|

|

| Rating: 4.8 | Downloads: 1,000,000+ |

| Category: Finance | Offer by: Kikoff, Inc. |

Kikoff – Build Credit Quickly is a financial application designed to assist users in establishing and improving their creditworthiness through responsible lending practices. This app provides guidance and access to financial products aimed at building a positive credit history, particularly for individuals new to the financial system or those with limited credit history.

The key value of Kikoff – Build Credit Quickly lies in its focus on accessible financial tools, helping users understand credit fundamentals and secure loans that can positively impact their financial journey. Its appeal is for anyone seeking a straightforward path to credit enhancement, offering support through the process of credit building.

App Features

- Credit Building Education: The app offers foundational knowledge on credit scores, reports, and responsible borrowing habits, empowering users with the information needed to make informed financial decisions. This feature acts as a learning tool, helping users understand the factors that influence creditworthiness.

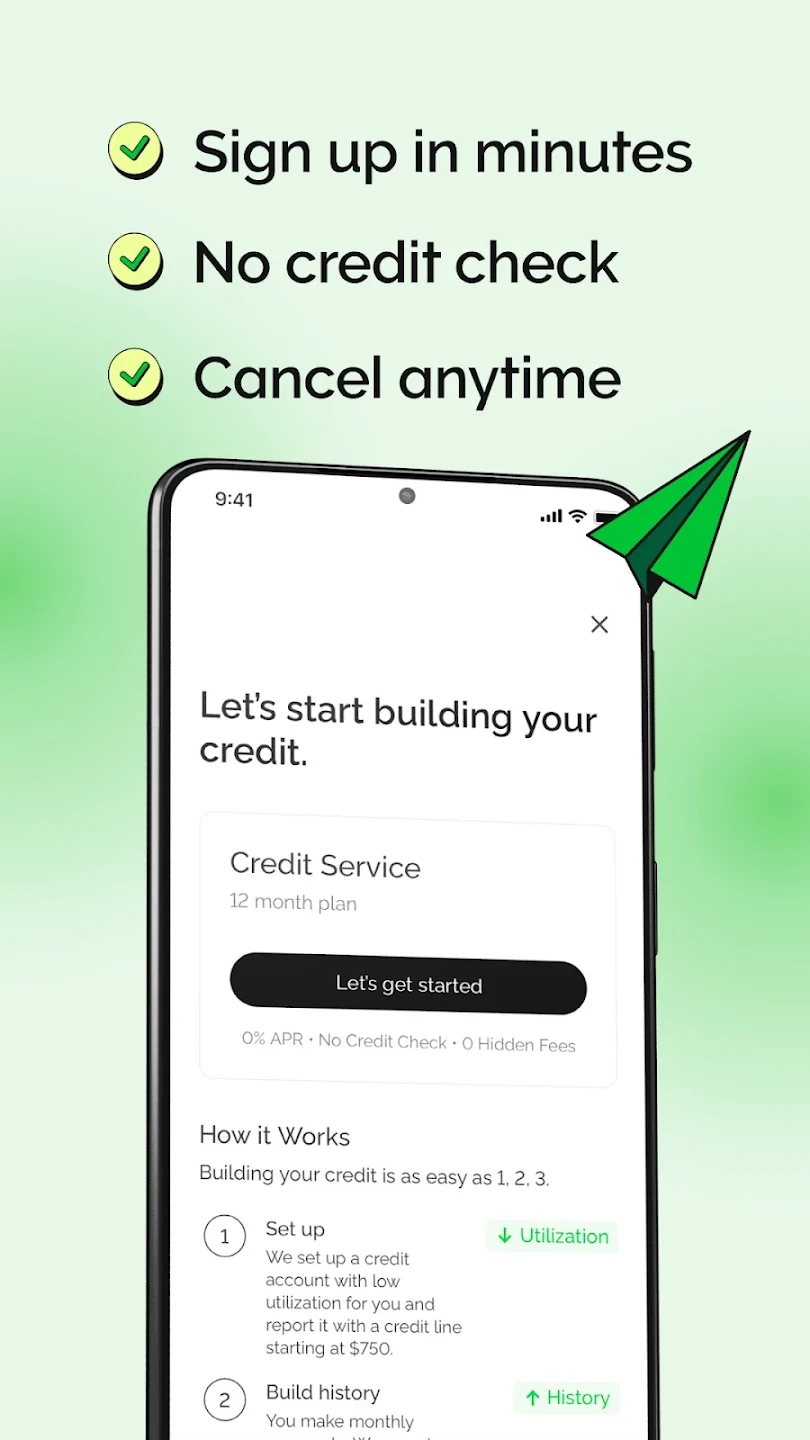

- Dedicated Application Process: Kikoff simplifies the application procedure for suitable credit-building loans, guiding users through each step with clear instructions and minimal paperwork. This streamlined approach saves time and reduces the complexity often associated with traditional financial institutions.

