|

|

| Rating: 4.6 | Downloads: 10,000,000+ |

| Category: Finance | Offer by: GEICO Insurance |

The GEICO Mobile – Car Insurance app is a dedicated tool designed for GEICO insurance customers, allowing them to manage their car insurance policies directly from their smartphone. It offers features like filing claims, viewing policy details, paying bills, and accessing roadside assistance information. This app is ideal for busy individuals and families seeking convenient digital solutions for their insurance needs.

This mobile application enhances practical usage by simplifying complex insurance interactions. Users can handle tasks like uploading claim photos or updating vehicle information anytime, anywhere, making car insurance management faster, easier, and more proactive. The GEICO Mobile – Car Insurance app empowers drivers to stay connected with their coverage details.

App Features

- Mobile Claim Filing and Support: Easily report accidents and file claims through the app by providing details and submitting photos of damage or incident scenes. This feature saves time by letting you start the claims process immediately after an event without waiting to speak with an agent, using your phone’s camera to capture crucial visual information for quick assessment.

- Document Upload and Storage: Digitally submit necessary paperwork like photos of license plates, registration, or vehicle damage for claims or policy updates. The app securely stores digital copies of insurance documents, reducing the need for physical copies and making it faster to access information or complete required documentation.

- Policy Information and Management: Check policy details, including coverage limits, deductibles, and renewal dates, all in one place. This feature enhances user experience by providing clear, up-to-date information on your coverage, helping you stay informed about expirations and important details without needing to call or log in to a website.

- Payment Options and Bill Pay: Make insurance premium payments conveniently through the app, often with the choice of automatic billing. This feature is valuable for maintaining coverage without interruption and saves money through discounts available for electronic payments, streamlining the financial aspect of managing your insurance.

- Roadside Assistance Lookup and Request: Find and request roadside assistance services linked with your policy directly from your phone. It solves the problem of knowing who to call for help, providing peace of mind when you’re stranded, and offers flexibility by allowing you to contact certified providers instantly during non-emergency situations.

- Bonus: Trip Sharing and Tracking (Optional): Share trip details, including mileage, with your insurance company or designated drivers for tracking purposes. This advanced feature supports usage-based insurance programs or trip documentation needs, offering insights into driving habits and providing data for accurate trip-related expense tracking.

Pros & Cons

Pros:

- Convenience and Accessibility

- Time-Saving Features for Claims and Payments

- Easy Access to Policy Information On-the-Go

- Integration of Essential Roadside Assistance

Cons:

- Learning Curve for New Users

- Potential Premium Changes Based on Usage Data (If Applicable)

- Dependence on Smartphone Functionality

- Limited Customer Support Channels

Similar Apps

| App Name | Highlights |

|---|---|

| State Farm Mobile App |

This app provides features like claims filing via chat, payment options, policy information access, and roadside assistance. Known for its interactive claim chatbot and seamless policy management. |

| Allstate Mobile App |

Designed for managing policies, payments, and claims. Includes guided claim steps and the ability to share policy with others. Focuses on user-friendly navigation and comprehensive claim tracking. |

| ProgressIVE Insurance App |

Offers digital bill payment, policy lookup, and tools for tracking safe driving rewards. Emphasizes digital engagement features and rewards tracking integration with driving behavior. |

Frequently Asked Questions

Q: What can I do with the GEICO Mobile – Car Insurance app?

A: You can view your policy details, make payments, file claims (submit photos/details), upload documents, access roadside assistance info, and sometimes even share trip data.

