|

|

| Rating: 4.5 | Downloads: 500,000+ |

| Category: Finance | Offer by: Four Technologies, Inc |

Four | Buy Now, Pay Later is a financial app that enables users to make purchases and split them into four equal, interest-free installments. It’s designed for anyone who wants flexibility in payment options without needing credit cards or loans upfront. Available through partner retailers, the Four app integrates seamlessly into your shopping experience, allowing instant checkout and deferred payments.

This service is especially appealing to consumers managing cash flow or building their savings. Instead of paying the full amount upfront, users receive four smaller payments spread out over time, making larger purchases more manageable. It offers responsible shopping without interest, helping users budget better and avoid expensive borrowing options.

App Features

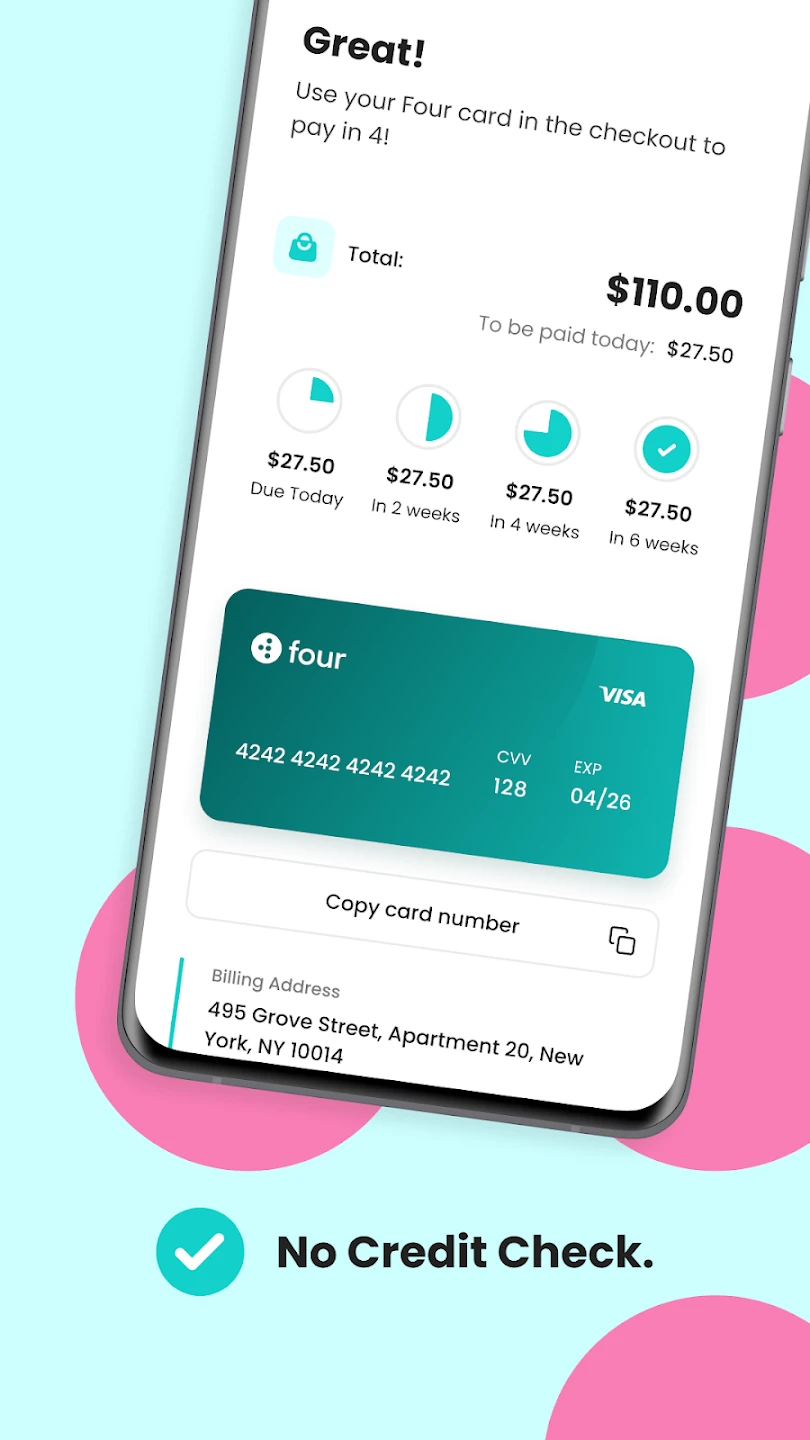

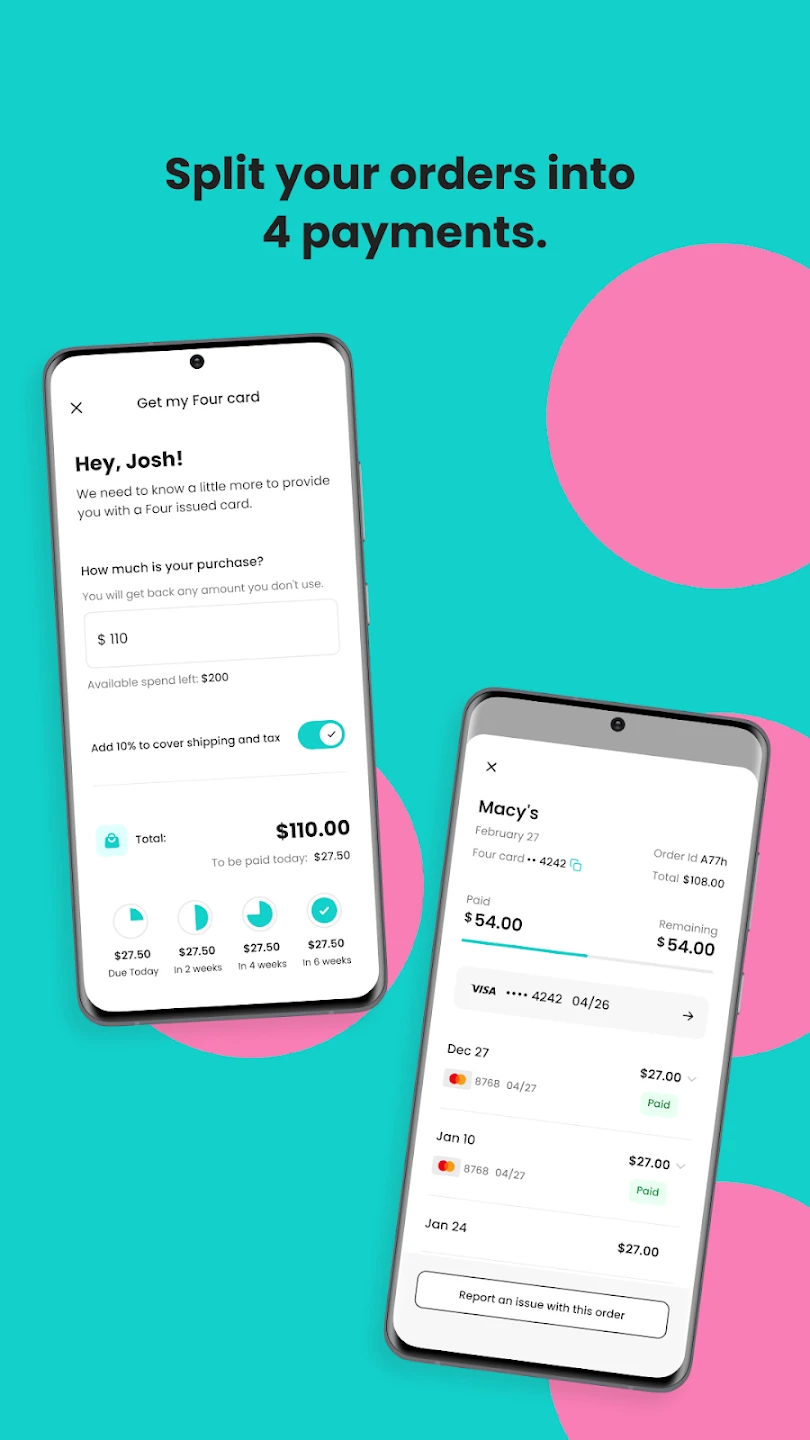

- Four Installment Payments: Split your purchase amount into four equal payments, typically due every two weeks. This allows you to spread the cost of big-ticket items while keeping them accessible. This makes large investments like electronics or furniture less intimidating upfront.

- Zero Interest & Transparent Fees: Four operates with a simple, upfront fee structure—no hidden charges or interest accrual. You’ll see exactly what you’ll pay before confirming each purchase. Unlike many credit options, Four keeps finance costs transparent and predictable.