- Creditworthiness Assessment: Before connecting users with loan options, the app performs a preliminary check of their credit history, providing insights into their potential eligibility and areas for improvement. Understanding this initial evaluation helps users prepare or take steps to strengthen their credit profile.

- Responsible Lending Partnerships: Kikoff collaborates exclusively with financial institutions known for ethical lending practices, ensuring that users receive fair terms and support throughout their loan tenure. This focus on partner selection offers peace of mind regarding the reliability of the financial products offered.

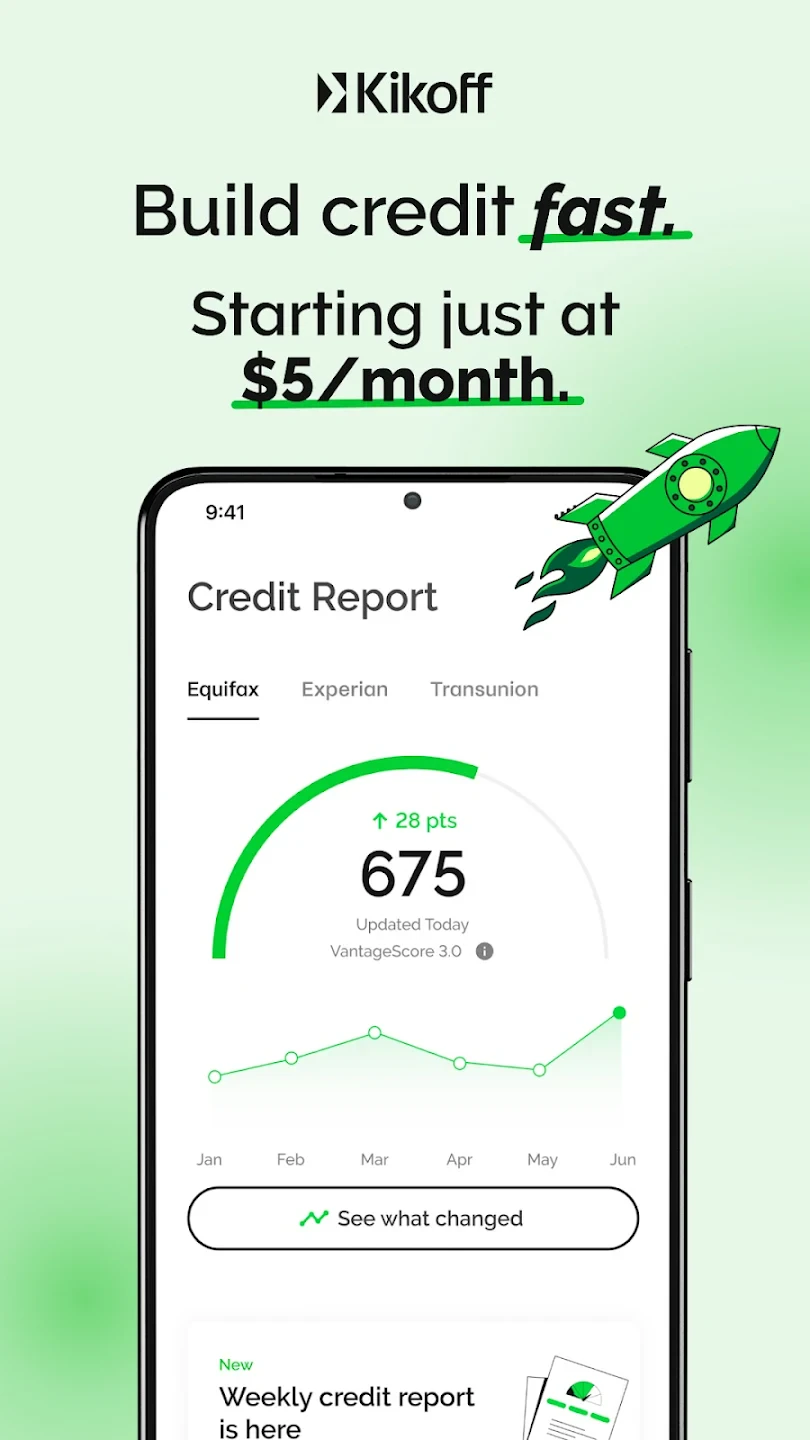

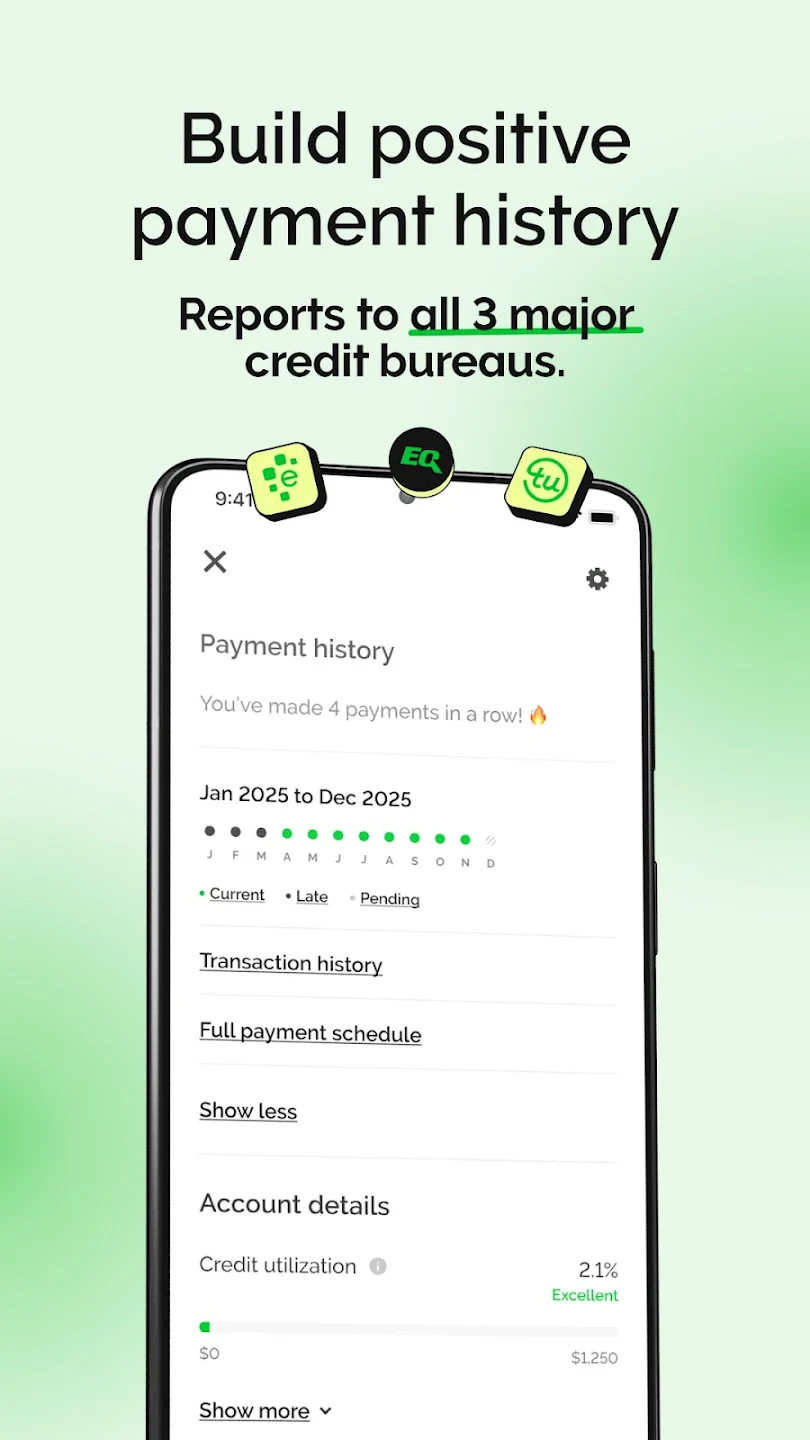

- Progress Tracking: Users can monitor their journey, seeing updates on their loan status and tracking the positive impact these financial interactions have on their overall credit history and score over time. This tracking feature provides motivation by clearly showing progress towards their credit building goals.

- Financial Guidance Resources: Beyond loan offers, the app provides supplementary information and tools on managing finances, debt reduction strategies, and long-term credit management best practices. These resources are invaluable for users committed to financial stability beyond just quick credit solutions.

Pros & Cons

Pros:

- Quick Access to Suitable Loans

- User-Friendly Guidance

- Focus on Building Good Credit Habits

- Simple Application Experience

Cons:

- Loan Options Primarily Tailored for Credit Building

- Interest Rates Potentially Higher Than Standard Lending

- Eligibility May Be Strict for Very Limited Histories

- Dependence on Partner Financial Institutions’ Criteria

Similar Apps

| App Name | Highlights |

|---|---|

| Loan Guru |

This app offers fast processing, intuitive design, and wide compatibility. Known for custom workflows and multi-language support. |

| Finance Path |

Designed for simplicity and mobile-first usability. Includes guided steps and real-time previews. |

| Credit Launch |

Offers AI-powered automation, advanced export options, and collaboration tools ideal for teams. |

Frequently Asked Questions

Q: How quickly can I expect the Kikoff – Build Credit Quickly loan application process to be completed?

