|

|

| Rating: 4.2 | Downloads: 1,000,000+ |

| Category: Finance | Offer by: Perpay Inc. |

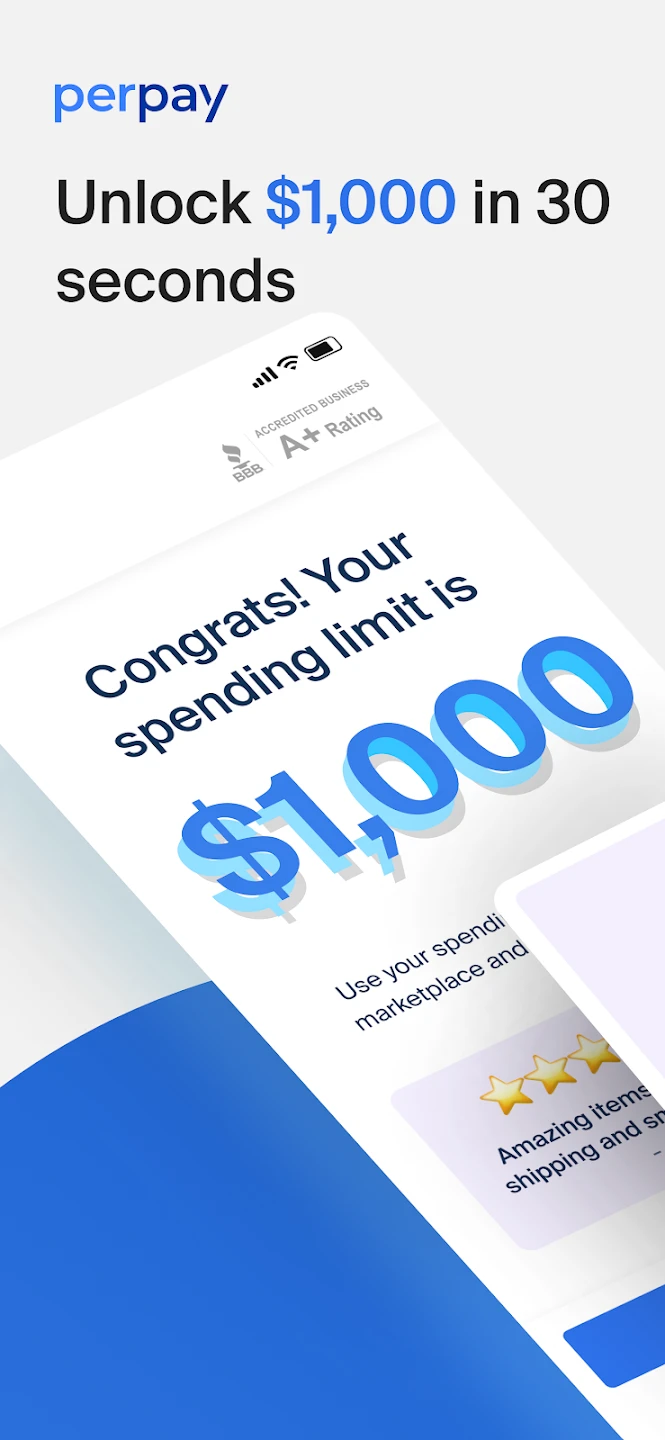

The Perpay – Shop and Build Credit app is designed to help users manage their online shopping activities and simultaneously improve their credit score. It provides tools to track spending, understand credit behavior, and potentially access financing options directly through shopping carts. This app is primarily for responsible shoppers looking to build or rebuild their credit history without feeling penalized or restricted.

The key value of the Perpay app lies in its integration of everyday shopping with credit-building goals. Users can see the direct impact of their purchases on their potential credit score growth, fostering better financial habits. It offers a practical way to build credit, especially for those starting out or with limited or poor credit, making the process feel less like a chore and more like a benefit of everyday spending.

