|

|

| Rating: 4.1 | Downloads: 500,000+ |

| Category: Finance | Offer by: Hiatus Inc |

Hiatus: Bill and Money Manager is a user-friendly application designed to centralize personal finance tracking, offering tools for budget creation and expense categorization. It provides a clear overview of spending habits and income flow, catering primarily to individuals seeking straightforward yet effective financial oversight in their daily lives.

This app streamlines financial management by offering customizable goal tracking templates and the ability to favorite relevant budget categories, making it quicker to monitor spending against targets. Hiatus helps users maintain better control and awareness over their finances, serving as a clear calling card for anyone looking for simplicity in personal finance management.

App Features

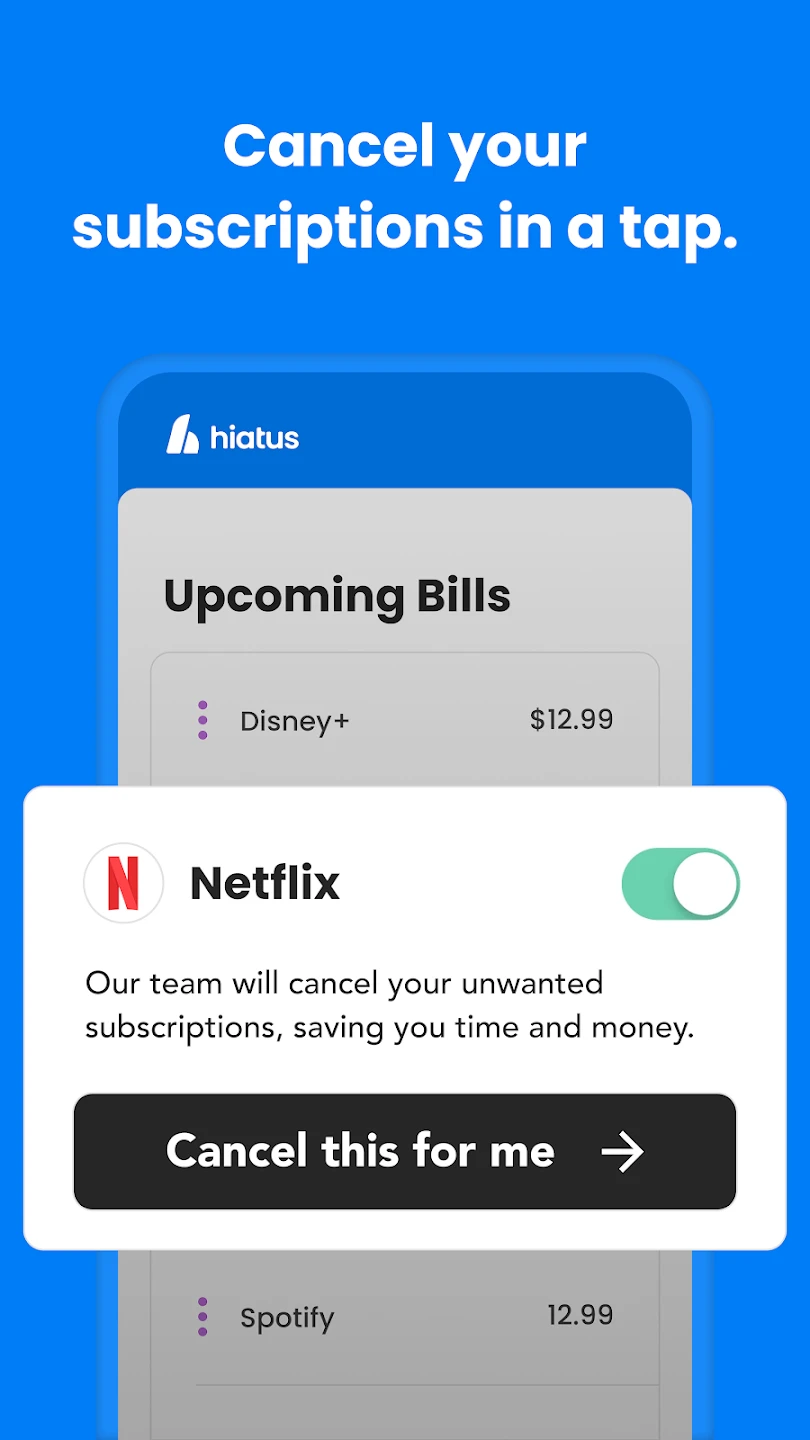

- Expense Tracking and Categorization: Record every transaction with a complete’record money’ or’bill payment’ action. The app automatically or manually assigns a category to each expense or income source, making it easier to spot spending patterns or income streams with highlighted categories for budget monitoring.

