|

|

| Rating: 4.7 | Downloads: 1,000,000+ |

| Category: Finance | Offer by: PREMIER Bankcard |

The PREMIER Credit Card app is your primary mobile gateway to your premium credit account. It enables you to make purchases, check balances, review transactions, and manage your account details securely anytime, anywhere. Perfectly designed for cardmembers seeking comprehensive financial control and sophisticated banking features on their smartphones or tablets.

Its key appeal lies in the convenience and power it brings to your fingertips, allowing you to stay on top of your finances, track spending, and respond quickly to your needs and the world around you with the ease of a mobile device. The PREMIER Credit Card app is ideal for active individuals and households looking to streamline their banking and maximize the benefits attached to their premium credit card.

App Features

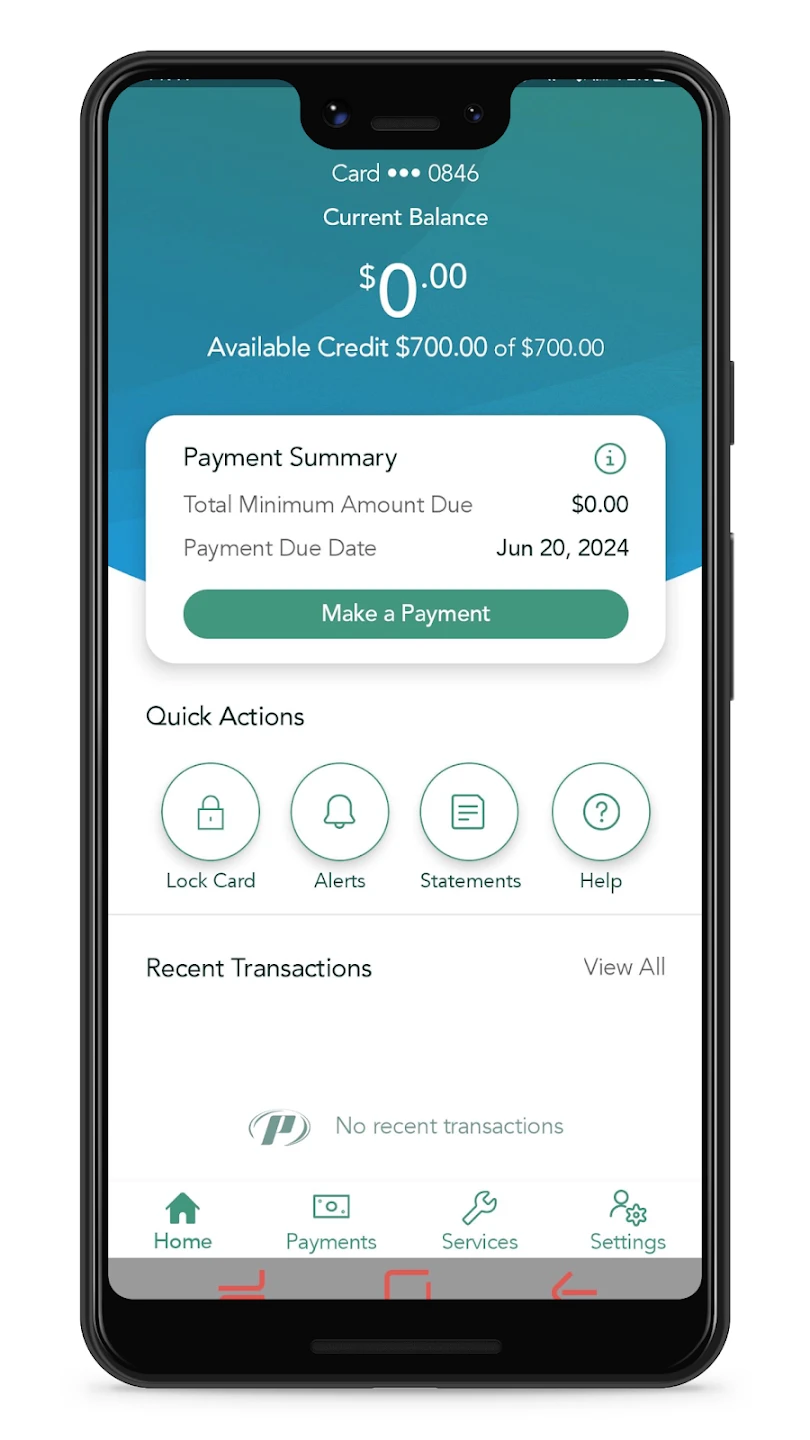

- Account Overview & Balance Checking: Instantly see your current credit card balance and a running total of recent transactions, providing a clear snapshot of your spending at a glance. This saves you the trip to the bank, ensuring you always know your financial standing from your phone.

- Cashback Redemption & Point Tracking: Use the app to easily monitor and redeem your earned cashback points or offers directly linked to your PREMIER Credit Card, integrating rewards seamlessly into your spending habits. The tracking simplifies maximising your benefits without constantly logging into separate portals, encouraging better use of your rewards program.

- Recent Transaction Categorization: The app automatically categorizes your spending for easy analysis of where your money goes, helping you identify trends and potential cost-saving areas in your budget. For example, seeing a recurring expense appear under ‘Dining’ prompts you to review subscription clubs or eating out frequency.

- Online & Phone Banking Portal Access: Quickly navigate from the app to schedule transfers, locate branches, update account information, or securely log in to the full online banking platform for more detailed management tasks or statement viewing. This integration simplifies daily banking interactions to a single, convenient point of access.

- Cardholder Alerts & Notifications: Customize which alerts you receive – like transaction confirmations, upcoming bill payments, low credit limit warnings, or security notifications – ensuring key updates are targeted directly to your phone. This feature promotes awareness and faster responses, enhancing control and security over your finances.