App Features

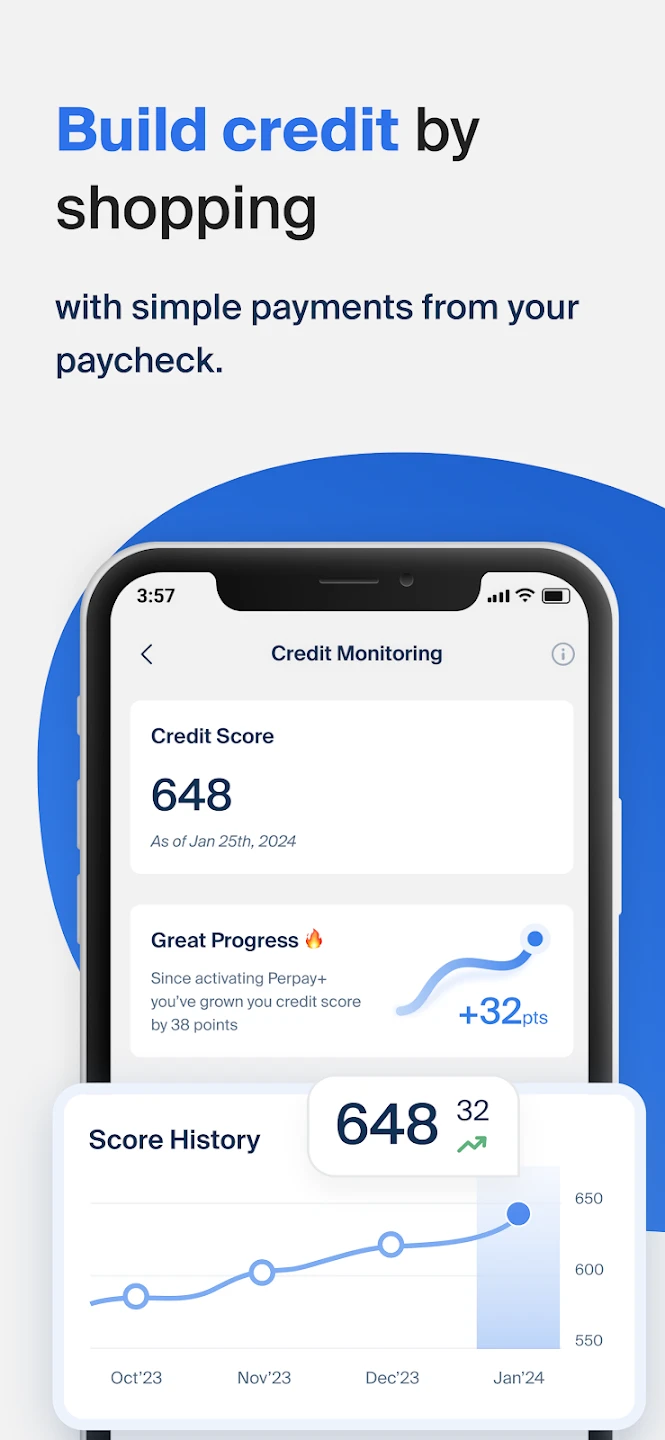

- Credit Building with Purchases: Perpay analyzes eligible purchases and assigns a potential credit impact score for each transaction. This helps users understand which approved charges contribute to improving their credit profile.

- Spending Tracker with Credit Insights: The app categorizes spending and links each transaction to its credit-building potential. Users see how responsible spending habits translate into positive account history and potentially higher credit limits.

- Eligibility for Credit Building: Not all purchases qualify; Perpay identifies transactions that positively impact credit scores. This feature filters out non-qualifying expenses, ensuring users focus on building credit where it counts.

