|

|

| Rating: 3.9 | Downloads: 10,000,000+ |

| Category: Business | Offer by: PayPal Mobile |

PayPal Business is a digital platform providing tools for businesses to manage online and in-person payment transactions efficiently and securely. It offers a suite of services for sending and receiving money, handling sales processing, and managing finances directly from a single application, primarily serving small-to-medium sized enterprises and freelancers.

The core appeal of PayPal Business lies in streamlining complex financial operations; it simplifies payment processing, reduces handling time, and integrates robust invoicing and reconciliation features, making financial management more accessible and less prone to errors for active users.

App Features

- Fully Integrated Payment Processing: Seamlessly accept payments from customers via debit/credit cards, online banking, or PayPal balance, directly expanding reach and simplifying checkout for customers worldwide. This integration drastically cuts down transaction friction, leading to potential sales increases and faster payment cycles compared to traditional methods.

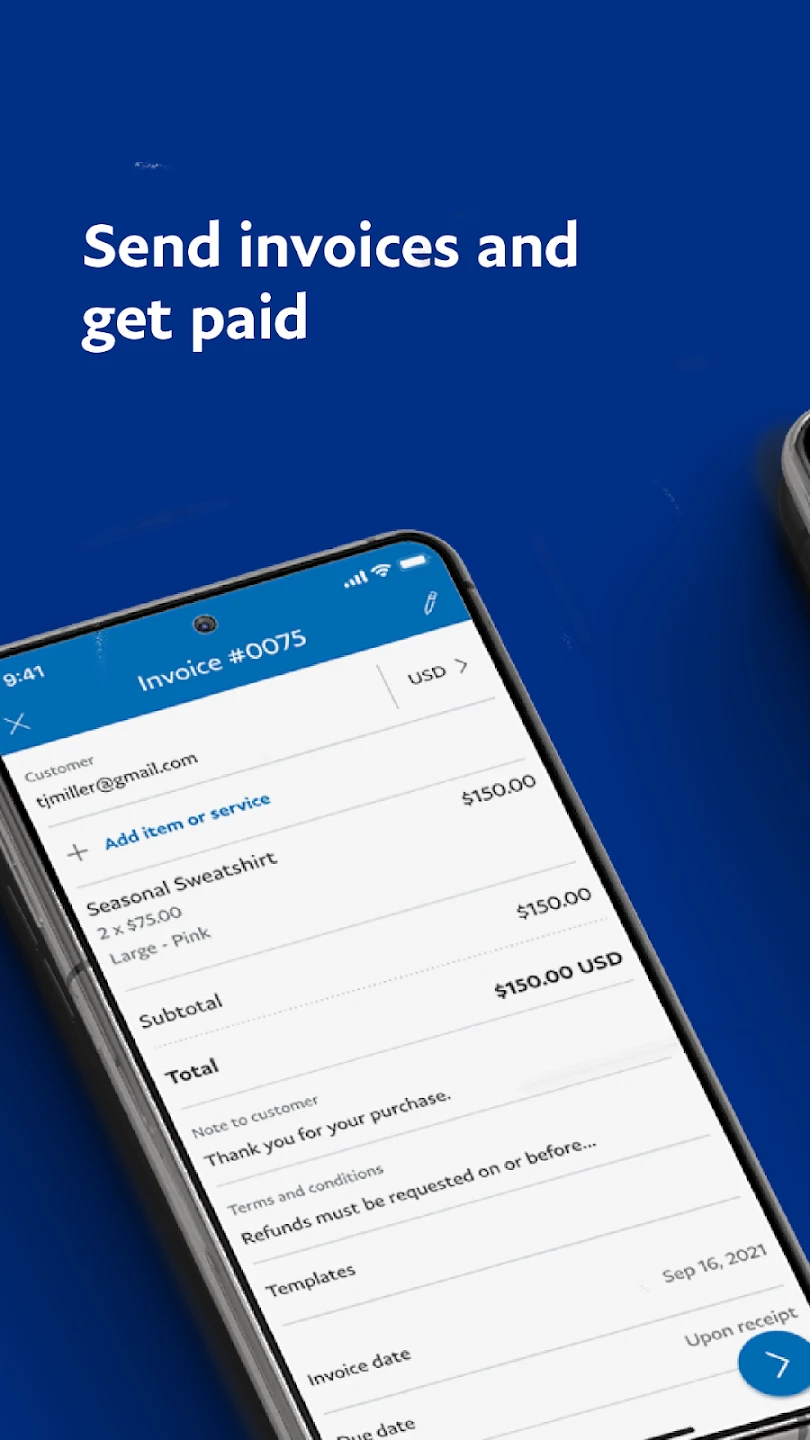

- Advanced Invoicing and Expense Tracking: Create professional, branded invoices quickly using templates, set automated payment reminders, and categorize business expenses with ease, compatible with various currencies. This feature significantly simplifies bookkeeping by automatically matching expenses to income for clearer financial oversight.

