|

|

| Rating: 4.2 | Downloads: 1,000,000+ |

| Category: Finance | Offer by: OneMain Financial |

“`html

OneMain Financial’s mobile app provides access to personal loans, budgeting tools, and financial management features designed for individuals seeking quick funding and improved money management. The app offers a streamlined way to apply for advances on your paycheck, monitor your finances, and explore options for better financial health.

This tool is particularly useful for people facing immediate financial needs but needing short-term solutions. OneMain Financial helps bridge the gap between current financial situations and future goals by connecting users with responsible lending options tailored to their specific circumstances.

App Features

- Advance Applications: Get cash quickly by applying for paycheck advances tailored to your situation. This lets you handle unexpected expenses or bills before your next payday without needing to visit a physical location.

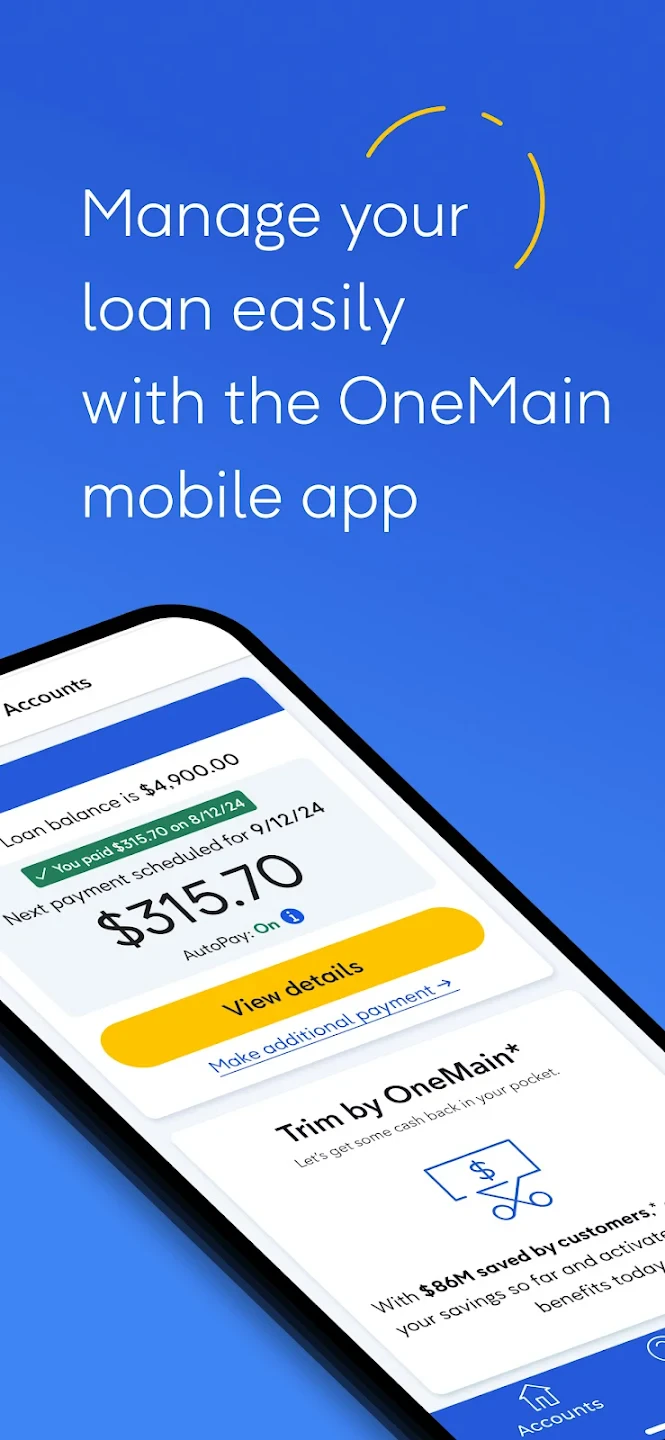

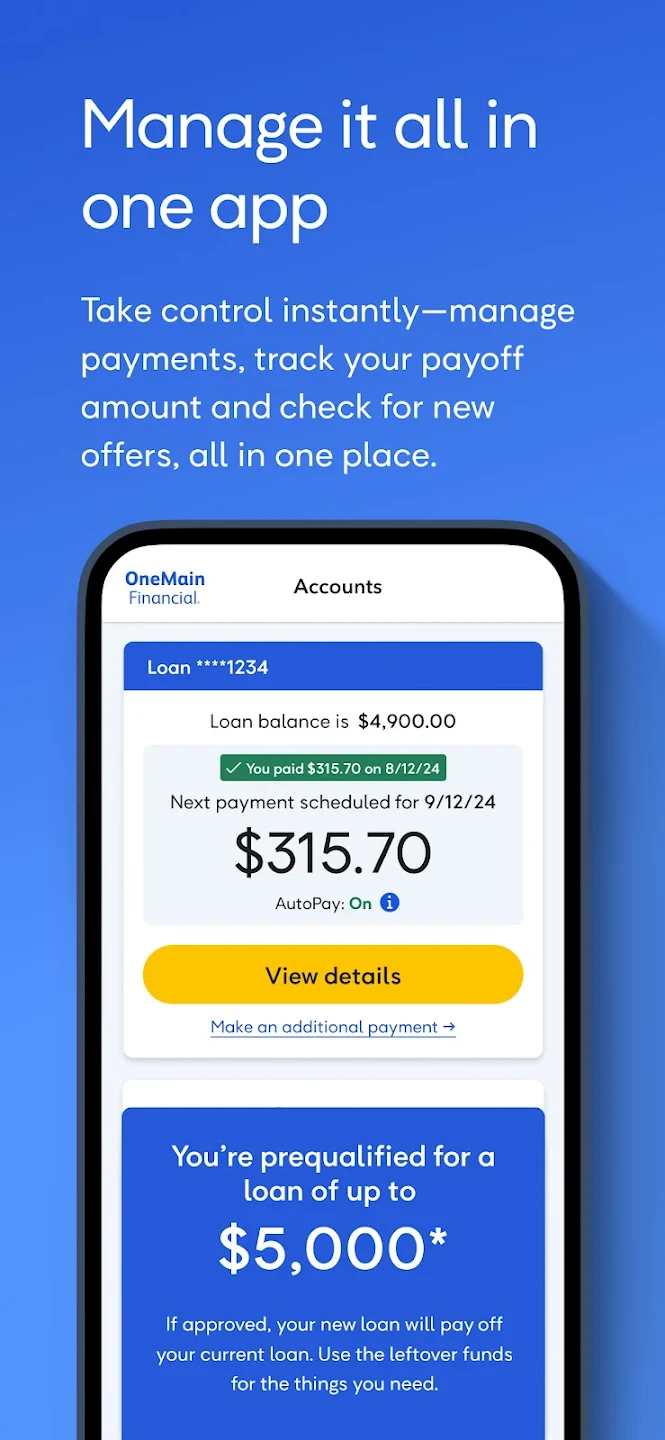

- Account Management Dashboard: View balances, recent transactions, and credit information in one convenient place. The dashboard offers customizable widgets showing your loan details, payment schedule, and overall financial status.

- Financial Guidance Resources: Access educational content covering budgeting tips, loan repayment strategies, and financial literacy. This feature includes personalized tips based on your spending patterns and offers tools for creating custom financial plans.

