|

|

| Rating: 4.6 | Downloads: 10,000+ |

| Category: Education | Offer by: Zimran Limited |

Finelo is an intuitive budgeting and expense management application designed for everyday people who want to gain better control over their finances. It simplifies tracking income and spending across various categories, offering clear insights into money flow. Ideal for individuals and small households seeking an easy-to-use tool to understand and improve their financial health, Finelo empowers users through straightforward management.

Finelo’s key appeal lies in its user-friendly interface combined with actionable financial insights, directly linking spending to budget goals. Its practical usage extends from personal finance tracking to helping manage shared expenses, making complex budgeting accessible and fostering better financial discipline without requiring advanced accounting knowledge. Using Finelo regularly provides a clearer picture of spending habits and progress towards financial objectives.

App Features

- Budget Tracking: Easily create and manage monthly budgets across different expense categories like groceries, entertainment, or utilities. This feature helps you stay within your means by comparing actual spending against allocated amounts, preventing overspending on non-essentials. Finelo keeps your budget in check.

- Expense Categorization: Automatically or manually tag transactions into predefined or user-defined categories for detailed analysis. Utilizing machine learning algorithms helps in suggesting categories, making expense tracking faster and providing a clear breakdown of where your money goes, which is invaluable for targeted financial planning. Finelo offers intelligent categorization.

- Income Management: Seamlessly add various income sources like salaries, freelance work, or gifts with just a few taps, clearly separating them from expenses. Finelo provides a consolidated view, making it easy to see net income and overall financial standing, perfect for freelancers or those with multiple income streams. Manage all your money in one place.

- Savings Goals: Set specific, achievable savings targets for purposes like vacations, emergencies, or large purchases directly within the app, with visual progress tracking. For example, you can set aside funds for a down payment on a car each month, and Finelo reminds you and tracks your progress visually. Finelo motivates you to save consistently.

- Expense Tracking: Record transactions with detailed information including date, merchant, amount, and category, supporting both manual entry and direct imports (where available). This detailed logging provides a comprehensive history of spending, essential for identifying trends and making informed adjustments to future budgets. Keep a meticulous financial ledger.

- Reports & Insights: Generate easy-to-understand charts and reports to visualize spending patterns, budget adherence, and overall financial trends over time. These insights reveal valuable information like which categories are consistently overspent, allowing users to pinpoint areas needing better budget discipline. Finelo turns your data into actionable advice.

Pros & Cons

Pros:

- Intuitive User Interface

- Comprehensive Budgeting Tools

- Visual Expense Tracking

- Clear Financial Insights

Cons:

- Initial Setup Can Require Effort

- Basic Expense Syncing May Not Cover All Accounts

- Mobile App Notifications Can Be Minor

Similar Apps

| App Name | Highlights |

|---|---|

| YNAB (You Need A Budget) |

Focused on the envelope system with an emphasis on zero-based budgeting. Strong in forcing intentional spending decisions, ideal for users prioritizing strict budget adherence. |

| MoneyLover |

Popular across multiple platforms, known for its wide feature set including investment tracking and bill reminders alongside comprehensive budgeting tools. |

| Everydays |

Dedicated expense tracking with robust categorization and visual charts, often praised for its ease of use and detailed insights tailored for tracking daily spending habits. |

Frequently Asked Questions

Q: Is Finelo a free app to use, or does it require a subscription?

A: Finelo offers a fundamental version with core budgeting and expense tracking features at no cost. Finelo Pro unlocks advanced tools like more detailed investment insights, expanded goal tracking capabilities, and potentially enhanced data export features, requiring a one-time purchase or recurring subscription.

Q: What types of financial transactions can I import directly into Finelo?

A: Finelo supports basic bank account imports via specific banking partnerships (like OFX or Plaid in certain regions) allowing you to pull in transaction history. You can also manually input expenses and income, or use the camera to capture bank or merchant statements for manual categorization later.

Q: Can I access my Finelo data on both my phone and computer?

A: Yes, Finelo provides dedicated mobile applications (iOS and Android) for on-the-go management and access to a web version (often via a link provided in the settings). Syncing across these platforms ensures your budget and expense data is consistently available from any device.

Q: What should I do if I accidentally enter a wrong expense or income entry?

A: You can easily edit or delete incorrect entries directly within the transaction list screen. Finelo maintains a simple transaction history log where you can locate and correct mistakes quickly, ensuring your budget and reports remain accurate. Most platforms also allow reclassifying entries into different categories.

Q: Is my financial data stored securely on Finelo’s servers?

A: Finelo employs standard data security practices, including encryption for sensitive data and secure servers to protect user information. For features involving direct bank imports, data access typically relies on secure protocols like OAuth to manage authorization between your financial institution and Finelo, prioritizing user security.