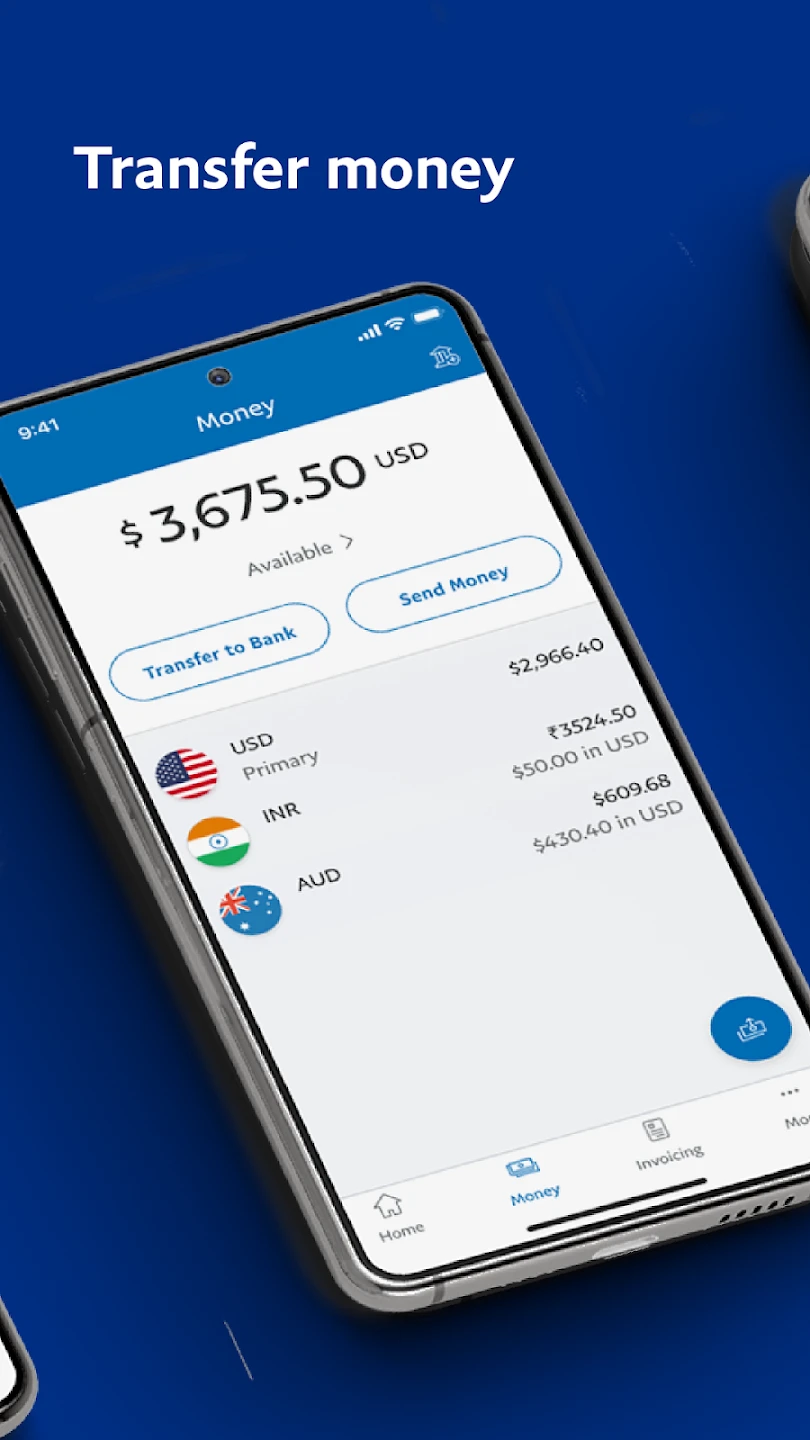

- Global Multi-Currency Transactions: Manage transactions in multiple currencies without complex foreign exchange hurdles, automatically converting funds to your preferred currency for straightforward accounting and reducing currency risk exposure. This capability is essential for businesses engaging with international clients and streamlines managing cross-border payments.

