|

|

| Rating: 3.7 | Downloads: 5,000,000+ |

| Category: Business | Offer by: Intuit Inc |

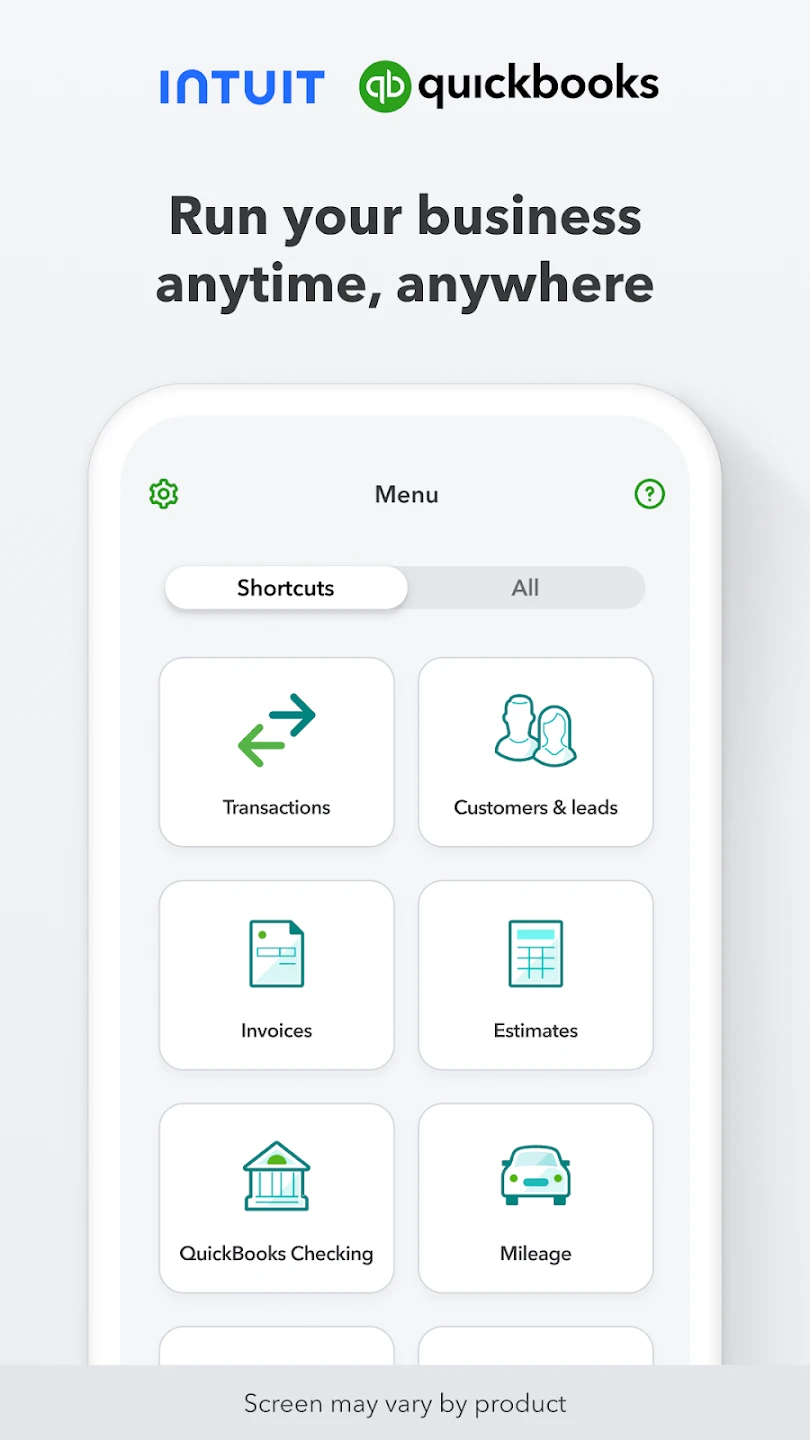

QuickBooks Online Accounting is a cloud-based accounting solution for small businesses, freelancers, and growing companies. It helps manage finances from invoicing and expense tracking to payroll and tax preparation. This versatile platform simplifies complex financial tasks and provides real-time insights to support informed business decisions.