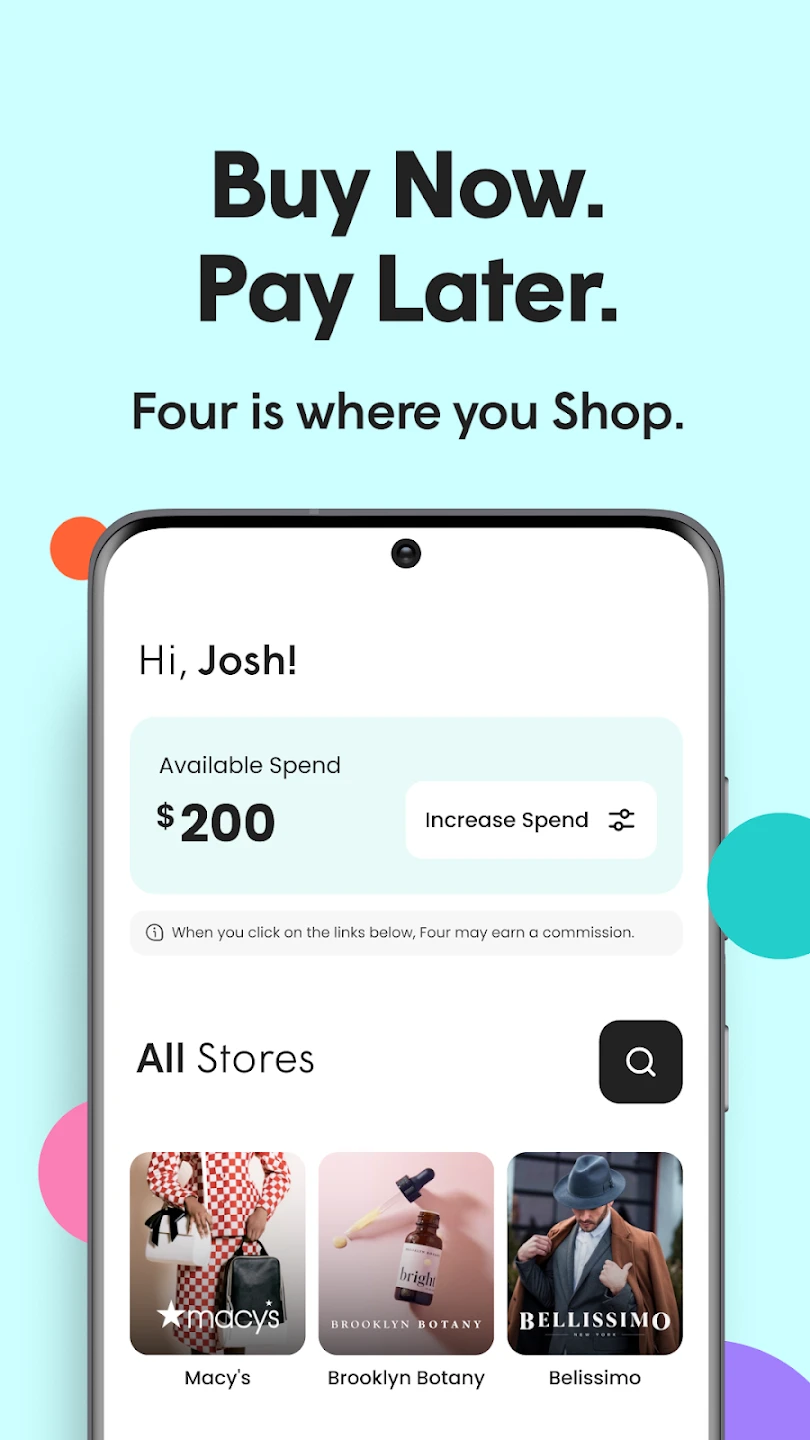

- Seamless Integration with Retailers: The app partners with thousands of stores, letting you choose Four at checkout like any other payment method. This means you don’t have to change your shopping habits to benefit from deferred payments.

- Flexible Payment Dates: While most payments are due every two weeks, Four offers some flexibility for managing cash flow. You can often view and modify scheduled payments through your app dashboard.

- Credit Building Potential: Consistent, on-time payments can help build or improve your credit history. For responsible users, Four can serve as a pathway toward better financial creditworthiness. This benefit makes it suitable for those establishing or rebuilding their credit profile.

- App Dashboard Overview: Your account dashboard provides a clear breakdown of pending and upcoming payments, spending analytics, and account status. Having everything in one place makes managing your installments straightforward and organized.

Pros & Cons

Pros:

- Interest-Free Payments

- Simple, No-Hidden-Fee Structure

- Wide Retailer Availability

- Credit Building Assistance

- Better Cash Flow Management

- Accessibility for Basic Purchases

Cons:

- Limited to Four Equal Payments Only

- Potential Balance Transfer Fees with Competitors

- Potentially Higher Overall Cost Than 0% Credit Cards

- Not Ideal for All Types of Purchases

Similar Apps

| App Name | Highlights |

|---|---|

| Kwai Pay |

This app offers quick purchase installment plans with diverse payment options. Known for user-friendly design and low minimum spending thresholds. |

| Afterpay |

An established player focusing on zero-interest shopping. Includes helpful payment reminders and secure checkout integration. |

| ZipPay |

Designed for budget-conscious buyers. Emphasizes transparency and includes tools to help users manage their installment payments effectively. |

Frequently Asked Questions

Q: How quickly can I get approved for a Four purchase?

A: Approval is typically instant when you’re shopping at partner retailers, depending on the retailer’s system integration. For direct Four app sign-up, verification might take 1–3 business days.

Q: Are there any upfront costs or interest charges on Four?

A: No, Four offers zero percent interest and transparent fees—what you see is what you pay. There are no hidden costs, balance transfer fees, late fees, or annual charges.

Q: Can I skip a payment if I’m short on funds?

A: You can miss a payment, but a small, clearly stated fee might apply depending on your location and the missed payment’s timing. Late fees are generally minimal compared to traditional credit penalties.

Q: Does Four help build credit history?

A: Yes, making on-time Four payments can contribute positively to building your credit history, helping you qualify for better financial products in the future.

Q: What happens to my installment plan if I don’t want it anymore?

A: You can close your Four account at any time before making any payments. If payments are already scheduled, you might have the option to cancel or reschedule them, depending on your location and the specific terms.

Screenshots

|

|

|

|