|

|

| Rating: 4.6 | Downloads: 1,000,000+ |

| Category: Finance | Offer by: Bambu |

MyBambu – Better than Banking is a modern mobile financial application designed to simplify personal banking through intuitive tools and enhanced features. It offers comprehensive account management, budgeting assistance, and seamless money transfers, catering primarily to individuals seeking greater control over their finances in a user-friendly format.

This innovative platform provides users with real-time insights and automated saving features, making financial tasks more efficient and accessible. Whether managing daily spending or planning long-term goals, MyBambu helps users take charge of their money with advanced tools designed for everyday financial wellness.

App Features

- Digital Dashboard with Real-Time Analytics: Instantly access your financial snapshot through a customizable dashboard that highlights balances, spending patterns, and savings progress. This feature eliminates guesswork by providing clear visual representations of your financial health, helping you spot trends and make informed decisions.

- Smart Budget Builder: Automatically categorizes transactions and allows users to set personalized spending limits across different expense categories. Advanced algorithms learn your spending habits to suggest realistic budgets and send proactive alerts before you exceed your limits, promoting healthier financial habits.

- Automated Savings Goals: Set specific targets like “Emergency Fund” or “Vacation Fund” and watch money accumulate automatically or in scheduled installments. The app creates visual progress bars for each goal, turning saving into an engaging game rather than a chore, with features like “round-up savings” where spare change is automatically directed to savings.

- Seamless Money Transfers: Send money instantly to friends, family, or colleagues with minimal input required—no need for recipient details or account numbers. Quick pay functionality allows sending just $5 or whatever small amount you need without typing full amounts, while scheduled transfers ensure bills are paid on time.

- Integrated Investment Tools: Roll over surplus funds into diversified portfolios with minimal risk, offering automated investing options for those new to the stock market, along with detailed performance tracking for more experienced users. This unique feature bridges traditional banking with investment platforms, providing accessible wealth-building tools directly in your banking app.

- Advanced Security Protocols: Two-factor authentication, biometric login options, and transaction encryption work in the background to keep your financial data secure—so you never need to worry about your information while enjoying the convenience of the app. Continuous monitoring flags suspicious activity, giving you peace of mind with constant protection.

Pros & Cons

Pros:

- Comprehensive financial management suite

- Intuitive user interface

- Advanced budgeting tools

- Robust security features

Cons:

- Premium subscription required for full investment tools

- Occasional sync delays with external accounts

- No physical branch support available

- Higher account minimums for certain features

Similar Apps

| App Name | Highlights |

|---|---|

| Chime Banking+ |

Focuses on instant deposits and fee-free ATMs, known for its “instant transfers” and no overdraft fees structure. |

| YNAB (You Need A Budget) |

Dedicated personal finance management with a unique “zero-based budget” philosophy and detailed expense tracking. |

| Acorns Invest |

Specializes in micro-investing and round-up savings, with features like “spending score” and AI investment guidance. |

Frequently Asked Questions

Q: Can I use MyBambu – Better than Banking internationally?

A: Yes, you can use the app globally, but account features may vary slightly by region due to local banking regulations. International transfers require additional documentation for compliance purposes.

Q: How are my finances kept secure within the app?

A: We employ bank-grade encryption, multi-factor authentication, and continuous AI monitoring for suspicious activity. Your transactions are protected by military-grade security protocols.

Q: Are there any hidden fees associated with budgeting tools?

A: The free version provides basic tools—our premium features include optional budgeting templates and personalized financial coaching. No subscription is required to use our core financial management features.

Q: What happens if I miss a bill payment deadline?

A: The system automatically generates reminders 5 days before due dates, integrates with common billing providers for automated payments, and provides a grace period with no penalties. We also offer payment scheduling tools to help prevent missed payments.

Q: Can I transfer money between my MyBambu accounts and external bank accounts without fees?

A: Yes, we support free ACH transfers between our internal accounts, but standard $15-30 third-party transfer fees apply when connecting to external financial institutions. International transfers have separate fee schedules.

