|

|

| Rating: 4.6 | Downloads: 10,000,000+ |

| Category: Finance | Offer by: KBZBANK.COM |

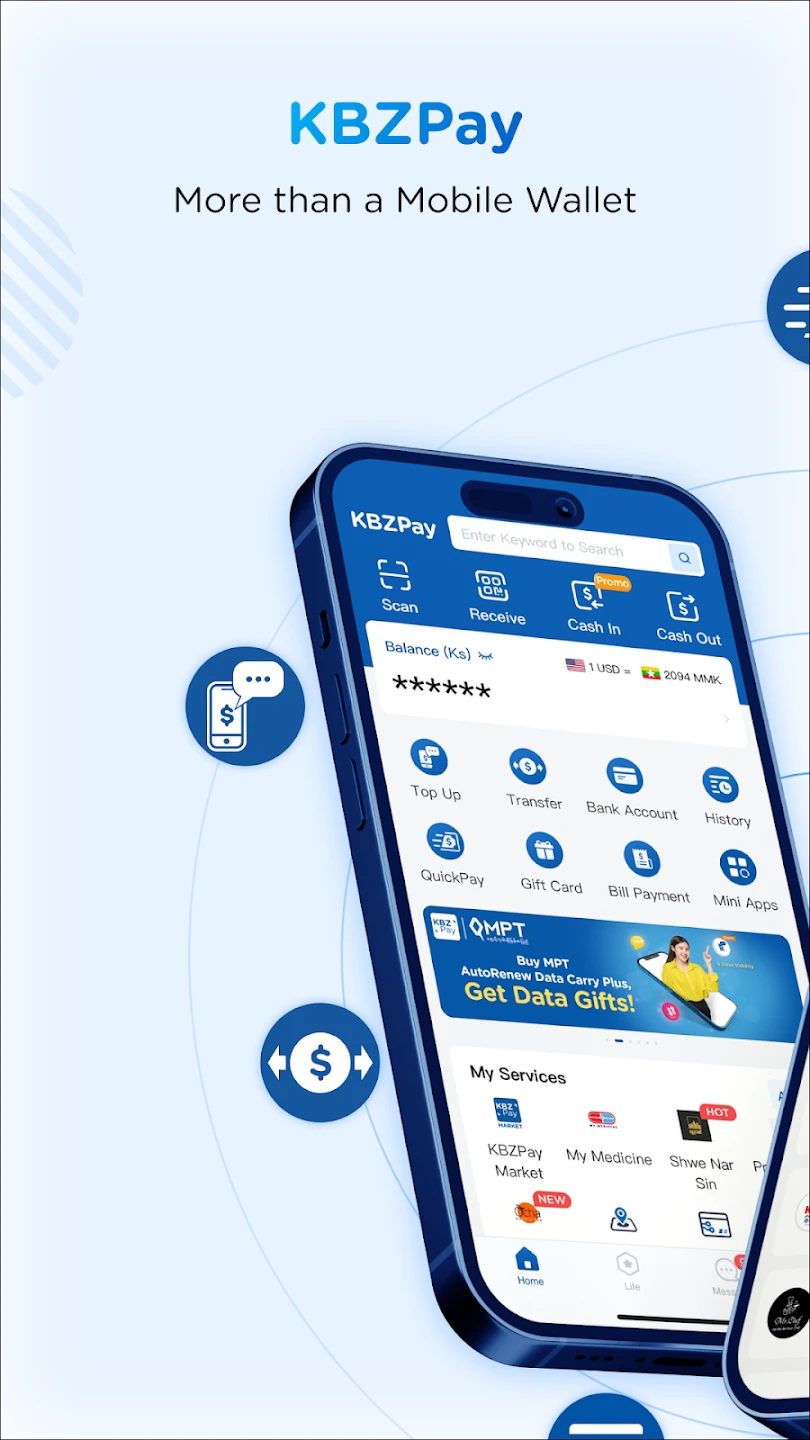

KBZPay is a digital financial services app developed and operated by KBZ Bank. It provides a comprehensive platform for users to manage their finances conveniently from their mobile devices, offering features like mobile banking, account management, and digital transactions primarily tailored for customers of KBZ Bank and the broader Myanmar market.

