|

|

| Rating: 4.7 | Downloads: 10,000,000+ |

| Category: Finance | Offer by: Experian |

The Experian mobile app provides users with access to their credit report and credit score information, helping them manage their financial health on the go. It offers tools for monitoring identity theft alerts, tracking personal financial information, and managing disputes directly from their smartphone. This digital platform is primarily designed for individuals concerned with their creditworthiness and financial safety, serving as a convenient companion to the core Experian credit reporting services.

Experian’s app is valuable for anyone looking to understand their financial standing, potentially secure better loan terms, or protect themselves from fraudulent activity without needing to visit websites or physical offices. Its practical usage includes checking score updates, reviewing recent credit inquiries, and accessing personalized financial insights anytime, empowering users to make more informed decisions about their money and personal finances effectively.

App Features

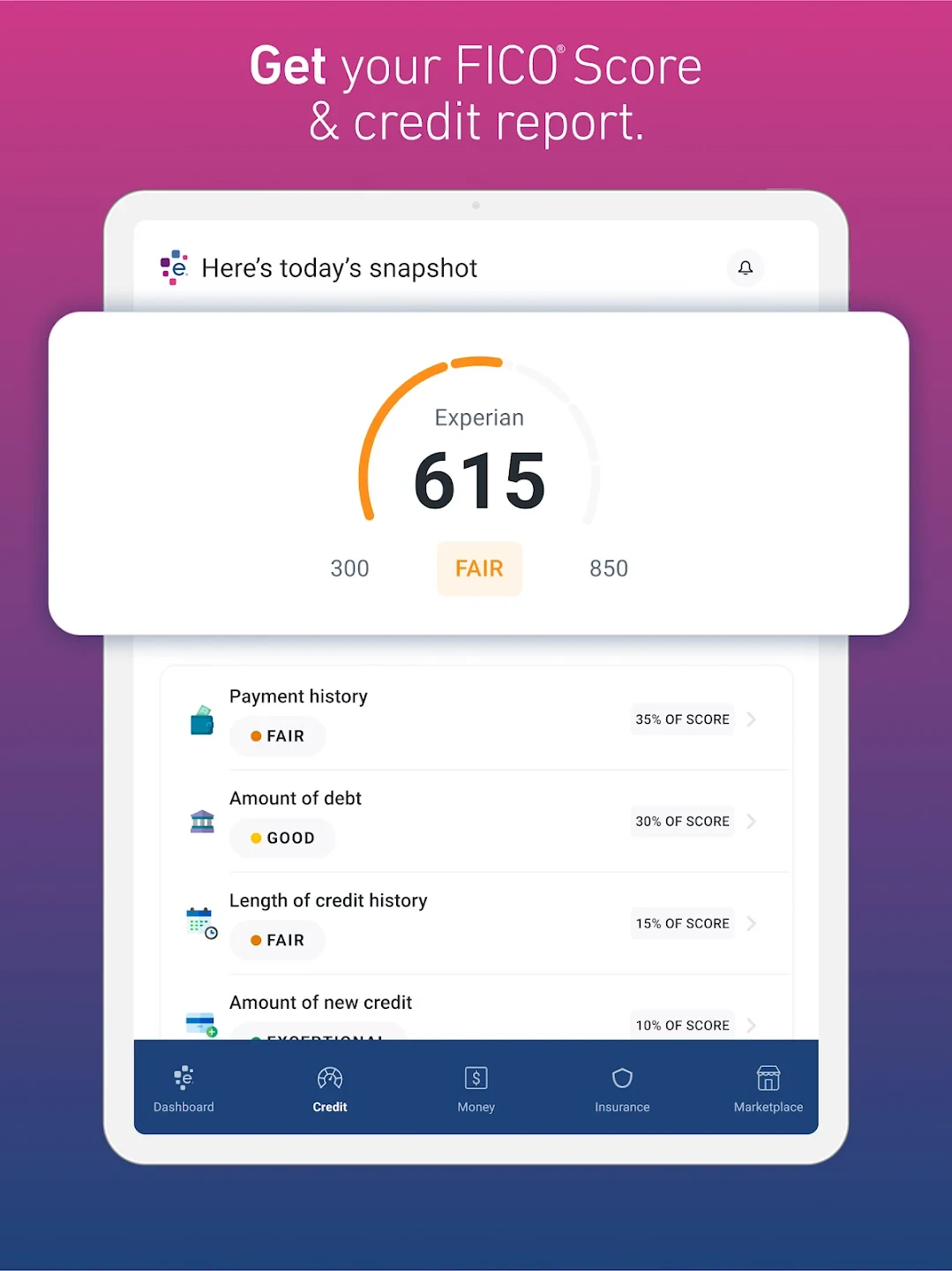

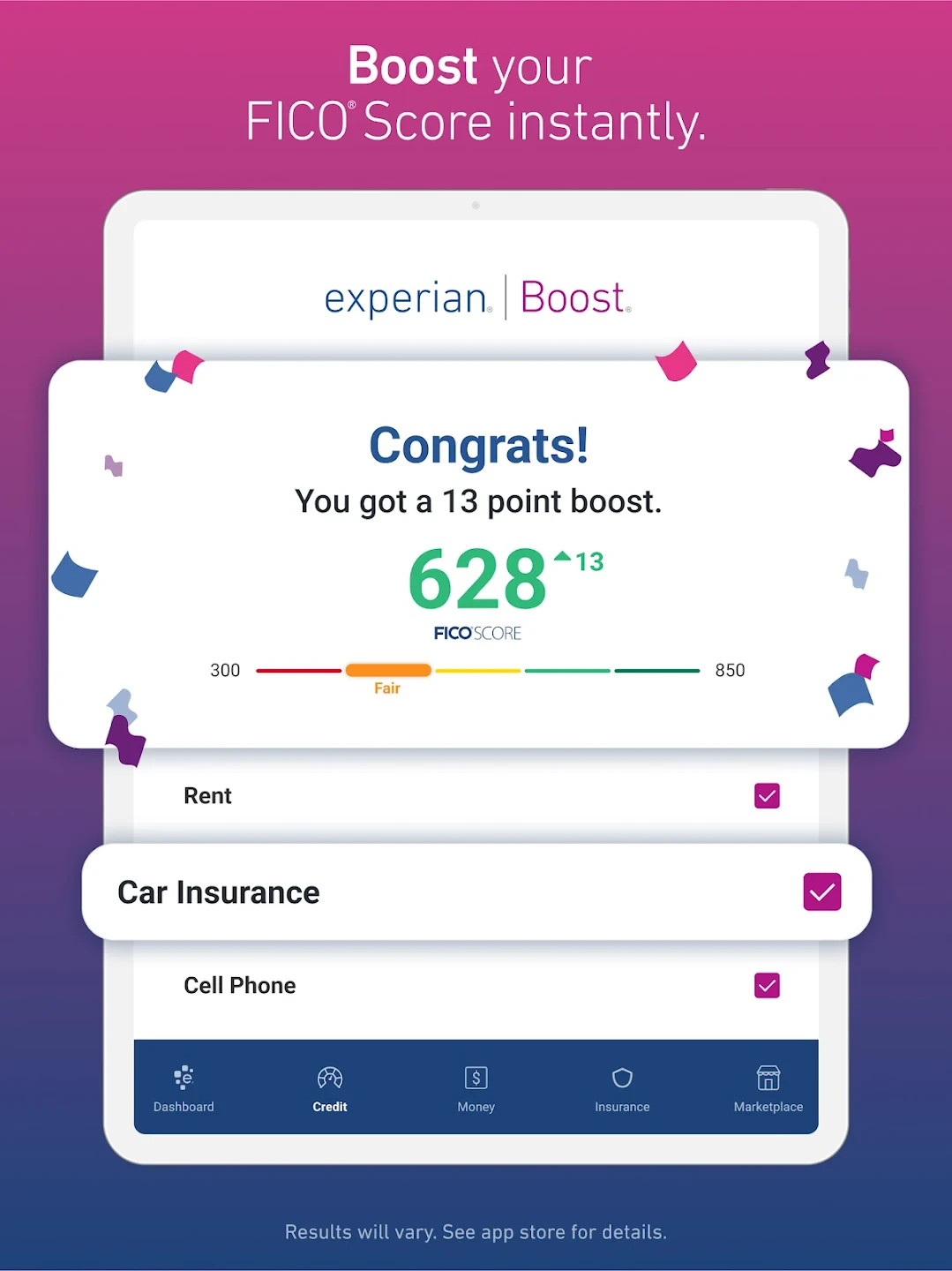

- Credit Score Monitoring: View your credit score and report highlights directly within the app, giving you a quick understanding of your credit health. This feature is especially beneficial for proactive users who want to know how their financial habits impact their score, for instance, noticing an immediate drop after a large purchase and investigating further.

- Fraud Resolution and Alerts: Easily report fraud, receive notifications about suspicious account activity, and manage alerts through an intuitive interface. The platform includes technical features like the Dark Web Scanner which actively looks for instances of your personal information online, providing robust protection that complements your security posture.

- Identity Restoration Tools: Simplify the process of recovering your identity after fraud by providing step-by-step guidance and resources within your mobile device. This feature solves the complex problem of identity theft recovery by offering immediate access to necessary documents and instructions, reducing the stress typically associated with such stressful situations.

- Account Management & Disputes: Manage linked accounts, submit disputes related to your credit report directly, and track the status of these actions from anywhere using your phone. This feature is particularly valuable for busy professionals who prefer mobile convenience and need timely updates without constant manual checks.