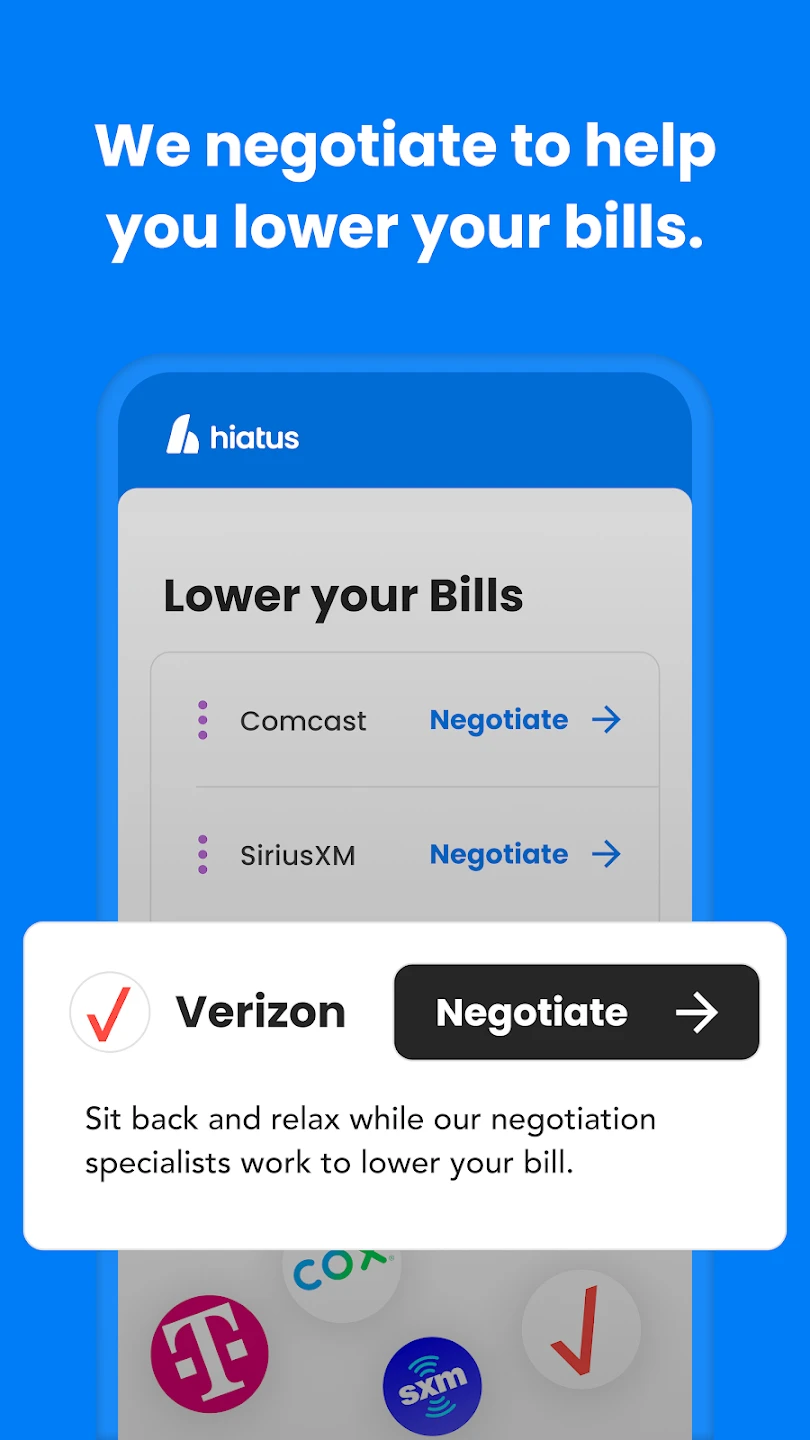

- Budget Planner with Real-Time Updates: Define specific spending limits across various categories using the simple budget planner. As new bills are recorded or money is spent in budgeted buckets, the calculated actual spending instantly reflects against the planned budget, providing clear progress bars or visual indicators.