- Travel & Purchase Protection Details: Access frequently referenced information about purchase protection benefits included with your card, details on extended warranties, or specifics regarding travel insurance coverage tailored for cardmembers. Having this readily available helps you understand and utilize these valuable features when making larger purchases or planning trips.

Pros & Cons

Pros:

- Convenience: Always have access to your account balance, transactions, and potentially card controls

- Benefit Management: Easier tracking and redemption of loyalty points and cashback rewards

- Security: Secure login and alert features help monitor account activity

- Integration: Seamless links to website and potentially mobile payment systems

Cons:

- Potential complexity: Advanced features might require some time to fully master

- Data usage: Frequent balance checks or transaction reviews can consume mobile data

- Device dependency: Important notifications miss if device is offline or payment fails

- App Compatibility: Functionality can vary slightly based on device OS version or specific model

Similar Apps

| App Name | Highlights |

|---|---|

| Gold MasterCard Mobile |

Focuses on straightforward balance checks and transactions with an emphasis on security features. Known for easy navigation and balance rounding tools for budgeting. |

| Premium Visa Suite |

Often includes companion apps for travel planning and expense management alongside banking. Includes dynamic spending goal features and enhanced portfolio views. |

| Solo Premium Account |

Highlights shopping benefits and included premium services. Offers robust points management system and pathfinding to optimal activation points. |

Frequently Asked Questions

Q: How does the PREMIER Credit Card app help me track my spending?

A: The app displays not only your current balance and statement but also automatically categorizes recent transactions for better spending insights. You can view detailed transaction breakdowns, filter by date or merchant, and analyze trends using built-in tools – all from your phone!

Q: Are there mobile-only features of the PREMIER Credit Card?

A: Yes, typically, premium credit card apps like ours offer features unavailable on the website, such as direct point redemption, immediate changes to spending limits (subject to bank policies), and often quicker customer support initiation directly through the app.

Q: My device is showing an error, what should I do?

A: First, check that the PREMIER Credit Card app is updated to its latest version via your operating system’s app store. If the issue persists, try restarting your phone or check your internet connection. Contacting app support or the credit card provider directly may be needed if problems continue.

Q: Can I manage co-authorized users of my PREMIER Credit Card through the app?