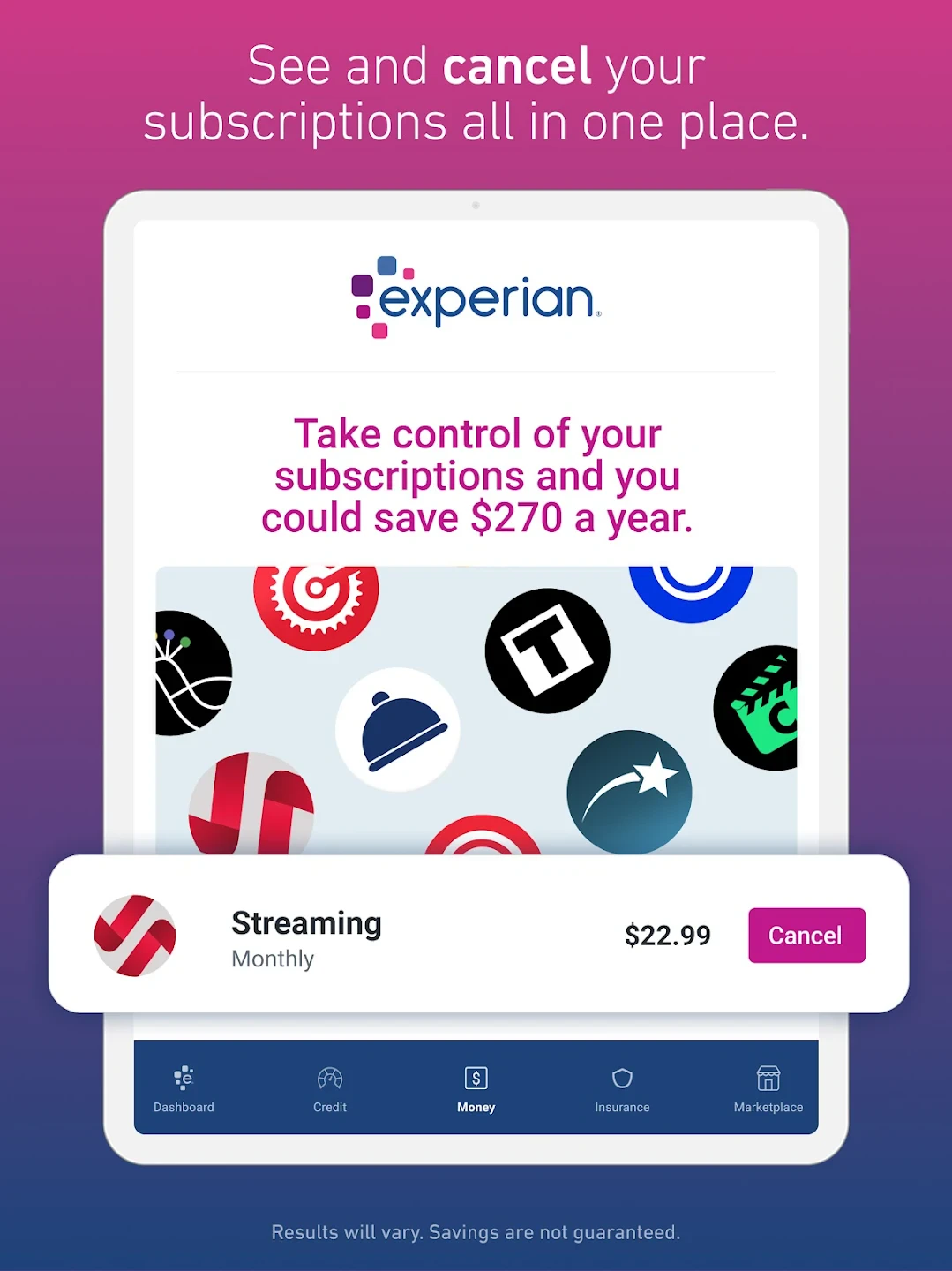

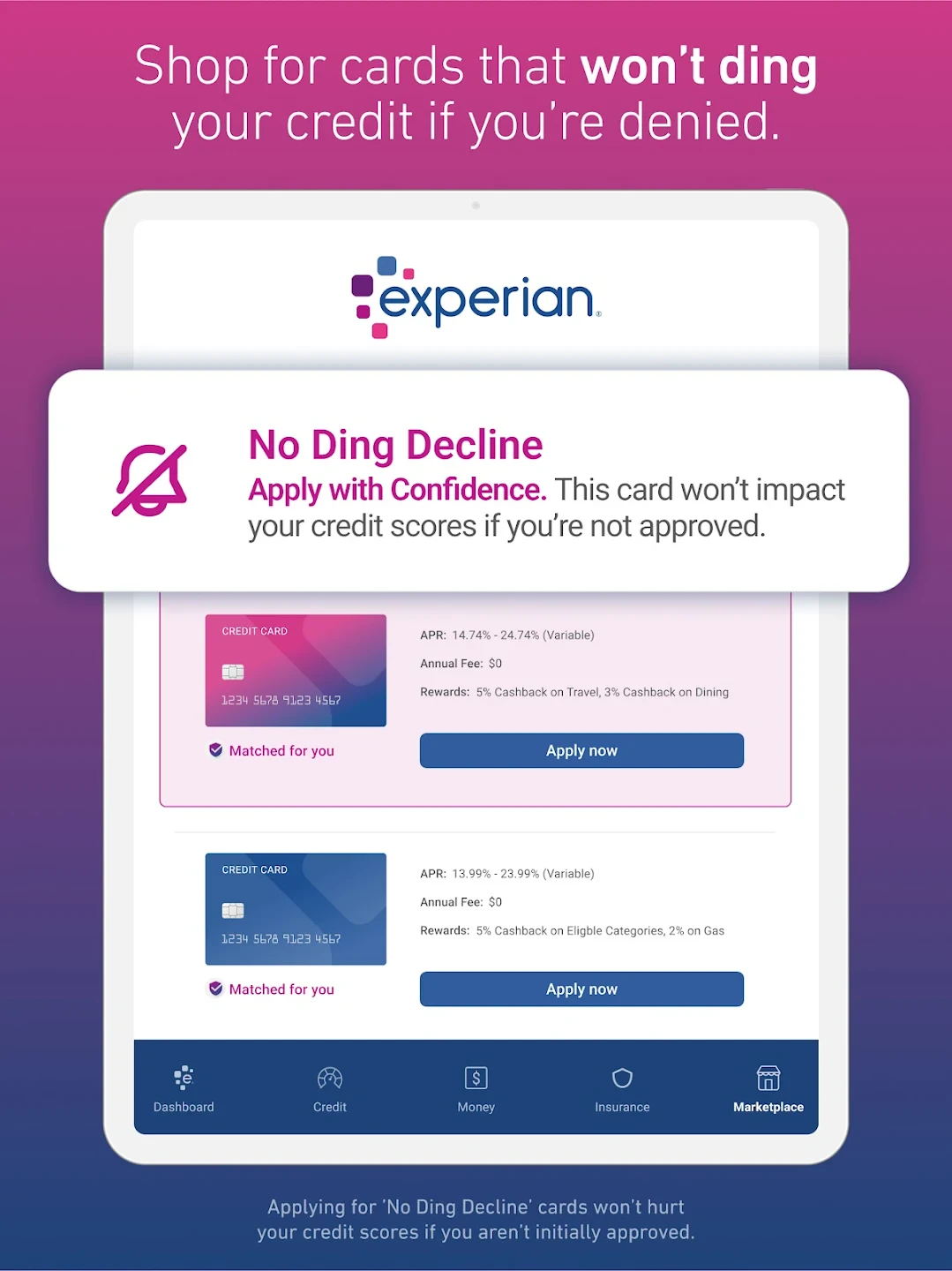

- Financial Insights & Recommendations: Gain access to personalized insights based on your credit behavior, including tips on improving credit health and suggested financial goals. The app offers flexibility by providing relevant information regardless of the user’s financial background, tailoring advice to different credit profiles for maximum usability.

- Dark Web Monitoring Integration: Continuously scan for your personal information, such as Social Security number, email addresses, and bank account details, on dark web marketplaces. This advanced feature significantly enhances security by proactively seeking and alerting users to compromised data, offering peace of mind with comprehensive monitoring capabilities not available in simpler tools.

Pros & Cons

Pros:

- Comprehensive Credit Score Access

- Robust Fraud Protection Features

- Convenient Mobile Monitoring & Alerts

- Easy Identity Restoration Guidance

Cons:

- Potentially Complex for Absolute Beginners

- Subscription Costs for Full Features

- Dependence on Online Data Sources

- Notification Overload Possible

Similar Apps

| App Name | Highlights |

|---|---|