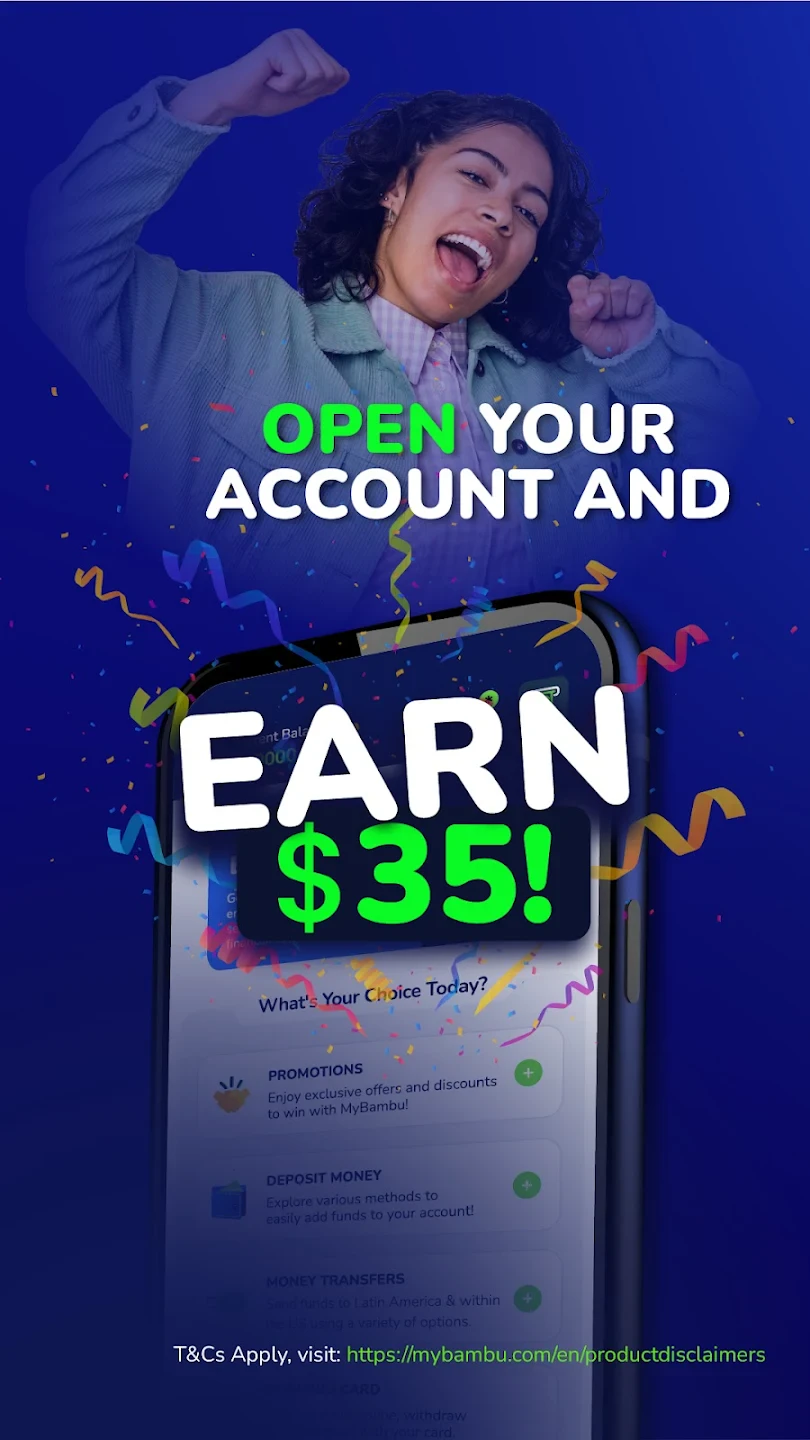

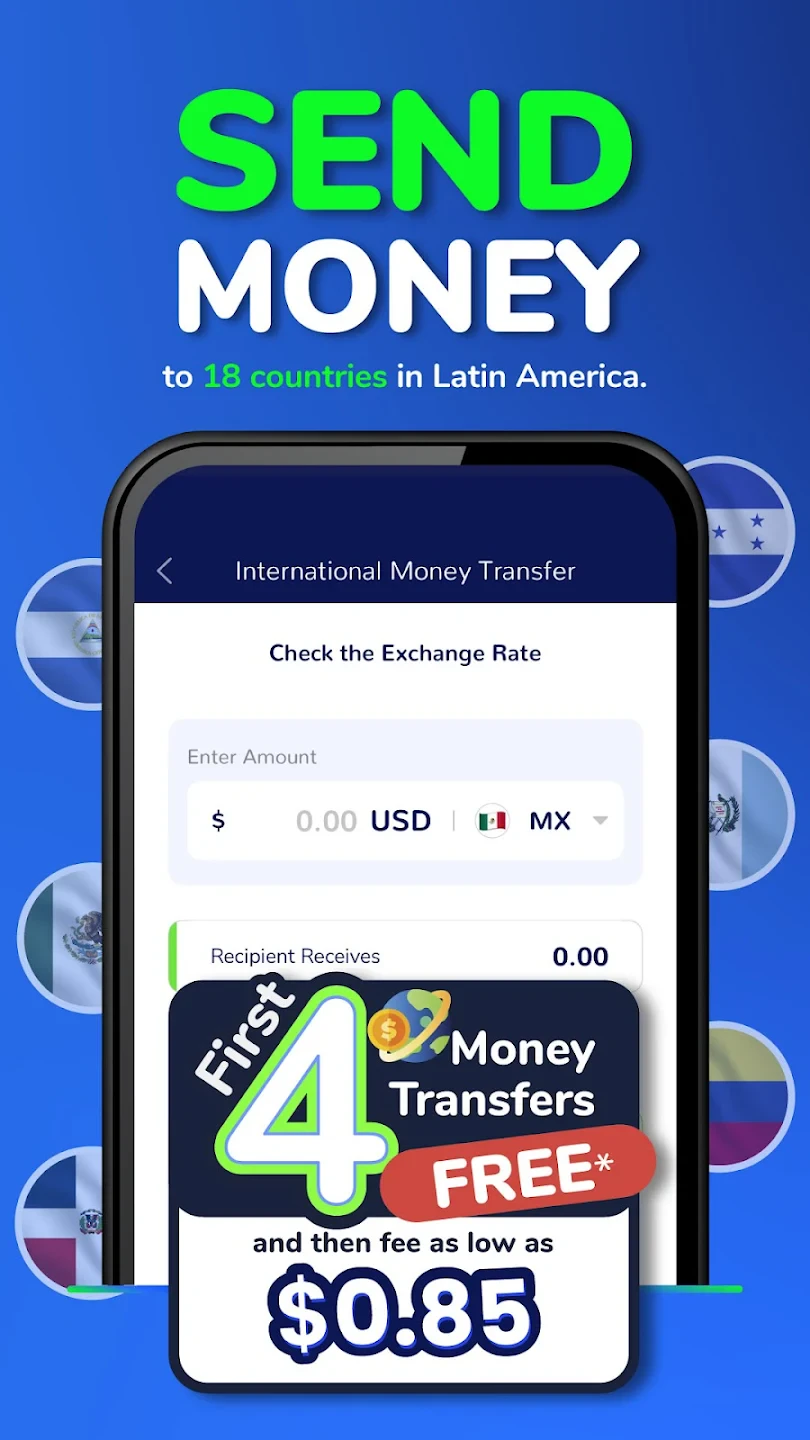

