|

|

| Rating: 4 | Downloads: 1,000,000+ |

| Category: Finance | Offer by: oportun |

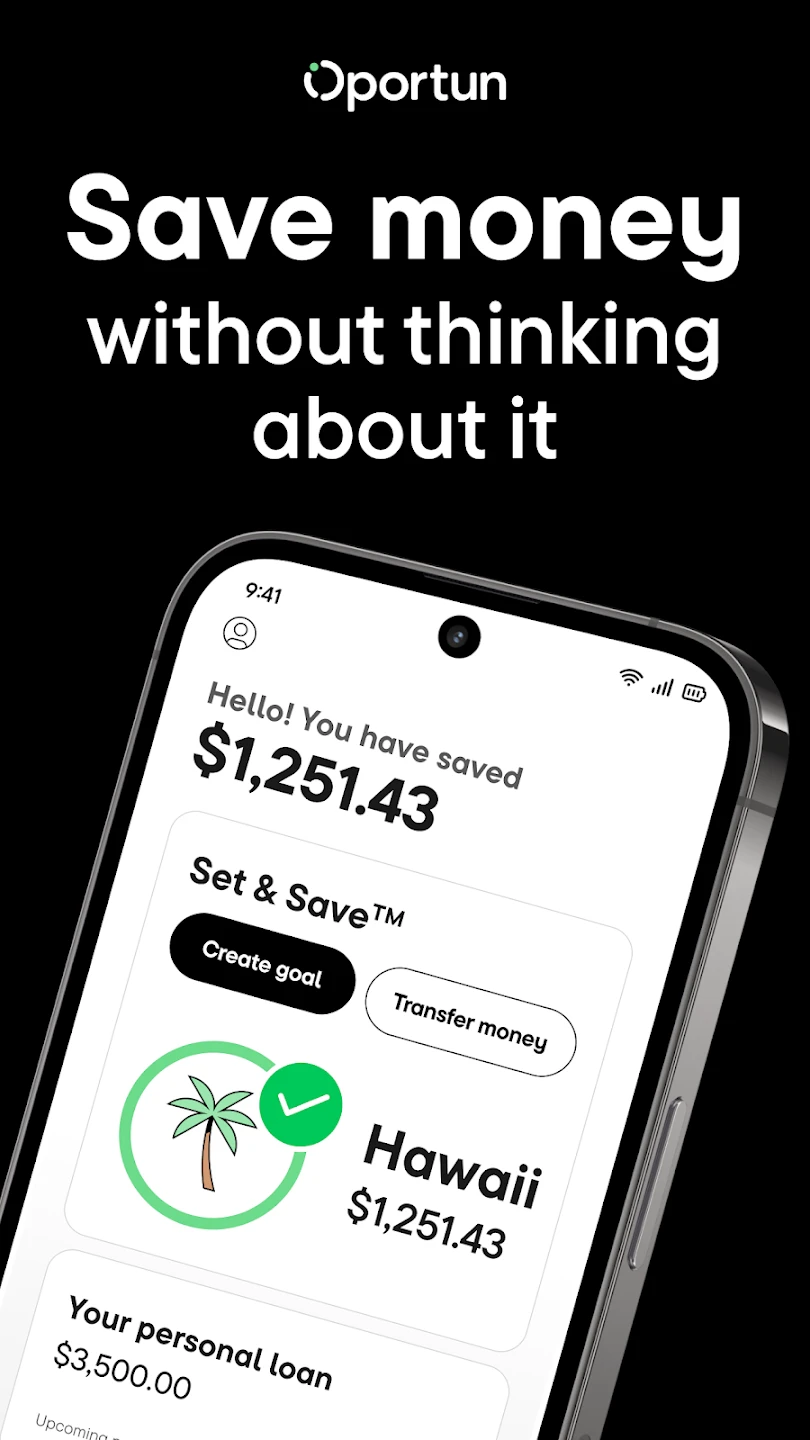

Oportun: Finances made simple is a user-friendly mobile banking app designed to simplify personal financial management for everyday individuals. It offers features like budget tracking, savings tools, and easy bill payments, making complex financial tasks straightforward and accessible for users of all experience levels.

The app’s core value lies in its ability to empower users to take control of their finances through intuitive tools. By consolidating banking features and financial advice in one place, Oportun: Finances made simple helps people make informed decisions, save money effectively, and build better financial habits without overwhelming complexity.

App Features

- Easy Budget Creation: Set monthly budgets for different spending categories like groceries and entertainment, helping you avoid overspending on non-essentials. This feature automatically syncs with your spending patterns, allowing you to visualize where your money goes and adjust allocations effortlessly.

