|

|

| Rating: 3.9 | Downloads: 10,000,000+ |

| Category: Finance | Offer by: Internal Revenue Service |

IRS2Go offers a range of features designed to streamline tax management and communication with the IRS. From checking the status of tax refunds to making payments and receiving helpful tax tips, the app puts the power of tax management in the hands of taxpayers. With IRS2Go, individuals can stay on top of their tax obligations and make informed decisions, all from the convenience of their smartphones.

Features & Benefits

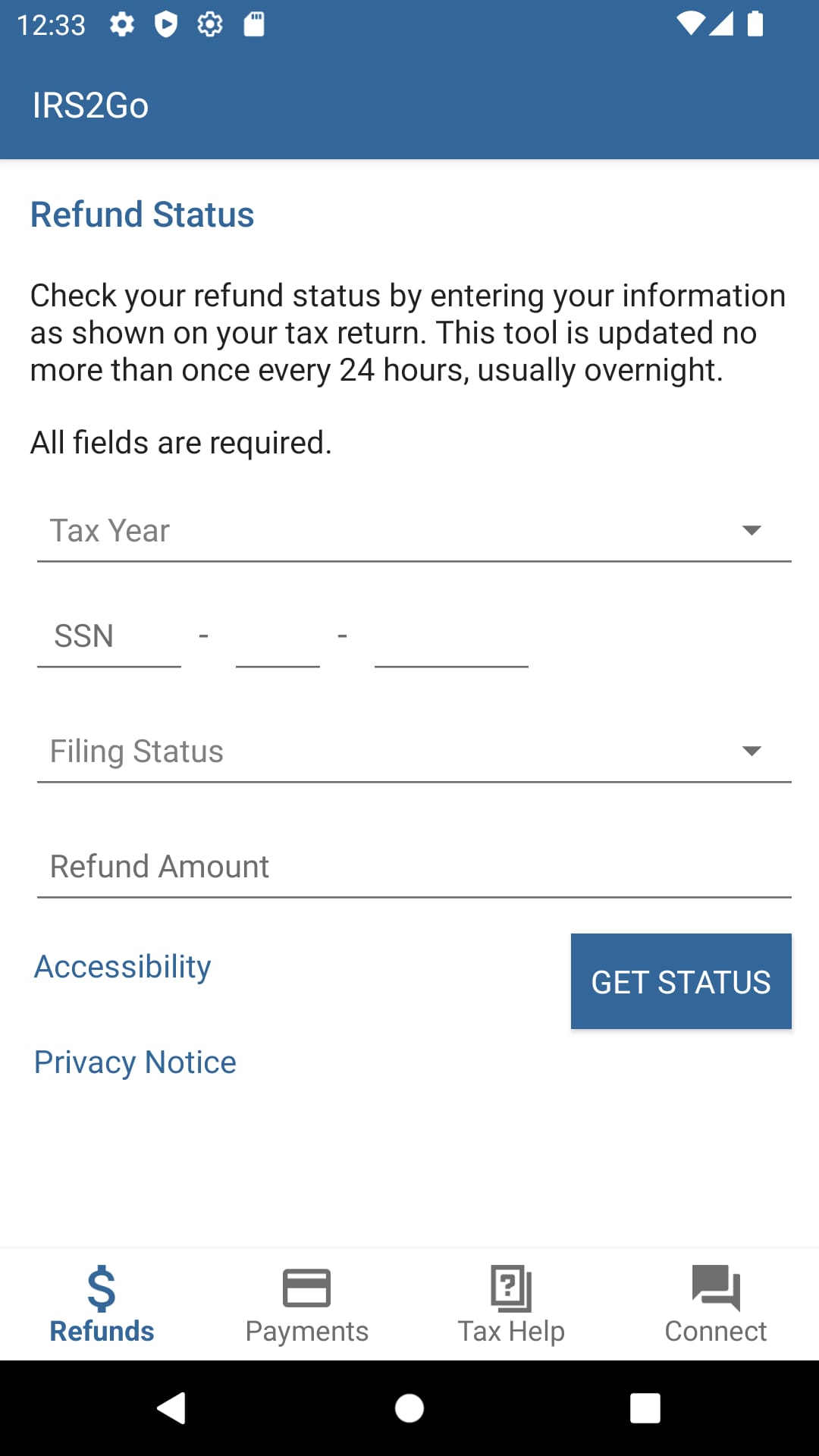

- Refund Status: One of the key features of IRS2Go is the ability to track the status of tax refunds. Users can enter their Social Security number, filing status, and the refund amount to get real-time updates on the progress of their refund. This feature provides peace of mind and helps taxpayers plan their finances accordingly, eliminating the need for frequent calls or visits to the IRS.