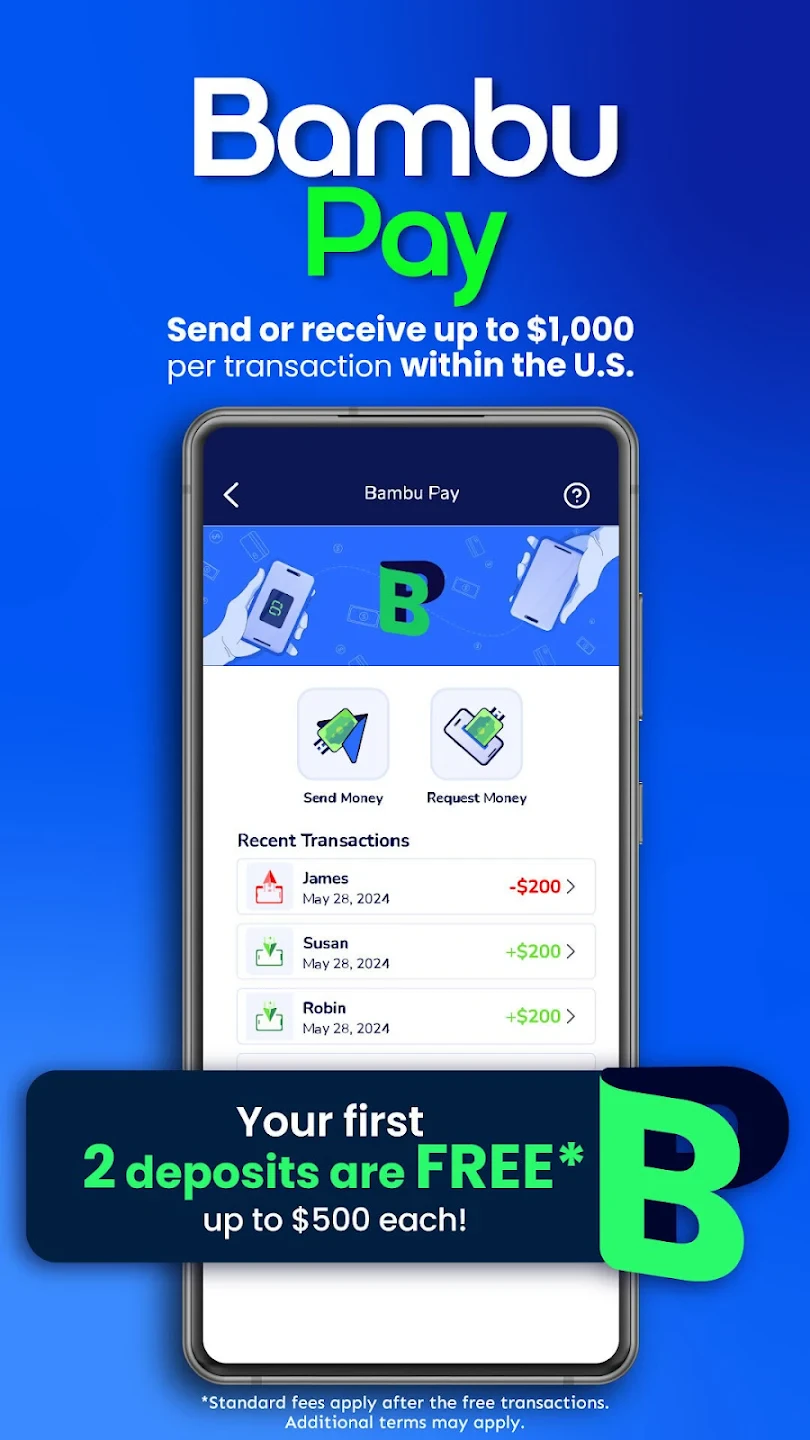

Screenshots

|

|

|

|