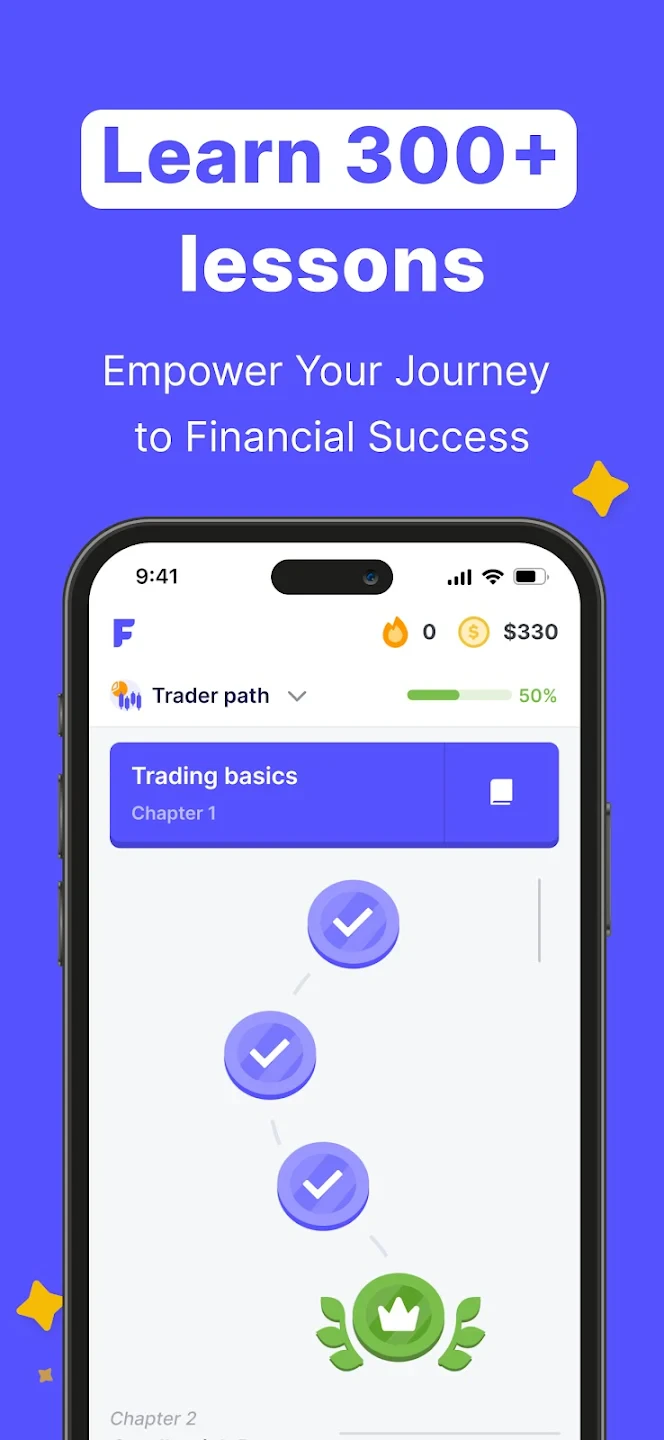

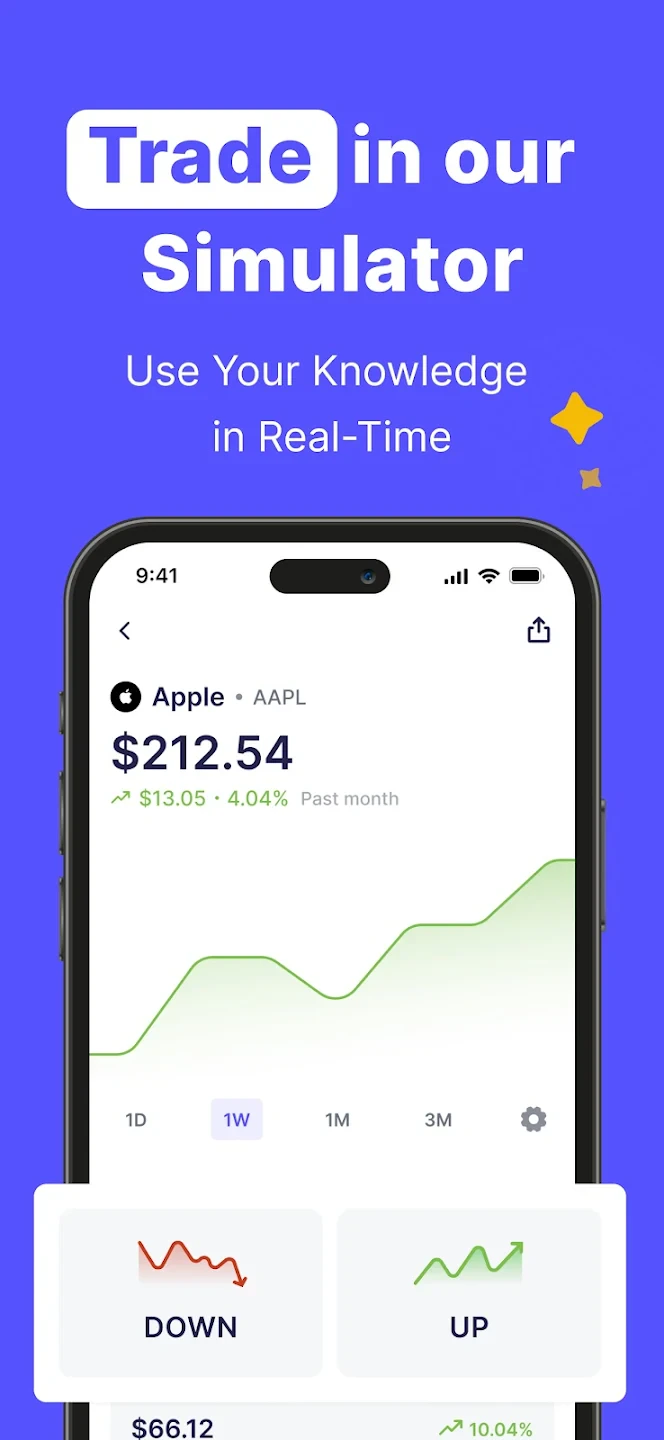