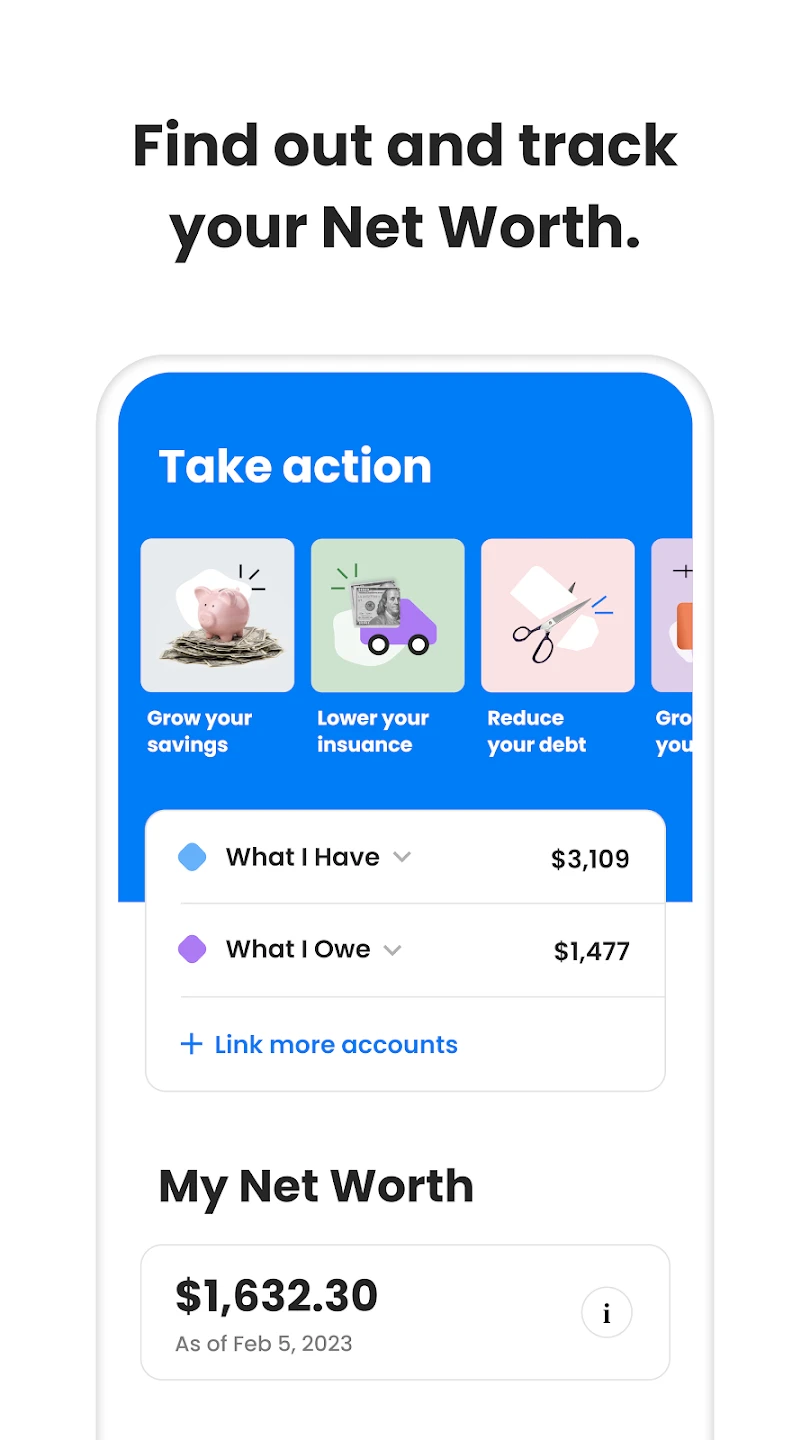

- Goal Setting and Expense Favorite Lists: Establish specific financial goals, like saving for a down payment or paying off debt, and the app calculates steps towards them. Users can create identify lists (favorite categories) showing what bills are crucial to track first, offering focused navigation within potentially long transaction histories.

- Accounts and Bill Reminder System: Define your account associated transactions specifically by linking balances to individual checking, savings, or loan accounts. An integrated, optionally configurable reminder system help prevents missing due deposits or creditor due dates, reducing late fee risks significantly.

- Customizable Summary Reports: Generate detailed user summary reports formatted for quick review, data, in dashboards. Users who are interested in more detailed views can filter reports by time period, income or expenses categories, or even just bills that align with recent activities or account balances.

Pros & Cons

Pros:

- Intuitive and Easy Interface for New Users

- Comprehensive yet Lightweight Feature Set

- Robust Notifications and Reminder System

- Clear Cost Structure and Excellent Privacy Measures

Cons:

- Limited Customization Fleet Initially

- Smaller Community Support Compared to Giants

- Occasional Sync Delays on Mobile Updates

- Less Advanced Investment Tracking Tools

Similar Apps

| App Name | Highlights |

|---|---|

| Mint |

An adaptable financial overview using AI to categorize transactions automatically. It provides smart budget recommendations and easy spending analysis on the account balances, often linked directly with banking accounts. |

| EveryDollar |

Designed for strict envelope budgeting using a robust goal feature. It emphasizes manual entering for greater adaptability and allows tagging beyond simple categories, fitting for users wanting goal-driven money management. |

| Goodbudget |

Focuses specifically on envelope-style budgeting with strong account roll-over handling and a clean design. It’s budget-focused from the start, making money management profoundly simple and focused. |

Frequently Asked Questions