| Equifax Mobile |

This app offers direct access to credit reports and score from Equifax, providing competitive security monitoring and fraud resolution tools, suitable for general credit management. |

| Credit Karma |

Built around providing free credit scores from TransUnion and Experian (VantageScore models), it focuses on score tracking and offers simple, user-friendly advice on improving financial health, though lacking full report access. |

| MyCreditRange |

Specializes in detailed credit analysis, offering unique financial health scoring across five dimensions (payment habits included) for a more granular view than basic credit scores, with strong reporting tools. |

Frequently Asked Questions

Q: Do I need a subscription to use the core features of the Experian app, or is it free?

A: While basic features may be available, full access to credit reports, detailed score analysis, and advanced fraud protection typically require a paid Experian subscription plan, varying by region and specific service level.

Q: How often are my credit score updates reflected in the app, and are there different score models shown?

A: Your score is usually updated daily, often reflecting changes from your latest credit activity. Experian typically displays its own score model, but may also offer scores based on competing models like FICO or VantageScore upon subscription.

Q: Can I dispute inaccuracies on my credit report directly from the mobile app, and how long does it take?

A: Yes, you can submit disputes directly via the app using a streamlined interface. The process can take several weeks for Experian or up to 30 days depending on the complexity, and you’ll receive updates on the status of your dispute through the app.

Q: What happens to my personal data when I use the fraud alerts and scanning features in Experian app?

A: Experian takes data privacy seriously; your information is encrypted and stored securely. When scanning the dark web, they look for matches but do not share your data with third parties without explicit consent, adhering to strict security protocols.

Q: Is the Experian app compatible with older smartphone models or operating systems?

A: Generally, the app targets current smartphone platforms and newer OS versions for optimal security and performance. Users of older devices may face limitations, and it’s recommended to check the app store listing for specific system requirements before downloading.

Screenshots

|

|

|

|