|

|

| Rating: 4.9 | Downloads: 50,000,000+ |

| Category: Shopping | Offer by: Klarna Bank AB (publ) |

Here is the HTML content:

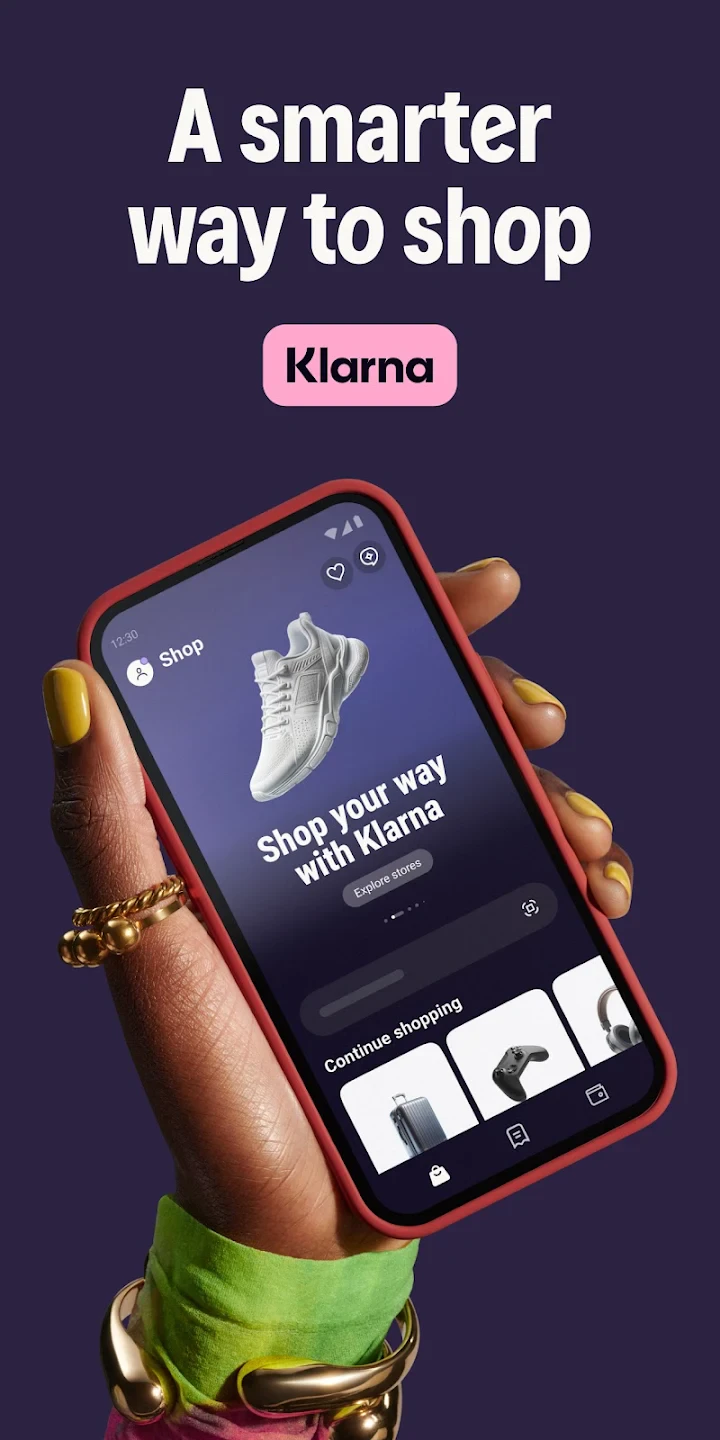

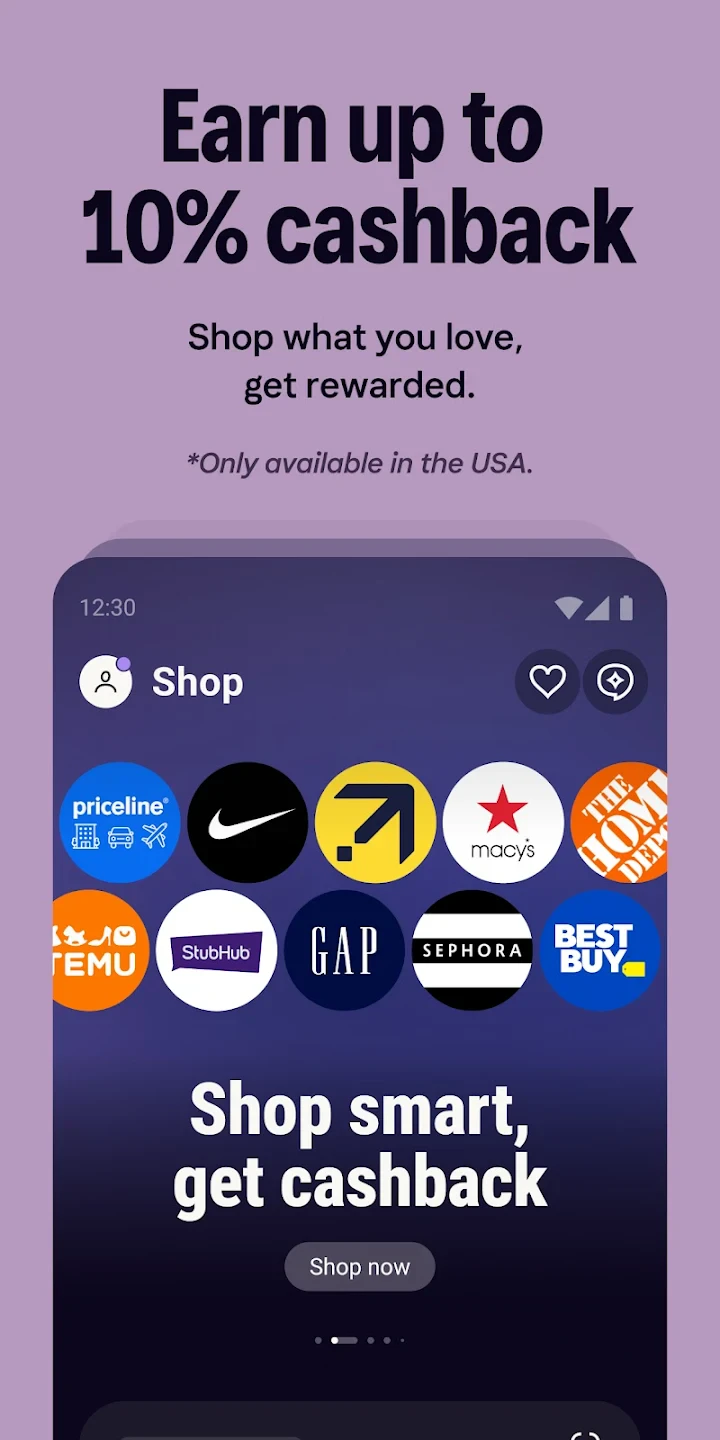

Klarna | Shop now. Pay later. is a financial services application that enables users to purchase items online with the option to delay payment, typically for 30 days. This app integrates with numerous retail platforms, allowing customers to shop across thousands of partner stores while benefiting from Klarna’s secure payment processing system.

Its core appeal lies in offering flexible payment solutions that fit various budgets and shopping behaviors, making it ideal for spontaneous online purchases or those seeking better cash flow management. Users appreciate the convenience of deferred payments without immediate impact on traditional credit scores, simplifying the e-commerce experience.