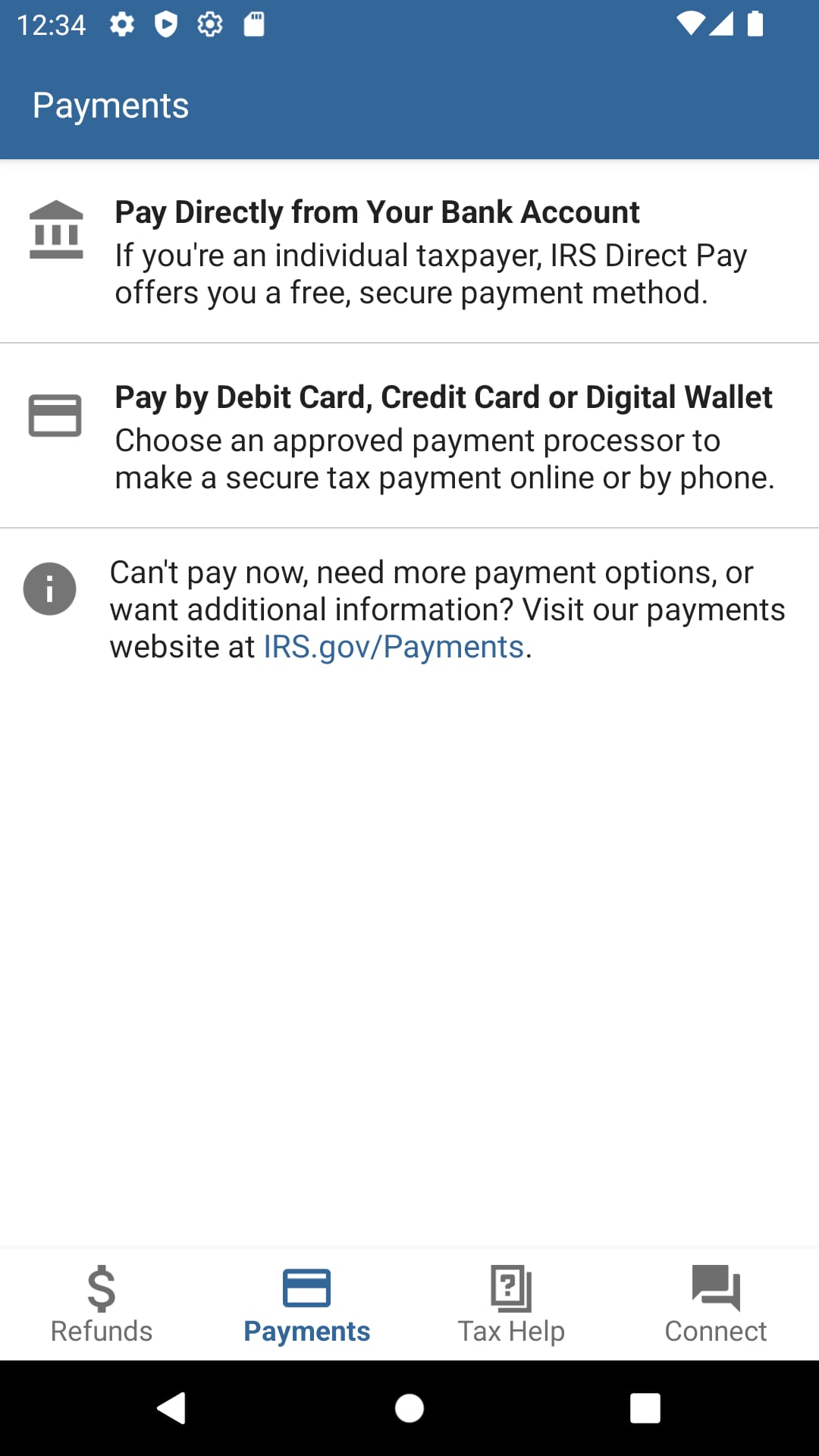

- Payment Options: IRS2Go offers multiple payment options for taxpayers. Users can make direct payments from their bank accounts or use a credit or debit card to pay their taxes securely. The app provides a seamless and convenient way to fulfill tax obligations, reducing the hassle of writing checks or visiting physical payment locations.