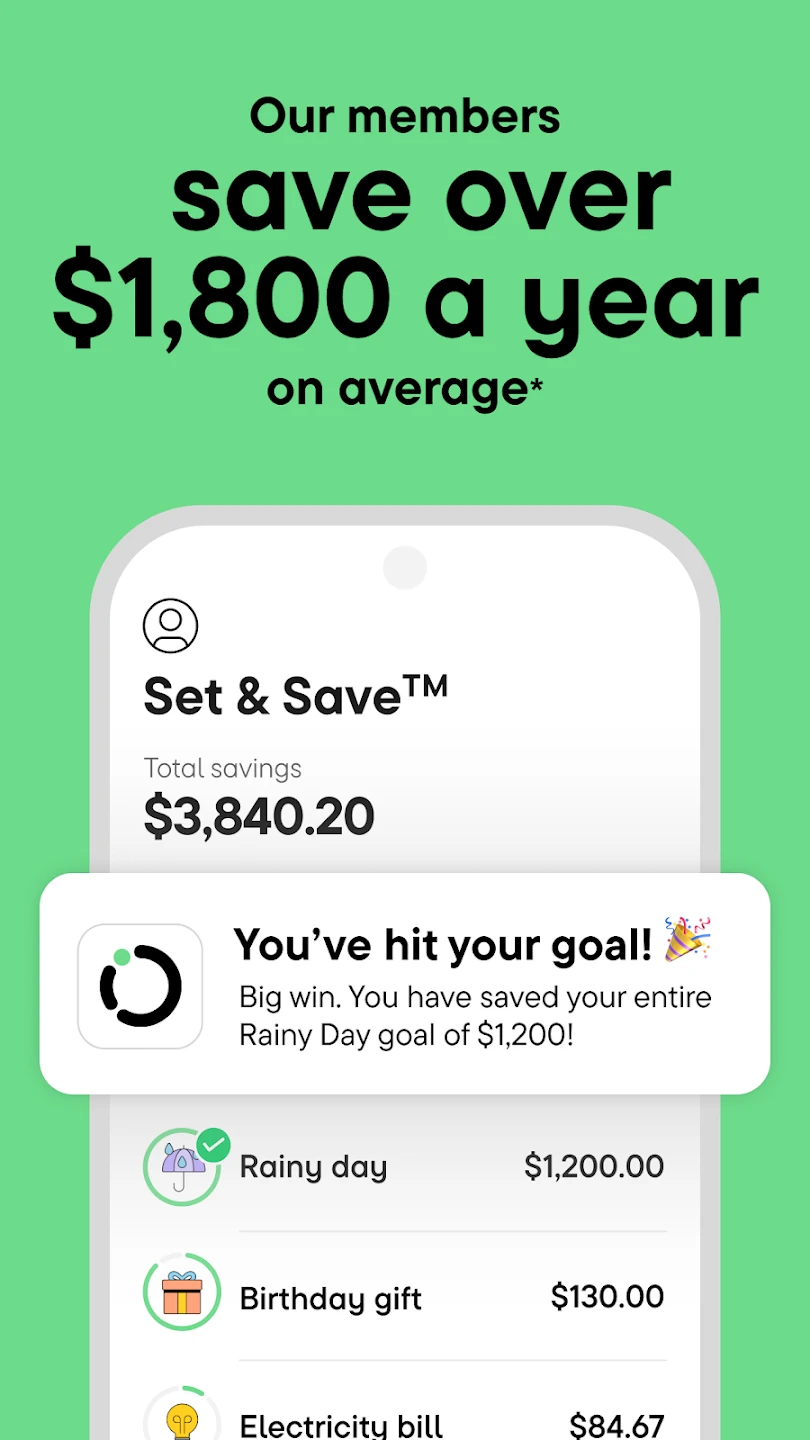

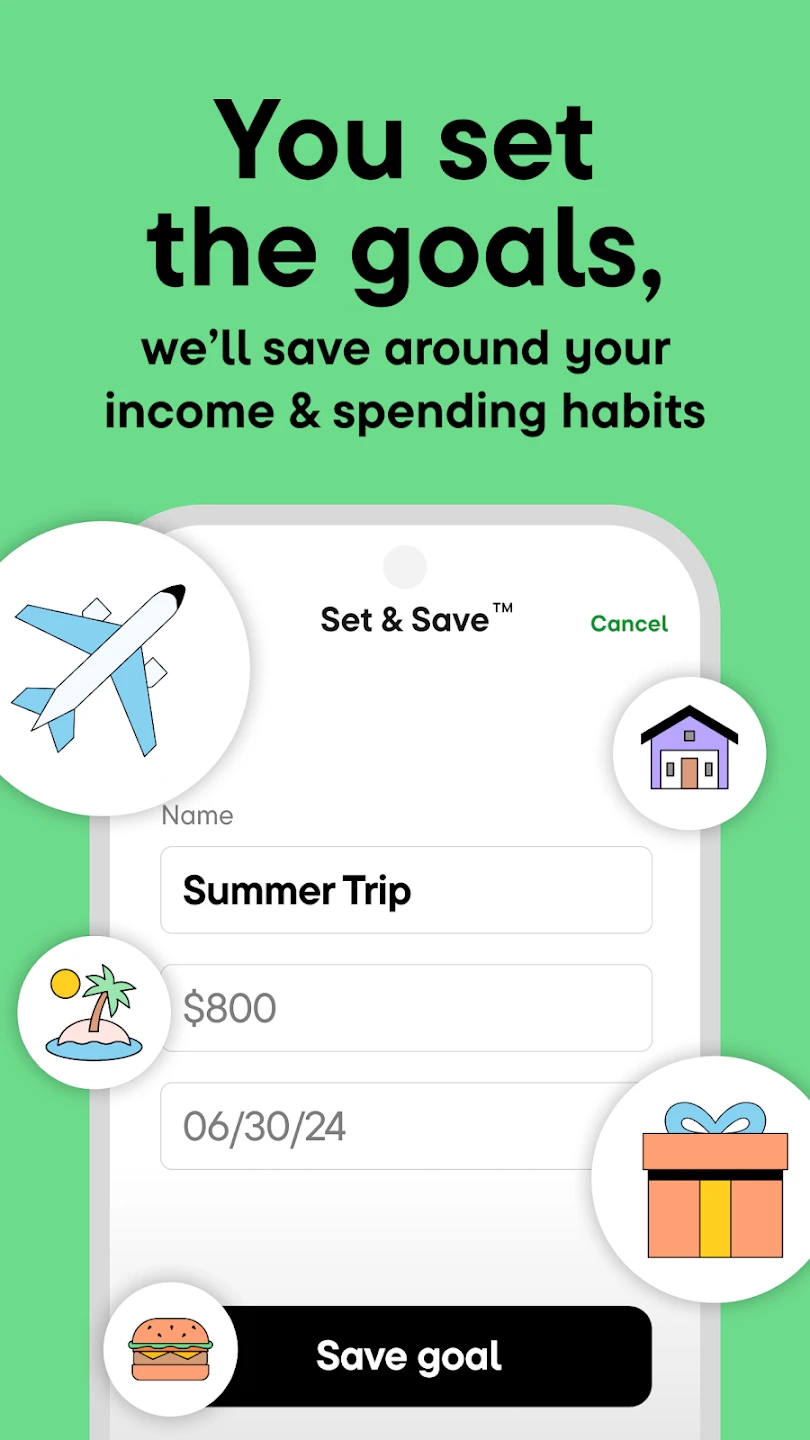

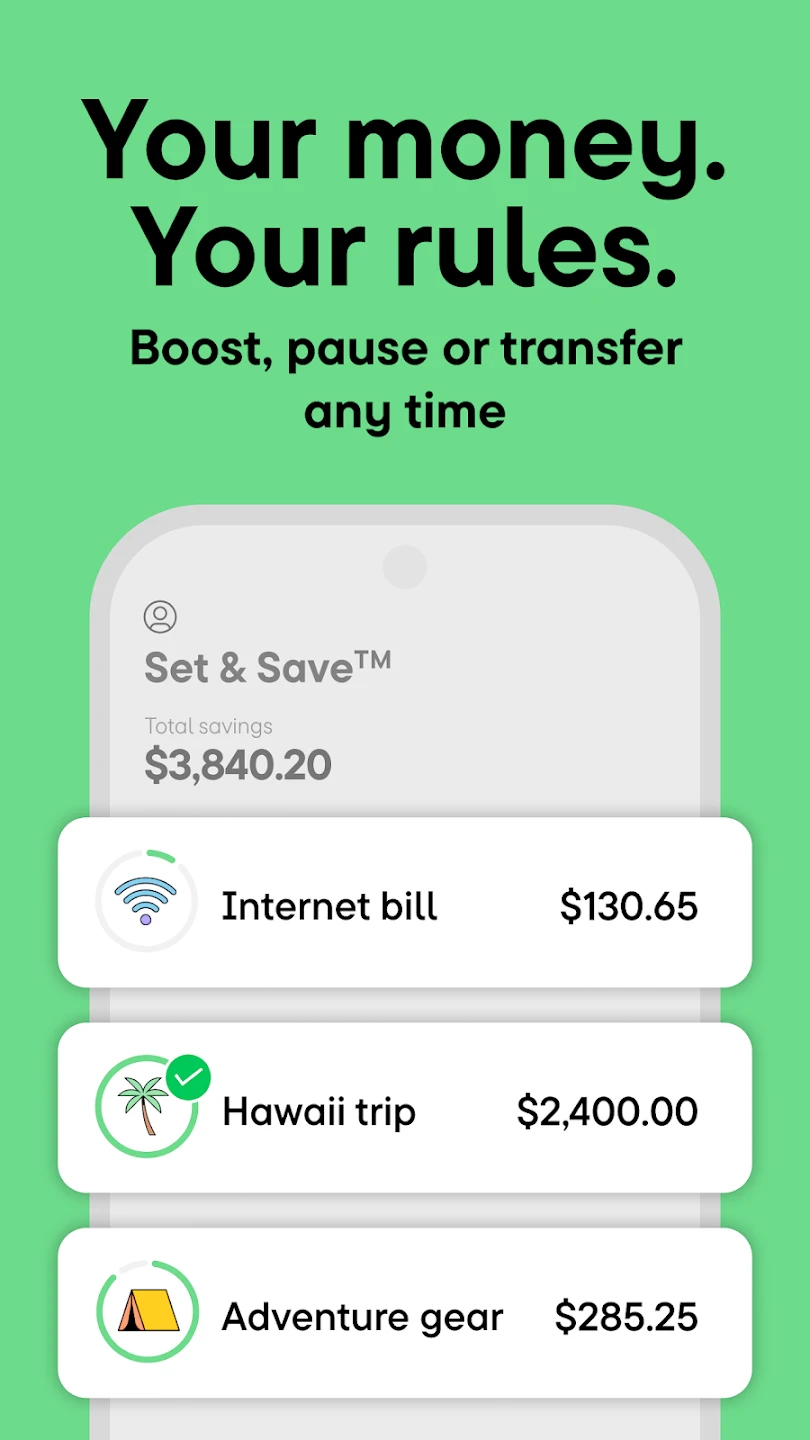

- Smart Savings Goals: Define specific savings targets (e.g., vacation fund or emergency savings) within a timeframe; the app tracks progress and suggests small, achievable steps to reach your goals faster. Its intelligent algorithms analyze your income and spending, offering personalized recommendations to accelerate savings growth.

- Real-time Expense Tracking: Monitor daily purchases across all accounts through automatic categorization and receipt scanning. This eliminates manual bookkeeping and provides immediate insights into spending habits, helping you identify areas to cut back quickly.

- Budget Forecasting: Predict future income and expenses based on your historical data, allowing proactive adjustments before financial issues arise. Key benefits include avoiding late fees and maintaining cash flow stability, especially useful during income fluctuations or unexpected expenses.

- Account Consolidation: View balances, transactions, and manage multiple bank accounts in one dashboard with customizable alerts. This flexibility makes comparing accounts and optimizing spending across platforms effortless, ideal for households or individuals with complex financial setups.

