|

|

| Rating: 4.1 | Downloads: 1,000,000+ |

| Category: Finance | Offer by: Possible Finance – A Public Benefit Corporation |

The Possible: Fast Cash & Credit mobile application streamlines financial transactions, allowing users to deposit cash, manage credit lines, and make instant payments. It caters specifically to freelancers, gig economy workers, small businesses, and anyone needing efficient access to and management of funds, often outside standard banking hours.

This app offers significant advantages for individuals and businesses needing quick access to capital or faster payment processing. By digitizing traditionally paper-based or lengthy cash handling and credit management tasks, it saves time and reduces errors, providing a modern solution for managing everyday financial flows.

App Features

- Cash Deposit Scanning: Quickly scan checks or deposits directly into your linked account using your phone’s camera. This feature saves trips to the branch, reducing processing delays, and offers immediate visibility of funds upon successful deposit confirmation.

- Instant Payment Request: Easily send money to anyone with just an email or phone number; recipients receive payment notifications instantly. Peer-to-peer transactions and service provider payments become significantly faster than traditional ACH transfers, enhancing convenience for everyday transactions.

- Dynamic Credit Line Management: Monitor and adjust your credit line limits based on your spending history and profile, offering flexibility without needing manual application. This tool helps optimize borrowing capacity, providing tailored financial flexibility for managing short-term cash flow needs seamlessly.

- Expense Categorization Dashboard: Automatically categorize transactions and provide detailed insights into your spending habits for better budgeting control. Users can easily analyze where their money goes, making informed adjustments and simplifying financial planning by visualizing cash outflows.

- Multi-Account Switching: Seamlessly switch between different linked bank accounts or credit cards to manage finances across various ventures or personal budgets. This feature is incredibly useful for freelancers managing separate income streams, promoting organized financial oversight and preventing mix-ups.

- App-to-Bank Transfers (Optional): Directly initiate ACH transfers between your Possible accounts and external financial institutions from within the app, though potentially with standard bank processing times. This supports fund consolidation and efficient resource allocation across your entire financial ecosystem.

Pros & Cons

Pros:

- Speedy Cash Access

- User-Friendly Camera Interface

- Enhanced Flexibility for Freelancers

- Transparent Fee Structure

Cons:

- Potential Camera Recognition Errors

- Credit Line Approval Criteria

- Standard Bank Transfer Times Outside

- Dependence on Smartphone Functionality

Similar Apps

| App Name | Highlights |

|---|---|

| PayNearMe |

Popular for cash depositing at various retail locations and sending money. Offers vast physical locations and robust P2P features. |

| MoneyGram Send Money |

Focused on global money transfers and remittances with physical and digital options. Includes international reach and in-person services alongside app features. |

| TransferWise (now Wise) |

Specializes in low-cost international bank transfers with clear exchange rates. Emphasizes cost savings for international transactions and professional multi-currency accounts. |

Frequently Asked Questions

Q: How quickly can I get cash into my account using the Possible: Fast Cash & Credit app?

A: Deposit requests via the app’s scanning feature are typically processed within 24-48 hours, depending on the type of instrument. Faster deposits might be available for certain checks or cash deposits at affiliated locations.

Q: Can I use the app to request a cash advance if I don’t have a traditional bank account?

A: The app primarily works with existing bank accounts and credit lines. While a traditional checking account is usually required for deposits, eligibility for a credit line might depend on alternative verification methods; it’s best to check their specific requirements.

Q: Are there any hidden fees associated with using the Possible: Fast Cash & Credit service?

A: Fees are transparently listed for services like deposits (potentially at branches or lockboxes) and transfers. The app’s core features like sending money and managing your credit line have no ongoing fees, but specific deposit methods might incur small charges, detailed within the app’s fee section.

Q: Does the app work offline, or do I need a constant internet connection?

A: Most core functions, especially sending/receiving money or accessing account details, require an internet connection (WiFi or cellular data). However, some aspects like viewing recent transactions or the deposit scanner interface might work with a limited cellular data connection, though full functionality is recommended with a stable connection.

Q: Can I receive notifications when my cash deposit has been successfully processed?

A: Yes, the app provides push notifications once your deposit scan is successfully submitted. While processing confirmation usually follows within the timeframe mentioned, the notification alerts you immediately that the request has been accepted for processing.

