|

|

| Rating: 4.5 | Downloads: 1,000,000+ |

| Category: Shopping | Offer by: PayRange Inc. |

PayRange is a modern expense management application designed to simplify how teams handle business spending. This digital tool streamlines the process from expense submission to approval, making financial tracking efficient for small businesses and large corporations alike.

The PayRange app offers significant value by automating tedious manual processes, providing real-time analytics, and ensuring compliance with company policies. Its user-friendly interface empowers employees and managers to monitor expenditures effectively, saving valuable time and preventing overspending in day-to-day operations.

App Features

- Expense Tracking & Categorization: Easily log all your business expenses with automatic categorization, helping you monitor spending habits without manual input. This feature provides immediate insights into where your company’s money goes, promoting better financial planning and control.

- Receipt Digitization: Seamlessly capture and scan receipts through your device’s camera, storing them digitally in an organized manner linked to expense reports. The app’s optical character recognition (OCR) technology intelligently extracts key details like dates and amounts, significantly speeding up the reimbursement process compared to traditional paper receipts.

- Team Expense Collaboration: Create and share expense reports with team members or managers for collaborative input before submitting, ensuring accuracy and faster approvals. This feature eliminates bottlenecks in expense management, allowing remote workforces to submit and manage expenses efficiently without being tied to a single office location.

- Real-time Analytics Dashboard: View comprehensive spending reports with visual charts displaying expenditure across categories, departments, or time periods directly within the app. This tool saves hours of manual data interpretation and allows executives to make informed decisions during strategic meetings.

- Policy Compliance Checker: Configure your company’s expense policies directly in the app, which then automatically flags any submitted expense against these rules before final approval. For multinational corporations navigating different regional regulations, this ensures consistent adherence across all locations, preventing costly non-compliance issues.

- Seamless Multi-channel Integration: Connect your PayRange account via secure API to your company credit cards, accounting software, and payment processors like Stripe or QuickBooks, creating a unified financial view. This eliminates redundant data entry and allows finance teams to reconcile books faster with less error risk.

Pros & Cons

Pros:

- Significant Time Savings

- Enhanced Transparency & Auditability

- Reduced Administrative Burden

- Improved Team Collaboration

Cons:

- Potential Learning Curve for New Users

- Premium Subscription Tiers for Advanced Features

- Requires Employee Adoption for Maximum Effectiveness

- Reliance on Internet Connectivity for Mobile Use

Similar Apps

| App Name | Highlights |

|---|---|

| Expensya |

Known for its comprehensive reporting features and strong integrations with major accounting systems like Xero and QuickBooks Online. |

| Concurs |

Offers robust policy management and travel booking capabilities, ideal for enterprises with complex international operations. |

| BensonHendrickson |

Features advanced expense analytics, machine learning fraud detection, and customizable approval workflows for large organizations. |

Frequently Asked Questions

Q: Can I use PayRange for international business travel expenses?

A: PayRange supports multi-currency transactions and provides built-in compliance tools for navigating different regional regulations. Simply configure your preferred tax codes and expense limits, and the platform handles the conversion and reporting requirements automatically.

Q: What happens to my expense data if I cancel my subscription?

A: Your data remains securely stored on our servers for two full accounting periods unless otherwise specified in your contract. We provide detailed export options, allowing you to maintain complete control and transparency over your financial records.

Q: Is PayRange suitable for small businesses with fewer than five employees?

A: Absolutely! PayRange offers scalable plans beginning at $10/month, perfect for startups and SMBs. Its intuitive interface requires no specialized training, and the basic features include everything you need to manage expenses effectively without overwhelming complexity.

Q: Can I customize approval workflows in PayRange to fit my team’s processes?

A: Yes, PayRange’s workflow builder allows you to design custom approval paths with multiple decision points. You can set up rules like mandatory secondary approvals for amounts over $500 or require expense category justification from the submitter before proceeding.

Q: How does PayRange handle tax-related expense information?

A: PayRange extracts tax codes automatically from receipts using OCR technology where possible. For manual entries, you’ll have the option to add relevant tax codes. All data is securely stored and organized by default to facilitate smooth tax filing during the end of the fiscal year.