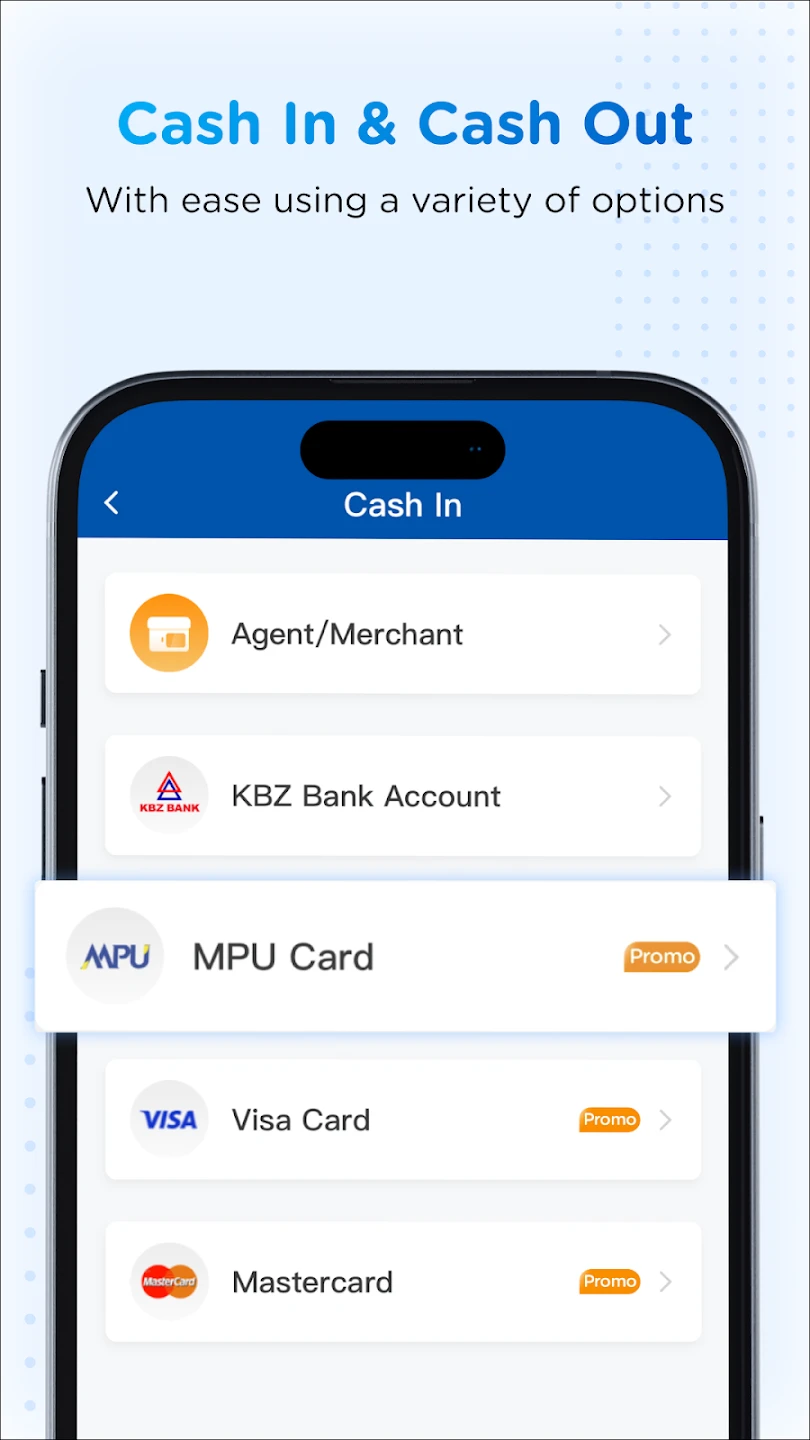

Available as a free mobile application, KBZPay enhances accessibility to essential financial services and everyday payments. It streamlines money management for individuals and small businesses, offering secure, fast, and potentially cost-effective ways to handle payments and build financial relationships, adding significant convenience to daily financial activities.

