|

|

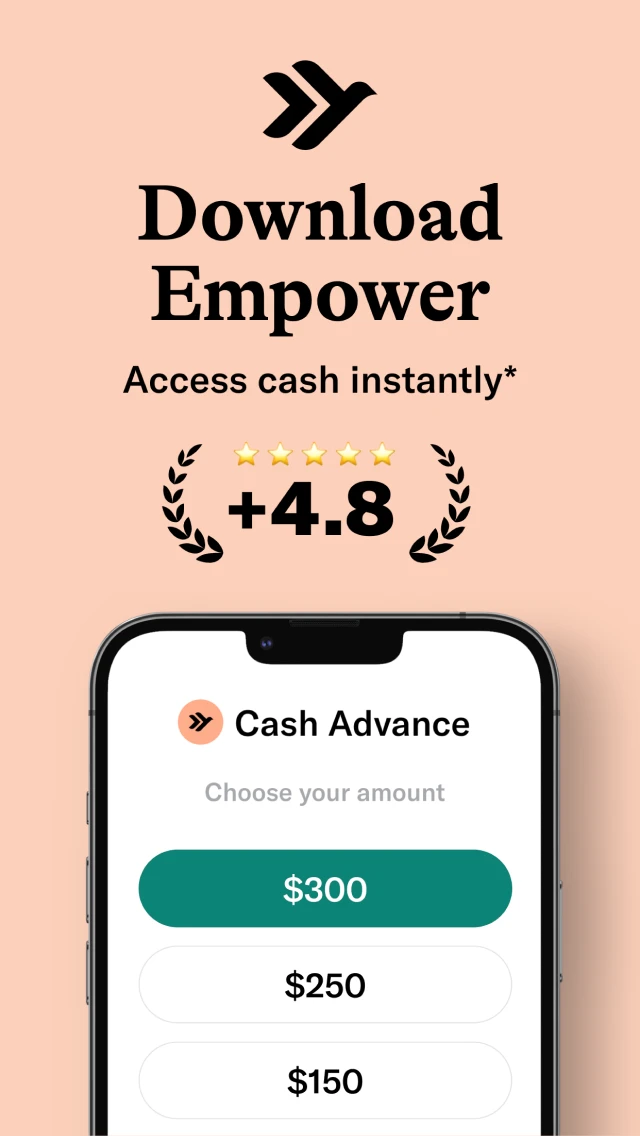

| Rating: 4.7 | Downloads: 5,000,000+ |

| Category: Finance | Offer by: Empower Finance |

Empower: Advance & Credit is a financial management application designed to help users navigate and utilize credit options more effectively. It offers tools for credit limit management, responsible borrowing, and tracking spending associated with credit accounts. This app caters primarily to individuals seeking better cash flow, those looking to build or rebuild their credit history, and anyone wanting greater control over their financial transactions using credit.

The key value proposition of Empower: Advance & Credit lies in its ability to provide accessible credit solutions and empowering users with insights and tools for better financial decision-making. Its practical usage involves setting spending limits, understanding credit utilization ratios, and accessing credit lines for specific needs like bill payments or short-term advances, ultimately aiming for improved financial well-being and credit health.

App Features

- Create & Manage Accounts: Easily set up your profile and link eligible credit cards or accounts directly within the app. This foundational step streamlines access to credit features and ensures your financial activities are tracked according to your preferences, saving you time and effort right from the start.