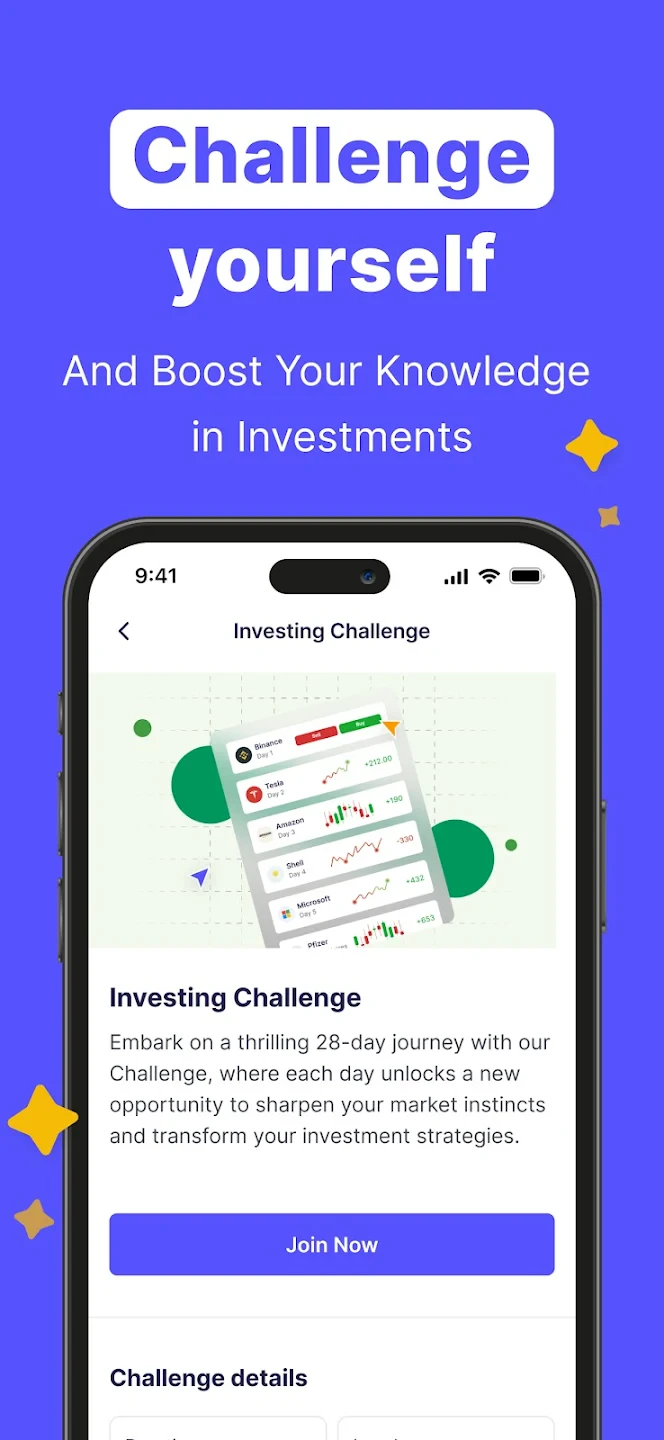

Screenshots

|

|

|

|