|

|

| Rating: 4.8 | Downloads: 100,000+ |

| Category: Business | Offer by: Labhouse Mobile |

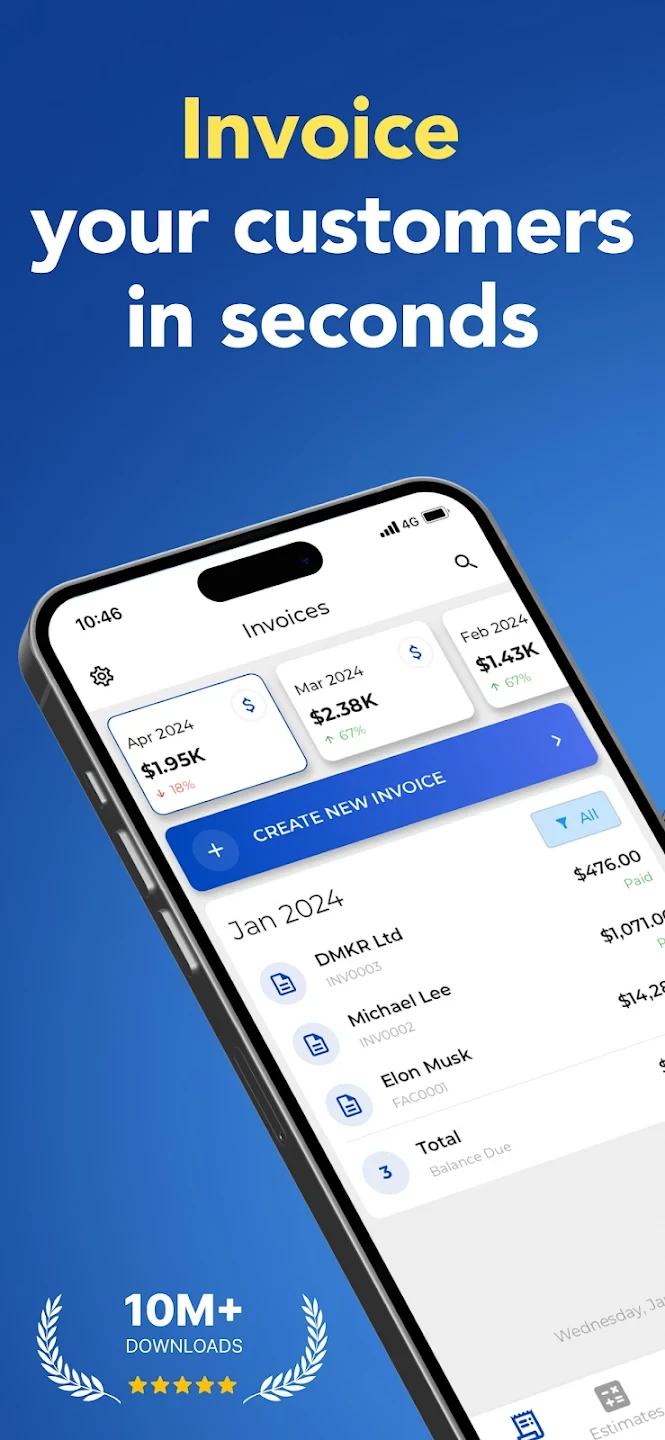

Invoice Maker – Invoice Fly is a mobile application designed to simplify the invoicing process for small business owners, freelancers, and entrepreneurs. It allows users to create professional invoices on the go, track payments, and manage expenses efficiently. This tool is perfect for anyone who needs quick access to invoicing capabilities without relying on complex accounting software.