App Features

- Digital Account Management: Seamlessly view your account balances and transaction history, link multiple KBZ Bank accounts, and even manage your credit card details, consolidating your entire banking presence on one screen for quick reference and oversight.

- Instant Person-to-Person Money Transfer: Easily send funds securely using the recipient’s KBZPay username, MBFC number, or phone number; the process runs quickly without needing card details, making split-second payments effortless and ideal for quick family or friend transactions.

- Utility and Bill Payments: Simplify essential payments by covering utility bills (electricity, water, gas) or school fees with minimal clicks, offering a safe and necessity-driven use case for handling regular expenses directly through the capable accounts interface.

- KBZPay Insurance Services: Access affordable insurance options within the app, including popular coverage types like critical illness plans or income protection, directly addressing core user financial security needs in straightforward plans.

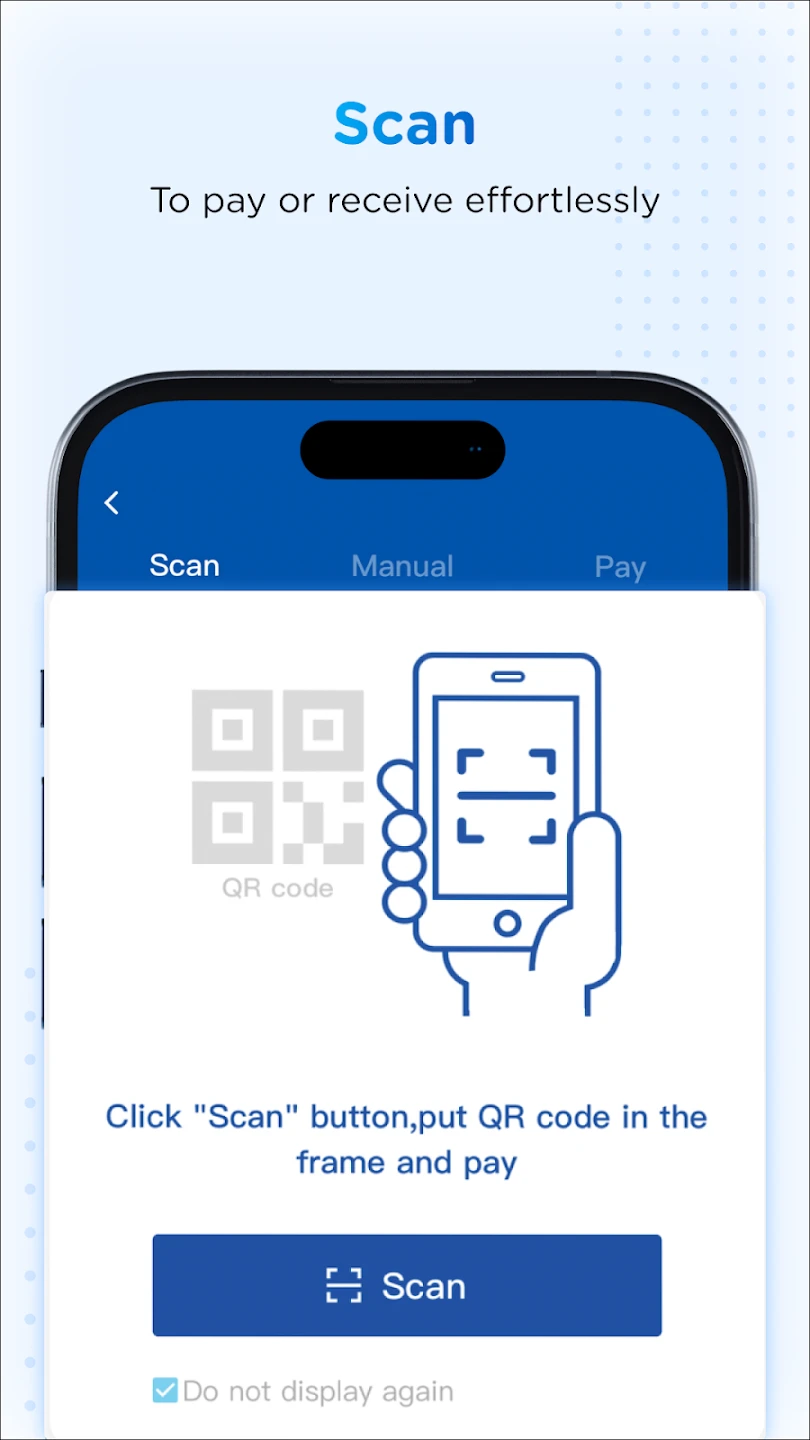

- Merchant Payments & Mini Programs: Conveniently pay for services provided by participating businesses like ride-hailing or food delivery directly via KBZPay, accessing convenient features such as easy insurance application processing. KBZPay has expanded its functionality to include various utility payments and potentially investment access.

- Investment Opportunities: Users can explore and invest in fixed-income products or FRR (Foreign Residual Rights) schemes offered through the app’s dedicated investment section, providing a mobile platform for secure portfolio management and fostering long-term financial growth.

Pros & Cons

Pros:

- Incredibly user-friendly with an intuitive interface.

- Works seamlessly as a primary banking tool.

- Excellent value for offering such diverse features for free.

- Highly secure platform with convenient login options.

Cons:

- Offline capabilities for accounts are quite limited.

- Interface elements might feel somewhat dated compared to newer apps.

- User support channels are primarily online and asynchronous.

- Functionality and available features can vary based on regional deployment.

Similar Apps

| App Name | Highlights |

|---|---|

