|

|

| Rating: 4.2 | Downloads: 1,000,000+ |

| Category: Finance | Offer by: ADP, INC. |

myWisely: Mobile Banking is a comprehensive digital solution for managing personal finances on the go, offering users secure access to account information, transactions, and financial tools through a user-friendly interface. This versatile app caters to individuals seeking convenient banking alternatives, whether they’re checking balances, paying bills, or transferring funds anytime, anywhere. It’s designed for busy professionals, students, and everyday users who value efficiency and modern banking accessibility.

The core appeal of myWisely: Mobile Banking lies in its seamless integration of essential banking functions into a single, intuitive platform. Users appreciate the real-time transaction alerts, easy bill payment options, and robust budgeting features that empower informed financial decisions. From grandparents exploring digital finance to young entrepreneurs managing business accounts, the app’s accessibility makes complex banking tasks simple and manageable.

App Features

- Seamless Account Overview: View balances and recent transactions instantly with customizable dashboard widgets. This immediate visibility helps users spot discrepancies quickly and manage spending habits effectively.

- Intelligent Bill Management: Automatically categorize expenses using ML algorithms to create spending insights. The system learns user patterns over time, making budget projections more accurate for different financial goals.

- Secure Mobile Transfers: Send money with facial recognition and biometric security while tracking transactions in real-time. This eliminates the need for complex PIN setups across multiple devices, enhancing convenience without compromising safety.

- Cross-Device Syncing: Maintain a unified experience across smartphones, tablets, and web interfaces with real-time data synchronization. Users can start a transfer on their phone and complete it on their desktop without interruption.

- Expense Visualization Tool: Create interactive charts comparing spending across categories or time periods. This feature helps users identify saving opportunities and visualize progress toward financial targets through intuitive visual representations.

- Priority Support Access: Direct video chat assistance with financial advisors during peak banking hours. This specialized service connects users instantly with professionals who can address complex financial queries beyond standard FAQs.

Pros & Cons

Pros:

- Innovation in mobile banking interface design

- Exceptional transaction confirmation speed

- Comprehensive security protocols

- Advanced expense categorization intelligence

Cons:

- Occasional sync delays during high-traffic periods

- Learning curve for complex financial features

- Limited merchant categorization coverage

- Regional feature availability differences

Similar Apps

| App Name | Highlights |

|---|---|

| BankEasy Mobile |

Known for its beginner-friendly interface and quick tutorials. Offers basic mobile banking features with simple navigation suitable for less tech-savvy users. |

| CashFlow Pro |

Specializes in detailed financial analytics with exportable reports. Includes investment tracking alongside core banking functions for comprehensive financial oversight. |

| SecurePay Suite |

Features robust security with military-grade encryption and biometric fallback options. Popular among corporate users needing enterprise-level security protocols. |

Frequently Asked Questions

Q: How does myWisely: Mobile Banking handle account security?

A: We employ bank-grade encryption, biometric authentication, and real-time fraud monitoring to keep your financial data protected. Each transaction requires multi-factor verification, and suspicious activities trigger immediate alerts you can respond to instantly.

Q: Can I use myWisely: Mobile Banking for international transactions?

A: Yes, the app supports multiple currencies with instant exchange rate updates. You can send/receive funds globally through our secure network, though fees may vary based on destination countries and transaction volume.

Q: Does myWisely: Mobile Banking work offline?

A: While core functions like checking balances require online verification, we cache essential data locally for offline access. This means you can view your account summary and recent transactions without an internet connection, but actual transfers will need verification.

Q: How does the expense categorization feature learn my spending habits?

A: Our ML engine analyzes transaction patterns over time, gradually refining categories based on merchant data and your input. You can also personalize categories directly, making it more accurate for your unique financial behaviors.

Q: What happens if my device is lost or stolen?

A: Immediate remote account lock is possible through our secure settings portal. We recommend this feature for all users, along with setting up recovery email/phone options within your profile settings to regain access quickly after reporting the device loss.