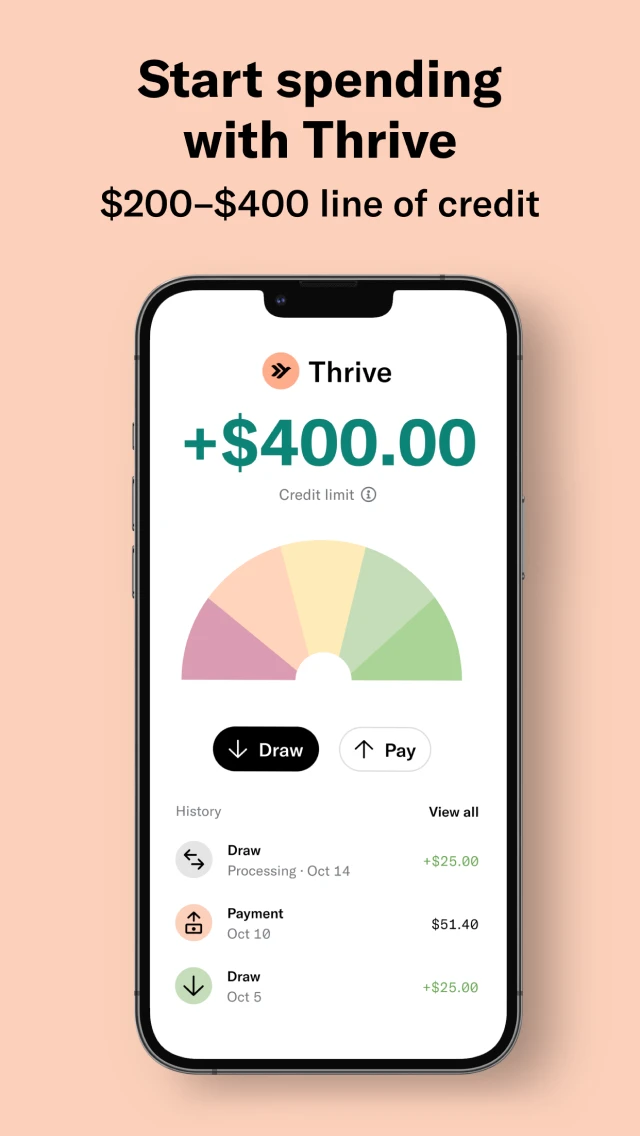

- Credit Limit Management: Adjust your spending limit for your credit line or account based on your current financial situation and needs. The interface provides a visual representation of your available credit, helping you avoid overspending and use credit more responsibly for everyday expenses or planned purchases.

- Spending Tracking & Insights: Monitor all transactions linked to your credit accounts, including spending habits and balances. Empower: Advance & Credit offers summaries highlighting your utilization rate and potential impact on your credit score, helping you identify areas for improvement and make informed decisions.

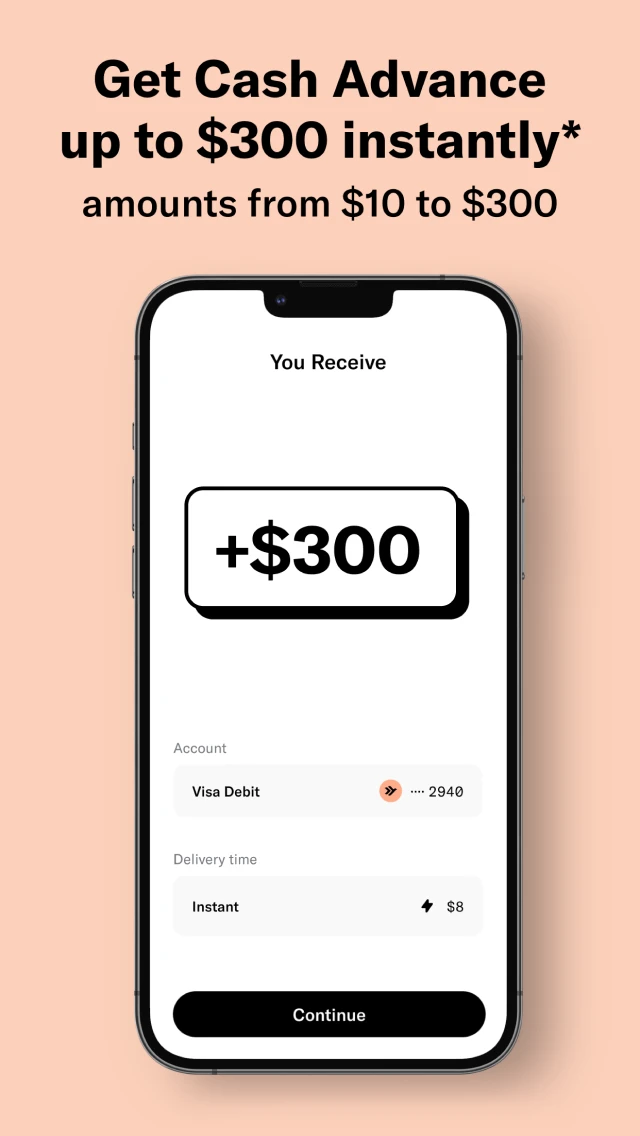

- Instant Credit & Advance Requests: Apply for additional credit or an advance on your available limit quickly and securely through the app. The streamlined process provides status updates, allowing you to access funds rapidly during emergencies or for approved expenditures without needing to contact customer service immediately.