A: Many users find the process relatively fast, often completed within a few business days, depending on the specific product and their individual circumstances. Kikoff aims to streamline the procedure, but lender review remains a key step.

Q: Can Kikoff help someone with no credit history at all build credit?

A: Yes, that is a primary target audience for Kikoff. They focus on responsible lending and guidance for individuals establishing or rebuilding credit, often starting with products designed for limited histories.

Q: What kind of information or guidance does Kikoff offer besides loans?

A: Kikoff provides foundational knowledge on credit scores, reports, responsible borrowing, and offers tools to track progress on their credit-building journey.

Q: Are the interest rates on Kikoff’s credit-building loans clearly stated upfront?

A: Yes, Kikoff is committed to transparency and clearly displays all associated costs, including interest rates and fees, before you proceed with any loan commitment.

Q: Is there a cost to start using the Kikoff – Build Credit Quickly app itself, or are the loan products paid for separately?

A: The basic Kikoff app usage is typically free, allowing exploration of features and education. However, loan products require separate acceptance and funding.

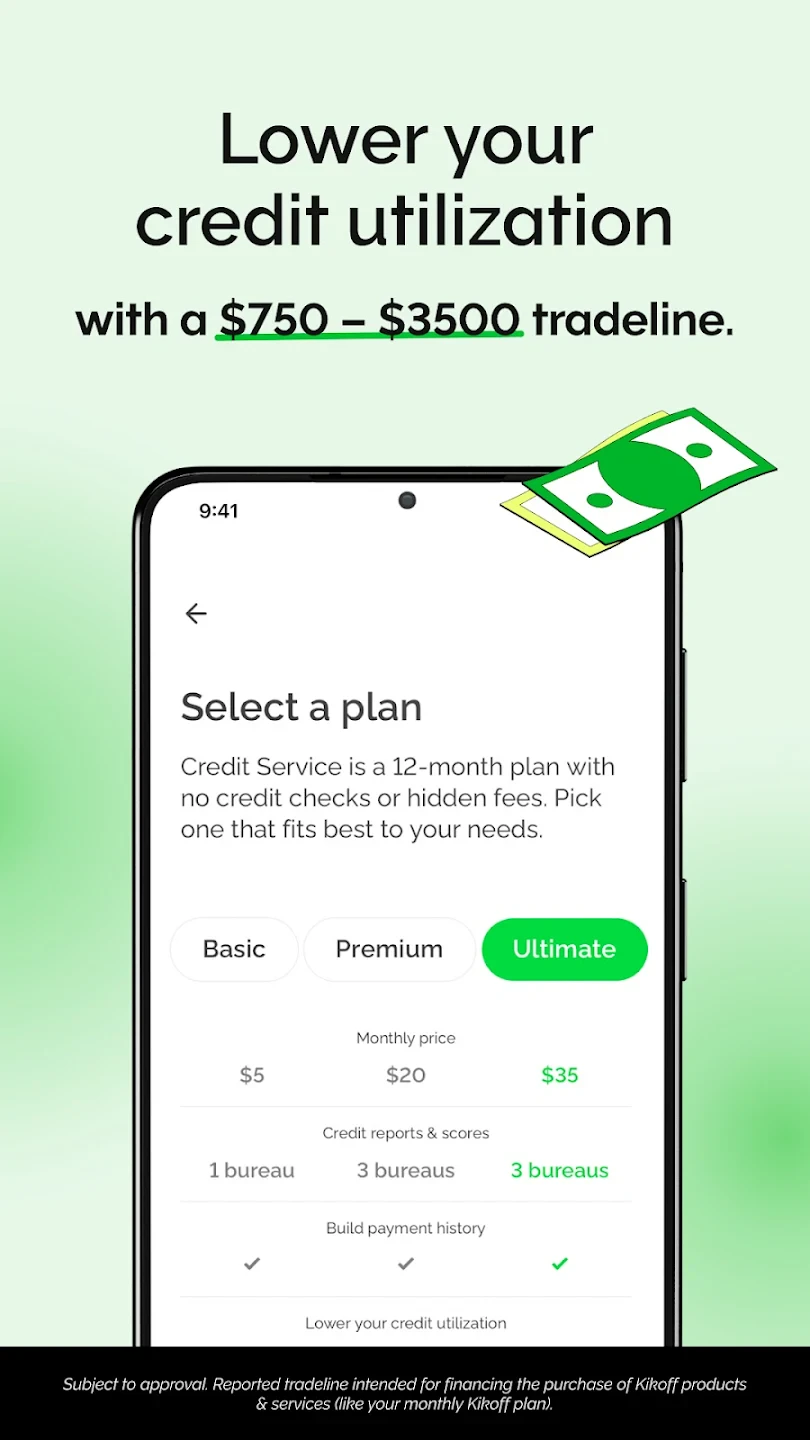

Screenshots

|

|

|

|