App Features

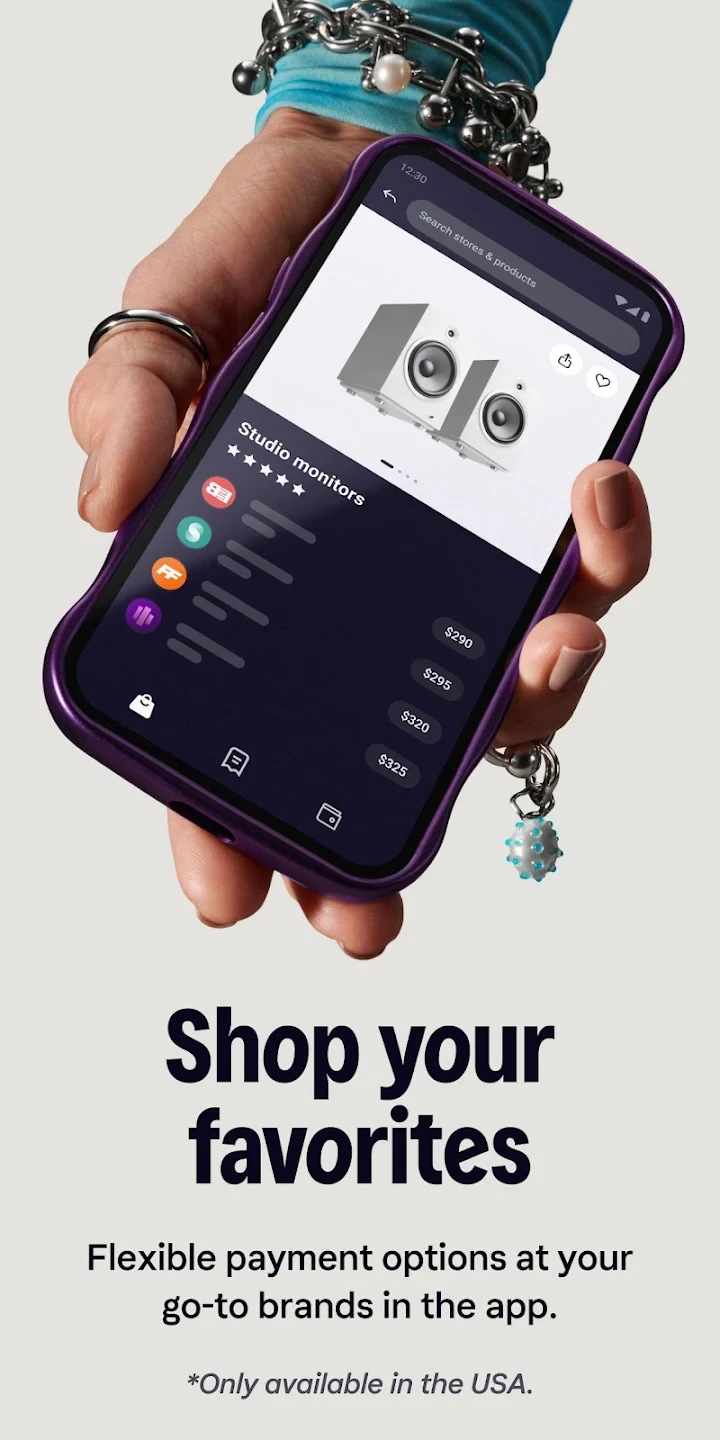

- Delayed Payment Options: Choose from 30-day, 45-day, or 60-day payment plans depending on the purchase, allowing you to shop and pay later without interest until the due date. This flexibility helps manage finances better and caters to different purchase timelines.

- Multi-Seller Platform Integration: Seamlessly connects with thousands of popular retailers globally, enabling users to make purchases on any partner site with just one click. This feature simplifies online shopping across various platforms while maintaining Klarna’s secure checkout environment.

- Simplistic Checkout Flow: Experience minimal friction during checkout with pre-filled payment details when returning to Klarna or using saved information. It eliminates redundant data entry, saving valuable time during frequent online purchases.