| Mirae Asset Global Shares (Myanmar) |

A comprehensive platform covering account management, remittances, utility payments, MiNT asset management, and popular KBZPay insurance, offering competitive financial solutions for everyday banking needs in Myanmar. |

| Shan P variety |

Facilitates quick and secure money transfers between accounts and provides digital access to some utility payment services, though its feature set and promotion model differ slightly from KBZPay. |

| Rabbit Pay (Shopee) |

Built primarily as a digital wallet for online shopping via Shopee’s platform but facilitates on-platform payments, OMNY-like NFC payments in some stores, and offers basic financial account services tailored towards e-commerce users. |

Frequently Asked Questions

Q: Can I download KBZPay on my older smartphone?

A: Yes, KBZPay requires a compatible device, and typically supports devices from around 4 years ago. During the setup process, the app will check your phone model and operating system version for compatibility, guiding you if your specific device isn’t supported.

Q: Is my information safe with KBZPay?

A: Absolutely. KBZPay implements robust security measures including encryption and secure login protocols, such as the simple pin or NCC pin, to safeguard your data and ensure that your transactions and personal information remain protected consistently.

Q: What are the standard monthly transaction limits for free users?

A: Each user’s transaction limits (for transfers, payments, topping up the main account) have limits dictated by verified identity checks during registration. Limits are usually quite reasonable by default, designed to facilitate everyday use, but higher limits can typically be arranged upon request.

Q: Can I receive KBZPay Cash without an account?

A: Yes, you can absolutely receive funds instantly without needing an active account. Any payments sent to your username, MBFC number, or phone number land directly into your KBZPay Cash balance, ready for use whenever you want.

Q: Are international bank transfers possible via KBZPay?

A: Currently, KBZPay primarily supports domestic transactions within Myanmar using KBZ Bank accounts and MBFC numbers; cross-border or international money transfer capabilities are not currently featured in the standard app version.

Screenshots

|

|

|

|