The appeal of QuickBooks Online Accounting lies in its intuitive interface, extensive reporting features, and seamless integrations. It empowers businesses to gain valuable financial clarity, save significant time on bookkeeping, and make strategic decisions based on accurate data. Whether you’re running a solopreneur venture or managing multiple locations, this tool streamlines essential accounting workflows.

App Features

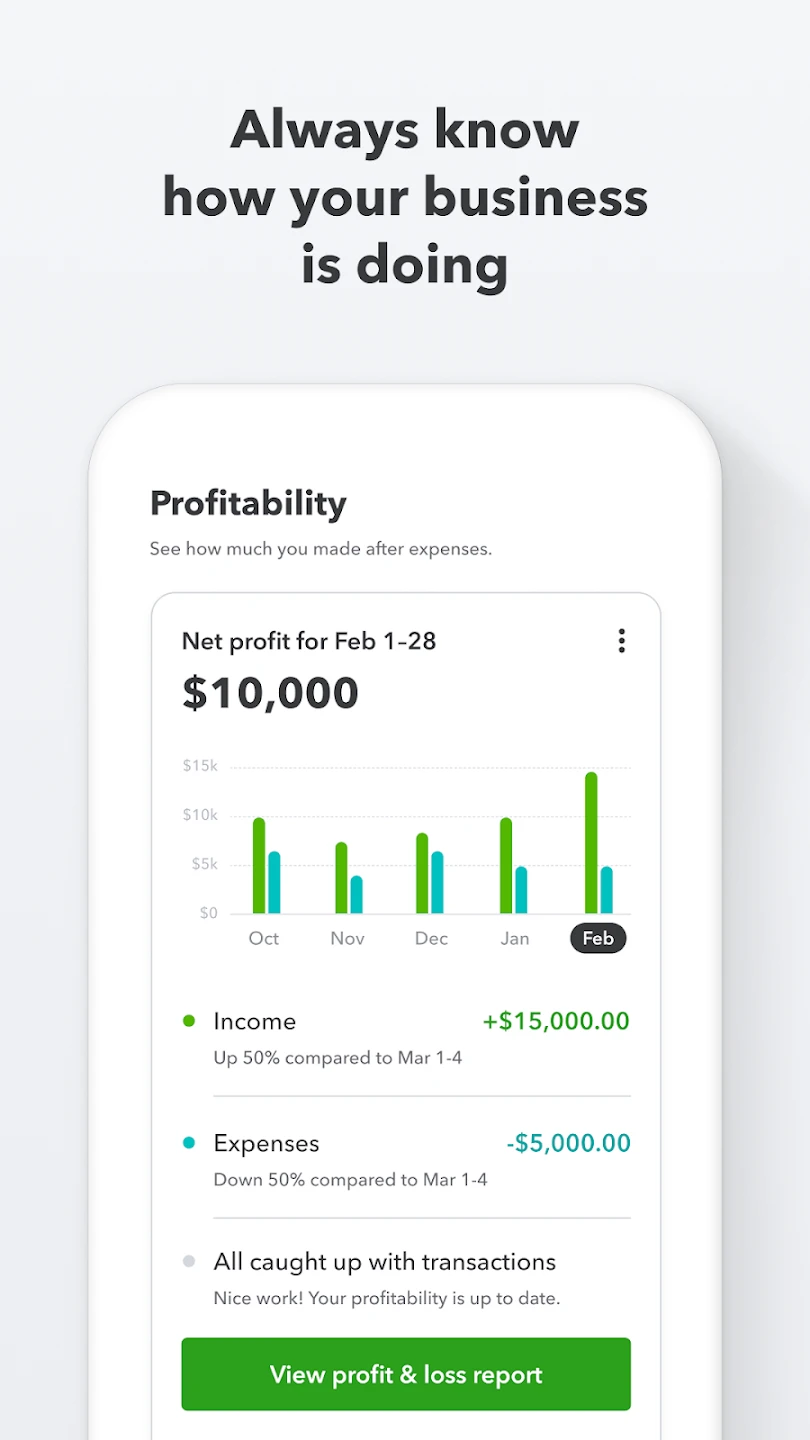

- Dashboard & Overview: Get a centralized view of financial performance, including cash flow, recent transactions, and top clients. This immediate access allows entrepreneurs to quickly assess their business health and identify trends without scrolling through multiple reports, saving valuable decision-making time.