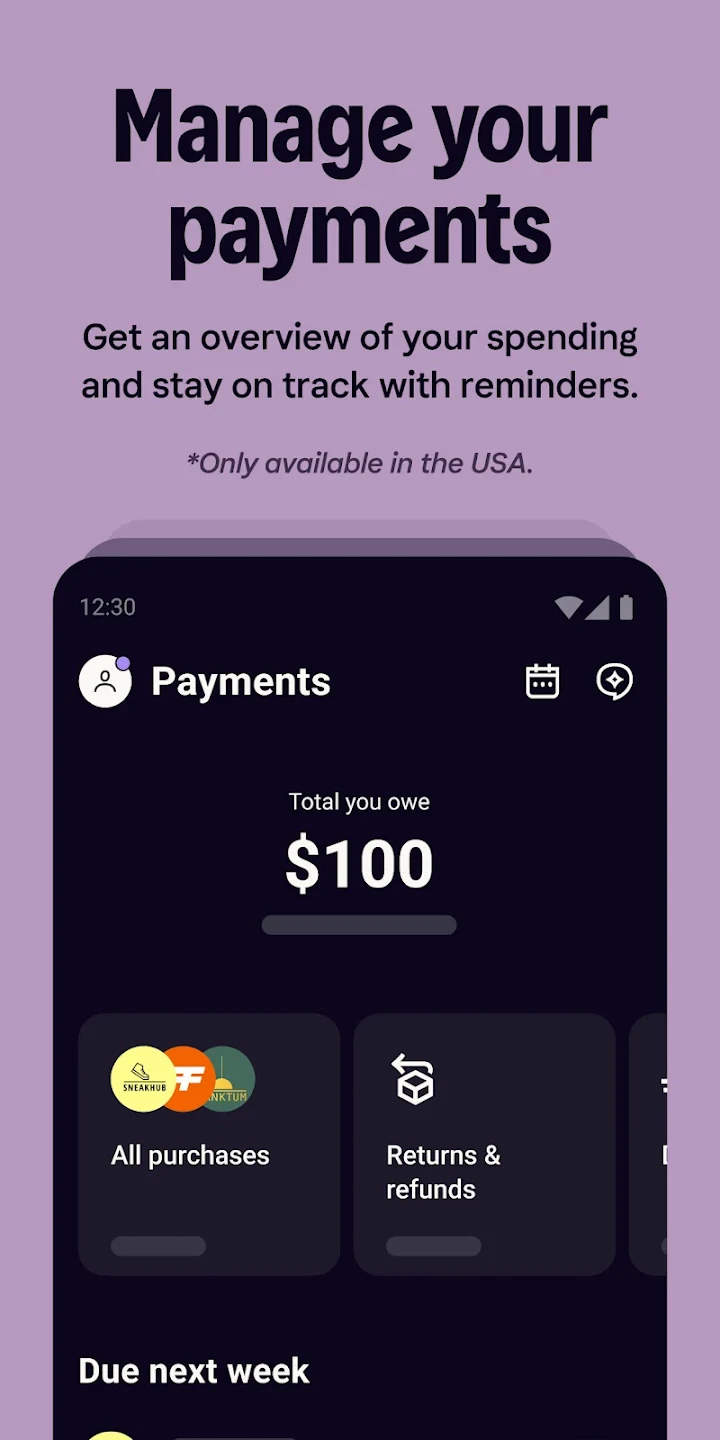

- Payment Calendar & Reminders: Receive automated notifications about upcoming payment due dates and transaction history, helping users stay organized financially. These timely alerts prevent missed payments and associated fees.

- Interest-Free Options: Access truly interest-free payment plans for eligible purchases, avoiding finance charges common with other credit solutions. This benefit provides cost savings compared to standard credit cards while still offering deferred payment convenience.

- Spending Control Dashboard: View a comprehensive breakdown of your purchase history, current obligations, and repayment status in one centralized location, offering financial clarity and control over your spending.

Pros & Cons

Pros:

- No Interest on Many Plans

- Extensive Retailer Network

- Minimal Checkout Hassle

- Credit Score Protection

- Transparent Fee Structure

Cons:

- Eligibility Requirements

- Interest Charges on Some Plans

- Regional Availability Restrictions

- Account Linking Requirements

Similar Apps

| App Name | Highlights |

|---|---|

| Afterpay |

This peer-to-Klarna service offers same-day purchase installment plans with minimal eligibility checks, known for its simple “buy now, pay later” interface across many retailers. |

| Square |

Known for comprehensive POS solutions with integrated Buy Now, Pay Later features, providing small businesses flexible payment options for customer transactions. |

| PayPal Credit |

Offers interest-free financing options with a familiar brand presence, integrated deeply into online and mobile shopping experiences globally. |

Frequently Asked Questions

Q: What is the typical payment timeline for Klarna | Shop now. Pay later. plans?

A: Klarna’s standard deferred payment options typically include a 30-day interest-free window. Some retailers offer extensions to 45-day or even 60-day plans depending on the purchase, but interest may apply if you delay payments beyond the specified terms.

Q: Is there a credit check required for using Klarna?

A: Klarna performs eligibility checks based on your purchase amount and potentially your payment history. However, these assessments are generally less intrusive than traditional credit card checks, and many users can access basic features without formal credit verification.

Q: What happens if I miss a payment?

A: A missed payment might incur a small fee and could affect your Klarna score. Repeated issues might limit your access to better payment terms or interest-free options in the future. It’s designed to be helpful, not punitive, so addressing payment reminders promptly is key.

Q: How does saving money work within Klarna | Shop now. Pay later.?

A: Klarna allows users to set up automatic transfers from their bank account to save funds specifically for upcoming payments or purchases. These savings are interest-free, helping you budget effectively without losing potential interest from other accounts.

Q: Is Klarna available outside my home country?

A: Klarna operates in many countries across Europe, North America, and select international platforms. Availability depends on your location and the retailer you’re using. You can typically find a list of supported countries in the app or on Klarna’s global website for the most up-to-date information.

Screenshots

|

|

|

|