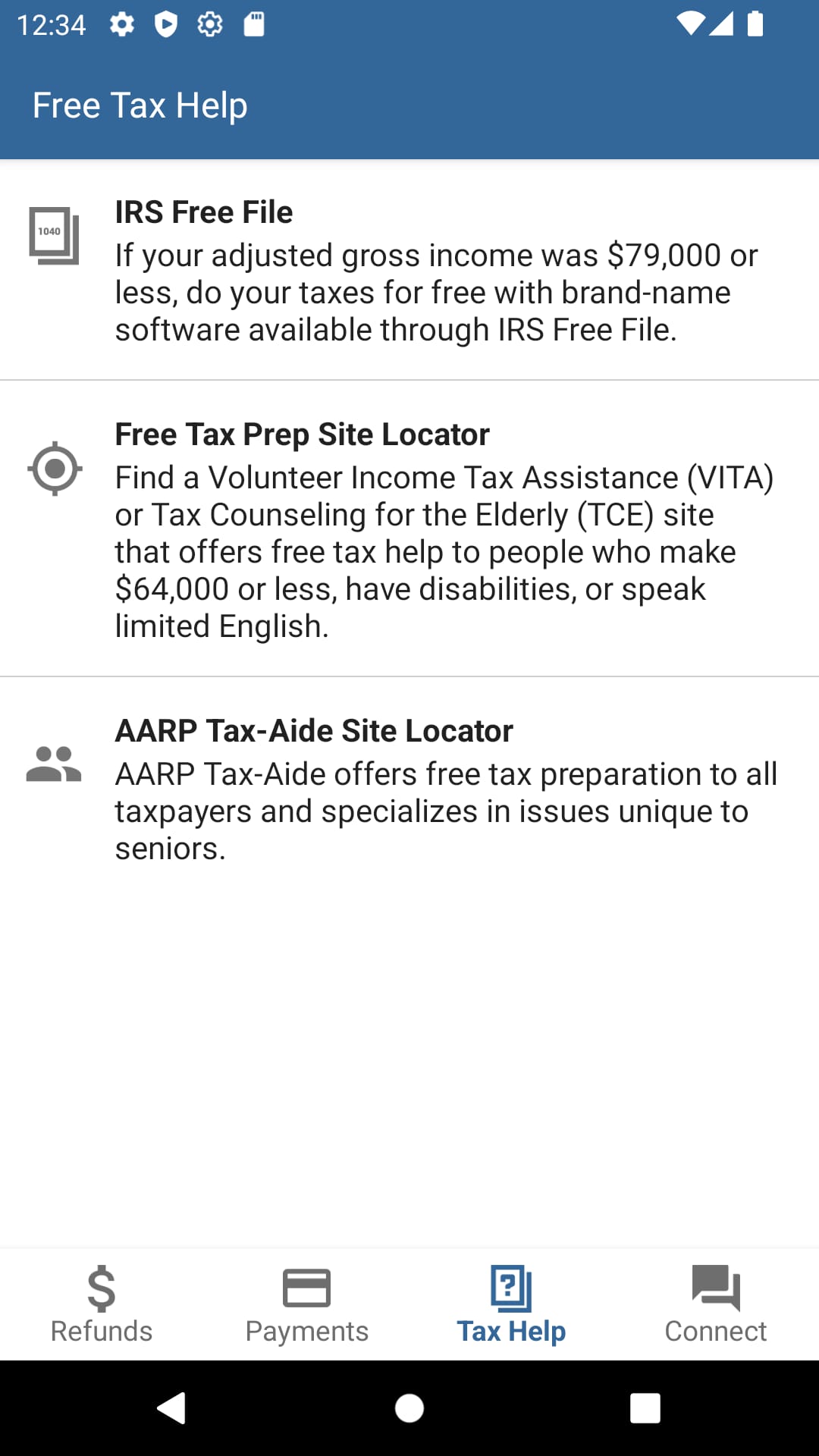

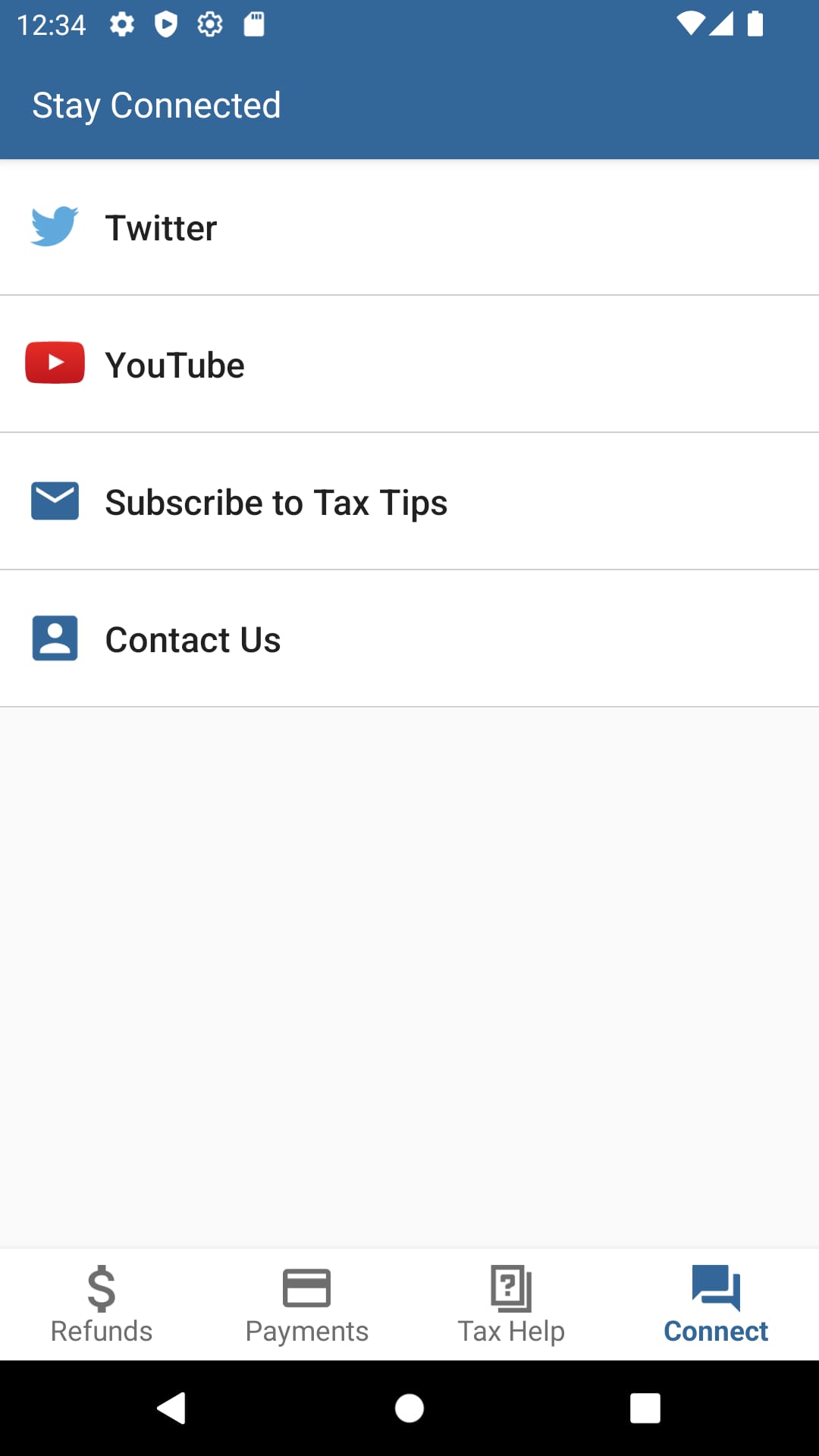

- Tax Tips and News: IRS2Go keeps taxpayers informed by providing access to a wealth of tax tips and news articles. These resources cover a wide range of topics, from tax deductions and credits to changes in tax laws and regulations. Users can stay up to date with the latest tax information, enabling them to make informed decisions and maximize their tax benefits.

- Get Transcript: With IRS2Go, users can request and receive tax return transcripts directly from their smartphones. This feature is particularly useful when applying for loans, financial aid, or other situations that require proof of income or tax filing history. The app streamlines the process, eliminating the need to wait for transcripts to arrive by mail.

- Taxpayer Assistance: IRS2Go provides access to various taxpayer assistance tools and resources. Users can find local IRS offices, schedule appointments with IRS representatives, and even get answers to frequently asked questions. This feature ensures that taxpayers have the support they need and can easily connect with the IRS for any additional assistance required.

Pros

- IRS2Go offers a user-friendly interface, making it easy for taxpayers to navigate and access the app’s features without any technical expertise.