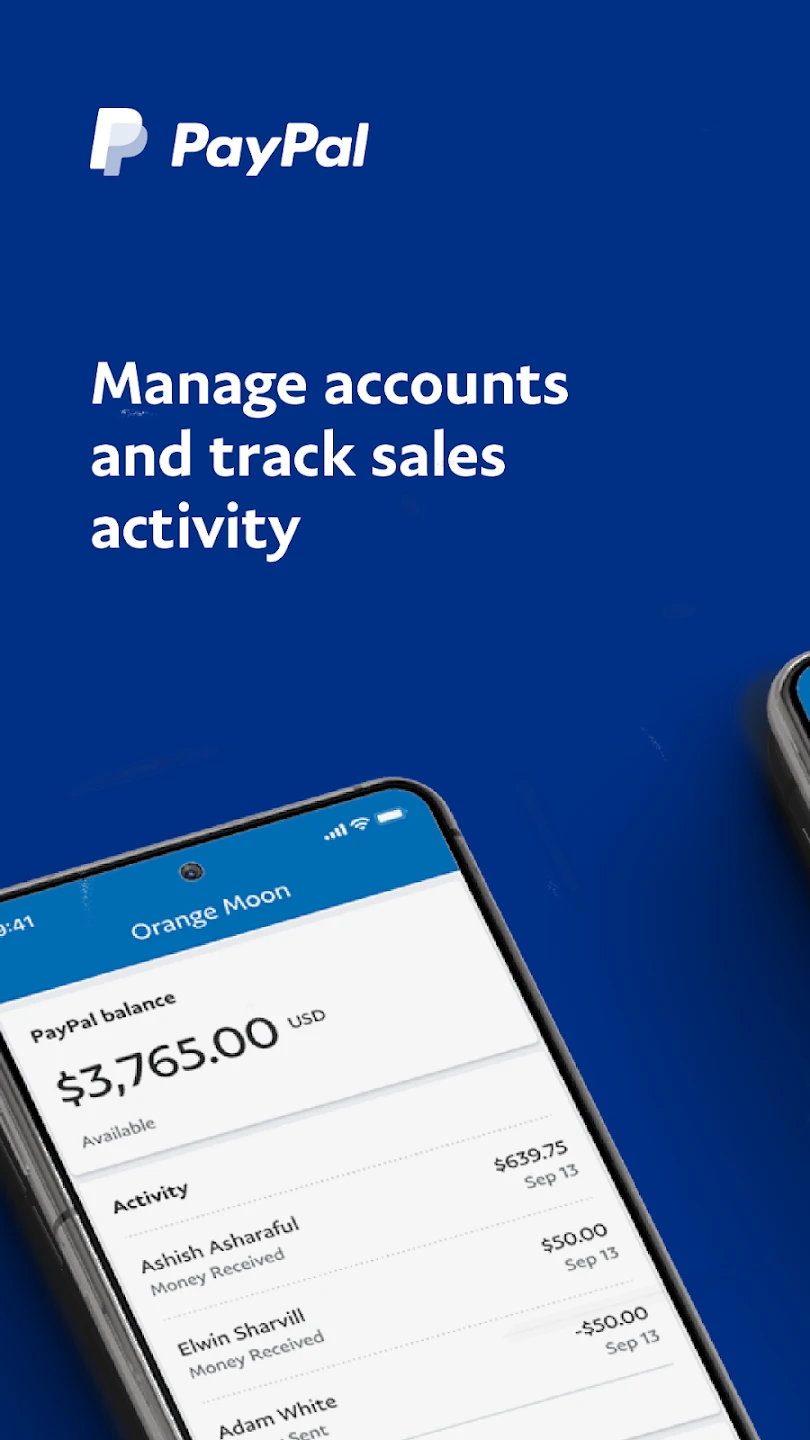

- Comprehensive Transaction Dashboard: Benefit from a detailed overview showing all recent transactions, sales performance, and financial activity in one place, accessible anytime via a secure mobile environment. Having this information readily available allows for quick performance reviews and informed strategic business decisions on-the-go.

- Streamlined Employee and Contractor Payouts: Efficiently manage payroll for employees, independent contractors, and freelancers using direct funding options, simplifying compliance and ensuring timely compensation across various payment methods. This function saves considerable administrative time by integrating with standard accounting systems, reducing manual payment processing.

- Automated Reconciliation Tools: Leverage AI to automatically match payments against invoices and transactions, flag discrepancies, and generate reports with minimal user input for faster financial oversight and reporting. This automation dramatically reduces the time spent on manual bookkeeping and minimizes errors associated with manual data entry.

Pros & Cons

Pros:

- Streamlined Multi-Channel Payments:

- Robust Invoicing & Reminders:

- Currency Management Made Easy:

- Invaluable Mobile Financial Control:

Cons:

- Higher Transaction Costs Than Some Alternatives

- Credit Card Processing Limits Require Review

- Advanced Features Can Have a Complex Interface

- Mobile App Lacks Advanced Charting Compared to Desktop

Similar Apps

| App Name | Highlights |

|---|---|

| Cashu Business |

Known for its simple interface, excellent customer support, and competitive merchant fees for online transactions. Offers easy payout schedules and dedicated account manager tiers for larger businesses. |

| Checkout Anywhere |

Focuses on point-of-sale capabilities, providing a full suite for physical locations alongside online sales channels. Features integrated loyalty programs and mobile card readers for versatile retail environments. |

