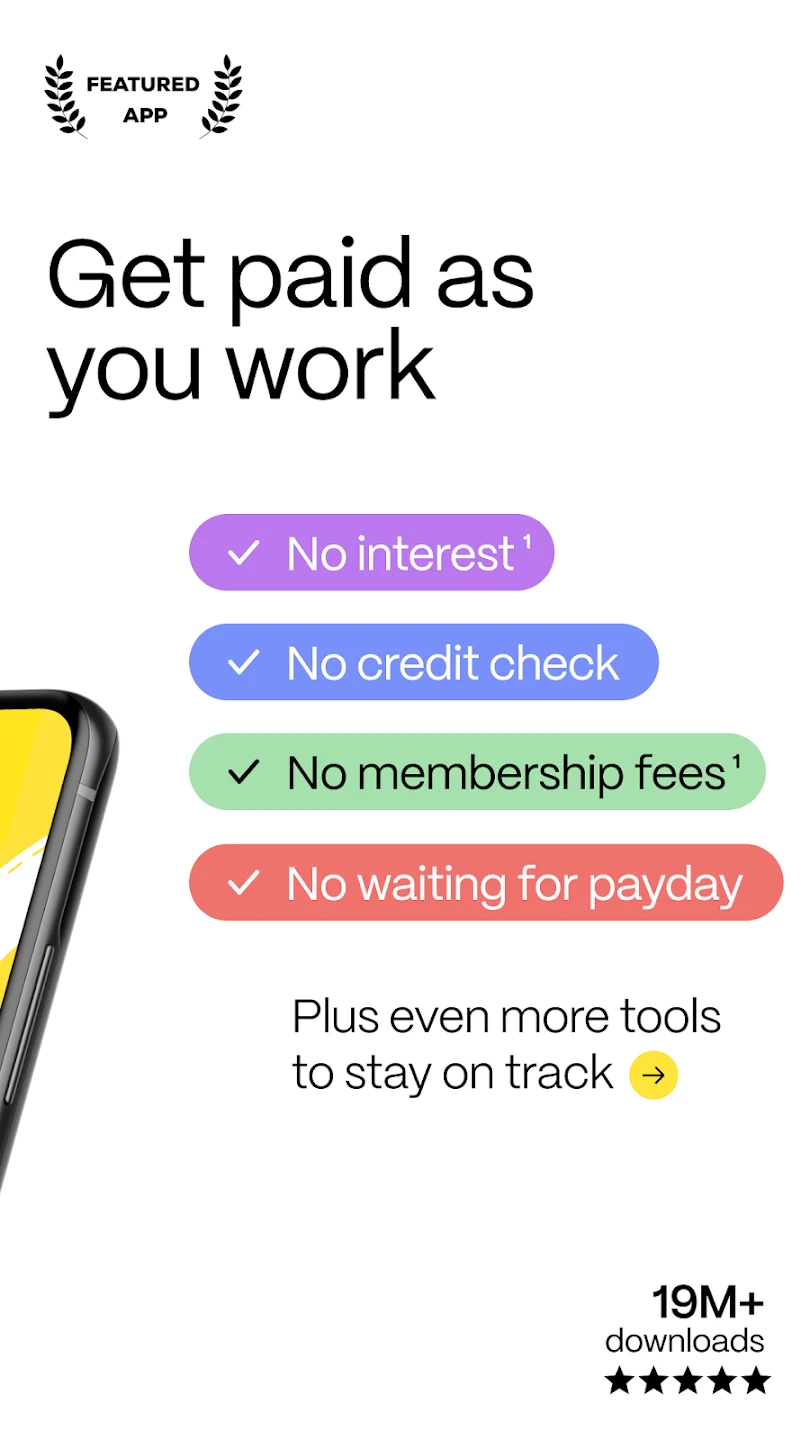

EarnIn: Why Wait for Payday? is a digital financial application designed specifically for individuals seeking quick access to cash between paychecks. It connects users with partner lenders to facilitate advance payday loans based on their verified income and employment details, offering funds within hours or the next business day. This app is primarily for hourly workers, freelancers, or anyone facing unexpected expenses while waiting on their regular paycheck.

The key value of EarnIn lies in its ability to bridge the gap created by waiting too long for payday. Instead of relying on high-interest credit cards or loans, users get a regulated payday advance tailored to their income, providing much-needed funds faster. It helps users manage unexpected costs, avoid bounced checks, or cover essential needs until their next salary arrives, making financial life smoother and less stressful.