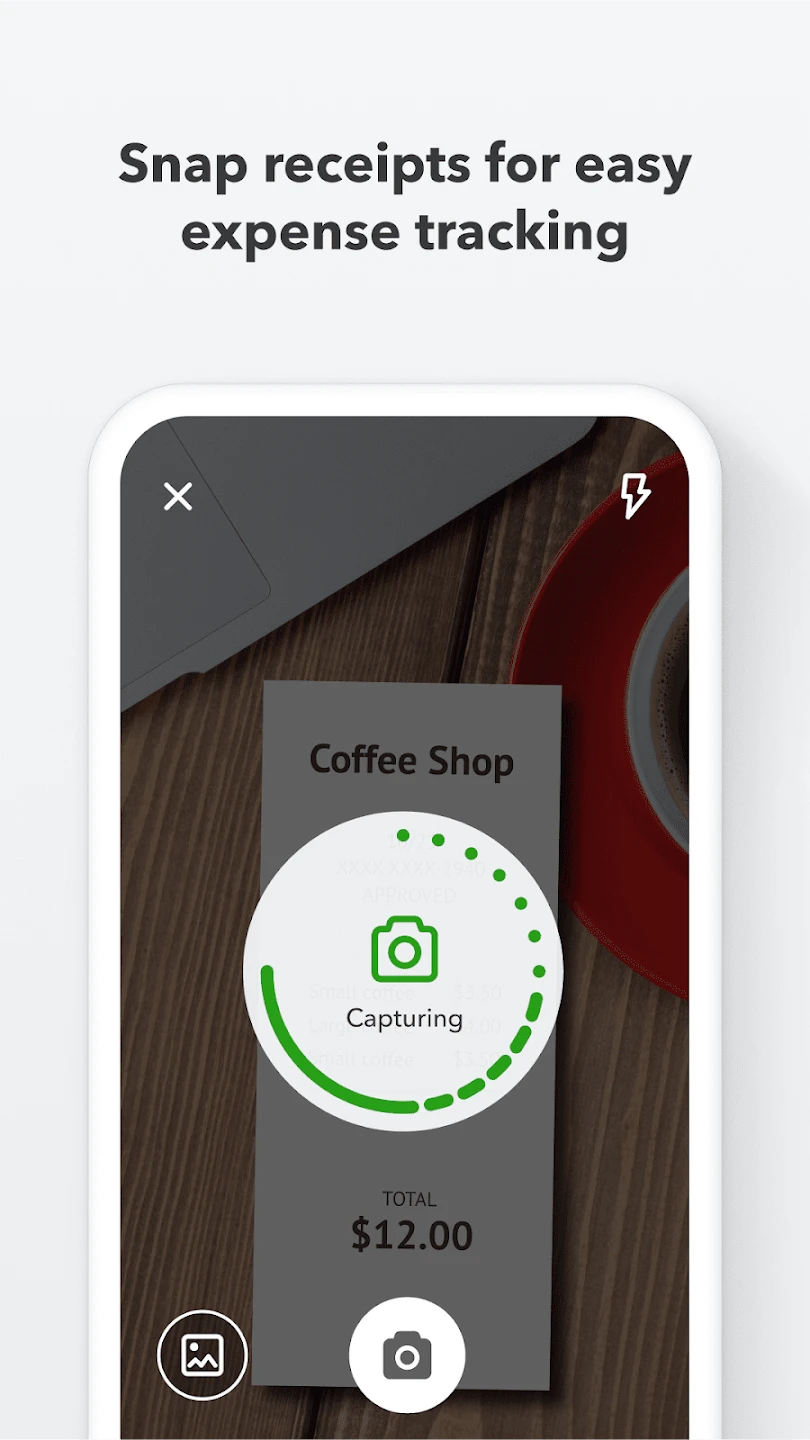

- Expense Management: Easily categorize and import expenses from bank accounts or receipts. The system automatically suggests categories based on merchant data, reducing manual input errors for businesses with frequent transactions and ensuring accurate expense tracking for tax purposes.

- Multi-Entity Tracking: Manage finances across multiple company entities, locations, or subsidiaries from a single dashboard. This feature is especially beneficial for growing businesses or franchisees who need to maintain separate financial records while having a consolidated view of overall company performance.

- Sales Tax Automation: Configure sales tax settings for different jurisdictions and have the system calculate and apply taxes automatically. For businesses dealing with cross-state sales, this prevents costly compliance errors and ensures accurate tax collections across varying state regulations.

