|

|

| Rating: 4.6 | Downloads: 10,000,000+ |

| Category: Finance | Offer by: Progressive Insurance |

Progressive is a mobile application designed to help users build and manage a comprehensive financial picture efficiently. It consolidates data from various accounts like bank accounts, credit cards, and investments into a single, easy-to-understand dashboard. Ideal for both everyday budgeting and long-term financial planning.

The core value of Progressive lies in its user-friendly interface and powerful tools for visualizing spending patterns, setting financial goals, and receiving personalized insights. It appeals by simplifying complex financial data and empowering users to gain better control over their finances through actionable suggestions, all while being committed to robust security.

App Features

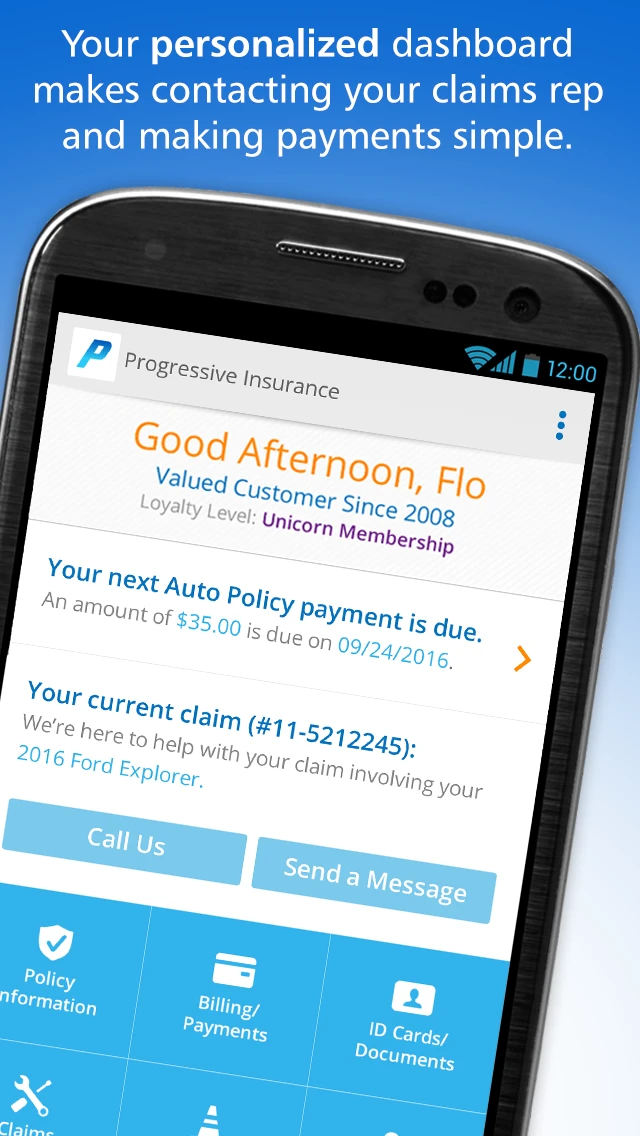

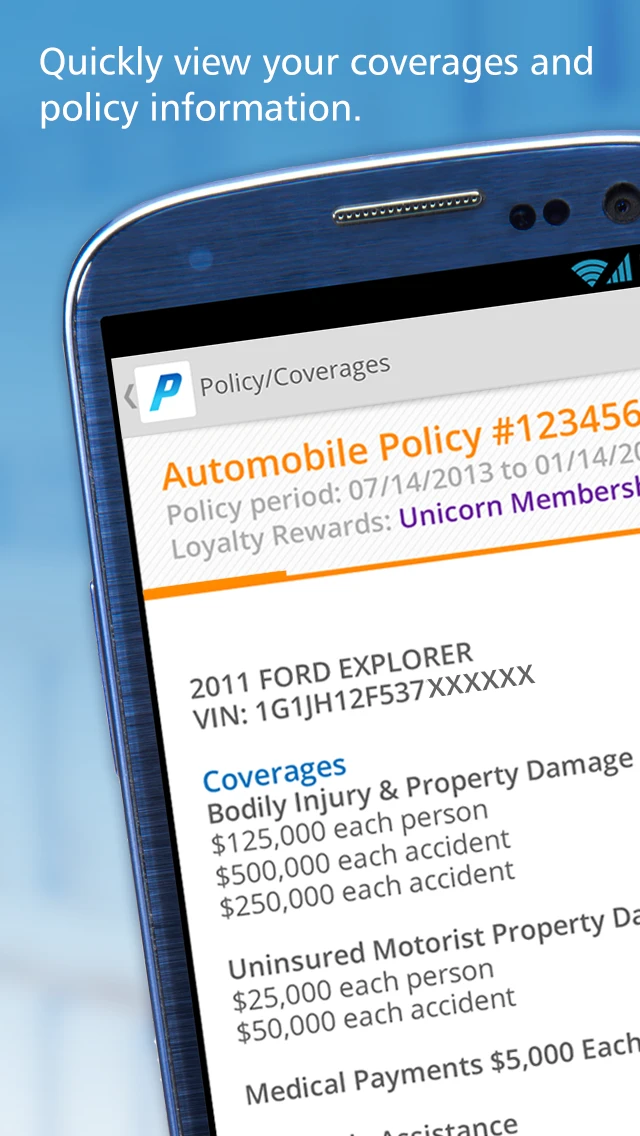

- Unified Dashboard View: This feature provides a single screen showing balances across all linked bank accounts, credit cards, investment accounts, and loan information. This saves significant time, eliminates manual data entry, and offers a clear overview, helping users quickly understand their net worth and cash flow situation.

- Smart Spending Tracking: Using advanced categorization algorithms, the app automatically classifies transactions. By identifying where money goes without manual tagging, users get a detailed breakdown of spending habits, revealing hidden patterns or areas for reduction that might otherwise go unnoticed, making budget adherence easier.

- Goal Setting & Tracking: Users can define specific financial objectives like saving for a down payment or paying off debt. Progressive helps by allocating funds (if linked accounts allow), tracking progress visually, and providing motivation through milestones achieved, turning abstract goals into tangible steps, particularly beneficial for users with long-term plans.