- The ability to track tax refunds in real-time provides users with peace of mind and eliminates the need for time-consuming inquiries or visits to the IRS.

- Multiple payment options make it convenient for taxpayers to fulfill their tax obligations securely and efficiently.

- The tax tips and news section keeps users informed about important tax-related information, helping them make informed decisions and maximize their tax benefits.

- The app’s taxpayer assistance tools provide users with access to crucial resources and support, ensuring a smooth tax management experience.

Cons

- Some users have reported occasional technical glitches or slow loading times when using the app, which can be frustrating.

- The availability of certain features may vary depending on the individual’s specific tax situation or the IRS’s implementation of the app.

- While IRS2Go provides valuable information and resources, it may not replace the need for professional tax advice in complex tax situations.

Apps Like IRS2Go

- TurboTax: TurboTax is a popular tax preparation app that offers a step-by-step process for filing taxes. It provides users with a range of features, including the ability to import tax documents, maximize deductions, and file both federal and state taxes. TurboTax also offers a mobile app that allows users to track their refund status, access tax documents, and receive personalized tax advice.

- H&R Block Tax Prep and File: H&R Block’s mobile app provides users with a comprehensive tax preparation and filing experience. It offers features such as easy data import, personalized tax guidance, and the ability to file both federal and state taxes. The app also includes a refund tracker, tax calculators, and access to tax experts for additional assistance.

- TaxAct: TaxAct is another popular tax preparation app that offers a user-friendly interface and a range of features. Users can import tax documents, navigate through various tax forms, maximize deductions, and file both federal and state taxes. TaxAct also provides a mobile app that allows users to track their refund status, access tax resources, and receive support from tax professionals.

Screenshots

|

|

|

|

Conclusion

IRS2Go app brings convenience and efficiency to tax management by providing taxpayers with a range of features and resources. With its ability to track refund status, offer multiple payment options, provide tax tips and news, offer transcript requests, and facilitate taxpayer assistance, IRS2Go empowers individuals to stay informed and connected with the IRS. While occasional technical glitches and the need for professional tax advice in complex situations are drawbacks, the overall benefits make IRS2Go a valuable tool for simplifying tax management.