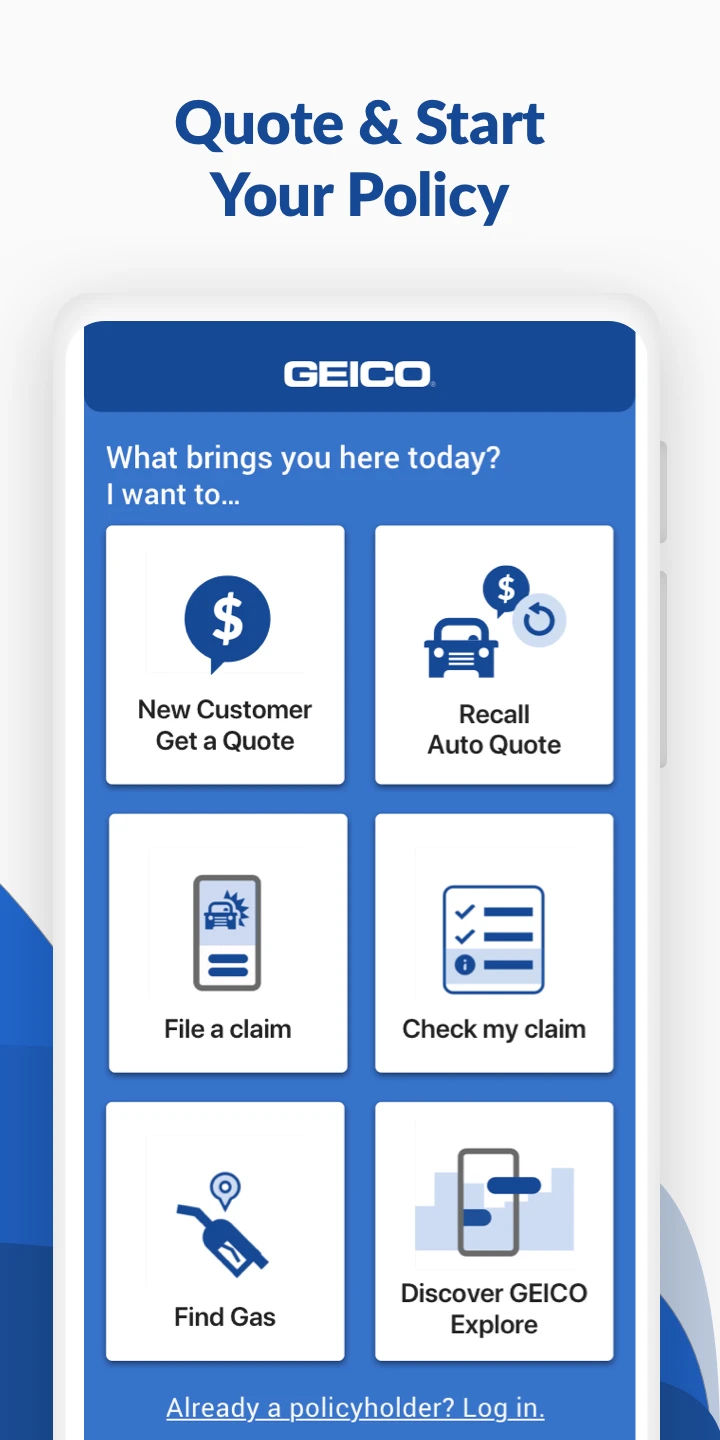

Q: How do I file a claim using the GEICO Mobile app?

A: Open the app and navigate to the ‘File a Claim’ section. Provide details about the incident, upload photos if available, and follow the on-screen prompts to guide you through the process.

Q: Are there any costs associated with using the mobile app features?

A: Basic features like viewing your policy, making payments (potentially), and filing claims are standard. Some features like trip sharing might depend on your specific policy or usage-based components, but core functionalities are included at no extra cost.

Q: What happens to my data when I use the app?

A: GEICO is committed to protecting your privacy. The app securely stores your data and uses it only to manage your insurance policy, process claims, and provide the services offered within the app, adhering to their privacy policy.

Q: Can I use the app to update my vehicle information or beneficiaries?

A: Yes, typically you can access sections within the app for policy details, where you might find options to update covered vehicles or beneficiaries, ensuring your information remains current and accurate.