App Features

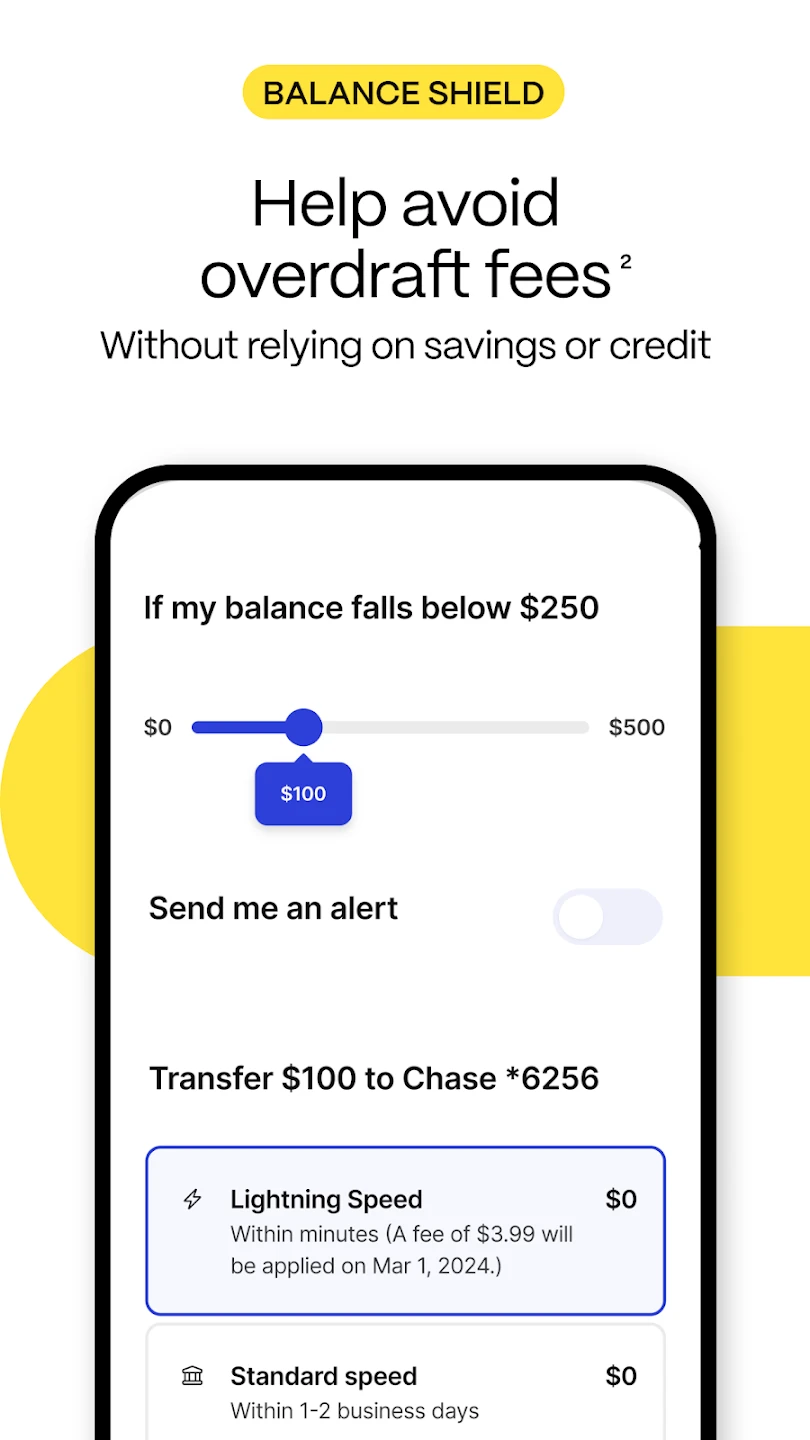

- Fund Transfer via ACH: This core feature allows approved funds to be deposited directly into the user’s bank account, often within 24 hours. It eliminates the need for physical checks or visiting physical lenders, making the entire process quick and convenient from your phone or computer.

- Income Verification: The app securely connects your bank account information to verify your income source and amount directly from your payroll provider. This automated verification speeds up the approval process and minimizes errors or delays associated with manual documentation, ensuring you receive your advance promptly.

- Eligibility Assessment Tool: Before applying, the app provides a preliminary estimate of your eligibility based on your reported income and state lending parameters. This feature empowers users to understand their options upfront, saving time and helping them determine if EarnIn: Why Wait for Payday? can meet their short-term funding needs.

- Funding Status Tracking: Users have real-time updates on their application from submission, to review, to funding decision and completion. This transparency is key, allowing users to easily track progress and know exactly where their application stands, reducing uncertainty during the wait for payday.

- Loan Repayment Options: This feature outlines the terms and repayment schedule clearly, usually due on the borrower’s next payday. Having a fixed repayment date integrated helps manage finances better, preventing late fees and ensuring the loan doesn’t negatively impact future access to funds, providing clarity for responsible borrowing.

- Customer Support Portal: While primarily self-serve, the app provides quick access channels like chat or FAQs to resolve simple issues. This integrated support minimizes wait times for common questions, enhancing user confidence in the service.

Pros & Cons

Pros:

- Speed of Funding

- Wide Accessibility

- Simple Application Process

- Better Interest Rates Than Alternatives

Cons:

- Potential for High-Interest Costs

- Requires Stable Income Source

- Repayment Due Date Can Be Challenging

- Eligibility Varies by State/Lender

Similar Apps

| App Name | Highlights |

|---|---|

| Payday Express |

Known for fast approvals and diverse lender options. Often includes features like overdraft protection for bank accounts. |

| LoanMeFast |

Focuses on user reviews and transparent fee disclosure. Emphasizes quick mobile application design for ease. |

| QuickCash Direct |

Offers online account management and automated payment reminders for upcoming loan due dates. |

Frequently Asked Questions

Q: How quickly can I get money after submitting an application?