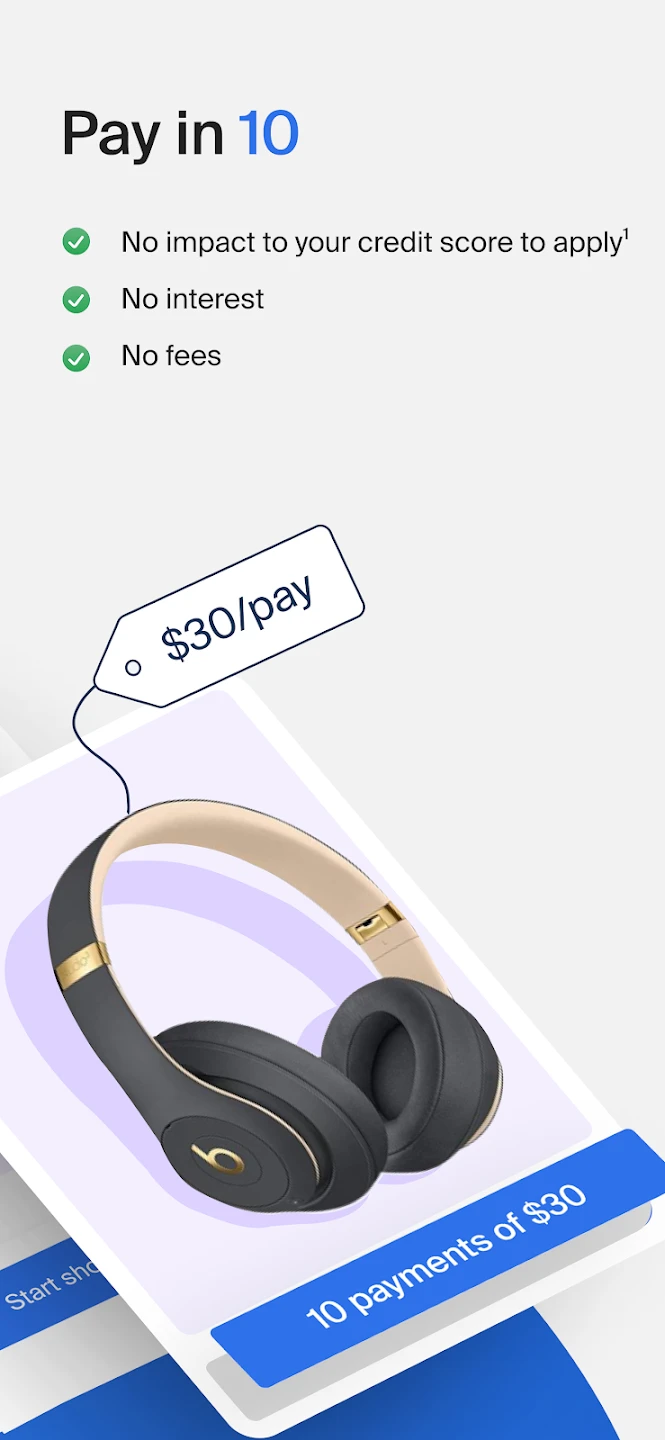

- Potential Financing Options: Integrated shopping features may offer Perpay financing, allowing users to pay over time. By combining payment plans with credit-building potential, it aims to simplify budgeting and responsible spending.

- Credit Score Monitoring: Users gain access to their credit score and reports (sometimes for a fee or via partner services). Understanding one’s own credit health is a core component of the Perpay experience.

- Budgeting Tools: Optional budgeting features help users plan spending aligned with their credit-building goals. This encourages financial discipline, linking short-term purchasing with long-term credit health.

Pros & Cons

Pros:

- Direct Link Between Spending and Credit Growth

- Accessible for Users with Limited Credit History

- Integrated Shopping Experience

- Potential for Lower Interest Financing

Cons:

- Potential Fees for Some Transactions or Monitoring

- Not All Purchases Contribute to Credit Building

- Better Results Require Consistent, Timely Payments

- Credit Score Visibility Might Come at a Cost

Similar Apps

| App Name | Highlights |

|---|---|

| ShopPay Now |

Focuses on Buy Now, Pay Later (BNPL) integrated with e-commerce. Known for simple payment plans and a seamless checkout flow. |

| Afterpay |

Offers interest-free installment payments on online orders. Includes features like spending controls and notifications. |

| Credit Building Simulator (Fictional Example) |

Hypothetical app providing detailed projections on credit score increases based on simulated purchase histories. Would likely feature detailed user guides and customizable financial goals. |

Frequently Asked Questions

Q: What exactly can I buy using the Perpay feature?

A: You can typically use Perpay financing options or credit-building features for a wide range of eligible online purchases. This includes items from retailers offering the Perpay integration, covering categories like apparel, electronics, household goods, and more. It’s always best to check the app for specific merchant compatibility.

Q: Will using Perpay hurt my credit score?

A: Generally, responsible use of Perpay, like making on-time payments, can help build a positive credit history and potentially improve your score over time. Remember, not all Perpay transactions report immediately; timely repayment is key, as it is with any credit product.

Q: Does Perpay only help me shop better, or does it actually help improve my credit?

A: Yes, the core objective of the Perpay – Shop and Build Credit app is to improve your credit. It achieves this primarily through responsible purchase options (like Perpay financing) and by potentially reporting on-time payments to credit bureaus, helping you build a stronger financial profile.

Q: Are there any fees associated with using the Perpay feature for shopping?

A: This depends on the specific feature you’re using. Some financing options might involve transaction fees or interest if the standard interest-free period isn’t used fully. The credit-building tracking itself is typically free, but accessing detailed credit reports or score monitoring might incur a subscription fee. Always review the terms and conditions within the app.

Q: Who is the Perpay app best suited for?

A: The Perpay app is best for individuals looking to build or rebuild their credit history. This includes beginners with no credit history, those with thin files, people looking to establish positive payment patterns (like recent graduates or young professionals), and individuals aiming to increase their credit limits responsibly through everyday purchases.

Screenshots

|

|

|

|