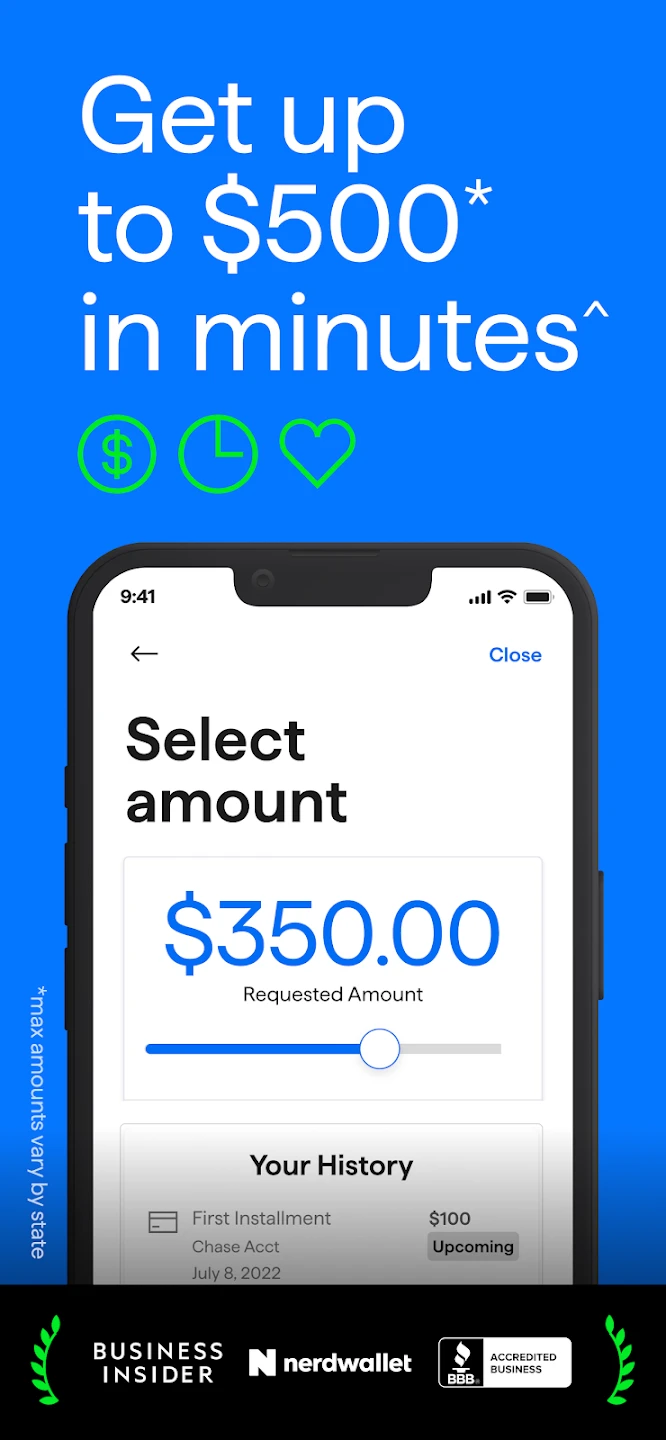

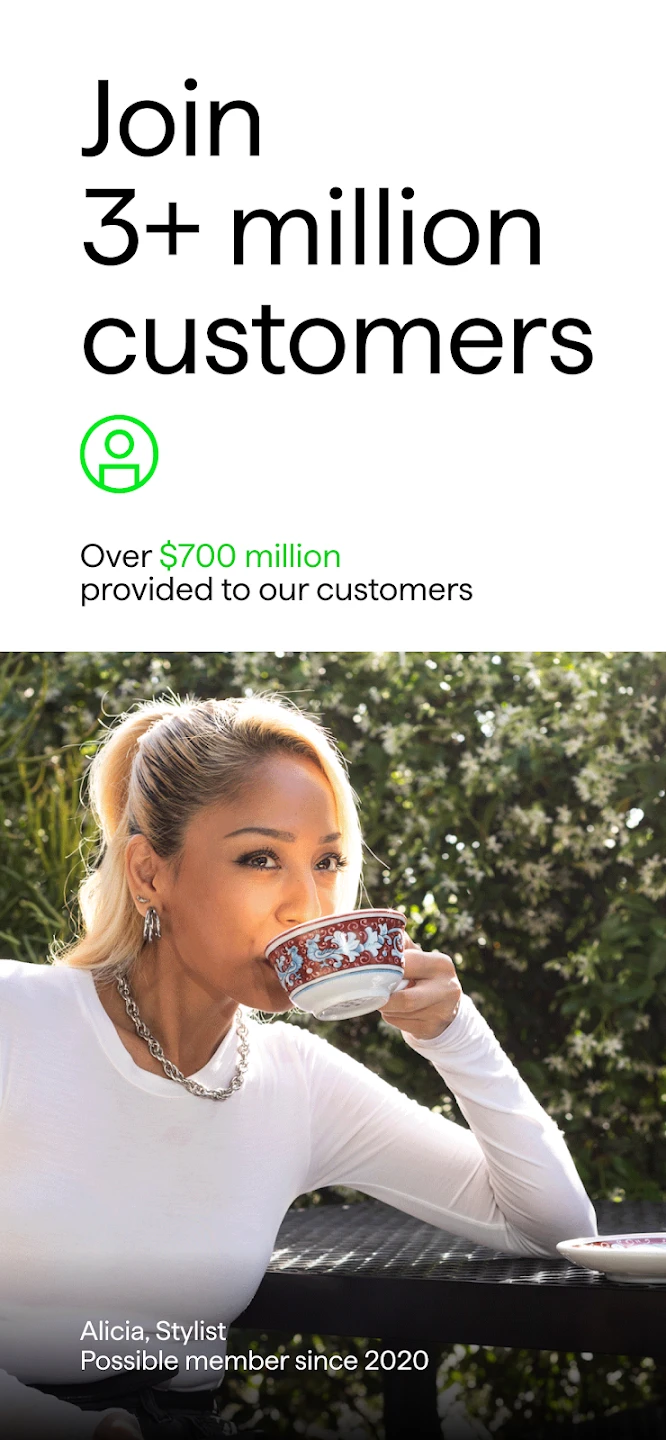