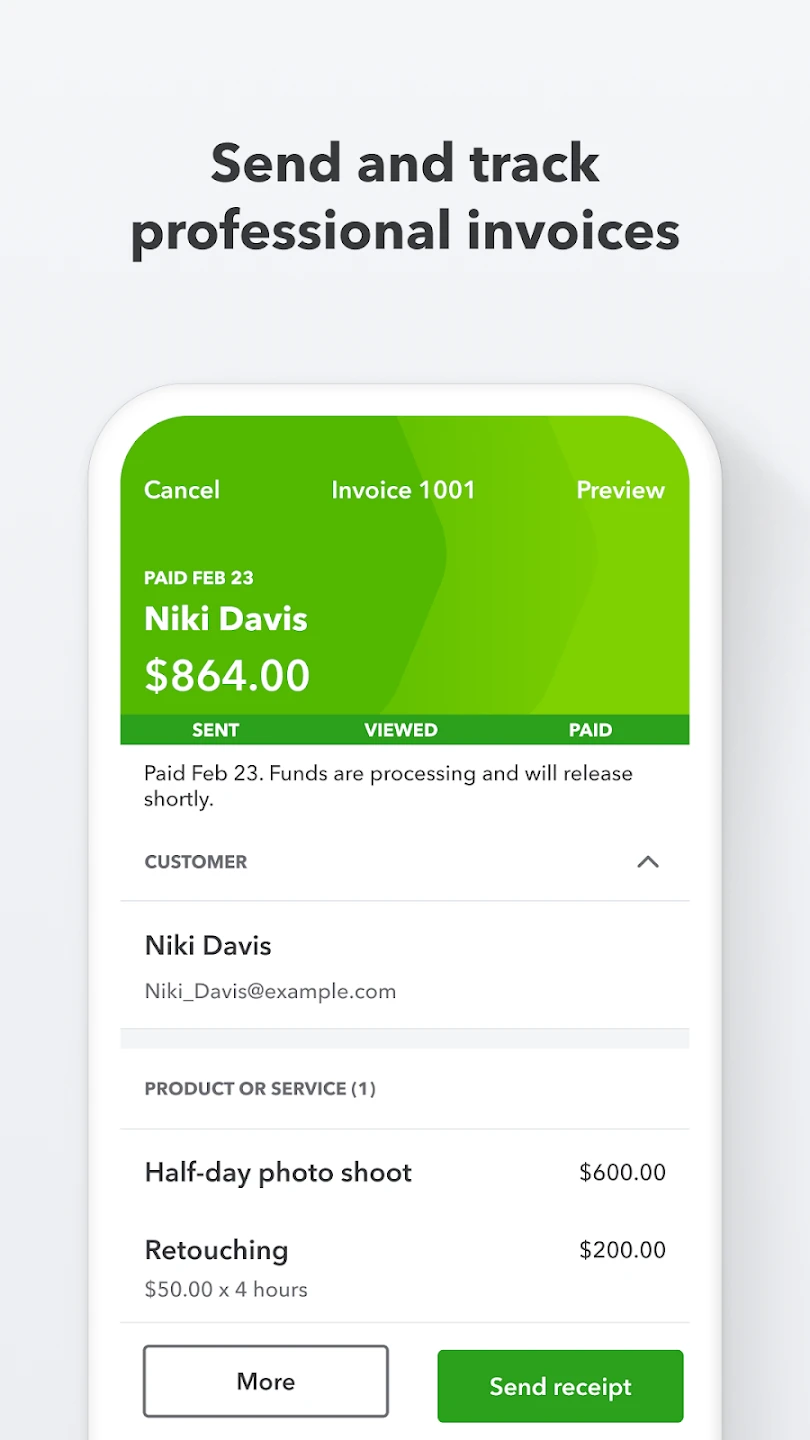

- Client Center: Provide clients with secure access to invoices and business data. This empowers customers to track payments, download invoices, and view their spending history, improving cash flow management by reducing follow-up time on overdue payments.

- Bank Feeds Integration: Connect directly to your financial institution accounts to import transactions automatically. This eliminates the need for manual data entry, cutting bookkeeping time in half for many businesses and reducing errors associated with manual input.

Pros & Cons

Pros:

- Comprehensive Feature Set for various business needs

- User-Friendly Interface suitable for non-accountants

- Frequent Updates with new features and compliance

- Robust Reporting Tools for financial analysis

Cons:

- Potentially Higher Cost for advanced features and support tiers

- Learning Curve for complex features despite intuitive interface

- Limited Customization in certain core processes

- Dependence on Internet for access and functionality

Similar Apps

| App Name | Highlights |

|---|---|

| Xero |

Popular accounting software with robust banking integration and detailed chart of accounts customization. Ideal for international businesses. |

| Freshbooks |

Designed for freelancers with simplified invoicing and project management tools. Emphasizes mobile accessibility. |

| Deembit |

Focuses on automated payments and cash flow management, ideal for businesses needing faster receivables. |

Frequently Asked Questions

Q: How often is QuickBooks Online updated with new features?

A: QuickBooks Online typically receives updates every few weeks, adding new features, improving existing tools, and enhancing security. These updates roll out gradually to minimize disruptions, with users receiving notifications about significant changes to key functionalities.