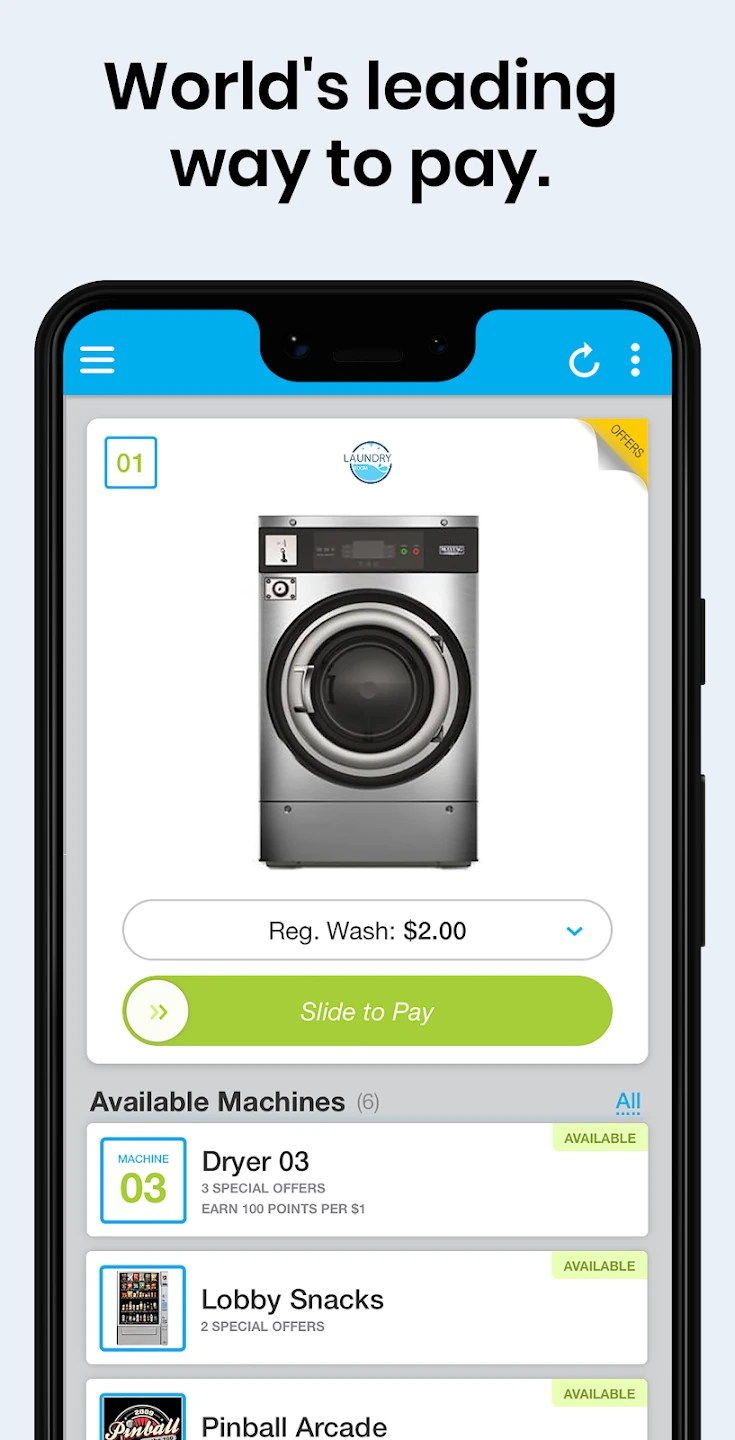

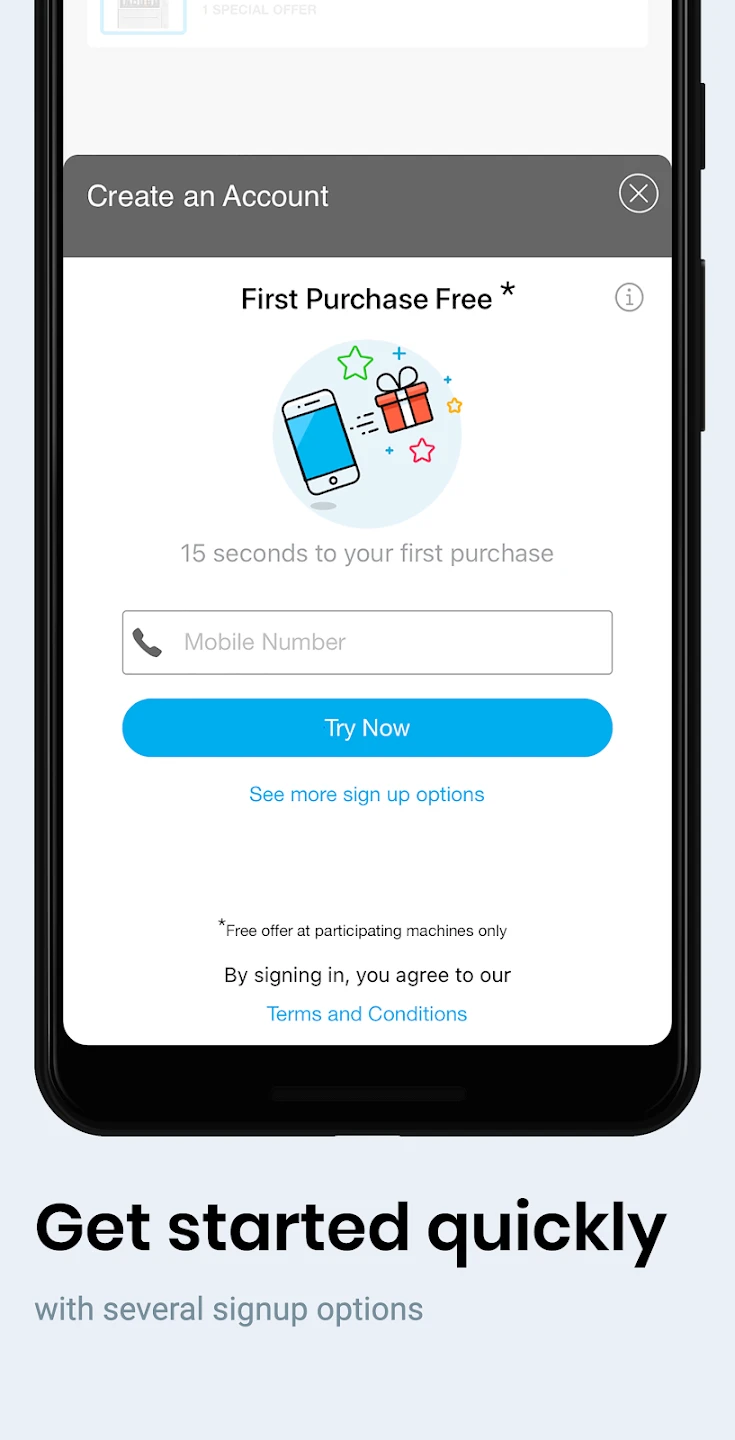