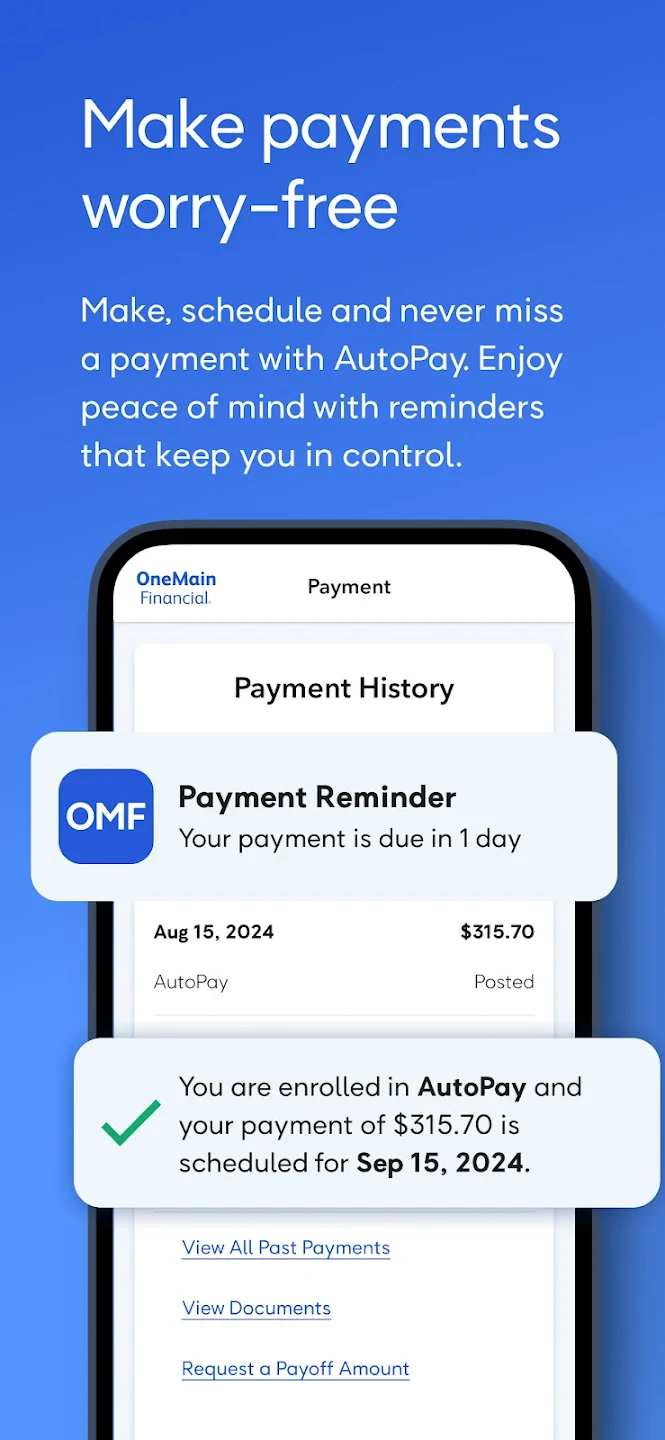

- Automatic Payment Tracking: Set up recurring payments with reminders, ensuring timely loan repayments to avoid fees and penalties. The system categorizes spending patterns to help identify savings opportunities and improve financial health.

- Loan Comparison Tools: Easily compare available loan options side-by-side to find the best terms for your unique situation. The interface includes visual indicators showing interest rates, repayment periods, and total potential costs.

- Customer Support Integration: Direct messaging connects you with representatives for guidance on loan applications, payment options, or financial advice. This feature offers priority assistance during business hours for urgent matters.

Pros & Cons

Pros:

- Quick Access to Funding: Streamlined process allows for rapid loan disbursement during times of need.

- User-Friendly Interface: Clean design makes managing finances accessible to users of all tech comfort levels.

- Comprehensive Financial View: Combines loan management with spending insights in one place.

- Multiple Support Channels: Offers phone, chat, and email support for flexible assistance.

Cons:

- Interest Rate Consideration

- Loan Limit Constraints

- Potential for Debt Accumulation

- Income Verification Requirements

Similar Apps

| App Name | Highlights |

|---|---|

| LoanMe Financial |

This app provides similar quick-access funding solutions with competitive rates. Known for fast approvals and seamless integration with direct deposit systems. |

| MoneyWise |

Designed for budgeting and financial tracking alongside lending services. Includes spending categorization and goal-setting features for comprehensive money management. |

| CashFlow Connect |

Offers versatile lending options including lines of credit and personal loans. Features advanced analytics for financial forecasting and planning tools. |

Frequently Asked Questions

Q: How quickly can I get the funds from an advance through the OneMain Financial app?

A: Funds are typically available on the same day or within one business day after your application is approved. The process includes electronic signature and direct deposit options for rapid disbursement.

Q: Are there any fees associated with using the app or managing my loan?

A: While the core app functionality is free to use, loan products have standard terms including interest rates. You’ll find transparent fee disclosures throughout the app to help you make informed decisions.

Q: What happens if I cannot repay my loan on time?

A: We recommend setting up automatic payments through the app to avoid penalties. If you anticipate difficulty, contact customer support immediately for assistance.

Q: Can I apply for multiple types of loans through the app simultaneously?

A: Yes, the app allows you to compare and apply for different loan products at the same time. Each application is reviewed independently, and you’ll receive notification on each.

Q: Is there an age requirement to use OneMain Financial services?

A: Minimum age requirements vary by state but typically require users to be at least 18 years old. The app includes identity verification to ensure compliance with regulations.

“`

Screenshots

|

|

|

|