A: This varies significantly depending on your specific issuer and card plan details. Some apps allow setting up limited spending users for shared accounts, while others offer detailed spending controls or joint viewing capabilities. Please consult your card agreement or contact customer service for precise information relevant to your account.

Q: What mobile security measures are built into the PREMIER Credit Card app?

A: Security is paramount. The app uses strong encryption, requires secure passwords or biometric logins (like Touch ID/Face ID), offers device passcode protection, transaction alerts, and possibly card control features. These layered defenses help protect your account and personal information from unauthorized access when using the app or interacting with your credit card.

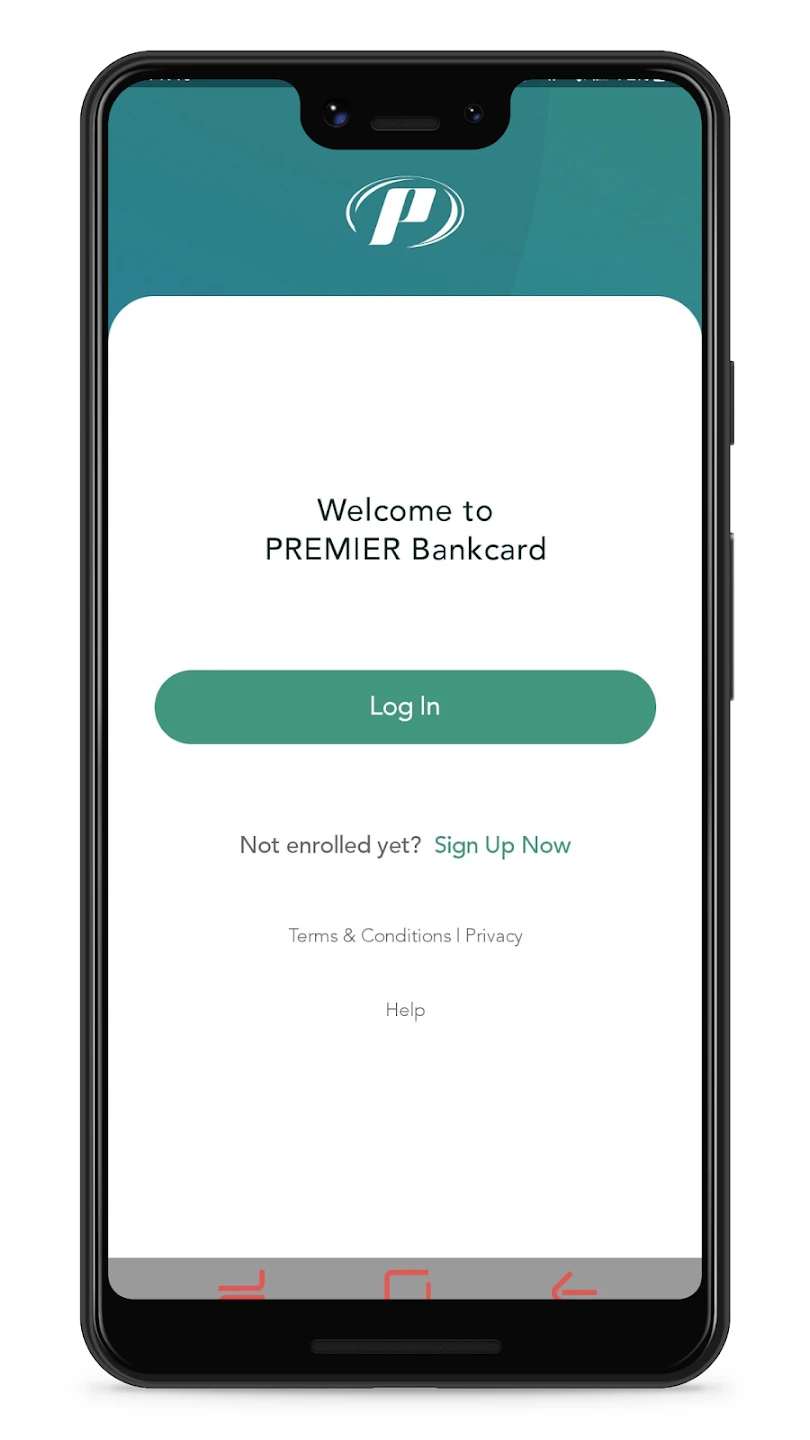

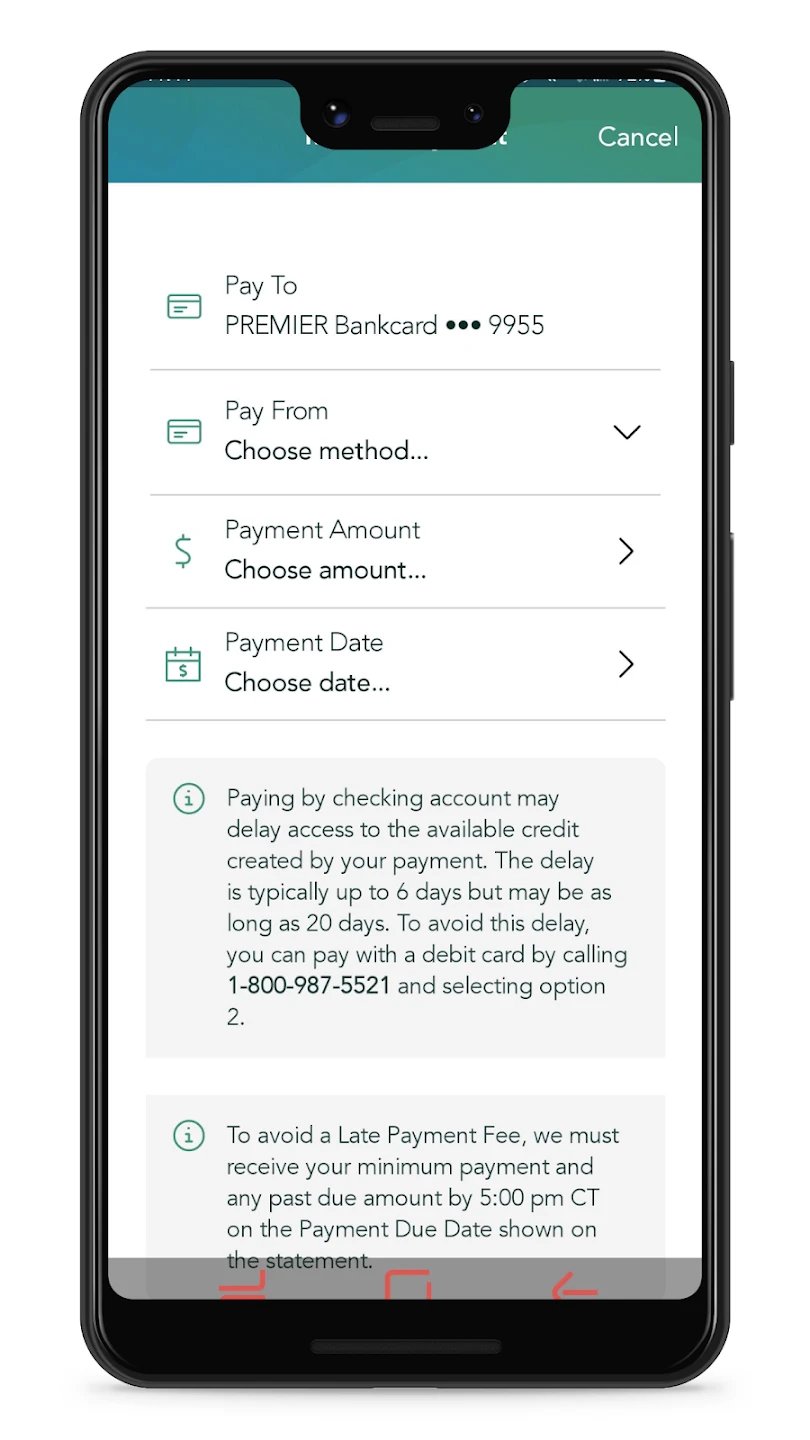

Screenshots

|

|

|