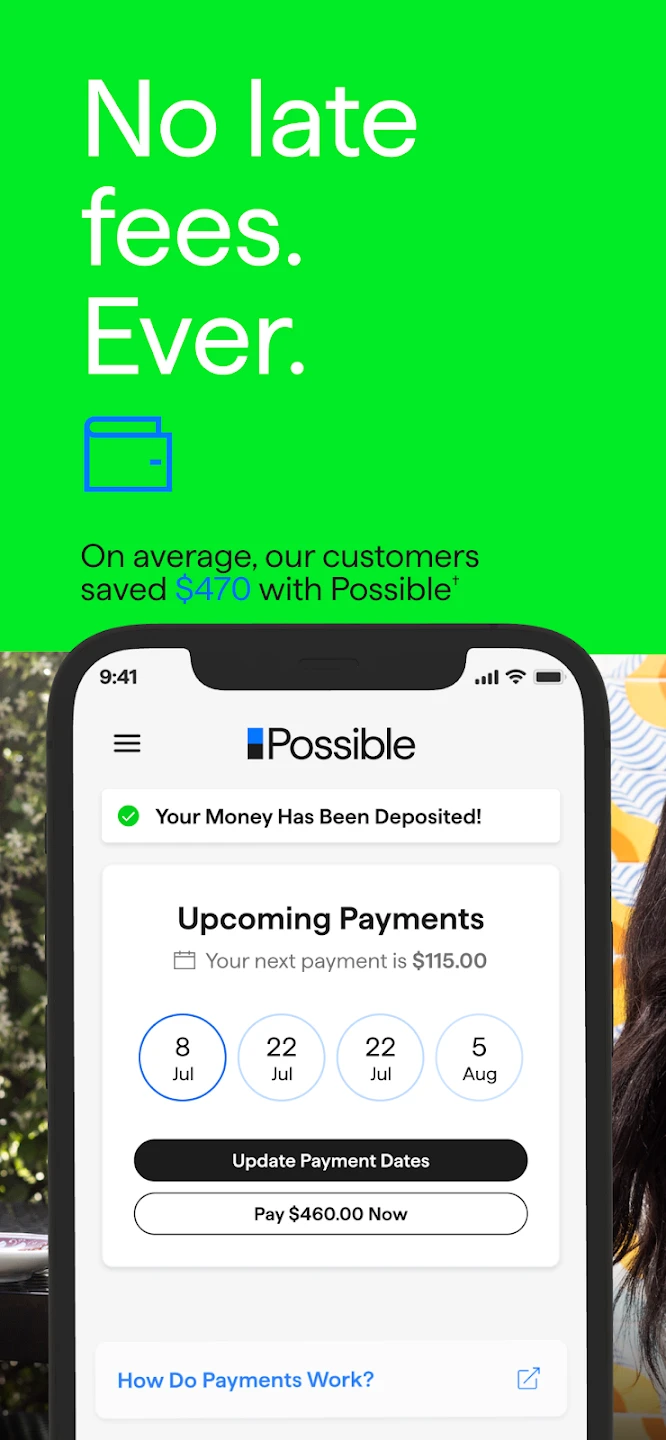