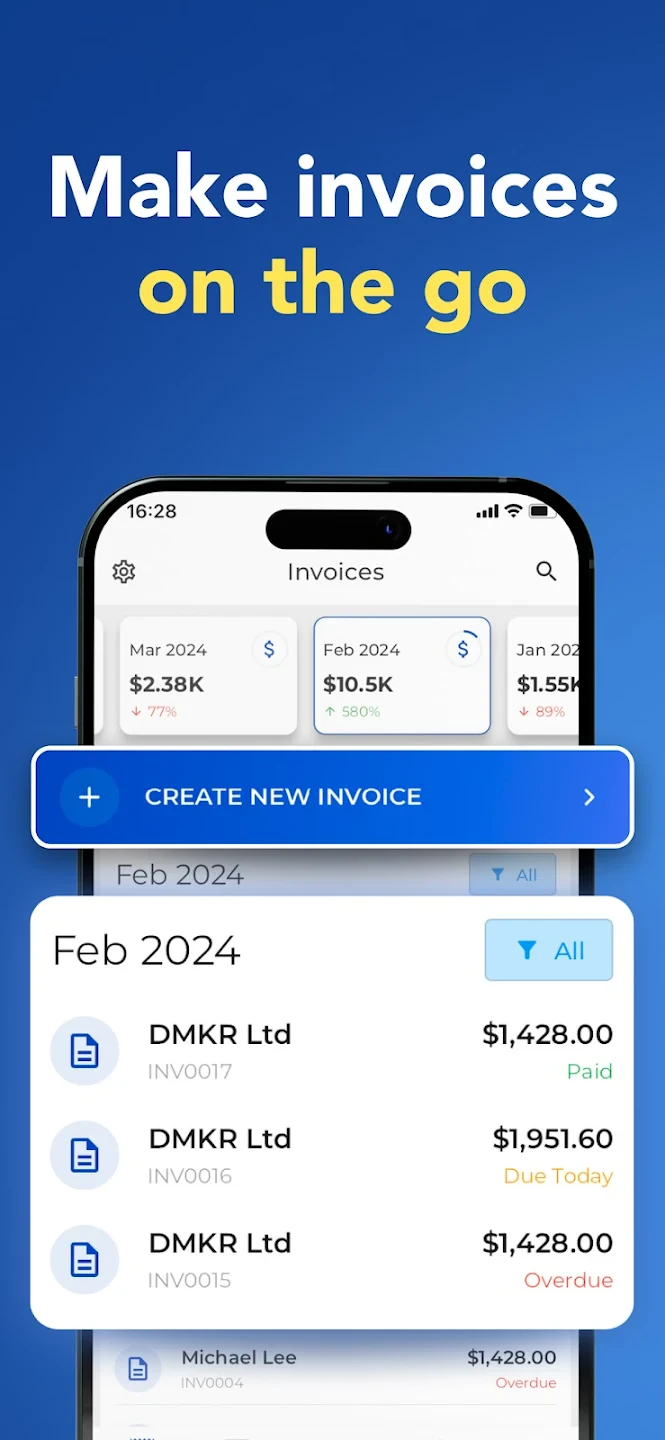

The app’s appeal lies in its user-friendly interface and comprehensive features that streamline financial management. Users can generate invoices in seconds with detailed client information, itemized services, and automated payment reminders. Invoice Maker – Invoice Fly serves as a versatile solution for various industries, from consultants to e-commerce businesses.