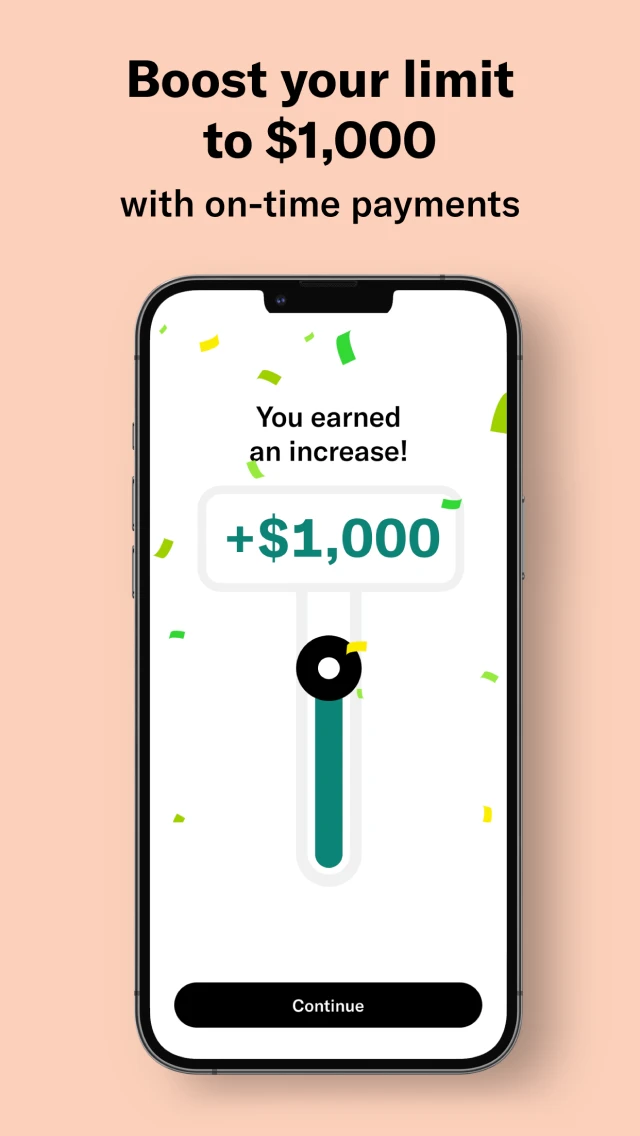

- Alerts & Notifications: Customize alerts for important account events, such as low credit limit, suspicious activity, upcoming billing cycles, or offers for credit limit increases. This proactive approach keeps you informed and in control of your financial health, enhancing security and awareness.

- User Account Security & Settings: Control your security with features like secure login, transaction confirmations, and the ability to set spending restrictions. Empower: Advance & Credit prioritizes data privacy, allowing users to manage their preferences and ensure their financial information is handled safely according to their comfort level.

Pros & Cons

Pros:

- Simple & Intuitive Interface

- Direct Account Management

- Clear Spending Insights

- Streamlined Request Process

Cons:

- Dependence on Credit Score

- Potential for Debt if Misused

- Eligibility Requirements May Apply

- Billing Cycles and Fees

Similar Apps

| App Name | Highlights |

|---|---|

| Cash Boost Plus |

This app offers fast processing, intuitive design, and wide compatibility. Known for custom workflows and multi-language support. |

| Finance Forward |

Designed for simplicity and mobile-first usability. Includes guided steps and real-time previews. |

| Credit Navigator |

Offers AI-powered automation, advanced export options, and collaboration tools ideal for teams. |

Frequently Asked Questions

Q: How do I set up my account in Empower: Advance & Credit?

A: Setting up is straightforward. Launch the app, enter your details during the initial signup process, and link your eligible credit card if prompted. You’ll typically confirm your identity, set your security preferences, and you’re ready to manage your credit features.

Q: How does requesting an advance work, and does it affect my credit score?

A: You can request an advance directly through the app interface, specifying the amount you need. Using the app’s feature to manage your credit line is primarily focused on your usage within that line; it generally does not impact your credit score directly, unlike traditional loan applications.

Q: Can I track my spending across multiple credit cards using Empower: Advance & Credit?

A: Yes, Empower: Advance & Credit typically allows linking multiple eligible credit accounts. You can view consolidated spending summaries, compare balances, and monitor transactions across all linked cards from within the app’s dashboard.

Q: What is the typical approval time for a credit limit increase request within the app?

A: Request times vary based on factors like your credit history and the requested increase. Simple requests might be processed instantly via the app, while others could take a few hours or up to 24 business hours for manual review. You’ll receive an update notification through the app.

Q: Is there a cost associated with using basic features of Empower: Advance & Credit?

A: Basic account management, spending tracking, and viewing of your credit line details are usually free. However, services like instant advances, credit limit increases, or specific premium features might come with associated fees, which are clearly disclosed within the app before you proceed.

Screenshots

|

|

|

|