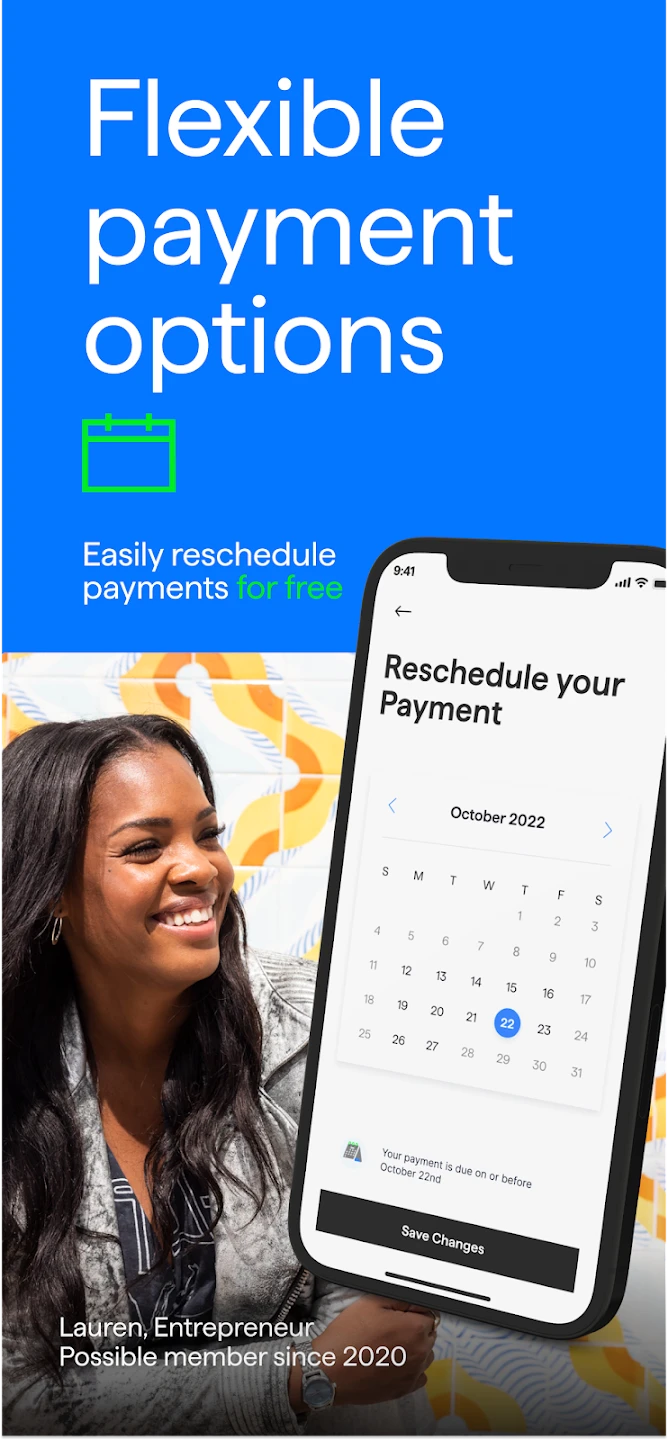

Screenshots

|

|

|

|