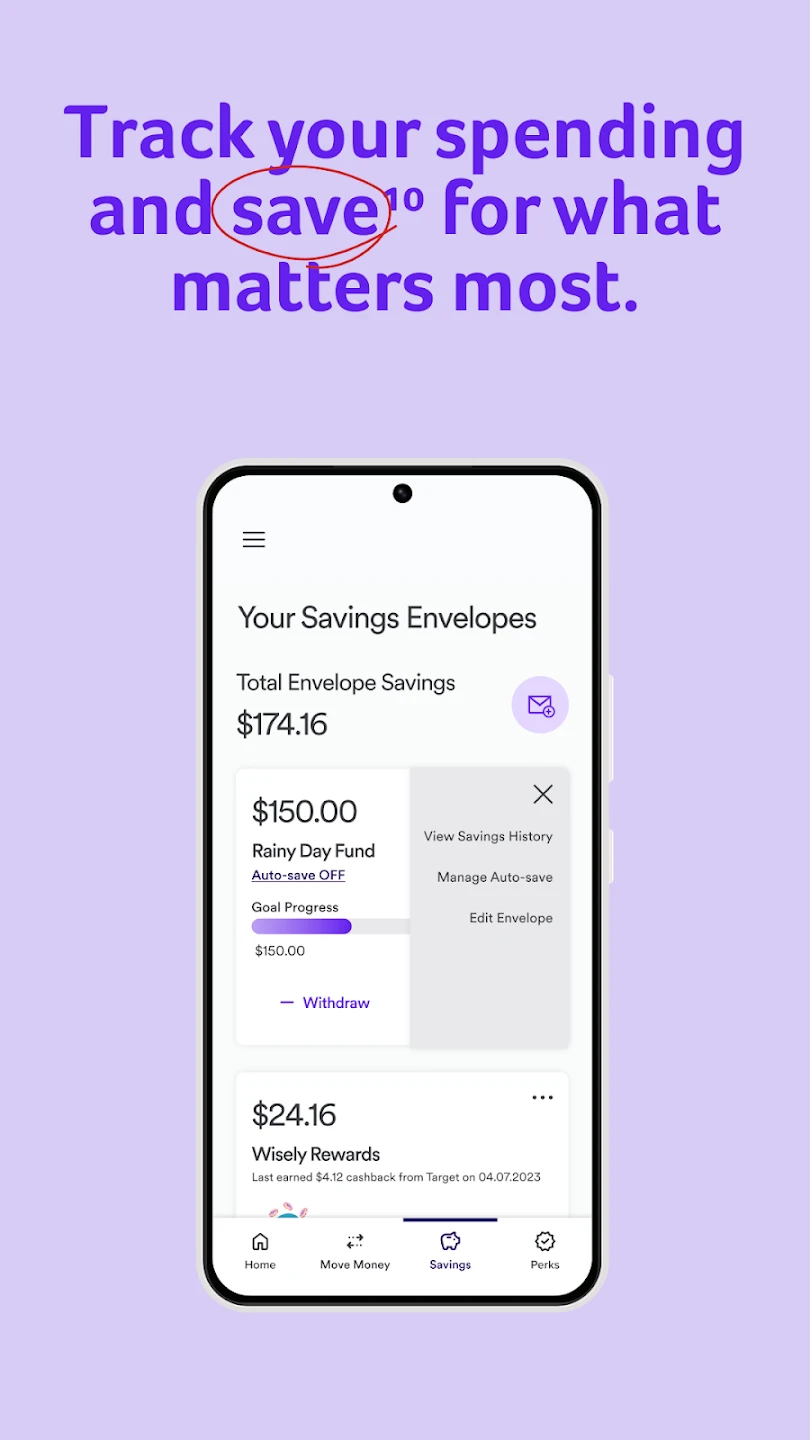

Screenshots

|

|

|

|