Q: Can I use QuickBooks Online for both my company and personal finances?

A: No, QuickBooks strictly separates business and personal finances. Setting up multiple company entities is allowed to track different business units, but personal accounts require separate setup. This separation ensures better organization and simplifies tax preparation by keeping business finances clearly separated.

Q: What’s the difference between QuickBooks Online Essentials and Advanced Payroll?

A: QuickBooks Online Essentials Payroll handles basic employee compensation and taxes for U.S. businesses. For more complex needs like contract workers, bonuses, or international staff, you would need Advanced Payroll, which offers more sophisticated features for multi-state tax compliance and specialized compensation structures.

Q: Is QuickBooks Online available on mobile devices?

A: Yes, QuickBooks offers dedicated mobile apps for iOS and Android, enabling users to manage finances on the go. These apps allow for viewing reports, approving time-off requests, tracking expenses, and even sending invoices while away from a desk, providing unprecedented flexibility for modern business management.

Q: How does QuickBooks Online handle multi-currency transactions for international businesses?

A: QuickBooks Online supports transactions in multiple currencies. When setting up foreign currency bank accounts or client transactions, you can specify the currency. The system automatically calculates exchange rates (using current market rates) and tracks gains/losses. This feature simplifies international accounting by handling currency conversion transparently for global businesses.

Screenshots

|

|

|

|