|

|

| Rating: 4.4 | Downloads: 1,000,000+ |

| Category: Finance | Offer by: FICO |

myFICO: FICO Credit Check is a dedicated application that empowers users by providing FICO credit scores and detailed reports directly. It enables individuals, ranging from aspiring borrowers to established homeowners, to monitor their credit health, understand their score components, and track progress over time, specifically through the lens of the FICO scoring model.

This app offers practical usage in financial decision-making, from securing favorable loan terms or credit cards to quickly assessing the creditworthiness needed for significant purchases or refinancing opportunities. Its key value lies in offering transparency and actionable insights into one’s credit profile, using the widely recognized FICO score benchmark.

App Features

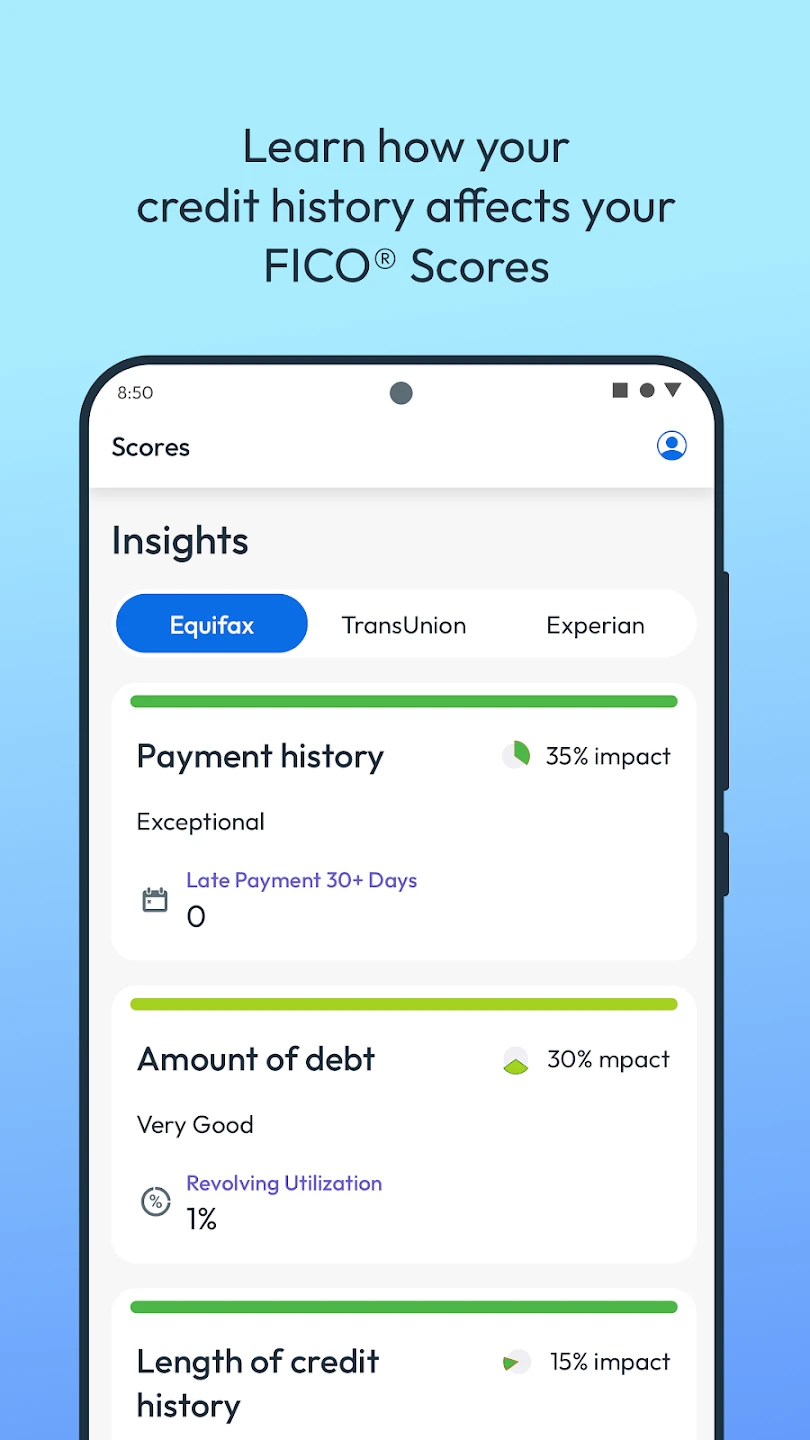

- FICO Score Monitoring: View your FICO credit score and track changes over time with regular updates. This feature helps you stay informed about your financial standing, allowing you to make timely adjustments if your score deviates unexpectedly.

- TransUnion Credit Report Access: Get detailed insights into your TransUnion credit history, including inquiries, accounts, and public records. This detailed view helps users pinpoint specific factors influencing their FICO score and address inaccuracies directly.

- Credit Summary & Analysis: Understand the factors contributing to your FICO score and receive personalized recommendations for improvement. The analysis simplifies complex data, highlighting areas like payment history or credit utilization that most impact your score using FICO scoring parameters.

- Free Score Check: Easily verify your FICO score for a limited period, often free, to gauge your current creditworthiness before applying for major loans or credit cards. This quick check saves time and provides a benchmark before committing to more extensive applications.

- Credit Score Notifications: Receive alerts for significant changes or drops in your FICO score, helping you stay proactive about potential risks or positive shifts. These timely notifications can prompt users to investigate late payments or fraud more quickly.

- FICO Score Explanation: Gain clarity on how FICO calculates and interprets scores, demystifying the process and explaining the nuances of the FICO scoring model. This feature educates users on the specific criteria used, empowering them with detailed financial knowledge beyond just the numerical score.

Pros & Cons

Pros:

- Focus on Widely Used FICO Score

- Access to TransUnion Data

- Comprehensive Analysis Tools

- Score Monitoring Features

Cons:

- Potentially Higher Costs for Premium Features

- Limited Free Access Period

- Dependence on TransUnion Data

- Score Updates May Require Subscription

Similar Apps

| App Name | Highlights |

|---|---|

| Experian |

This app offers access to Experian credit information, including credit reports, score tracking, and identity theft services, providing a different bureau perspective alongside FICO. |

| Credit Karma |

Designed for simplicity and mobile-first usability |

| Mint by Intuit |

Often includes basic free credit monitoring and score access alongside budgeting tools, offering integrated money management but potentially less FICO-specific analysis than dedicated apps. |

Frequently Asked Questions

Q: How often will myFICO update my FICO score?

A:

Q: Why is my credit score different from other sources? Is the myFICO app reliable?

A:

Q: Can I get a free FICO score without subscribing to myFICO?

A:

Q: How do I dispute inaccurate information on my TransUnion report via myFICO?

A:

Q: Is myFICO available on my mobile device?

A:

Screenshots

|

|

|

|