A: Often within 24 hours, but it can sometimes take 1-3 business days depending on your state and the lender’s processing time. Approval is typically faster than the final funding.

Q: Is EarnIn: Why Wait for Payday? only available to certain states?

A: Yes, the app operates with partner lenders who are licensed differently across states. You’ll only be eligible to borrow money in states where EarnIn has a lending partner. The app usually shows this during the verification stage.

Q: Can I have multiple payday loans outstanding simultaneously?

A: Laws vary significantly by state, and reputable lenders typically limit borrowers to one active loan at a time. It’s generally best practice to avoid multiple loans as they can become difficult to manage and increase your costs.

Q: How is my sensitive financial information kept safe?

A: The app uses bank-level security protocols and adheres to GDPR and CCPA compliance standards where applicable for data privacy and secure transmission.

Q: What happens if I repay my loan early?

A: Early repayment is usually possible without penalty. You may still be subject to the original interest cost prorated over the agreed term, but you’ll save on finance charges compared to letting the loan roll over.

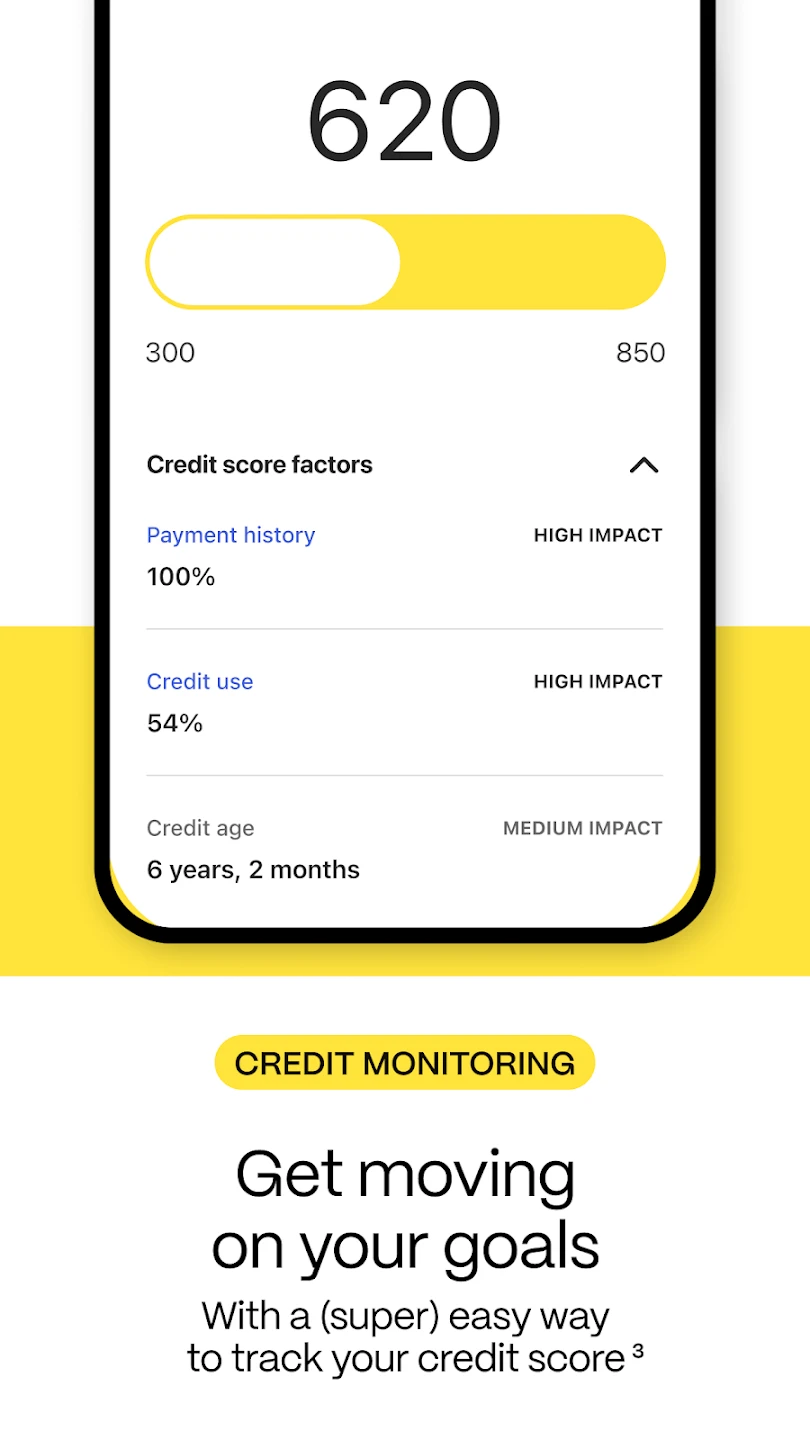

Screenshots

|

|

|

|