App Features

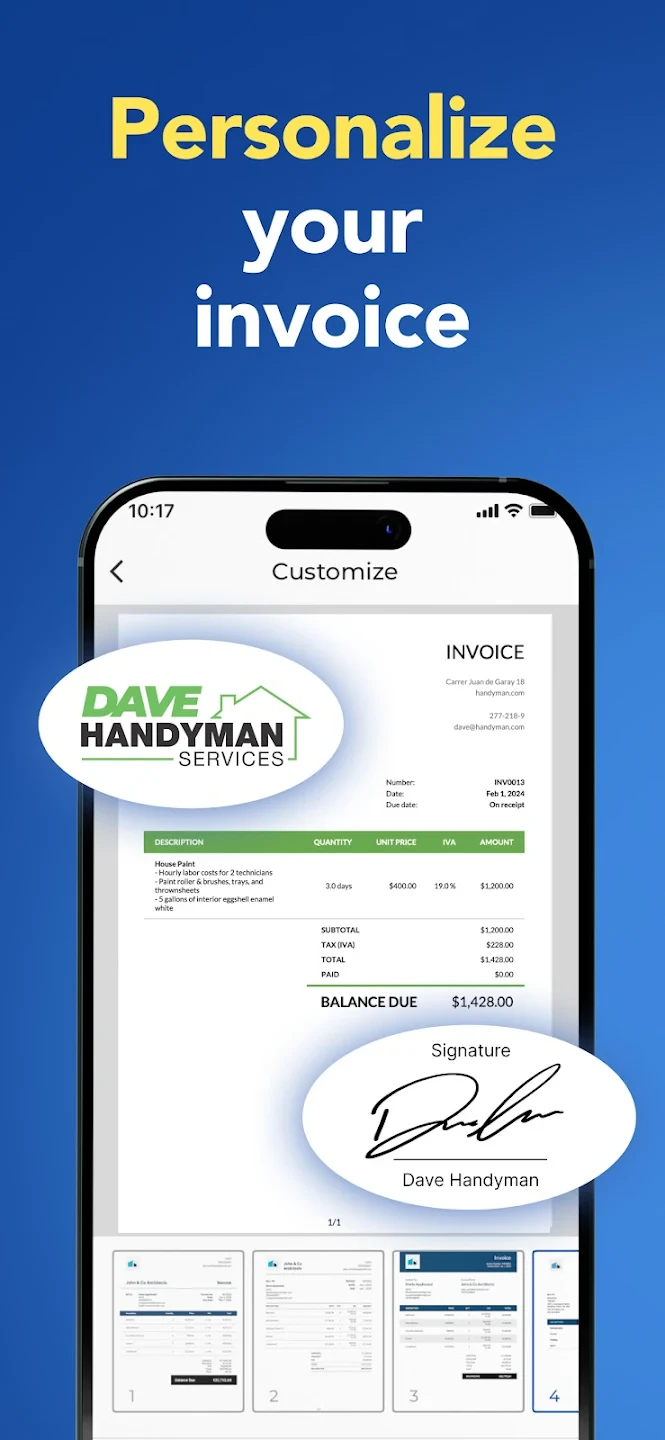

- Quick Invoice Template System: The app provides customizable templates that help users create professional invoices instantly. For example, a freelancer can select a template based on client industry, automatically populating relevant fields to save time. This feature significantly cuts down the time spent manually creating invoices from scratch.

- Multi-Payment Method Integration: Connect various payment gateways like PayPal and Stripe directly through the app. With built-in QR code generation, businesses can accept cash payments instantly with digital receipts, enhancing customer convenience and accelerating payment collection. This integration supports diverse customer preferences while reducing transaction errors.

- Expense Tracking Dashboard: Users can categorize business expenses, attach receipts, and track spending across different projects. Imagine managing a construction project – you can record material costs, equipment rentals, and travel expenses all linked to the specific job. This organized approach provides clear financial visibility and simplifies expense reimbursement processes.

- Client Database Management: The app maintains organized client profiles with payment history, contact details, and recurring information. Key benefit: When creating invoices for regular clients, the app auto-populates previous details, reducing data entry time by up to 70%, while the analytics feature helps identify clients with overdue payments.

- Automated Tax Calculation: Users simply input their tax rates, and the app automatically applies them to taxable items. This ensures compliance with local business regulations and prevents costly calculation errors. For e-commerce businesses, the system handles complex tax jurisdictions based on shipping destinations, saving time on manual adjustments.

- Offline Mode Capability: Create and manage invoices even without internet connection, with full data sync once reconnected. This unique offline-first approach supports field sales teams working in remote locations or international teams with unstable connectivity, maintaining productivity regardless of network conditions.

Pros & Cons

Pros:

- Intuitive Mobile Interface

- Comprehensive Invoicing Features

- Cloud Sync Across Devices

- Automated Tax Compliance

- Free Version Availability

- Multi-Platform Support

Cons:

- Advanced Features Behind Premium Wall

- Occasional Sync Delays Reported

- Basic UI on Older Devices

- Limited Multi-Currency Exchange Rates

Similar Apps

| App Name | Highlights |

|---|---|

| QuickBooks Self-Employed |

A comprehensive solution with integrated expense tracking and mileage tracking, known for its robust tax preparation tools and detailed financial reports, though more complex for beginners. |

| Wave Invoices |

Focused purely on invoicing with a clean design, offers unlimited invoices, and includes payment tracking with real-time notifications. Popular for its simplicity but limited expense categorization. |

| Expensify |

Specializes in receipt scanning and expense management with AI-powered categorization, providing detailed analytics for business expenses. Ideal for teams managing multiple company accounts. |

Frequently Asked Questions

Q: How long does it take to create my first invoice with Invoice Maker – Invoice Fly?

A: The first invoice is typically ready in under two minutes. Just enter client details, choose a template, add items/services, set prices, and customize tax information. The app’s intuitive wizards guide you through each step, even if you’ve never created an invoice before.

Q: Can I create recurring invoices for regular clients or services?

A: Absolutely! The recurring invoices feature saves you time between projects. Set a template once and schedule automatic invoice generation on specific dates. This is perfect for subscription-based services or regular maintenance fees.

Q: What payment methods are supported for collecting money via invoices?

A: Invoice Maker – Invoice Fly integrates with popular gateways including PayPal, Stripe, and Square, plus local payment processors. You can also generate QR codes for cash transactions or set up automatic bank transfers for larger payments.

Q: Is my financial data secure when using the app’s cloud storage?

A: Yes, the app employs end-to-end encryption for data transmission and stores information on secure servers. They also offer local backup options and multi-factor authentication, giving you control over your financial information’s security.

Q: Can I track my expenses across multiple jobs or projects?

A: Definitely! The expense tracking system is designed to work across projects. When adding expenses, you can link them to specific jobs or clients, then generate detailed reports showing profitability for each venture.

Screenshots

|

|

|

|