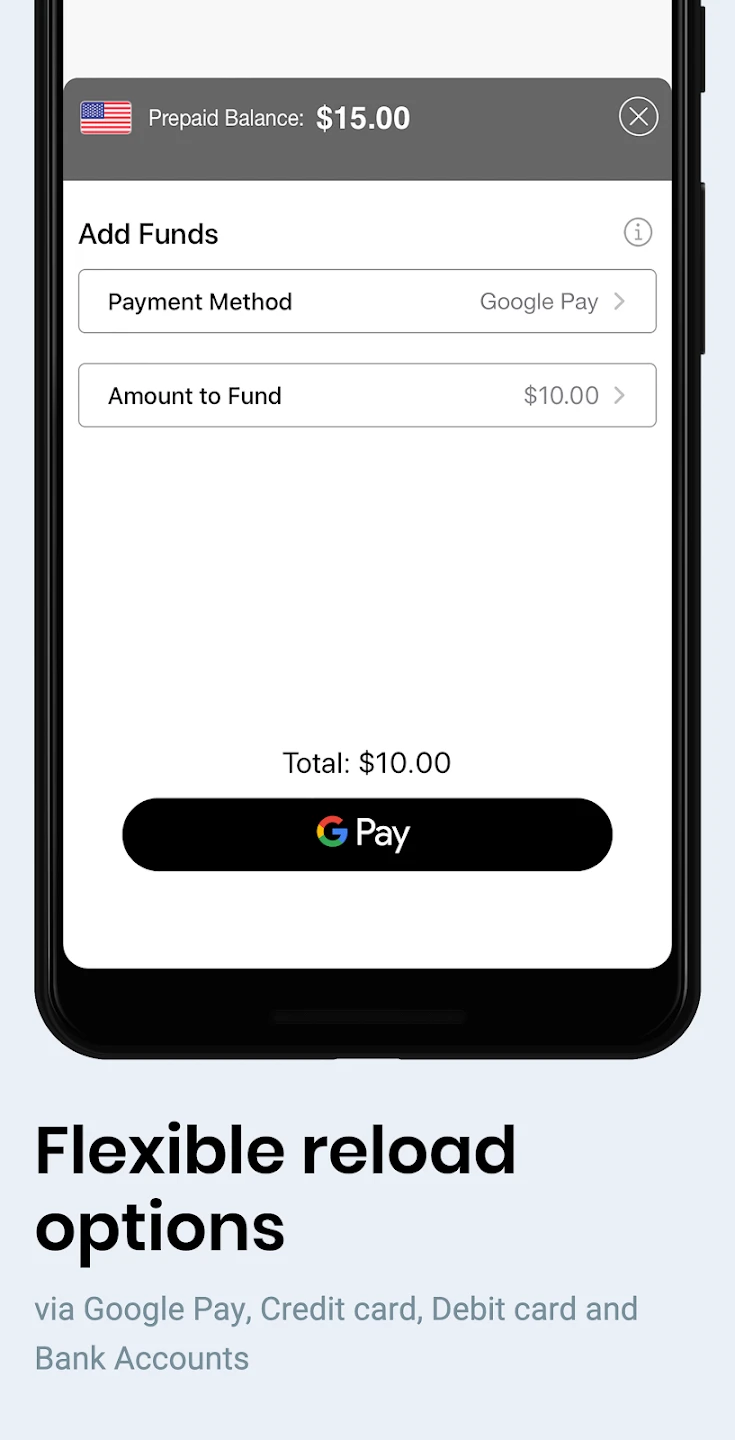

Screenshots

|

|

|

|