|

|

| Rating: 3.7 | Downloads: 5,000,000+ |

| Category: Finance | Offer by: Green Dot |

Green Dot Mobile Banking is the official mobile application from Green Dot, designed to give users complete control over their finances from their smartphone. It allows users to check their account balances, transfer money between linked accounts or cards, deposit checks via the camera, and manage their Green Dot debit card settings, all without needing a physical card present. This app is essential for anyone who primarily manages their money using a mobile device.

The key appeal of Green Dot Mobile Banking lies in its accessibility and convenience, enabling users to handle everyday banking tasks quickly and securely on the go. For frequent travelers or those with busy schedules, its features like direct deposit setup and mobile check deposit significantly reduce the need for visiting physical locations, making personal finance management more practical and immediate.

App Features

- Account Management & Balance View: Instantly check balances for all associated Green Dot accounts and cards linked through the app. This real-time visibility helps users stay on top of their spending and budget effectively, preventing overdrafts and providing peace of mind.

- Transfers & Payments: Users can easily send money to other users within the Green Dot network or designated contacts, or set up one-time, recurring, or percentage-based transfers to linked accounts, including external banks or Green Dot cards. This feature streamlines bill payments and money movement, saving time and effort compared to traditional banking methods.

- Mobile Check Deposit: Using the phone’s camera, users can deposit checks remotely by simply taking a clear picture. This significantly reduces the waiting time for check clearance, often making funds available faster than waiting for a deposit slip to process.

- Green Dot Debit Card Management: Users can activate, temporarily disable (freeze), or re-enable their Green Dot Debit Card directly from the app. They can also set spending controls and view recent card transactions, providing easy oversight and control over their card usage.

- Direct Deposit Setup: Green Dot Mobile Banking simplifies the process of setting up direct deposit for paychecks, government benefits, or other income sources. Users can securely provide their banking details without needing to contact the payer directly, which is particularly helpful for new account holders or frequent direct deposit recipients.

- Bill Pay Integration: The app allows users to create recurring payment profiles for bills, link checking accounts, and set payment schedules. This automates payments and reduces the risk of missed due dates, integrating seamlessly with the user’s existing financial responsibilities.

Pros & Cons

Pros:

- Incredibly User-Friendly Interface

- Fast Mobile Check Deposit Capability

- Wide Range of Debit Card Features Integrated

- No Monthly Fees For Basic Account Use

Cons:

- Limited Investment Product Options

- Some Advanced Investment Features Absent

- International Transaction Fees May Apply

- Customer Support Access Primarily Through Online Channels

Similar Apps

| App Name | Highlights |

|---|---|

| Chime |

This app offers fast processing, intuitive design, and wide compatibility. Known for direct deposit next-day access and daily notifications. |

| PayPal |

Designed for simplicity and mobile-first usability. Includes guided steps and real-time previews for sending/receiving money. |

| N26 |

Offers AI-powered spending insights, budgeting tools, and multi-currency accounts ideal for international users. |

Frequently Asked Questions

Q: Can I link my existing external bank accounts to Green Dot Mobile Banking?

A: Yes, Green Dot Mobile Banking allows you to link your external bank accounts securely for viewing balances and potentially sending/receiving money, subject to specific feature permissions and bank-to-bank transfer capabilities.

Q: How quickly can I access the funds from a deposited check using the mobile app?

A: Green Dot typically makes deposited checks available within 1-2 business days after the deposit image is submitted, which is generally faster than traditional banking methods that can take several days.

Q: What happens if I lose my phone? Will I lose access to my Green Dot account or card?

A: If you suspect your phone is lost or stolen, you should immediately disable your Green Dot Debit Card directly through the app (if you can access it) or contact Green Dot support. Furthermore, you can remotely log out of the specific device used to access your account from within the app’s security settings.

Q: Are there any foreign transaction fees when using my Green Dot card abroad?