| Bench |

Designed as a comprehensive platform integrating payments with bookkeeping software. Includes automatic bank reconciliation and team collaboration tools for businesses focused on detailed financial tracking. |

Frequently Asked Questions

Q: How quickly are payments processed through PayPal Business?

A: Payment processing times can typically range from immediate authorization to same-day settlement, depending on the specific payment method chosen by the payer and the currency involved. Faster processing speeds are often achievable for transactions using linked bank accounts.

Q: Can I manage international clients effectively with PayPal Business?

A: Yes, absolutely. PayPal Business excels in handling international transactions. Users can easily send and receive payments in many currencies globally, view transaction details, and access currency conversion tools without needing complex foreign bank accounts.

Q: What security measures are built into the PayPal Business mobile app?

A: PayPal Business incorporates multiple security layers, including biometric authentication, secure data encryption, real-time transaction monitoring, and automatic fraud detection algorithms designed to protect user accounts and transactions effectively.

Q: Is there a monthly fee for using the PayPal Business app?

A: PayPal Business typically has no monthly subscription charge for basic account usage. Transaction fees vary based on the payment method (e.g., card payments vs. bank transfers) and currency conversion; detailed pricing information is available within the app settings or on the PayPal Business website.

Q: Can I use the PayPal Business app for in-person sales?

A: Yes, the PayPal Business app supports in-person payments. Users can accept debit and credit card payments directly on their mobile device through the app’s integrated payment processing feature, making it suitable for pop-up shops, mobile services, or small business locations without dedicated hardware.

Screenshots

|

|

|

|