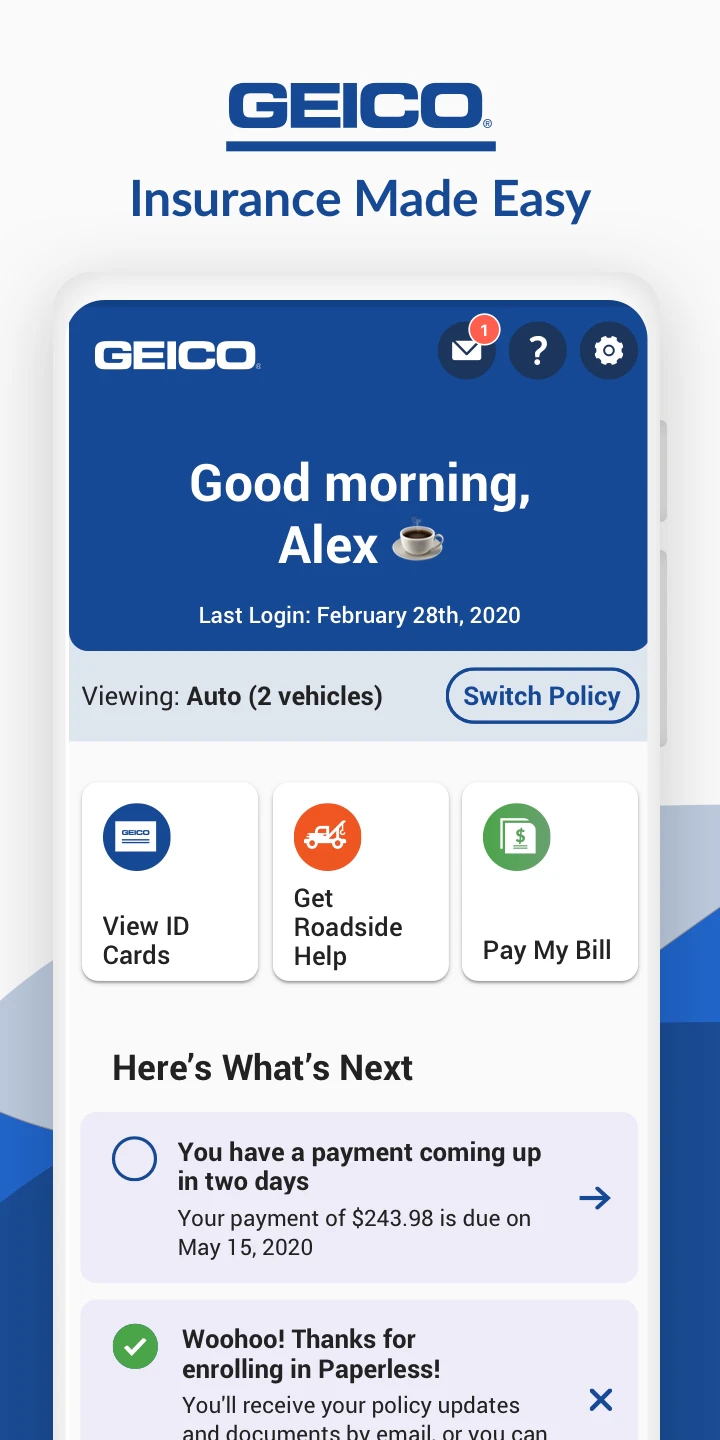

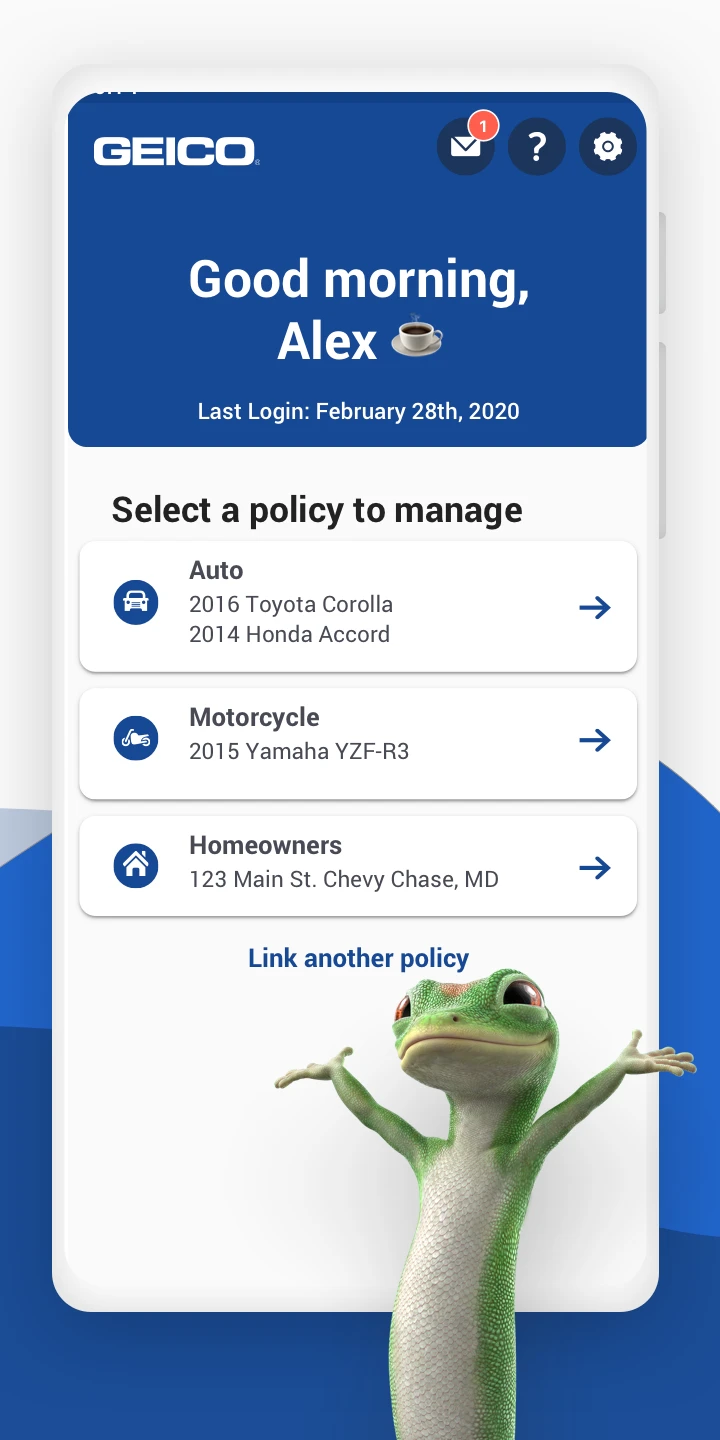

Screenshots

|

|

|

|