Q: Have you utilized your app for multi-account management effectively, and can all accounts be differently categorized or set with personal spending limits? Could you share more about that experience?

A: Hiatus supports meticulous management across numerous accounts; each bank account or credit card can have specific budget categories, crucial limits, and separate user labeling. Users take full control, customizing rules and categories per account.

Q: I know your app allows setting up automatic monthly bill payments. What are the types of bills you can set up and how does the budget allocation system handle recurring expenses?

A: Our primary bill setting automates recurring payments (e.g., rent (expense), subscription fees (expense), salaries (income)). These are subtracted from budget balances, preventing spending buffers from being exhausted before manual money records.

Q: How user-friendly is the expense category tagging feature? Are there independently customizable, extensive specific categories available, like tracking entertainment vs groceries separately, or can I set up my own list?

A: Expense tagging is extremely user-friendly: available categories include widely recognized ones like groceries (expense) and entertainment as well as personal favorites. Users can easily expand their category lists based directly on account (expense/income) specific needs or favorites.

Q: If I’m switching from other apps, how does your “favorite category” function compare or contrast with similar list features found elsewhere, especially in terms of ease of finding critical bills quickly?

A: A key Hiatus advantage is the “favorite category” function which allows marking frequently accessed or critical expense groups. This is far beyond simple lists, streamlining navigation specifically to high-priority bill categories within the broader managed datasets.

Q: How robust is your account security? I know concerns exist regarding personal finance apps, but what data protection measures do you implement to safeguard user information?

A: Your financial data is our highest priority. Hiatus employs end-to-end encryption on data transmitted and stored our secure server side. We have strong verification and no log retention policies to maximize information dashboard user privacy.

Screenshots

|

|

|

|