|

|

| Rating: 4.3 | Downloads: 100,000,000+ |

| Category: Finance | Offer by: PayPal Mobile |

The **PayPal – Pay, Send, Save** app is the official mobile application from PayPal, offering users a secure and convenient way to manage their finances. It enables easy payment processing for online and in-app purchases, facilitates sending and receiving money globally, and provides tools for saving and budgeting. Designed primarily for individuals but also offering tools beneficial to small businesses, it caters to anyone needing reliable digital money management.

This app streamlines everyday financial tasks, providing significant convenience for personal transactions and online shopping internationally. Its core appeal lies in the seamless integration with your online accounts and strong security features, making managing finances digital and less hassle compared to traditional methods.

App Features

- One-Click Payments: Seamlessly complete online purchases with saved cards or PayPal balance using the app, saving time during checkout for regular online shoppers. For example, quickly buying concert tickets online without manual card entry.

- Global Money Sending & Receiving: Easily transfer funds internationally with built-in currency conversion and competitive exchange rates; this feature simplifies splitting bills across countries or receiving money from abroad. It improves usability by integrating standard bank details lookup, reducing the chance of sending money to the wrong recipient.

- Personal Savings & Budgeting Tools: Set automated savings goals, track spending, and monitor budgets within your account using intuitive dashboards; this helps users achieve financial objectives like saving for a holiday or managing monthly expenses effectively. These tools provide visual insights into spending habits and progress towards targets, enhancing financial literacy.

- Manage Linked Accounts: Consolidate and manage multiple bank accounts, credit/debit cards, and PayPal balances from different institutions within your single PayPal profile; typically used when consolidating personal finances or simplifying bill payments, it offers greater flexibility and visibility over one’s overall financial picture.

- Business Tools (for eligible users): Provides features for receiving payments from customers, tracking expenses, and managing online invoicing, making it relevant for small business owners or freelancers needing separate financial management. This feature offers flexibility for different user types and integrates smoothly with personal transactions if needed.

- Secure Authentication & Fraud Protection: Utilizes advanced security measures like biometric login (fingerprint or face recognition) and multi-factor authentication; this advanced layer ensures sensitive financial information remains protected during online transactions and app usage.

Pros & Cons

Pros:

- Extremely Secure Transactions

- Intuitive User Interface

- Seamless Online & In-App Purchases

- Robust Global Money Transfer Functionality

Cons:

- Potential Transaction Fees for Certain Currencies

- Complex for Basic Users (though intuitive overall)

- Requires Internet Connection for Core Functions

- Limited Advanced Investment Features

Similar Apps

| App Name | Highlights |

|---|---|

| QuickPay Wallet |

Known for fast person-to-person payments, robust spending categorization tools, and excellent integration with local banks. Offers a simple dashboard and low-fee transfers. |

| TransferPro |

Designed for simplicity and mobile-first usability. Includes guided steps for complex money transfers and provides real-time transaction updates. |

| SpendSmart |

Offers detailed expense analytics, goal tracking for savings, and the ability to link various financial apps for consolidated views. |

Frequently Asked Questions

Q: How do I set up my PayPal account linked to my app?

A: Setting up a PayPal – Pay, Send, Save account usually requires just an email address, creating a password, linking a bank account or credit card, and verifying your identity via email or phone. Once verified, your account is ready for sending, receiving, or making payments.

Q: Are there any costs associated with using the app itself?

A: While many features are free, fees may apply depending on your activities. Sending money to friends and family within specific countries is typically free, but international transfers, currency conversions, and purchases with a credit card often involve fees. Check your specific transaction details within the app.

Q: How secure is my money when using the app?

A: Security is a top priority for PayPal – Pay, Send, Save. Transactions are protected by advanced encryption, fraud detection, and buyer protection. You can use strong, unique passwords and enable two-factor authentication for even more protection against unauthorized access.

Q: Can I use the app to receive payments for my small business?