- Financial Education Hub: Access curated articles on topics like debt reduction and investing basics, complementing the core features. Advanced users can explore detailed analysis tools and market trends to make informed investment choices within the app.

Pros & Cons

Pros:

- User-friendly interface

- Budget management tools

- Savings goal tracking

- Automatic expense categorization

Cons:

- Basic investment features

- Mobile-only access limitations

- Account minimum requirements

- Occasional syncing delays

Similar Apps

| App Name | Highlights |

|---|---|

| YNAB – You Need A Budget |

This app emphasizes zero-based budgeting principles with intuitive transaction categorization and robust goal tracking. Known for its punchcard system to encourage consistent deposits and detailed expense breakdowns. |

| MoneyLion |

Designed with mobile-first simplicity and instant deposit features. Includes guided budgeting steps and real-time financial insights, making complex tasks approachable for beginners. |

| Mint by Intuit |

Offers comprehensive account aggregation and financial goal tools powered by AI. Features include investment tracking and family budget sharing with strong security protocols and custom dashboard customization. |

Frequently Asked Questions

Q: How does Oportun: Finances made simple handle my sensitive financial data?

A: We employ bank-level security including end-to-end encryption (not SSL only) and multi-factor authentication to protect your information. All transactions are secured through our proprietary system with regular audits for maximum protection.

Q: Can I transfer money between my personal and business accounts using this app?

A: Yes, our app supports internal account transfers. However, for business accounts, you’ll need to use the dedicated Oportun Business platform available through our secure web portal for more robust features.

Q: How does the expense categorization work, and can I customize categories?

A: Our system automatically categorizes transactions but allows you to create custom groups for unique expenses. You can set rules for recurring purchases to ensure accurate tracking without manual input.

Q: What happens during the account opening process? Is it instant?

A: The standard account application is completed within minutes through our intuitive form system. However, initial deposit processing may take up to 2 business days depending on your funding source and verification requirements.

Q: Does the app offer investment guidance for my savings goals?

A: Yes, our Smart Savings feature analyzes your risk tolerance and financial objectives to suggest appropriate investment options. You can access market insights and portfolio performance tracking through the dedicated investment section.

Screenshots

|

|

|

|