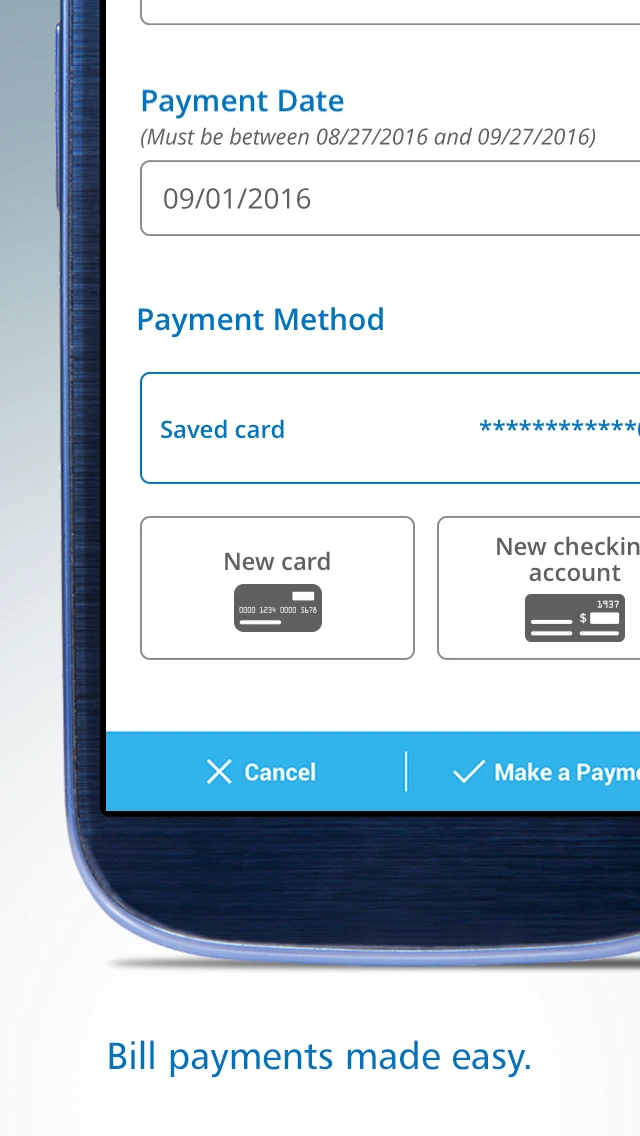

- Budget Builder & Alerts: The app creates custom budget templates based on income and spending patterns, then allows users to adjust these as needed. Furthermore, customizable alerts notify users about unusual spending, low balances, large transactions, or approaching bill due dates, acting as proactive financial safeguards that prevent overdrafts and missed payments.

- Investment Portfolio Analysis: Integrated tools allow linking brokerage accounts to track investment performance against benchmarks and visualize asset allocation. This feature offers crucial context for investors, providing performance data alongside cash flow information, helping users make more balanced financial decisions across all asset classes, especially valuable for diversified portfolios.

- Secure Data Sync & Notifications: Data from financial institutions is securely synced using robust encryption protocols and secure authentication methods. For instance, users can set up notifications for account anomalies or investment performance triggers, offering peace of mind and timely information without compromising security.

Pros & Cons

Pros:

- Simplified Financial Overview

- Intelligent Spending Categorization

- Goal Setting Tools with Visual Tracking

- Comprehensive Account Linking Capabilities

Cons:

- Setup can be Time-Consuming Initially

- Dependence on Account Linking for Full Functionality

- Potential for Overwhelming Amount of Data

- Limited Advanced Customization Options

Similar Apps

| App Name | Highlights |

|---|---|

| Mint |

Also focuses on budgeting and debt tracking with a user-friendly interface. Known for its budgeting tools and free basic features, often used alongside financial goals and bill reminders. |

| YNAB (You Need A Budget) |

Emphasizes zero-based budgeting principles. Offers robust transaction categorization and detailed financial goal management, providing a comprehensive money management experience focused on intentional spending. |

| Acorns |

Designed primarily for investing spare change automatically. Features spending insights, goal tracking, and a simple investment platform, ideal starting point for beginners looking to grow their wealth passively. |

| Personal Capital |

Specializes in investment analysis and retirement planning. Provides sophisticated market data visualization and retirement income calculators, catering to users focused on investment performance and long-term wealth accumulation. |

Frequently Asked Questions

Q: How does Progressive ensure the security of my bank and investment account information?

A: Progressive employs industry-standard encryption (like AES-256) for data at rest and in transit. They also use secure authentication methods and partner directly with financial institutions that adhere to strict security protocols, prioritizing user data protection throughout.

Q: Can I link international bank accounts or investment portfolios from other countries using Progressive?

A: Progressive primarily focuses on accounts offered by major US financial institutions. Support for international accounts varies; while they aim to expand, users with overseas accounts should verify current compatibility directly with the Progressive support team before attempting to link.

Q: What happens to my financial data if I stop using the Progressive app? Is it deleted permanently?

A: If you choose not to use Progressive anymore, the app will no longer display your financial data. The data is not deleted from the app’s servers unless explicitly requested via the account deletion process. It’s important to note that the primary holder of your financial data (your bank/investor) maintains your records independently. Your data with Progressive remains subject to their data retention policies until deletion is requested.

Q: Does Progressive itself charge fees for its services, or are there hidden costs involved?

A: Progressive generally offers a core feature set for free, similar to apps like Mint or Acorns. However, premium features, specific investment products, or certain enhanced reporting services may require a subscription or separate fee. Always review the app’s in-app information or website for detailed pricing before subscribing to any paid services.

Q: Can I effectively use Progressive if I primarily manage cash or credit, without significant investments or assets?

A: Yes, absolutely. Progressive is designed for anyone with financial responsibilities, regardless of their asset level. It excels at budgeting, tracking spending from checking/savings, categorizing credit card transactions, and managing loan repayments. The goal tracking and insights are particularly useful for managing day-to-day finances effectively.

Screenshots

|

|

|

|