A: Absolutely! The PayPal – Pay, Send, Save app (especially with a PayPal Business account) provides tools specifically for businesses, allowing you to receive payments easily, issue invoices, track expenses, and manage your professional transactions securely.

Q: How do I track my savings progress or spending within the app?

A: Navigate to the “Wallet,” “Savings,” “Budget,” or “Spending” section depending on your app’s layout. You’ll find visual representations like graphs and goal bars that show your current savings, progress towards your budget targets, and breakdowns of your spending categories.

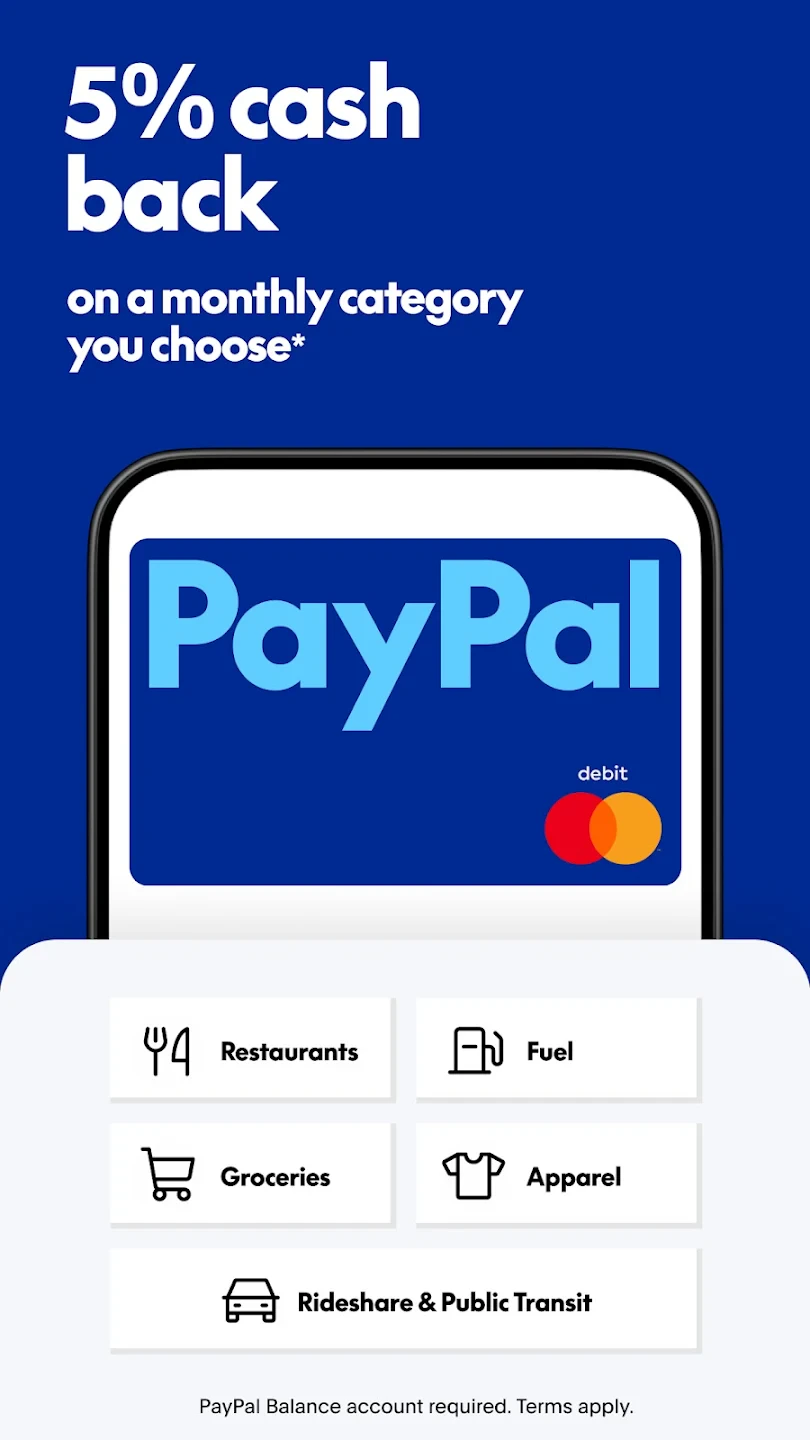

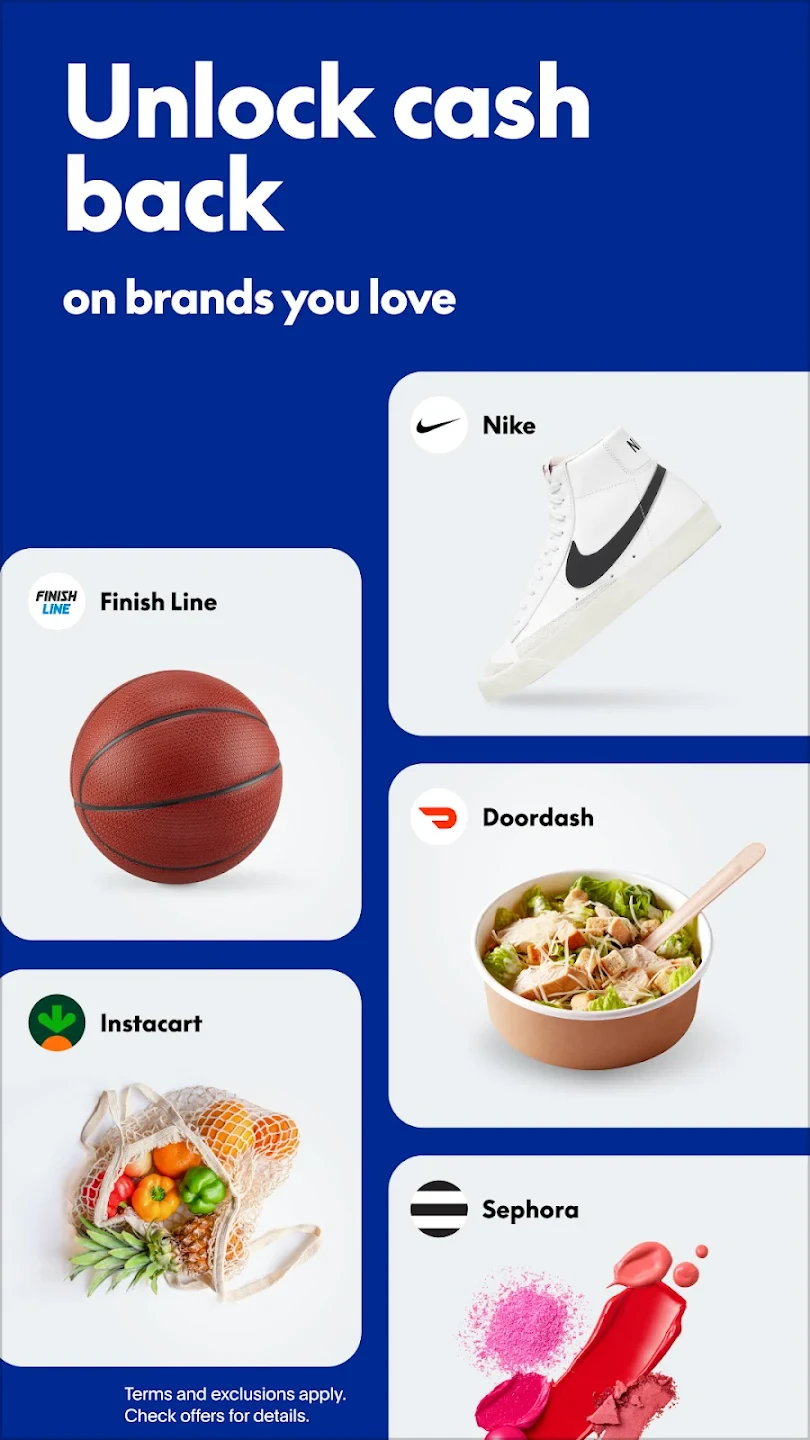

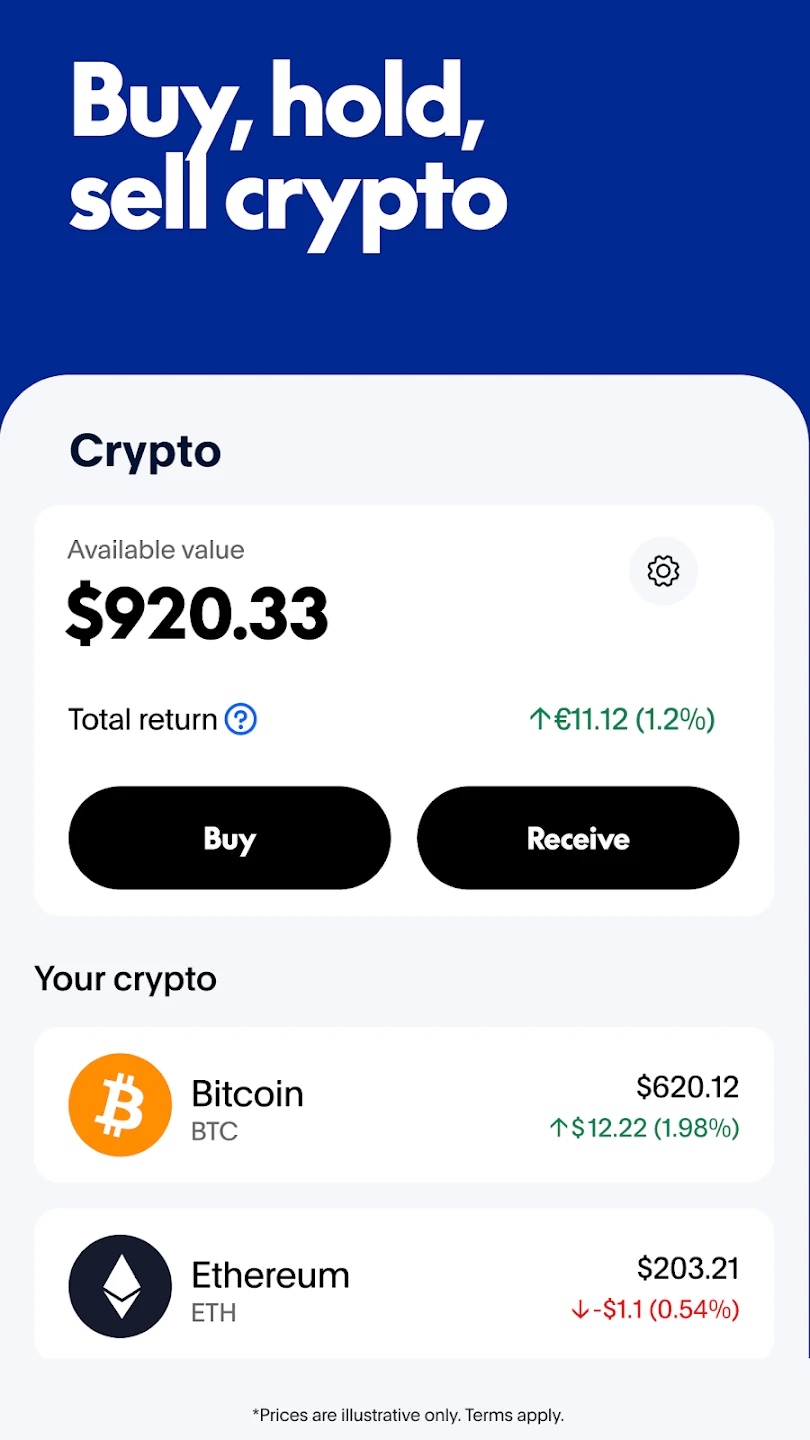

Screenshots

|

|

|

|