A: Green Dot charges a standard 1.5% fee on purchases made in a currency different from your base account currency. This fee is deducted from your account and is common practice with most US-issued credit and debit cards when used internationally.

Q: Can I set up recurring bill payments directly within the Green Dot Mobile Banking app?

A: Yes, the Green Dot app includes a Bill Pay feature where you can set up recurring profiles for regular payments. You can link your accounts, set specific dates, and ensure your bills are paid on time without manual intervention each cycle.

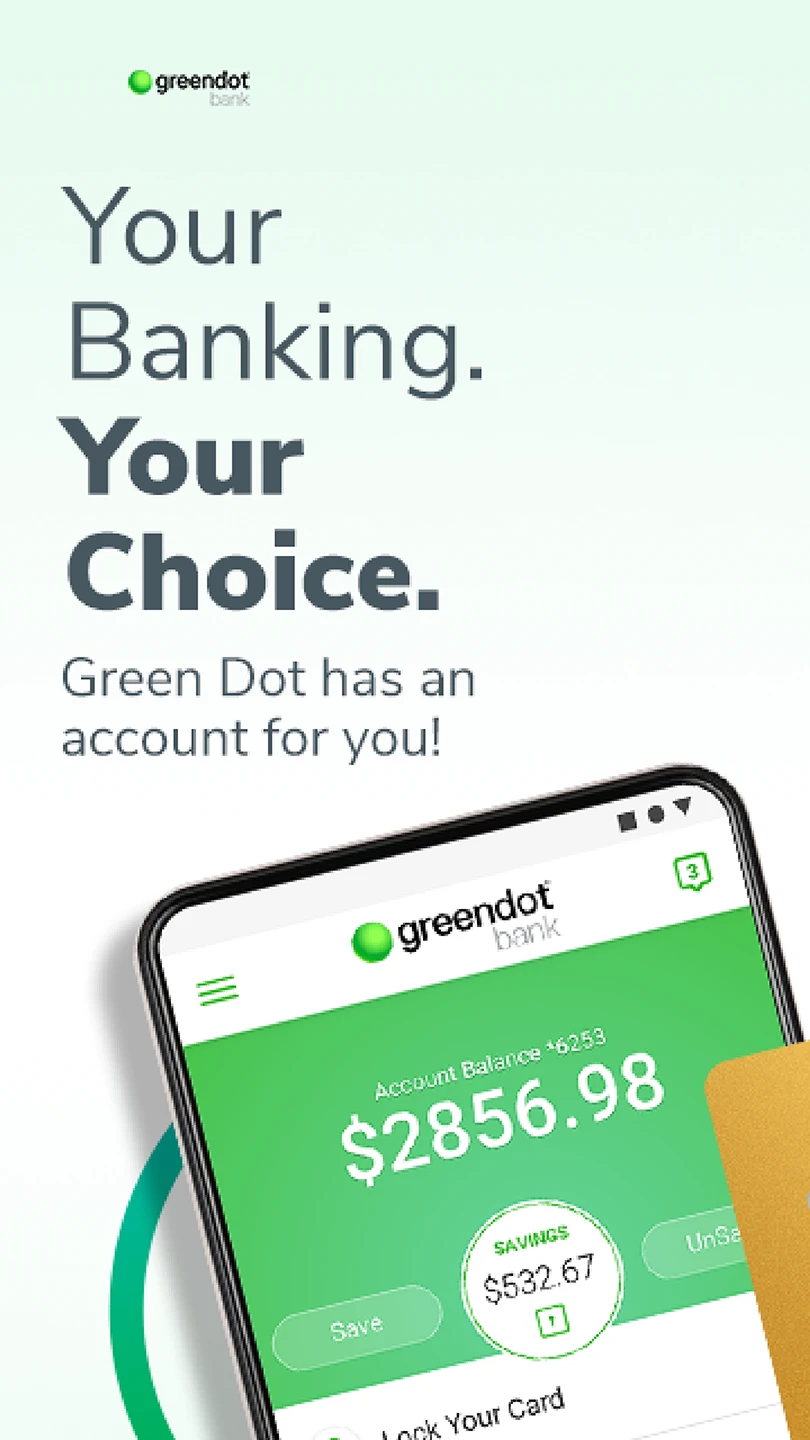

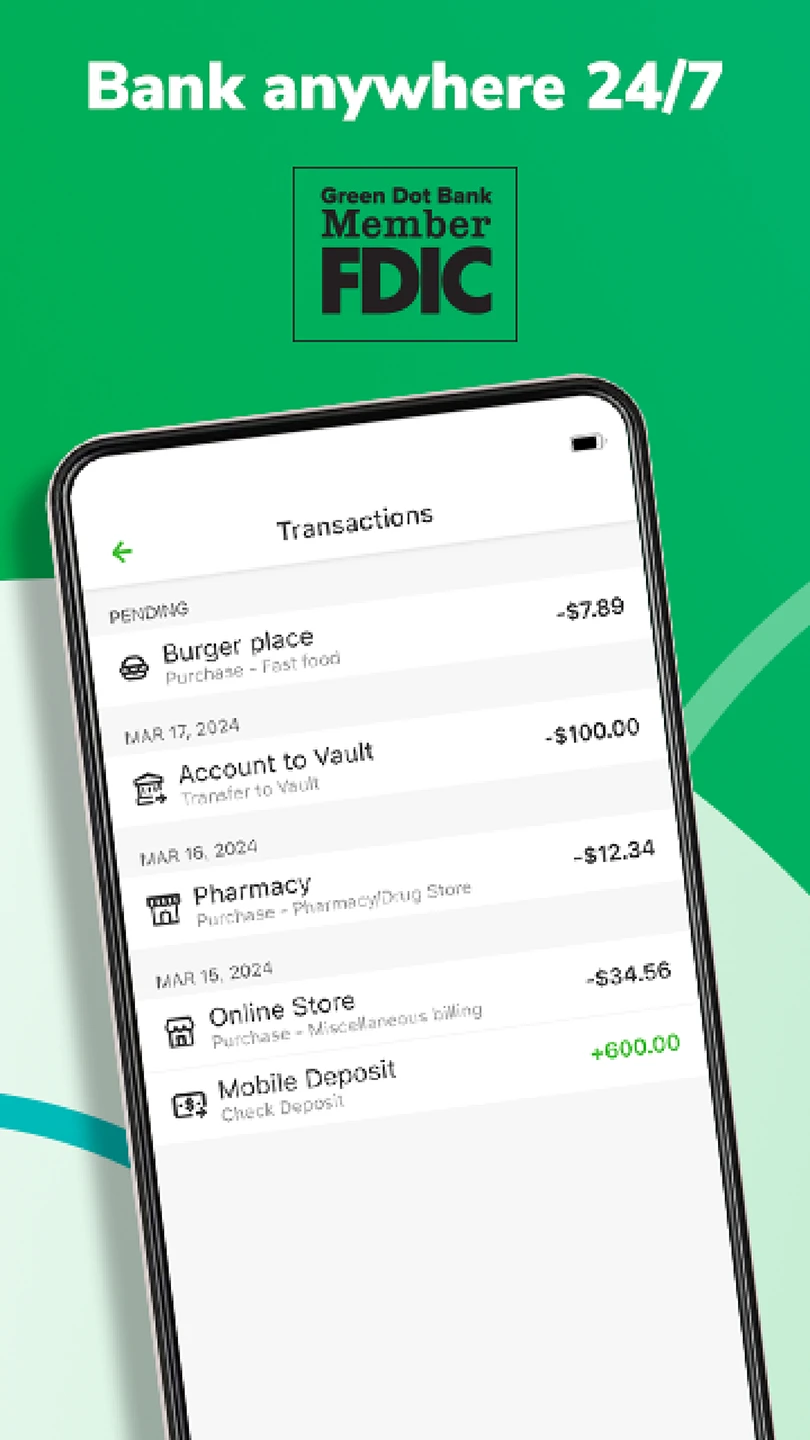

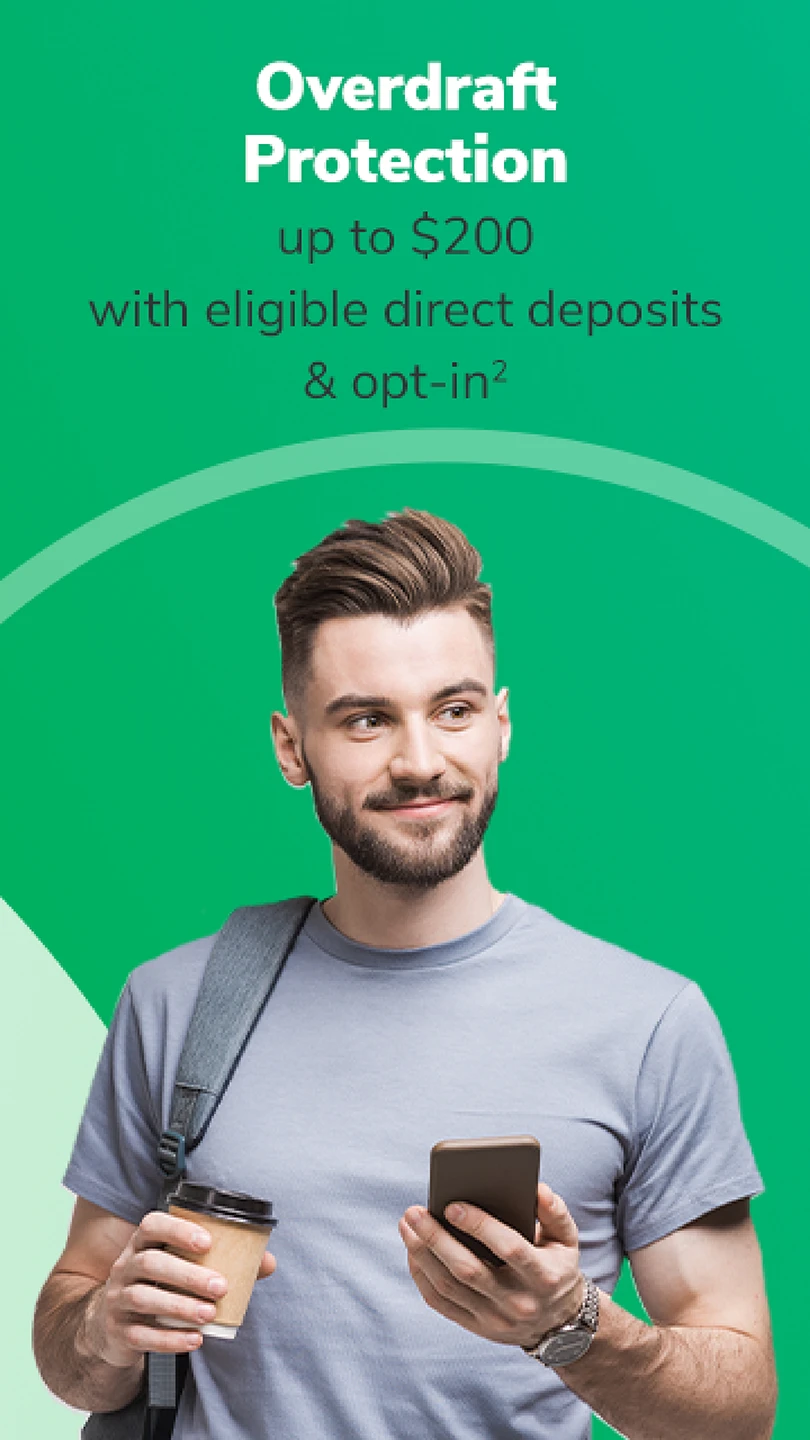

Screenshots

|

|

|

|